The scope of this study is to assess the impact of the unconventional monetary policy (UMP) of the European Central Bank (ECB) on the dynamics of the Albanian economy. The results support the view that exogenous expansions of the ECB balance sheet have strong positive effects on the financial conditions of Albania, but small negative effects on the real sector. Next, I investigate through which channels those exogenous shocks to the balance sheet expansions of the ECB affect the Albanian economy. I find that the negative effects of unconventional monetary policy on real output through the portfolio-rebalancing channel counterbalance the observed positive effects through the financial channel.

At the brink of the global financial crisis of 2008-2009, large central banks like the Fed and the ECB adopted an unconventional approach to implementing monetary policy (MP) in order to save their financial systems from collapse and to lift their economies from the ongoing recession. They embarked on massive injections of central bank money through the direct purchase of public and private debt securities.

It did not take long for economists to realize that those unconventional measures would spill over globally in emerging markets (EMs) and small open economies (SoEs). Stronger financial and trade links to advanced economies like the US and Euro area made the SoEs prone to strong foreign policy shocks. Accumulated statistical evidence showed a large portfolio shift towards emerging markets following the unconventional MP of the US (BIS (2014)).

Among the SoEs, the Central Eastern and Southeastern European economies (CESEE) are in a unique position due to their strong economic ties to the Euro either because some of them are members of Euro area (or of the EU), or due to their proximity and candidate status for EUmembership. Therefore, the rational view is that it is the ECB’s policies that matter the most, while the impact of the Fed’s policies is rather secondary.

A thorough review of the above list shows that there has been limited interest on the impact of the unconventional policies of ECB relative to domestic shocks on the Southeastern European (SEE) countries. Among the few studies that have a scope to analyse the indirect impact of ECB policies in non-euro area economies, the unconventional MP is not identified directly. Instead, in those papers the authors either assess the spillover effects of a decline in long term yields and of term spreads or have a very limited country coverage.1 The number of studies that exclusively focus on the evaluation of the implications of ECB’s unconventional MP shocks on the SEE economies in the post 2008 era is relatively small, while only one study done at the ECB focuses on EU candidate countries of the Western Balkans.2

Despite the limited focus of these studies, there is a consensus regarding the spillover effects on financial markets following a shock in the Euro area. First, the strongest effects take place through the financial channel, mainly risk variables and liquidity channels. Second, the intensity depends critically on factors like trade or financial integration with the Euro area economy. The effects on real activity are rather mixed. Two potential reasons for the diverging results, as proposed by Bluwstein and Canova (2015), are closely related to the relative share of foreign bank ownership and to the flexibility of the exchange rate in a particular country. In this line of reasoning, the countries with a high share of foreign bank ownership have displayed stronger output dynamics. Critical factors for the transmission of those effects are the exchange rate and financial (wealth, risk, and portfolio rebalancing) channels.

The focus of this study is to investigate the spillover effects of ECB policies on a single EU candidate country from the Western Balkans. It is a special case because it shares some of the features that were critical for the transmission of ECB policy shocks in existing studies. Albania is not an EU member country and only gained its EU candidate status in 2014. Yet the banking sector has been dominated by foreign banks. At its peak in the past decade, about 70-80% of the banking system assets were managed by large banks owned by larger Euro area banks. Other features of the Albanian economy include a free-floating exchange rate regime, very strong financial and trade links to Euro area and a significant degree of trade openness reaching as high as 90% of its GDP. Therefore, Albania shares all those features that many authors find significant for unconventional MP of the ECB to have a particular impact on small open economies.

To investigate how these features matter for the spillover effects of ECB balance sheet expansion, I explore the transmission of foreign policy shocks through a range of indicators from all sectors of the Albanian economy. I refer to Albanian and Euro area (EA) indicators as home and foreign variables, respectively.3

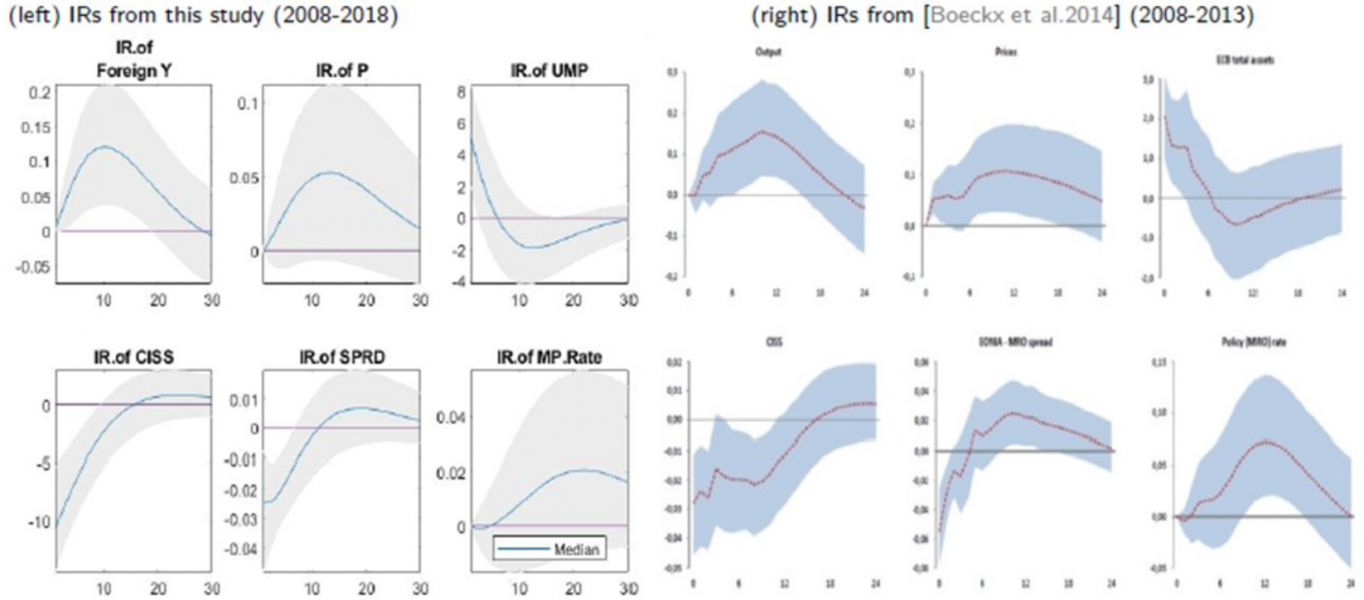

First, I evaluate how the EA variables respond to the unconventional MP shock and compare them to those in the existing studies. The impulse responses show that following an exogenous expansion of the ECB balance sheet, the financial conditions improve while real sector variables go up indicating a positive impact for the aggregate demand in the Euro area economy (shown in Figure A. 1 in the Appendix). These results are very similar to what is already reported in the existing studies despite my longer Euro area data sample. The positive response of output peaks 12 months later, the response of prices is muted, the two financial stress indicators (the Composite Indicator of Systemic stress and Eonia spread) decline instantly while the policy rate has little room for maneuvers.

The results indicate a strong impact of the ECB’s unconventional MP shock on the Albanian (home) financial indicators but a muted effect on the real sector.

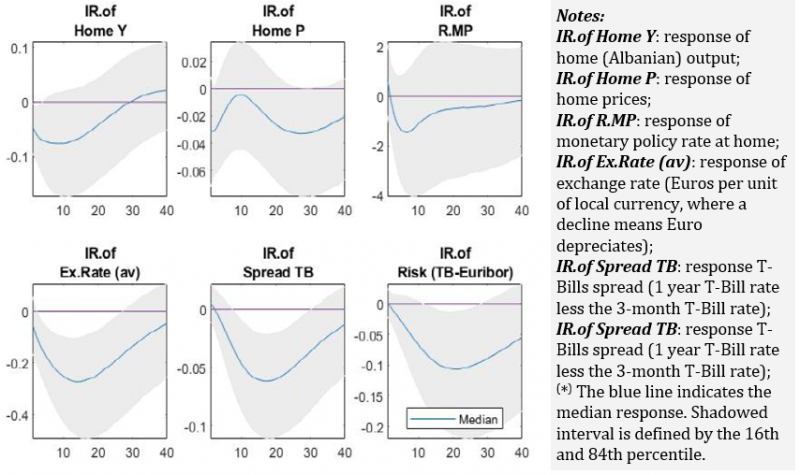

Figure 1: Response of Albanian indicators to the ECB’s UMP shock(*)

These results suggest there is a strong operative financial channel. One standard deviation in the ECB balance sheet growth leads to 0.25 % appreciation of domestic currency (Euro depreciation), a minor 0.01% decline in interest rate differential (home T-Bill yield less Euribor) and a 0.07% point decline in term premium (TB Spread). It implies that the 1-year Albanian T-Bill yield moves in tandem with the 1-year Euribor when the ECB carries out large purchases of securities.

The transmission of UMP shocks via the financial or risk channel and the exchange rate channel in SoEs or emerging economies is in line with what is already reported in the literature on CESEE. This is particularly the case of the downward response of the country risk variable, measured as the home T-Bill yield less Euribor, and the appreciation of home currency.

The financial and exchange rate channel are closely related. Exogenous ECB balance sheet expansions will first drive the yields in the Euro area economy down, putting pressure on Euro to depreciate. To prevent further appreciation of their respective currencies, market forces in small open economies respond by reducing the yields of securities denominated in local currencies.

The response of real sector variables following an exogenous ECB balance sheet shock is rather controversial. The median response of Albanian output and prices shows a decline, although Euro area output responds positively. The price decline fades quickly, within 6-9 months, while the downward median response of output lasts for 2.5 years. Textbook literature suggests that a portfolio re-balancing channel would be consistent with upward financial or capital inflows to small open economies following an expansion of ECB balance sheet. Transmission through these channels should drive up the aggregate demand in SoEs leading to positive responses of output and prices. Therefore, the current results may seem controversial considering the positive correlation of output and of business cycles widely reported through the literature that focuses on spillover effects.4

Yet, a negative output response in CESEE countries is not quite new in the existing literature. Similar findings of a negative effect of UMP shocks on real sector for some Southeastern European countries are also confirmed in a study that focuses on this region. I cite Bluwstein and Canova (2015) on page 87:

“Output responses to euro-area UMP shocks are quite heterogeneous. …, those in the CEE countries are insignificant, and those in SEE countries are persistently negative and significantly smaller than in the euro area after about two weeks.”

I dwell a bit longer on this result by further modifying the benchmark model with additional domestic variables from the balance of payments or from the monetary account of Albania to allow for foreign shocks to have an impact through different transmission channels.

I change the benchmark model by adding one of the following macroeconomic indicators at a time to the home block of variables:

(i) capital flows or financial flows,

(ii) bank loans to the private sector or money supply,

(iii) remittances,

(iv) exports or imports,

(v) consumption or investments.

For each extra variable, I measure the impulse responses following the same exogenous ECB balance sheet shock as before and see how these responses change.5 The approach used here is to open a new channel of transmission for the effects of the exogenous unconventional MP shock to be transmitted into real sector indicators of Albania. The extra indicators are set so that exogenous balance sheet expansions by the ECB affect the home variable contemporaneously and through lags, while the exogenous shocks from extra home variables affect the other home variables only with a lag.6

To assess the results from each estimation, I take note of the peak of the median responses of 3 key indicators, (1) the median response of the added home variable, (2) the median response of home real output, and (3) the median response of home prices.

The general view is that, following an exogenous ECB balance sheet shock of 5%, almost all the added Albanian macro indicators respond negatively, except for Albanian exports which go up. The median response of prices does not change much when the extra macro indicators are added to the benchmark model. The median response of home output is much stronger only when capital flows of the balance of payments are allowed to respond to an exogenous balance sheet shock of ECB. This is the case when the portfolio re-balancing channel is active through capital flows. The median output responds by declining by 0.10 % relative to a decline 007% in the benchmark estimation. In addition, the credible interval (not shown here) that measures the uncertainty of the response clearly indicates that the response of home output is much stronger when the portfolio re-balancing channel is active.

Clearly, the exogenous expansions of ECB balance sheet trigger a contraction of capital inflows towards Albania. This is consistent with the findings of Bluwstein and Canova (2015) about output responses in SEE region, as cited above. The general view is that investors are less inclined to search for higher yields in emerging markets when the ECB was willing to expand its balance sheet in order to stabilize its own financial markets. This view is consistent with a reverse portfolio re-balancing channel.

In a final step of the analysis, I check how the two components of output, consumption and investment, respond to an exogenous ECB balance sheet shock of 5% and find that it is real investments that respond the most to such a foreign shock by 1% while the response of consumption is negligible. A supporting argument is that given the strong need for Albania to catch up with the Euro area average in terms of GDP per capita, most of investments are financed through a negative saving-investment ratio, driven by a positive capital or financial account. Therefore, any strong response by the financial or capital inflows to Albania trigger a strong response of real investments in the country. Those channels of transmission should be similar for all the Western Balkan countries with a low GDP per capita and the need to catch up with the Euro area average.

BIS (2014). The transmission of unconventional monetary policy to the emerging markets, bis papers, no. 78 (august, 2014). https://www.bis.org/publ/bppdf/bispap78.pdf.

Angelovska–Bezhoska, A., Mitreska, A., and Bojcheva–Terzijan, S. (2018). Unconventional monetary policy had large international effects. Journal of Central Banking Theory and Practice, 2:25–48.

Backé, P., Feldkircher, M., and Slacík, T. (2013). Economic spillovers from the Euro area to the cesee region via the financial channel: A gvar approach. Focus on European Economic Integration, Oesterreichische Nationalbank (Austrian Central Bank), issue 4, pages 50–64.

Bluwstein, K. and Canova, F. (2015). Beggar-thy-neighbor? the international effects of ECB unconventional monetary policy measures. CEPR Discussion Papers 10856, C.E.P.R. (October 2015).

Ciarlone, A. and Colabella, A. (2016). Spillovers of the ECB’s non-standard monetary policy into cesee economies. Revista ESPE – Ensayos sobre Política Económica, Banco de la Republica de Colombia (December 2016), 34(81):175–190.

Fadejeva, L., Feldkircher, M., and Reininger, T. (2014). International transmission of credit shocks: Evidence from global vector autoregression model. Bank of Latvia Working Paper No.5/2014.

Feldkircher, M., Gruber, T., and Huber, F. (2017). Spreading the word or reducing the term spread? assessing spillovers from Euro area monetary policy. Department of Economics Working Paper Series No. 248, WU Vienna University of Economics and Business, Vienna.

Falagiarda, M., McQuade, P., and Tirpak, M. (2015). Spillovers from the ECB’s non-standard monetary policies on non-Euro area eu countries: evidence from an event-study analysis. Working paper 1869, ECB 2015.

Hájek, J. and Horváth, R. (2016). The spillover effect of Euro area on Central and Southeastern European Economies: A global VAR approach. Open Economies Review, Springer, 27(2):359–385.

Horváth, R. and Voslárová, K. (2017). International spillovers of ECB’s unconventional monetary policy: the effect on Central Europe. Applied Economics., 49(24):2352–2364.

Moder, I. (2017). Spillovers from the ECB’s non-standard monetary policy measures on Southeastern Europe. Technical Report, European Central Bank.

Figure A.1: Response of EA variables following ECB’s UMP shock

(left – IRs from this study; right – IRs from Boeckx et al. (2014), figure 4, p.25).

See Feldkircher et al. (2017), Fadejeva et al. (2014), Hájek and Horváth (2016), Backé et al. (2013), Angelovska–Bezhoska et al. (2018), or Ciarlone and Colabella (2016) or Falagiarda, McQuade, Tirpak (2015) for event studies.

See Bluwstein and Canova (2015), Horváth and Voslárová (2017) and Moder (2017).

The working paper version is published on the website of the Bank of Albania.

EBRD Transition Report (2012) reports positive correlation of business cycles of CESEE economies with Euro area. IMF Spillover Report (2012) estimates that a decline in EA output by 1% leads to a drag on real output of CESEE countries by 0.4%.

A similar approach of shutting down the transmission channels is also used by Bluwstein and Canova (2015).

Two exceptions are the ordering of exports and imports before all the other variables and the order of consumption and investment right after output. The literature is firmly suggestive about these cases.