This policy brief is based on Banco de Portugal, Working Papers 2024, No 10.

Abstract

This policy brief examines the role of firms’ characteristics in determining loan pricing by banks in Portugal, focusing on measures of firms’ indebtedness, liquidity, and profitability. The study shows that banks price firms’ financial conditions differently based on factors like firm size, age, the number of banking relationships, and the broader macroeconomic and financial environment. As firms grow, profitability becomes a more significant factor in loan pricing, while leverage and liquidity play a larger role for smaller firms. It is also found that during periods of high uncertainty or tight financial conditions, banks tend to be stricter in pricing firm leverage. Banks become more attentive to firms’ liquidity in times of tight financial conditions. Furthermore, during periods of lower economic growth, banks show increased sensitivity to firm profitability.

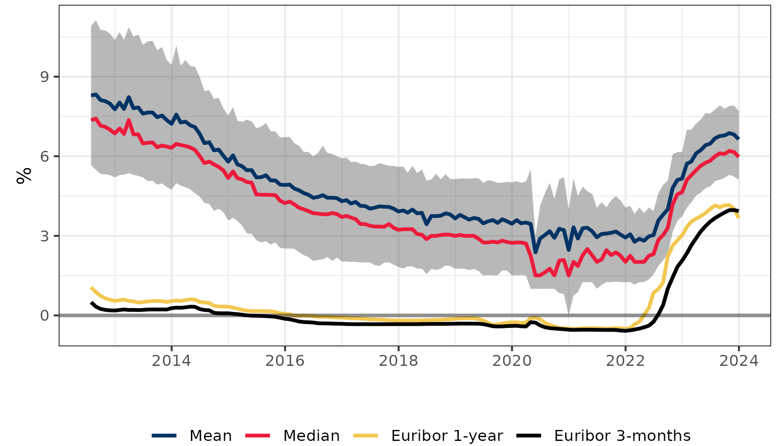

Interest rates on new loans to firms in Portugal, while driving by general macroeconomic and financial conditions, show considerable dispersion over time (Figure 1). For instance, starting in July 2022, in response to a rapid rise in inflation, the European Central Bank (ECB) implemented the fastest increase in policy rates since the creation of the Euro Area. This led to a generalized rise in interest rates on new loans, as banks passed on the increased funding costs to firms. Between June 2022 and July 2023, the average interest rate on new loans to firms in Portugal rose sharply from 3% to 6.6%. Despite this overall rise, the shaded areas in Figure 1, which represent the 20th and 80th percentiles, show substantial dispersion in loan pricing. This variability in pricing reflects multiple factors, including borrower, loan, and bank characteristics, as well as broader macroeconomic and financial conditions.

Figure 1. Interest rates on new loans to firms and 1-year/3-months Euribor

Notes: The blue line represents the simple average of interest rates on new loans to Portuguese firms, while the red line shows the median interest rate on these loans. The grey shaded area indicates the range between the 20th and 80th percentiles of the interest rates distribution.

Firms’ characteristics play a key role in explaining loan pricing dispersion. To evaluate firms’ riskiness, banks need to look into different dimensions, including their structural characteristics, which may depend on firm industry and/or size, and also to analyze firms’ financial standing. This study focuses on three critical financial aspects of firms: indebtedness, liquidity, and profitability. Understanding how these indicators affect loan pricing is essential, as they can either amplify or mitigate the impact of economic and financial shocks. For instance, during periods of rising borrowing costs—such as those driven by monetary policy tightening—the effect on a firm’s financing conditions may vary depending on its financial standing. These shifts in borrowing costs can also influence the broader economy; for example, Durante et al. (2022) found that investments of highly leveraged firms are more responsive to monetary policy shocks. From a financial stability perspective, how banks price a firm’s financial characteristics is crucial for their own stability. Banks must be able to identify borrower vulnerabilities and adjust pricing accordingly.

This policy brief summarizes recent research (Leyva, 2024), showing the importance of firms’ characteristics in determining loan pricing by banks, both in the cross-section and over time in Portugal. The study shows that banks price firms’ financial conditions differently based on factors like firm size, age, the number of banking relationships, and the broader macroeconomic and financial environment. The analysis used the following financial indicators to assess firms’ financial conditions: i) leverage, the ratio of financial debt to total assets, representing firm indebtedness; ii) liquidity, the ratio of cash plus deposits to total assets (hereinafter referred to as cash over assets,); and iii) profitability, the ratio of EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) to total assets. These variables correspond to three core dimensions in a firm’s financial assessment, related broadly to financial autonomy, the ability to absorb shocks, and returns.

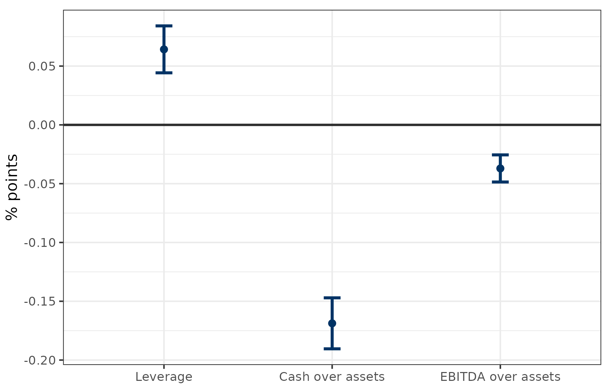

Using panel methods, the baseline specification decomposes interest rates on new loans based on borrower, bank, and loan characteristics, controlling for fixed effects on bank, industry, and time. Figure 2 shows the sensitivity of interest rates to firms’ financial conditions. Firms with higher leverage encounter tighter financial conditions, a 1 standard deviation increase in leverage results in an increase of 6.4 basis points in interest rates. Conversely, firm liquidity and profitability help reduce borrowing costs. A 1 standard deviation increase in the cash-to-assets ratio leads to a 17 basis point reduction in interest rates, while a 1 standard deviation increase in EBITDA over assets results in a decline of 3.7 basis points.

Figure 2. Sensitivity of interest rates to firms’ financial conditions

Notes: The figure illustrates how interest rates on new loans to firms respond to changes in indebtedness, liquidity, and profitability, while accounting for bank and loan characteristics, as well as fixed effects for bank, industry, and time. The bands represent the 90% confidence interval.

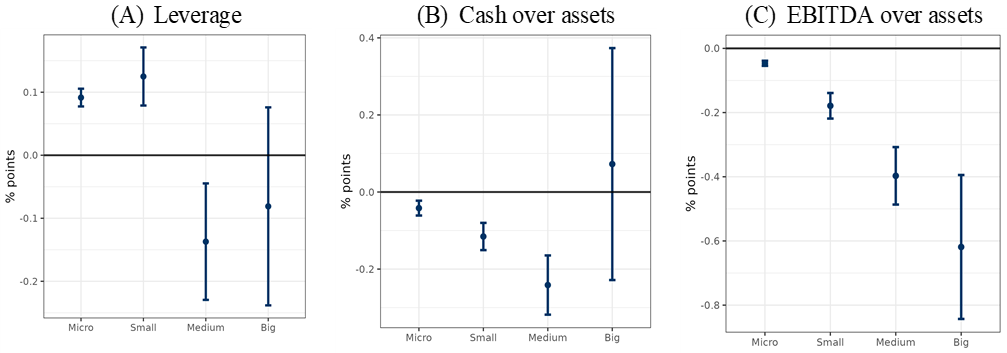

Banks tend to charge higher interest rates to micro and small firms based on their leverage (Figure 3, Panel A), while for medium-sized firms, increased leverage is associated with lower interest rates. This may reflect that, for medium-sized firms, higher leverage indicates greater investment dynamism and better future economic prospects, rather than just financial vulnerability. For large firms, the impact of leverage on loan pricing is insignificant. In terms of liquidity (Figure 3, Panel B), higher liquidity leads to lower interest rates for micro, small, and medium firms, but this effect is not significant for large firms. Regardless of firm size, higher profitability reduces interest rates, though the magnitude of the effect increases with firm size (Figure 3, Panel C). For example, a 1 standard deviation increase in profitability reduces rates by 4.6 basis points for micro firms, but by 62 basis points for big firms.

Figure 3. Sensitivity of interest rates to firms’ financial conditions, conditional on firm size

Notes: Each panel illustrates the reaction of firms’ interest rates to changes in leverage (Panel A), cash over assets (Panel B), and EBITDA over assets (Panel C), conditional on firm size. The results are obtained from separate regressions for each firm dimension, controlling for bank and loan characteristics, as well as fixed effects for bank, industry, and time. The shaded bands represent the 90% confidence intervals.

Regarding firms’ age, it appears that throughout a firm’s life cycle, banks’ loan pricing place greater emphasis on the level of debt for younger firms, rather than on their profitability. As the firm ages, leverage becomes less relevant in loan pricing, while the importance of profitability grows. Finally, firms with few bank lending relationships are charged a higher interest rate regarding their leverage compared to firms with a high number of bank relationships.

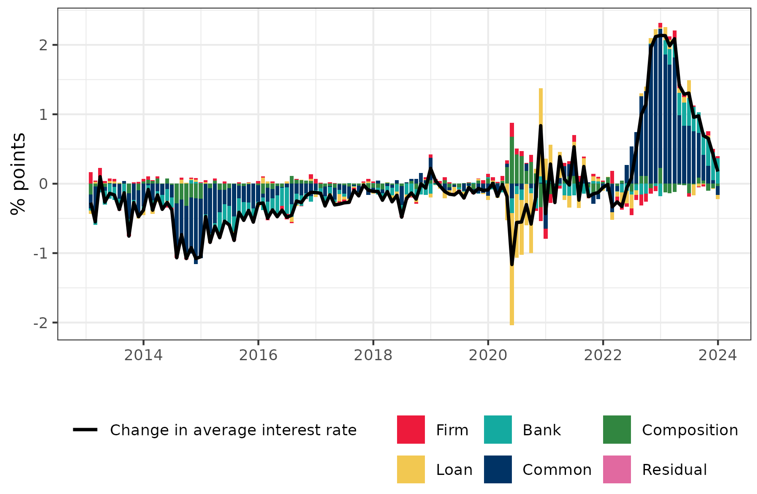

The 6-month change in the average interest rates is analyzed, attributing it to various factors, including characteristics of firms, loans, and banks, common macroeconomic shocks, and a sample compositional factor (Figure 4). The common macroeconomic shock stands out as the primary driver of average interest rate changes, significantly contributing to the decrease in rates from 2013 to 2017 and leading the increase from June 2022 to mid-2023. The bank component was vital in explaining the reduction in the average interest rate from 2013 to 2017, primarily due to a decrease in banks’ implicit funding costs, thus enabling lower rates for firms. Starting from January 2023, the bank component has been instrumental in driving up rates, indicating the delayed effect of ECB policy rate hikes on banking variables, especially the implicit funding cost of Portuguese banks. During the COVID-19 period, loan characteristics played a significant role in lowering interest rates. The firm component responded notably during various macroeconomic and financial events, driving rates higher following the sovereign debt crisis, during, and after the COVID-19 crisis, as well as in the current tightening cycle of financial conditions.

Figure 4. Decomposing the six-month change in the average interest rate

Notes: The plot displays the decomposition of the six-month change in the average interest rate (Black line) into different factors for each month.

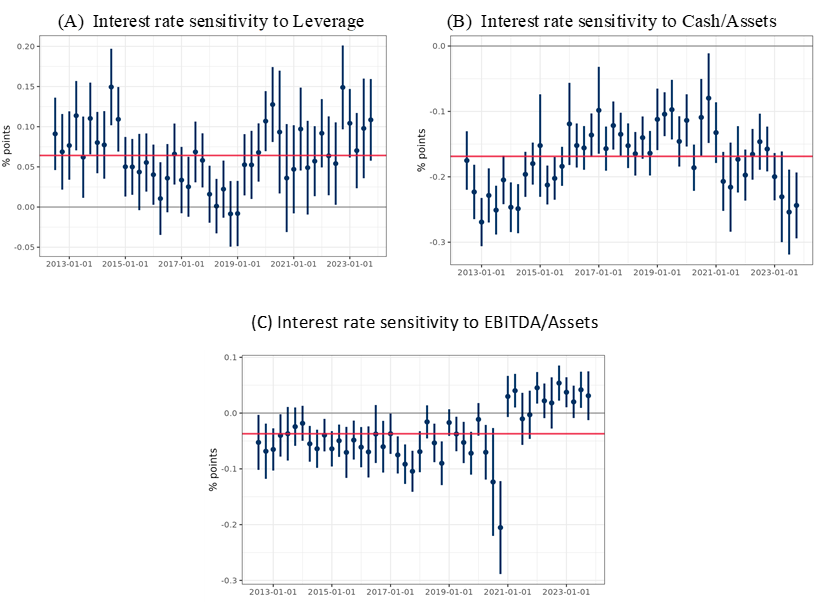

To assess this, the baseline model is adjusted to include time-varying parameters. Figure 5 shows the time-varying sensitivity of banks’ pricing to firms’ financial conditions (blue dots) alongside the baseline’s time-invariant parameters from Figure 2 (red line). The sensitivity of banks to these financial indicators deviates from the average effect, highlighting that banks’ pricing strategies fluctuate over time.

The time-varying sensitivities are regressed against measures of economic activity, proxied by GDP growth (year-on-year) and financial conditions, measured by 10-year PT government bond yield and the 1-year Euribor rate. Additionally, to identify periods of economic and political uncertainty, the index developed by Ahir et al. (2022) is used. In times of higher economic uncertainty and tighter financial conditions, banks show increased sensitivity to changes in firm leverage, understanding that a firm’s indebtedness becomes significantly more relevant in loan pricing due to the increased risk of non-repayment. The sensitivity to leverage increased during the COVID outbreak, a period of high economic uncertainty, while the increased sensitivity at the end of 2022 can be related to the monetary policy tightening (Figure 5, Panel A).

In parallel, during periods of tight general financial conditions, banks pay closer attention to firms’ liquidity levels, i.e. a more intense monitoring of firms’ capacity to accommodate an increase in debt service. Banks were more sensitive to firms’ liquidity around 2012-2014 and 2022-2023, when overall financial conditions were tight, and less responsive during the period of low/negative interest rates from 2015 to 2021 (Figure 5, Panel B).

In times of lower economic growth, the responsiveness of interest rates to firms’ profitability becomes more pronounced. This shows the importance of firms’ performance in reducing borrowing costs in periods of negative economic shocks. Panel C of Figure 5 shows that from 2012 until 2020, the estimated coefficient is negative, indicating an inverse relationship between firm profitability and the loan interest rates during this period. Since 2021, interest rates have become less responsive to firms’ profitability, with the sensitivity becoming more frequently statistically insignificant. This pattern likely reflects banks’ view that, during periods of tightening financial conditions, firms’ financial vulnerabilities are more closely tied to their leverage and liquidity rather than profitability.

Figure 5. Changing sensitivities of banks’ interest rates to firms’ financial conditions

Notes: Each panel shows how interest rates on new loans to firms respond to changes in leverage (Panel A), liquidity (Panel B) and profitability (Panel C) across time. The red line shows the average estimated sensitivity in the baseline results for every financial indicator.

Ahir, H., Bloom, N., and Furceri, D. (2022). The world uncertainty index. NBER Working Papers, 29763.

Bonfim, D., Dai, Q., and Franco, F. (2018). The number of bank relationships and borrowing costs: The role of information asymmetries. Journal of Empirical Finance, vol. 46(C):191–209.

Bonfim, D., Queiró, L., and Farinha, L. (2021). Heterogeneity in loan pricing: the role of bank capital. Banco de Portugal Economic Studies.

Cloyne, J., Ferreira, C., Froemel, M., and Surico, P. (2023). Monetary Policy, Corporate Finance, and Investment. Journal of the European Economic Association.

Durante, E., Ferrando, A., and Vermeulen, P. (2022). Monetary policy, investment and firm heterogeneity. European Economic Review.

Lian, C., and Yueran, M., (2021). “Anatomy of Corporate Borrowing Constraints.” The Quarterly Journal of Economics.

Leyva, J. (2024). The role of firms’ characteristics on banks’ interest rates, Working Papers 202410, Banco de Portugal

Santos, C. (2013). Bank interest rates on new loans to non-financial corporations– one first look at a new set of micro data. Banco de Portugal Economic Studies.

Strahan, Philip E. (1999). “Borrower risk and the price and nonprice terms of bank loans.” Federal Reserve Bank of New York, Staff Reports 90.