In our paper “The saving and employment effects of higher job loss risk”, we use Norwegian tax data and a novel natural experiment to isolate the impact of job loss risk on individual saving behavior. We find that a one percentage point increase in the job loss rate increases liquid savings by roughly 1.3 – 1.7 percent. The response is driven by low-tenured workers, who face the largest increase in job loss risk. Further, we show that an increase in savings due to higher job loss risk is associated with lower employment in local industries. The results are consistent with a household demand channel of recessions, implying that an increase in household savings due to higher job loss risk can amplify economic downturns.

Saving rates tend to increase during recessions, as was the case following the 2008 financial crisis and the ongoing pandemic. Policymakers and academics have linked the increase in savings to higher economic uncertainty, often pointing to an increase in job loss risk. Higher job loss risk increases the volatility of expected future income, while at the same time lowering the level. Both of these effects may induce people to save more, and hence consume less. The reduction in consumption implies a reduction in household demand, which in turn implies lower demand for local firms. As a result, the saving response to higher job loss risk may work as an amplifier of economic downturns.

Identifying the impact of job loss risk on savings is challenging however, as it requires both an exogenous increase in job loss risk and a strategy to isolate the impact of job loss risk form other recession effects, such as falling house prices. In our paper “The saving and employment effects of higher job loss risk” we use administrative tax data from Norway and a novel natural experiment to study the impact of higher job loss risk on savings and local employment.

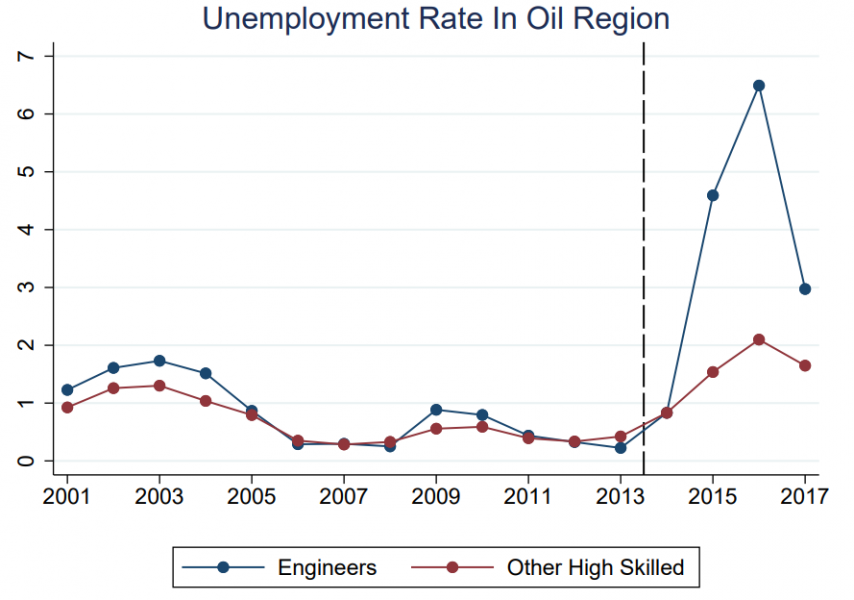

The sudden collapse of the international oil price in 2014 led to an exogenous increase in job loss risk for certain regions and occupations. The negative labor market effects were mostly concentrated in the South-West of Norway, which we refer to as the oil region. More than 60 percent of the people employed in the oil industry live in this region. The most severely affected occupational group was engineers, often directly employed in the oil sector. Unemployment rates for engineers increased from less than one percent to almost seven percent, making it the largest increase for any occupational group over the past fifteen years. This striking development is illustrated by the blue line in Figure 1.

Did the increase in job loss risk for engineers induce them to save more? Simply examining the saving behavior of engineers directly may not be sufficient to answering this question, as the oil price collapse could have affected saving rates through a number of different channels. For instance, we know that the oil price collapse led to falling house prices, which may have increased saving rates through a wealth channel. To answer this question we therefore compare the saving behavior of engineers to a control group consisting of other high skilled individuals who did not experiences an (equivalently large) increase in job loss risk. Because we restrict the analysis to only including individuals living in the oil region, other recession effects – such as falling house prices – should not be driving our results. The red line in Figure 1 illustrates the unemployment rate for other high skilled workers living in the oil region. Note that these other high skilled individuals have very similar unemployment rates to engineers prior to 2014, at which point a divergence occurs.

Figure 1. Unemployment rates for engineers and other high skilled workers in the oil region (%).

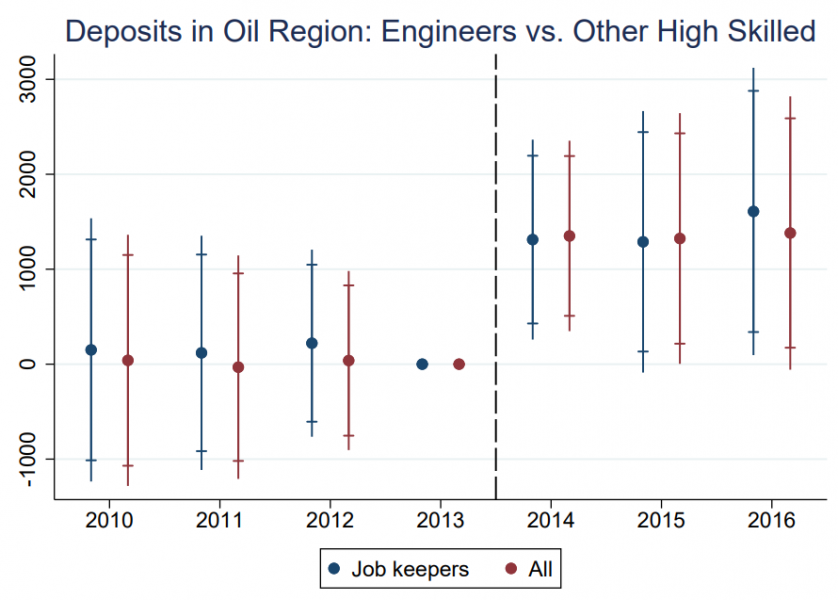

We use a difference in difference analysis to estimate the impact of job loss risk on savings. Here we report results for liquid savings in the form of bank deposits, which turns out to be driving the saving response. The coefficient estimates are illustrated in Figure 2, and capture the difference in savings between engineers and other high skilled workers relative to 2013 – the year prior to the oil price collapse. There are two key takeaways from the graph. First, the coefficient estimates are all close to zero in the years leading up to the oil price collapse, indicating that engineers and other high skilled workers were not on different saving trajectories prior to 2014. Second, once the oil price collapses and job loss risk increases, engineers increase their liquid savings relative to other high skilled workers. The results show an annual increase in savings for engineers relative to other high skilled workers of roughly $1,300, or just above three and a half percent. Scaling this by the increase in job loss risk, we find that a one percentage point increase in the job loss rate increases savings by 1.3 – 1.7 percent.

Even though the increase in job loss risk was exogenous, the probability of being laid off was far from random. Engineers with low tenure faced unemployment rates of roughly nine percent, compared to four percent for those with high tenure. Given that the saving increase is indeed driven by an increase in job loss risk, we would expect larger saving responses for engineers with low tenure. Reassuringly, this turns out to be the case. Low-tenured engineers increase savings by roughly $2,200, while the increase for high-tenured engineers is not statistically significant.

Figure 2. Bank deposits for engineers relative to other high skilled workers. The difference is normalized to zero in 2013.2

Higher savings reduces local employment

Higher savings means lower consumption, which could have an adverse impact on local firms and hence local employment. Did the increase in savings lead to a reduction in employment? To investigate this we compare municipalities with many oil workers to municipalities with few oil workers, and show that the saving increase is larger in the former. Moreover, in the municipalities with stronger saving responses, there is a greater unemployment increase in local industries such as retail, food and accommodation services, and construction.

Because we are doing a cross-sectional comparison, the local employment response is unlikely to be driven by factors which are common to all municipalities – such as exchange rate effects. However, there are some potential drivers of local unemployment which may be larger in municipalities with more oil sector workers. For instance, if many individuals working in the oil sector are laid off, these may seek employment in other industries – potentially crowding out employment in local industries. With the individual level panel data, we can explicitly account for the number of oil workers who switch sectors however, making sure that this mechanism is not driving the observed increase in local unemployment. Further, we also account for lower demand from oil firms, which is likely to have a negative impact on firms which produce inputs to the oil sector.

While we do not have an identification strategy to separate the impact of lower consumption resulting from realized unemployment from lower consumption resulting from higher job loss risk, we argue that the latter is quantitatively more important. Back of the envelope calculations suggest that the total consumption loss resulting from the risk channel is more than four times as large as the total consumption loss resulting from realized unemployment. The reason being that, although unemployed individuals have larger consumption declines, there are relatively few of them compared to the many affected workers who keep their jobs but face an increase in risk. As a result, a simple decomposition exercise suggests that the risk-induced increase in savings can explain about forty percent of the increase in local unemployment. We thus conclude that the data is consistent with job loss risk being an important amplifier of economic downturns.

Juelsrud, Ragnar E., and Ella Getz Wold. The saving and employment effects of higher job loss risk. Norges Bank, 2019.

Norges Bank. This policy brief should not be reported as representing the views of Norges Bank. The views expressed are those of the authors and do not necessarily reflect those of Norges Bank.

Coefficient estimates from a difference in difference analysis. Bars show 95 (90) percent confidence intervals. “Job keepers” is estimated on a sample in which those who lose their job at some point are excluded, while “All” is estimated on the full sample.