This policy brief is based on Working Paper Research, No 466 “A bridge over troubled water: flooding shocks and supply chains”, the views expressed are those of the authors and do not necessarily reflect those of the National Bank of Belgium.

Abstract

The increasing frequency and intensity of extreme weather events, like the July 2021 floods in Belgium, underscores the economic risks posed by climate change. These events not only disrupt local economies but also propagate significant ripple effects through supply chains. Our research shows that the floods had a strong negative, but temporary, impact on the performance of surviving firms active in the area. More importantly, in terms of the supply chain effects, we find negative and persistent effects on for firms buying from the directly affected businesses. Understanding these indirect impacts is vital for designing effective mitigation strategies and quantifying the broader costs of climate change.

In July 2021, extreme rainfall caused unprecedented flooding in Germany, Belgium, and the Netherlands, with Wallonia in Belgium suffering the most severe impacts. The flooding in Wallonia led to over €10 billion in economic damages, affecting 100,000 people, damaging 48,000 buildings (including 3,000 firms), and destroying over 500 bridges. Rainfall in the Liège region exceeded 250 mm over 48 hours — a “once-in-100-years” event — devastating infrastructure, homes, and businesses. These most affected areas, particularly the Vesdre Valley, experienced rapid and catastrophic water level rises, causing businesses to halt operations and disrupting supply chains.

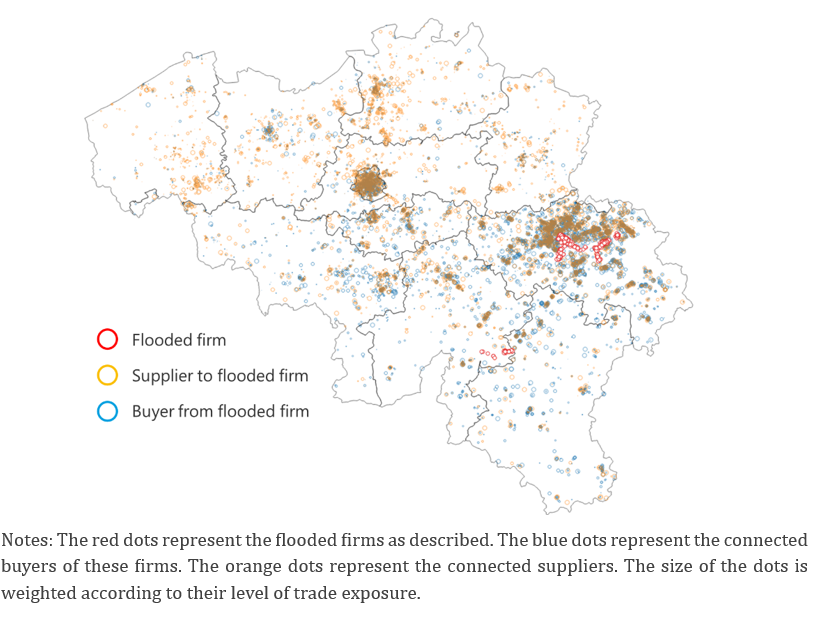

In Bijnens et al. (2024) we utilise granular microdata and analyse the Vesdre floods’ economic consequences, including VAT returns, business-to-business (B2B) transactions, and geolocation data. By identifying the flooded firms, their clients and suppliers (Chart 1), we can provide insights into the direct impacts on business performance and the complex propagation of economic shocks through supply chains, highlighting the intricate and far-reaching consequences of extreme weather events on regional economic ecosystems.

Chart 1. Detailed location of flooded firms, their clients and suppliers in Belgium

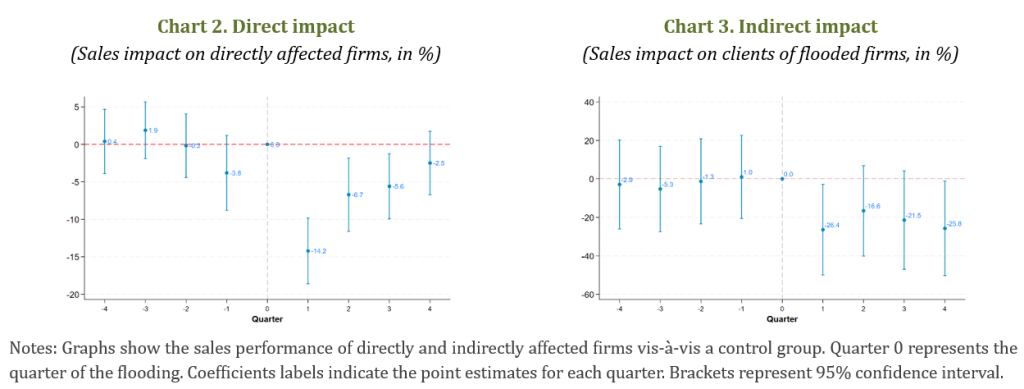

Our findings highlight significant impacts on firms affected by floods. Directly hit firms experienced a sharp 15% drop in sales during the first quarter post-flood (Chart 2), with recovery only occurring in the fourth quarter. Additionally, employment decreased by 5% immediately after the shock, though firms increased investment levels to rebuild infrastructure. These results reflect a credible disruption of operations and supply chains, and they exclude firms that did not survive the floods, suggesting the estimated impact may be underestimated. The floods’ effects also propagated through supply chains. Firms relying on suppliers in flooded areas suffered a persistent 0.3% decline in sales per 1 percentage point increase in exposure, lasting up to three quarters (chart 3). To measure this indirect impact: There are approximately 11,000 firms buying from directly hit businesses. A firm at the 90th percentile of purchasing exposure source 17% of their inputs from directly affected firms. Consequently, they experience a sales decline of 0.3% times 17 or roughly 5%. These disruptions were most severe when relationships with suppliers were long-standing, underscoring the importance of durable input-specificity. Conversely, firms supplying flooded regions did not show a consistent pattern of decline. Employment mirrored these trends, with firms upstream of flooded suppliers reducing staff, while downstream firms experienced negligible change. Overall, the results emphasize the vulnerability of interconnected firms to regional shocks, especially through long-term supplier relationships.

We also explore which firm characteristics enhance resilience to supply chain shocks, focusing on supply chain diversification, the number of buyers and suppliers, and international trade flows. Firms with higher import-to-sales ratios experience greater sales declines when exposed to upstream shocks, suggesting that international and domestic inputs rather act as complements and not as a substitute. Moreover, firms with low upstream industry diversification face steeper losses, indicating a vulnerability to supplier disruptions. Interestingly, neither geographic concentration nor the number of buyers and suppliers significantly influences resilience. Following a shock, firms adjust their supply chains irrespective of prior exposure, possibly reflecting confidence that such disruptions are unlikely to recur in the short term.

Our findings highlight the critical need to account for both direct and indirect shocks when evaluating the full economic impact of natural disasters. As climate-related catastrophes become more frequent, strengthening supply chain resilience through supplier and buyer diversification will become even more essential to safeguard regional economies from climate related shocks.

Bijnens, G., Montoya, M., & Vanormelingen, S. (2024). A bridge over troubled water: flooding shocks and supply chains. Working Paper Research 466, National Bank of Belgium.