This policy brief is based on Banco de España Working Papers, No 2447. The policy brief is the exclusive responsibility of the authors and does not necessarily reflect the opinion of the Banco de España or the Eurosystem.

Abstract

The global financial crisis drew the attention of policy makers to international banking and its impact on financial stability. In this context, the Basel Committee on Banking Supervision (BCBS) agreed on a methodology for assessing the systemic importance of large banks (BCBS, 2018). This framework considers that the greater the volume of international activity, the greater the systemic risk, regardless of the type of banking assets and liabilities. In this study, we focus on the major banking groups to investigate whether the different types of banking foreign claims (assets) play a different role in the activity of international banks in foreign countries. We find that, during systemic crises, banking systems with a higher reliance on local claims in local currency (claims booked by foreign branches or subsidiaries vis-à-vis their own residents in the country’s currency) experience a significantly smaller decline in foreign claims.

Banks can lend in foreign markets in essentially two ways: by establishing a branch or a subsidiary in the borrower’s country, or through offices or headquarters located in any country other than that of the borrower’s residence. When following the former approach, the bank books a local claim in the third country, while in the latter, it books a cross-border claim. The aggregate of local claims (denominated in either local or foreign currency) and cross-border claims constitutes the total foreign claims of a banking group.

Both types of positions (local and cross-border claims) are taken into account in the methodology used by the BCBS for the identification and evaluation of Global Systemically Important Banks (G-SIB). This methodology includes an indicator (Cross-Jurisdictional Activity indicator) that captures the international activity of banks. For the purpose of calculating a bank’s systemic importance, this indicator only considers the volume of activity outside the domestic market. In other words, all else being equal and given exposures of the same size, a bank that expands through local positions will have the same score as a bank only expanding through cross-border positions.

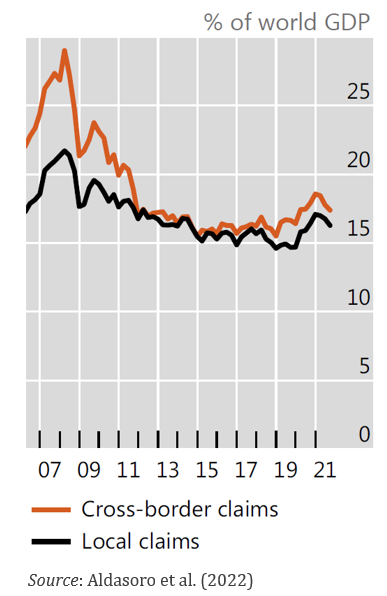

Before the onset of the Global Financial Crisis, global banks primarily engaged in foreign lending through cross-border claims (see Chart 1). In the subsequent years, this type of positions contracted significantly, explaining a large part of the reduction in foreign credit observed during the crisis. In contrast, local positions remained stable. This pattern is not exclusive to the crisis period; it has also been observed to a greater or lesser extent in subsequent years. Chart 1 shows how cross-border claims are markedly more procyclical than local claims, as they tend to expand more rapidly during upswings and retrench sharply in times of stress.

Chart 1. Evolution of cross-border and local claims

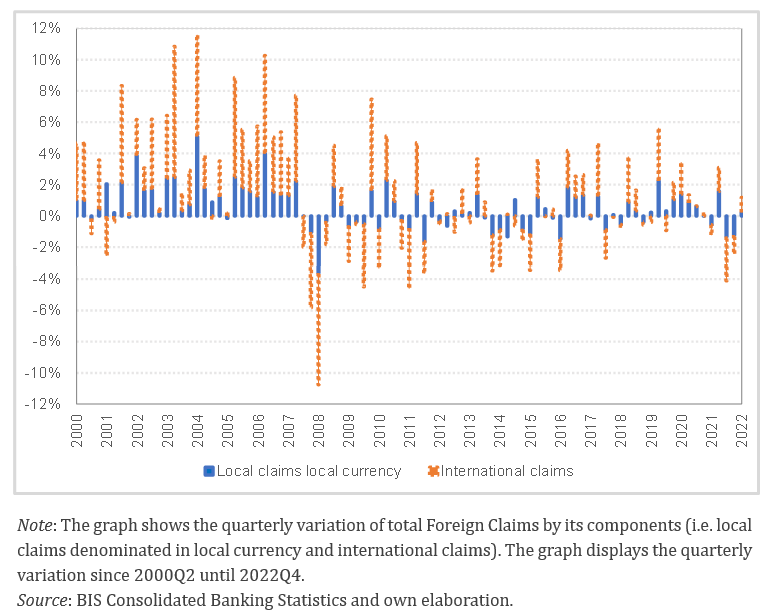

In line with the above, Chart 2 shows the contribution of local claims and cross-border claims to the quarterly variation of foreign claims from the period between 2000 and 2022. Local claims remain, in general, more stable over time than cross-border claims. Therefore, one would expect that the international expansion of a banking group that is fundamentally based on local claims would be more robust and less volatile than that of a banking group that expands primarily through cross-border claims.

Chart 2. Contributors to the quarterly variation of Foreign Claims

The volatility exhibited by cross-border positions is relevant from a financial stability perspective, given that in situations of stress, a shock to international financial markets may force banks relying heavily on cross-border funding to reduce lending and liquidate collateral (for example, if they cannot roll over maturing liabilities) more than banks that rely on a local funding model. Similarly, bank borrowers unable to replace international bank funding with local funding sources may be forced to reduce their economic activity, with negative feedback effects on the real economy. On the other hand, a model relying on cross-border positions (instead of local funding) may be less vulnerable to local funding shocks due to diversification. It is therefore an empirical question to determine which of these two opposing forces prevails, making one of the models more or less vulnerable than the other. That is the question our research aims to address.

In theory, one would expect loans by branches and subsidiaries located in the borrower’s country (local claims) to be less volatile than those booked by offices located in other countries. First, the balance sheet of local branches and subsidiaries will be more insulated from external shocks, as the bank is likely to define its lending strategy based on local economic conditions. Second, greater proximity to the borrowers could contribute to better market knowledge, prompting banks to hold more assets in local markets (Buch (2005)), even during a crisis (Cerutti et al. (2014) and Park and Shin (2020)). Third, banks expanding into an international market through branches or subsidiaries often face high costs that make it difficult to adjust local operations as quickly and easily as cross-border operations entered into by offices located abroad. In that sense, banks operating in foreign markets through branches or subsidiaries tend to have longer-term relationships (Gambacorta et al. (2019)).

Our study employs an econometric model to examine the evolution of foreign claims, both during normal periods and in systemic crises, in banking systems with varying levels of local claims in local currency vis-à-vis foreign claims. We also study how relevant home and host country economic features can affect banks’ foreign claims.

We use country-level data over the period 2000-2022 to examine the behavior of 76 banking groups headquartered in 18 different countries, identified as home countries. The selected banks are those that participated in the end-2020 assessment exercise for Global Systemically Important Banks (G-SIB) conducted by the BCBS. These banks represent, on average for the period 2000-2022, 80% of total foreign claims in the combined balance sheets of international banks.

In line with the stabilizing role of local claims described in Aldasoro et al. (2022), Gambacorta et al. (2019), McCauley et al. (2012) and Muñoz de la Peña and Van Rixtel (2015)), we assume that the higher the ratio of local claims the lower the retrenchment of foreign claims during systemic crises. This hypothesis is based on the fact that cross-border claims are more volatile and higher in volume than local claims (Chart 1 and 2). We also study the Global Financial Crisis and the Covid-19 pandemic separately because of the heterogeneous nature of these periods. The GFC was an endogenous shock partly motivated by weak underwriting standards, while the Covid-19 pandemic was an exogenous shock to the global economy that began as a health crisis. Thus, financial stability and the banking sector were affected differently during both crises (Batten et al. (2023)).

The paper also studies how different levels of local claims affect the change in foreign claims taking into account the GDP and the local stock market’s volatility.

The findings indicate that when the parent bank’s jurisdiction is experiencing a systemic crisis, a higher ratio of local claims in local currency compared to foreign claims helps mitigate the decline in foreign claims, thereby stabilizing their variation. In other words, the higher ratio lessens the drop in the variation of foreign claims during periods of systemic crisis, suggesting that foreign claims are more stable during such crises when the parent’s banking system has a significant proportion of local claims in local currency. Such result is observed both during the GFC and the Covid-19 pandemic.

Regarding the impact of certain economic features of home and host countries on the international presence of global banks, the results also show that banking systems tend to reduce their exposure to volatile scenarios. Specifically, banks tend to reduce their foreign exposure when international markets face high volatility and to also reduce their home country exposure when they face high domestic economic volatility, which in turn contributes to an increase in the international presence of global banks through shifting of funds to foreign markets. However, this flight of funds to foreign markets is lower when the banking system has a higher ratio of local claims to foreign claims. In other words, the international exposure of global banks would not be exaggeratedly adjusted in the face of a domestic shock.

In addition, banks increase their presence in foreign countries whose GDP is booming. Similarly, when the country in which the banking system is headquartered grows, banks tend to focus more on their domestic market, thus reducing their foreign exposure.

However, in foreign countries where the banking system has a relatively high presence of local claims, the drop in credit that would ensue an economic upswing in the home country is smaller compared to countries where the banking system has a reduced presence in the form of local positions. Therefore, when the home country’s GDP increases, the banking system invests more in the domestic market to the detriment of investing abroad, i.e., there is a shift of funds from foreign markets to the domestic market, but that shift is mitigated if the proportion of local claims in local currency is higher, the banking system thus holding more assets abroad due to the higher proportion of local claims. Therefore, holding a higher proportion of local claims allows banks to maintain a long-lasting relationship with their foreign markets, even when the economy of their home country is booming, reinforcing their presence and strengthening interconnections with the geographies in which they operate, as stated in Gambacorta et al. (2019).

We have utilized data of major international banking systems to analyze the evolution of their exposure to foreign countries. Our findings indicate that banks expanding abroad mainly through loans by branches and subsidiaries located in the borrowers’ countries, i.e. through local claims denominated in local currency, experience a smaller decline in credit granted in foreign countries during crises. This evidence underscores the importance of local claims in local currency in mitigating the sensitivity of foreign claims to systemic crises, thus helping to preserve the financial stability under a crisis scenario.

In addition, our analysis reveals that the contraction of foreign claims following an economic upswing in the home country is mitigated by a higher ratio of local claims in local currency to foreign claims. Similarly, the increase in foreign claims following periods of high economic uncertainty in the home country is also offset by a higher ratio of local claims to total foreign claims. Thus, a higher proportion of local claims in local currency helps to stabilize the volatility of foreign claims in conditions where foreign claims tend to be more volatile.

The previous results highlight the financial stability relevance of differentiating the various models of international banking expansion. A methodology based exclusively on the volume of international activity as a proxy for the systemic risk associated with a bank’s international presence does not adequately differentiate the treatment of exposures showing greater stability during times of crisis. This research lays the foundation for a possible revision of the methodology used by the BCBS to identify and assess Global Systemically Important Banks (G-SIB).

Aldasoro, Iñaki, John Caparusso and Yingyuan Chen. (2022). “Global banks’ local presence: new lens”. BIS Quarterly Review. https://www.bis.org/publ/qtrpdf/r_qt2203d.htm

Basel Committee on Banking Supervision. (2018). “Global systemically important banks: revised assessment methodology and the higher loss absorbency requirement”. https://www.bis.org/bcbs/publ/d445.htm

Batten, Jonathan, Sabri Boubaker, Harald Kinateder, Tonmoy Choudhury and Niklas F. Wagner. (2023). “Volatility impacts on global banks: Insights from the GFC, COVID-19, and the Russia-Ukraine war”. Journal of Economic Behavior & Organization, 215, pp. 325-350. https://doi.org/10.1016/j.jebo.2023.09.016.

Buch, Claudia M. (2005). “Distance and International Banking”, Review of International Economics, 13(4), pp. 787-804. https://doi.org/10.1111/j.1467-9396.2005.00537.x

Cerutti, Eugenio, Galina Hale and Camelia Minoiu. (2014). “Financial Crises and the Composition of Cross-Border Lending”. IMF Working Paper 14/185. https://doi.org/10.5089/9781484361443.001

Gambacorta, Leonardo, Adrian van Rixtel and Stefano Schiaffi. (2019). “Changing business models in international bank funding.” Economic Inquiry, 57, 2, pp. 1038–55. https://doi.org/10.1111/ecin.12738

McCauley, Robert, Patrick McGuire and Goetz von Peter. (2012). “After the global financial crisis: From international to multinational banking?” Journal of Economics and Business, 64, 1. https://doi.org/10.1016/j.jeconbus.2011.06.004

Muñoz de la Peña, Emilio, and Adrian Van Rixtel. (2015). “The BIS international banking statistics: Structure and analytical use”, Bank of Spain, Revista de Estabilidad Financiera, 29, pp. 29–46. https://repositorio.bde.es/bitstream/123456789/11429/1/restfin2015292.pdf

Park, Cyn-Young, and Kwanho Shin. (2020). “Contagion through National and Regional Exposures to Foreign Banks during the Global Financial Crisis”. Journal of Financial Stability, 46. https://doi.org/10.1016/j.jfs.2019.100721