We empirically investigate how Euro Area cross-country spillovers affect the systemic risk-taking channel of monetary policy. We employ a GVAR model and high-frequency monetary surprises to identify both conventional and unconventional monetary policies. The empirical findings indicate that there are significant cross-country spillovers and that peripheral economies are disproportionately more systemically important than core countries. In addition we find that the relationship between systemic risk and monetary policy changes over time. In the period before 2009, monetary expansions result in higher systemic risk. However, the relationship is reversed in the period of the Zero Lower Bound, when expansionary shocks mitigate systemic risk. Cross-country spillovers account for a significant fraction (17.4%) of systemic risk responses’ variation. We also show that near term guidance reduces systemic risk, whereas the initiation of the QE program has the opposite effect. Finally, the effectiveness of monetary policy exhibits significant asymmetries, with core countries driving the union response.

Since 2008 and the collapse of Lehman Brothers, systemic risk has been a focal point of research and policy analysis. Systemic risk is driven by both endogenous factors and exogenous shocks (ECB, 2009). In 2011, Christine Lagarde, the then Managing Director of the IMF, highlighted the importance of latter, when she argued that international cross-country financial exposures were “transmitting weakness and spreading fear” across markets. We focus on the systemic risk spillovers in the Euro Area, which is a special case because, on the one hand there is significant heterogeneity among countries and on the other hand, there is a single monetary authority and high financial integration. The high degree of financial interconnection, despite all the direct and indirect benefits, could lead to more costly crises, since economies are exposed to both domestic and currency union shocks. A country level systemic risk event may become aggravated, due to strong financial contagion in the Euro Area banking system, and lead to a widespread adverse effect on the union-wide financial stability (Allen et al., 2011).

According to the joint report of Financial Stability Board (FSB), International Monetary Fund (IMF) and Bank for International Settlements (BIS), systemic risk is defined as “the disruption of the flow of financial services, caused by an institution or by a part of the financial system, that could have an adverse effect on the real economy”. A number of different systemic risk measures have been proposed in the literature, however there is not a commonly accepted approach (see Bisias et al, 2012). For our analysis, we construct a systemic risk country index by employing one of the most popular systemic risk methodologies, ΔCoVaR, proposed by Adrian & Brunnermeier (2016). The method builds on the concept of Value-at-Risk (VaR), which is arguably one of the most widely used risk measures for investors and policymakers. However it cannot be used for macroprudential purposes since it does not take into consideration the links among firms. To capture this aspect of risk, Adrian & Brunnermeier (2016) develop the concept of Conditional VaR, defined as the VaR of the entire financial system when an examined institution is under distress. The systemic importance of an institution can be measured by ΔCoVaR, which is defined as the difference between the CoVaR at the qth percentile and the one estimated in normal times.

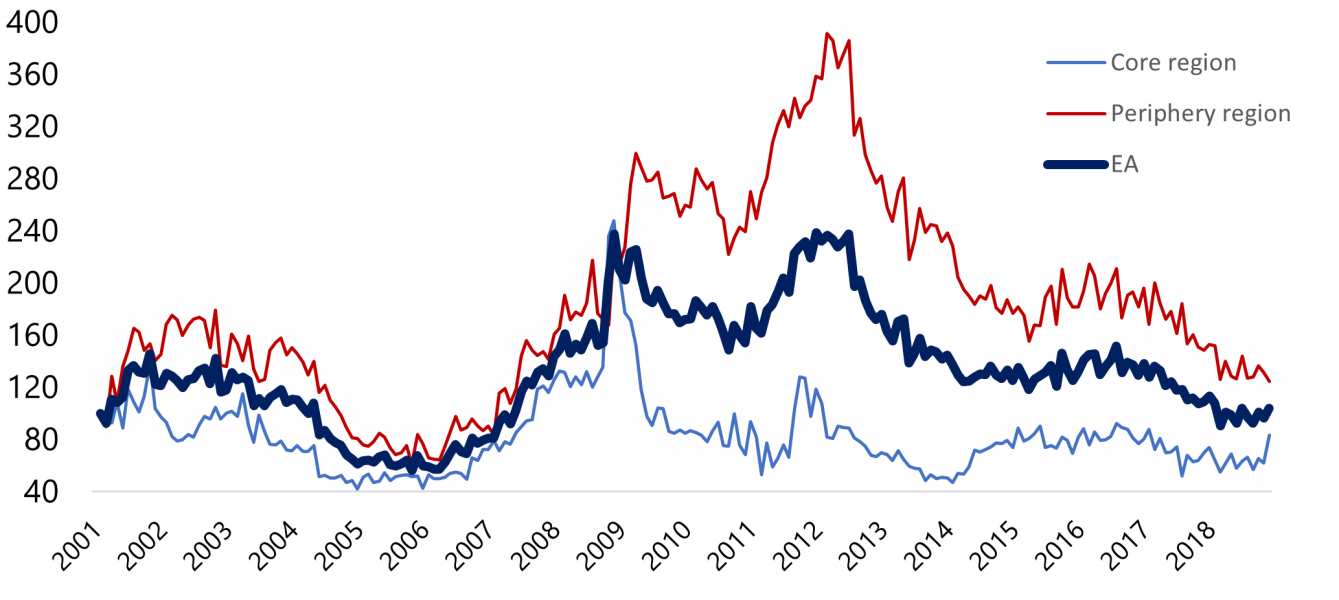

For the cross-country analysis, we estimate the level of systemic risk at the country level by introducing an aggregate version of the ΔCoVaR measure. We compute the systemic risk for a market capitalization weighted portfolio of financial firms including banks, financial services, real estate and insurance companies. The main advantage of this index is that it is based on micro-data and therefore is more informative than country-level measures that are based on government securities. In our sample of ten large Euro Area economies, we observe two distinctive patterns. Core countries, namely Germany, France, the Netherlands, Belgium and Austria, affected mostly by the 2008 global financial crisis, whereas the increase in systemic risk in 2012 was considerable weaker. These countries present a very high degree of interconnectedness and co-movement for the entire examined period. On the other hand, peripheral countries, namely Italy, Spain, Greece, Portugal and Ireland, present high level of risk in both periods, with the peak values to be observed in 2012. For illustration purposes in Figure 1, we present the average systemic risk for the two regions and the Euro Area aggregate.

Figure 1: Euro Area systemic risk

Note: The estimation of systemic risk at the country level is based on Market Capitalization-weighted portfolios of all the domestic financial institutions. In this Figure we present the average systemic risk per region using the average value of all the countries included. The sample period extends from January 2001 (base year) up until December 2018.

We then incorporate this systemic risk index in a Euro Area Global VAR (GVAR) model to allows us to capture the cross-countries spillovers. There are different methodological approaches in the literature to capture interconnectedness among firms or countries, such as market data-based (systemic risk) measures (Billio et al., 2012) and network analysis (Covi et al. 2019). Our approach differs from the other papers in the literature since we capture contagion by analysing (exogenous) shocks among member countries or union regions. The GVAR framework is a common approach to model financial linkages among countries (Galesi & Sgherri, 2009) and has been extended to the Euro Area financial markets (Bicu & Candelon, 2013; Caporale & Girardi, 2013). All of the papers in the Euro Area GVAR literature argue that there are significant spillovers in terms of economic activity and financial stability.

To measure the degree of interconnectedness and its drivers, we quantify the impact of country-level systemic risk shocks to the union aggregate level. A shock in the two Euro Area regions has a quantitatively similar effect on the union aggregate, however, Periphery only accounts for 22% of union’s cross-country claims (based on BIS data) and 1/3 of the EMU’s GDP that indicates that they are disproportionately systemically important in comparison to core countries. Spillovers are stronger from periphery to core economies than from core to the periphery. Italy is the most systemically important country in the Euro Area, followed by Spain. The largest economy in the monetary union, Germany, is also systemically important, especially across core countries. We observe that core countries are highly interconnected with a country level shock having a strong impact on the rest of the economies of the region but a weak effect on peripheral economies. On the other hand, peripheral economies’ shocks affect both regions. It is worth noticing that small economies appear to be also systemically important. Portugal and Ireland account together for less than 4% of Eurozone’s GDP, but their contribution to aggregate systemic risk is significant.

The 2008 financial crisis highlighted how a systemic event, such as the collapse of Lehman Brothers, can substantially affect real economic activity. Monitoring financial stress has become a major concern for regulators especially since the Great Recession and the European sovereign debt crisis. The relationship between financial stress and business cycles is widely-documented in the literature (see Kremer, 2016).

Our empirical evidence suggests that an unexpected increase in systemic risk results in a persistent slowdown in economic activity and spillovers account for 2/3 of GDP’s response, which highlights the importance of the cross-country contagion that amplifies the impact of systemic risk shocks. The degree of interconnectedness is considerably higher in core countries, which are more exposed to systemic risk shocks at the union level. The responses of the countries in the Periphery are also significant but smaller in magnitude on average, driven mostly by domestic factors, whereas the exposure to core economies and the spillovers effect are weak or insignificant. Therefore, our results support that the main transmission channel of systemic risk is running from peripheral to core countries. Our findings are consistent with Gorea & Radev (2014) who estimate the market-perceived probability of joint default of the Euro Area countries and they find evidence of an active contagion transmission channel from the Periphery towards the Core region.

In addition, we shed light on the role of spillovers on the systemic risk-taking channel of monetary policy. An extensive literature has focused on the risk-taking channel of monetary policy that suggests that accommodative monetary policy encourages more risk-taking behaviour of financial institutions (Borio & Zhu, 2012). In the period of the ZLB the empirical evidence is mixed and another strand of the literature argues that expansionary unconventional monetary policy supported the financial system during the crisis (see Gambacorta et al., 2014). Faia & Karau (2019) find that systemic risk increases following an unexpected decline in the shadow rate, which was used as instruments of both conventional and unconventional monetary policy. However their model also presents evidence of a price puzzle, which indicates that the identification of the monetary shock is problematic.

We adopt the high-frequency monetary surprises by Altavilla et al. (2019) that overcome this issue and also allows us to examine the impact of other forms of monetary policy (such as forward guidance and QE) on systemic risk. The results indicate that the impact of monetary policy is not homogeneous across time. We divide the sample period into two sub-periods with the cutting point being when the shadow rate becomes negative. The specific sub-samples are being selected so we can analyse the impact of the monetary policy before and after the period of the ZLB. For the first period, an accommodative policy shock results to an increase in GDP and prices, but the regional and country responses are not homogeneous. The impact is stronger in core countries and drive the Euro Area aggregate response, whereas the peripheral economies present insignificant results. The consequence of an unexpected monetary expansion is the increase in systemic risk in both regions, which is line with the “risk-taking channel”.

On the second period, that shadow rates become negative, the empirical evidence underlines the asymmetric transmission of monetary policy across the Euro Area, not only in terms of output, but also with regards to financial stability. A negative monetary policy shock, as captured by “target” surprises, mitigates systemic risk significantly in both regions. In other words, an unexpected monetary expansion from ECB leads to a reduction of the Euro Area systemic risk aggregate. Output and price level increase following a negative monetary policy shock, with only the results for core economies being statistically significant. The heterogeneity in the transmission of monetary policy can be explained by various factors such as the fragility of the banking system, as the ease of doing business or the low level of GDP per capita result in higher output gains (Burriel & Galesi, 2018).

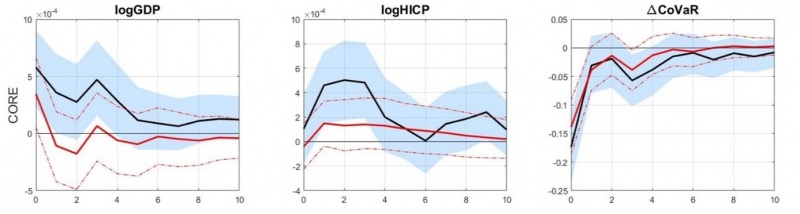

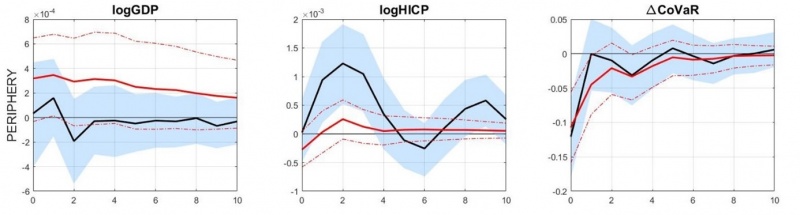

Figure 2: Expansionary monetary policy shock: Systemic risk responses

Note: The figure reports the SGIRFs of output, prices and systemic risk following an expansionary monetary policy shock. The shock is defined as one standard error decrease in the exogenous cumulative “target” surprises series provided by Altavilla et al. (2019} and the identification strategy is based on the Cholesky decomposition. The black line stands for the benchmark model and the red line when we mute the cross-country spillovers. The responses include the aggregate Euro Area and two regions; core and periphery. The examined period is 2009m1-2018m9. The lag selection is based on the Akaike information criterion (AIC). The shaded area represents the 68% confidence level, which is based on 200 bootstrap iterations.

The results indicate that cross-country spillovers play an important role in the transmission of monetary policy shocks. In Figure 2, we present the Euro Area responses following an expansionary monetary policy shock for the period after 2009. In the first column, the spillovers account for 13% of the variation of the Euro Area GDP aggregate response. The role of spillovers however varies across the two regions. In core economies, the interconnectdness appears to be beneficial in terms of output gains with spillovers to account for a fraction of 40% of GDP response. On the other hand, peripheral countries that suffered from severe recessions during the examined period, present negative externalities across the region. When we take into consideration the spillovers channel the impact is insignificant and less than half than before. With regards to the impact on systemic risk, spillovers account for 17.4% of the response. In this case the cross-country spillovers have a positive effect across both regions. In core economies, a fraction of more than 20% can be attributed to the monetary union spillovers, whereas in the case of the peripheral economies this percentage is 11.6%.

Our empirical findings highlight how misleading can be, for the policymakers, to ignore the spillovers across the monetary union, both in terms of the macroeconomic impact but also the response of the financial markets.

Our results indicate that the expectation channel has a positive relationship with systemic risk. In other words, expansionary monetary policy announcements lead to a systemic risk reduction. The effect of the “timing” shock, that refers to the short-term expectations has an immediate strong effect and it results to an increase in output and a decrease in systemic risk, but also causes inflationary pressures. The “forward guidance” factor presents similar results leading to a decline in systemic risk a few months after the occurrence of the shock. It is worth noticing though that in both channels we observe considerable heterogeneity across regions, in line with the previous findings. The Euro Area systemic risk response is predominately driven by core economies, whereas peripheral countries experience in some cases higher systemic risk, inflationary pressures and weak growth (see Fendel et al., 2020).

The findings from QE shocks indicate that the asset purchases program led to an increase in the aggregate systemic risk, which creates a trade-off for the ECB between economic growth and financial stability. In 2016, Mario Draghi, the then president of the ECB, recognized this adverse effect and he clarified that is not the goal of the ECB to ensure the profitability of any particular institutions. More specifically, QE programs can reduce the profitability of financial institutions such as insurance companies which are exposed to the decline in interest rates. Additionally, it may result in asset prices disconnecting from the fundamentals and fuelling asset price bubbles, which can trigger a banking crisis in the medium or long term.

Our empirical evidence suggests that there are considerable systemic risk spillovers across the union. More specifically, we observe high degree of financial contagion among core countries, which is not spreading out to the Periphery. On the other hand, peripheral economies are affected mostly by domestic factors and they are a source of systemic risk for the EA. Our findings suggest that a Euro Area systemic risk shock results in a significant drop in GDP across the union and that the responses are mostly driven by the spillovers channel that accounts for around two thirds of the responses’ variation. Spillovers also play an important role in the transmission of monetary policy. We find that in normal times a monetary contraction reduces systemic risk. However, during the ZLB period, when the unconventional forms of policy were introduced, the relationship is reversed, and expansionary monetary shocks lead to a decrease in the risk level. Near term guidance mitigates systemic risk, whereas the opposite effect is being observed for QE shocks. Most importantly, the evidence suggests that neglecting cross-country spillovers would underestimate the impact of monetary policy shocks, since they account for a substantial fraction of the systemic risk responses.

Adrian, T. & Brunnermeier, M. K. (2016), ‘CoVaR’, American Economic Review, 106 (7), pp. 1705–41.

Allen, F., Beck, T., Carletti, E., Lane, P. R., Schoenmaker, D. & Wagner, W. (2011), ‘Cross-border banking in Europe: implications for financial stability and macroeconomic policies’, Centre for Economic Policy Research (CEPR).

Altavilla, C., Brugnolini, L., Gu rkaynak, R. S., Motto, R. & Ragusa, G. (2019), ‘Measuring Euro Area monetary policy’, Journal of Monetary Economics, 108, pp. 162–179.

Bicu, A. & Candelon, B. (2013), ‘On the importance of indirect banking vulnerabilities in the eurozone’, Journal of Banking & Finance, 37 (12), pp. 5007–5024.

Billio, M., Getmansky, M., Lo, A. W. & Pelizzon, L. (2012), ‘Econometric measures of connectedness and systemic risk in the finance and insurance sectors’, Journal of Financial Economics, 104 (3), pp. 535–559.

Bisias, D., Flood, M., Lo, A. W., & Valavanis, S. (2012). A survey of systemic risk analytics. Annu. Rev. Financ. Econ., 4(1), 255-296.

Borio, C. & Zhu, H. (2012), ‘Capital regulation, risk-taking and monetary policy: a missing link in the transmission mechanism?’, Journal of Financial stability, 8 (4), pp. 236–251.

Burriel, P. & Galesi, A. (2018), ‘Uncovering the heterogeneous effects of ECB unconventional monetary policies across Euro Area countries’, European Economic Review, 101, pp. 210–229.

Caporale, G. M. & Girardi, A. (2013), ‘Fiscal spillovers in the Euro Area’, Journal of International Money and Finance, 38, pp. 84e.1–84e16.

Covi, G., Montagna, M., Torri, G. et al. (2019), ‘Economic shocks and contagion in the Euro Area banking sector: a new micro-structural approach’, Financial Stability Review (1).

Draghi, Mario (2016), ‘Introductory statement to the press conference (Q&A)’, European Central Bank, Frankfurt am Main, 21 January, available at:

https://www.ecb.europa.eu/press/pressconf/2016/html/is160121.en.html

ECB report (2009), The concept of systemic risk, Financial Stability Review pp. 134–142.

Faia, E. & Karau, S. (2019), ‘Banks’ systemic risk and monetary policy’, CEPR Discussion Paper (no. DP13456).

Fendel, R., Neugebauer, F. & Kilinc, M. (2020), ‘ECB’s communication and the yield curve: Core versus Periphery effects’, Applied Economics Letters pp. 1–5.

Financial Stability Board (FSB), International Monetary Fund (IMF) and Bank for International Settlements (BIS) (2009), ‘Report to G20 finance ministers and governors: Guidance to assess the systemic importance of financial institutions, markets and instruments: Initial considerations’.

Galesi, A. & Sgherri, S. (2009), ‘Regional financial spillovers across europe: A Global VAR analysis’, International Monetary Fund, No 9-23.

Gambacorta, L., Hofmann, B. & Peersman, G. (2014), ‘The effectiveness of unconventional monetary policy at the zero lower bound: A cross-country analysis’, Journal of Money, Credit and Banking, 46 (4), pp. 615–642.

Gorea, D. & Radev, D. (2014), ‘The Euro Area sovereign debt crisis: Can contagion spread from the Periphery to the Core?’, International Review of Economics & Finance, 30, pp. 78–100.

Kremer, M. (2016), ‘Macroeconomic effects of financial stress and the role of monetary policy: A VAR analysis for the Euro Area’, International Economics and Economic Policy, 13 (1), pp. 105–138.

Lagarde, Christine (2011), ‘Global risks are rising, but there is a path to recovery’, Remarks at Jackson Hole, August 27, available at: https://www.imf.org/en/News/Articles/2015/09/28/04/53/sp082711

This Policy Brief is based on Skouralis, Alexandros, The Role of Systemic Risk Spillovers in the Transmission of Euro Area Monetary Policy (2021). ESRB: Working Paper Series 2021/129.

Author contact: alex.skouralis@city.ac.uk