The opinions expressed here are the authors’ own and do not necessarily reflect those of the institutions they are affiliated with.

European manufacturing industry has not yet significantly reduced its carbon emissions in recent years. This in contrast to the electricity generation sector. However, the European Union’s “Fit for 55” package of measures contains ambitious targets for cutting these emissions by 2030. Like the well-known channel that increases overall productivity, the effort to reduce emissions will have to rely not only on innovation but also on the transfer of economic activity to the most emission-efficient firms. A limited shift of activities within a sector away from those companies that produce the most emissions, could achieve substantial emission reductions. When developing emission reduction plans, policy makers cannot focus solely on greening incumbent industrial firms but must consider that some of these companies will have to downsize and leave the market to more carbon efficient firms. A reallocation solely based on a rising carbon price, however, will not necessarily be the most optimal redistribution to reduce emissions. This is because the least profitable firms are not always the least carbon efficient.

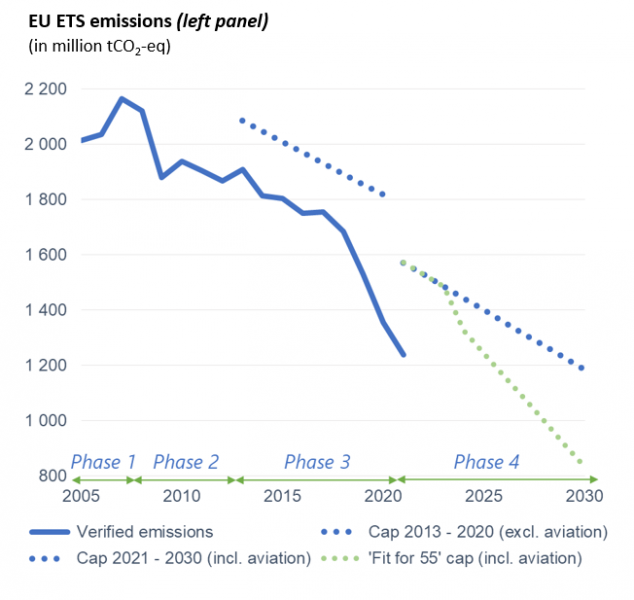

Since its introduction in 2005, the EU Emissions Trading System (ETS) has been an ambitious attempt to reconcile economic growth with the reduction of carbon emissions from large companies in both the manufacturing and energy sectors. The ETS operates as a “cap and trade” system whereby installations can use CO2 emissions trading to offset emissions above or below a certain threshold of freely allocated allowances. Supporters of the EU ETS point out that it has certainly delivered on its promises. Actual emissions remained far below the set cap and the emission reduction target for the period 2005 to 2020 was already reached in 2014 (figure 1, left). Looking beyond the overall EU ETS emissions, however, it is clear that the reductions were predominantly driven by the electricity generation sector (figure 1, right), which has substantially reduced its carbon intensity.1 Previous studies show that this was certainly not achieved solely by the adoption of new technologies but also by switching to less carbon-intensive fossil fuels (see Teixidó et al., 2019, for an overview). This is best described as coal-to-gas switching. Whether or not the substantial reductions in emissions from the electricity generation sector (and by extension the emissions covered by the EU ETS) are due to the EU ETS or rather to other policies remains debated.2 One can, however, safely say that the EU ETS played at least a supporting role in the reduction of emissions, including outside the power generation sector.3

Figure 1: EU ETS emissions fell and remained well below the set cap, but the reduction was mainly due to the power generation sector

Sources: EC, EUETS.info, NBB analysis.

If the overall emission reductions of the EU ETS were largely driven by the electricity generation sector, this implies that the manufacturing sector’s emission reduction efforts (or the result of those efforts) remained limited. This observation has already been made by Vieira et al. (2021). They conclude that the past EU ETS performance might well produce a false sense of an economy in transition. And a transition will certainly be needed. The European Union’s “Fit for 55” package of measures contains ambitious targets for cutting emissions by 2030. A far-reaching transformation of the carbon-intensive manufacturing sector is hence a must.

Analysis of the debate on how to achieve climate neutrality plainly reveals the focus on green innovation. The European Commission (EC) intends its new Industrial Strategy for Europe to lead Europe’s manufacturing firms to a carbon neutral future while making them more globally competitive. It intends to “help industry to reduce their carbon footprint by providing affordable, clean technology solutions and by developing new business models”.4 The focus is clearly on developing innovative technology and processes and ensuring their adoption across Europe. Whilst we do not doubt the importance of green innovation, this strategy implicitly follows the view that the necessary technology to enable Europe’s manufacturing industry to start its deep decarbonisation process is not yet available.

Whilst we do not doubt the strong need for innovation to eventually reach climate neutrality, in Bijnens and Swartenbroekx (2022) we argue that medium term emission reduction targets can be met by another mechanism, i.e., the reallocation of economic activity away from the worst performing firms with respect to emission efficiency towards the best performing firms. This is an established concept within the economic literature commonly referred to as “creative destruction”. The pioneering work of Foster et al. (2001) has shown that this mechanism is at least as important as innovation in explaining aggregate productivity growth. Yet, when policy makers lay out plans to become more “carbon productive” this mechanism is almost never considered.

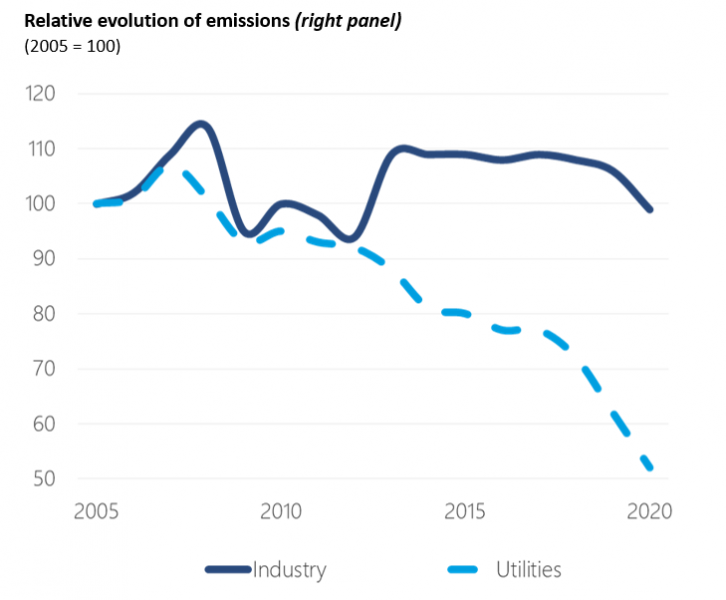

The complex system that the EU ETS uses to distribute free emission rights amongst industrial installations is based on a benchmark set by the best performing installations producing a similar product. It hence acknowledges that there is a certain dispersion in carbon performance within narrowly defined sectors. More specifically, Vieira et al. (2021) study the progress of EU ETS emissions and find that manufacturing firms performing the same activities presented results ranging from no reduction to more than 80 % of emissions abated over the period 2005 – 2017. We indeed find that emission intensity is very unevenly distributed among firms within the same manufacturing sector. For most sectors, a limited number of firms with relatively poor emission efficiency account for a large share of emissions (figure 2). This implies that there is a huge untapped potential for technological “catching-up” and reallocation of activities between firms to reduce overall emissions. A limited reallocation away from the most emission-intensive firms can result in an overall emission reduction of ~40 %.

Figure 2: A limited number of firms with relatively poor emission efficiency account for a large share of emissions, but only a limited share of employment1

Sources: EUETS.info, ORBIS, NBB analysis.

1 The horizontal axis ranks the firms from most to least emissions intensive and the vertical axis represents their cumulative emissions and employment vis-à-vis total emissions and employment. The yellow line therefore indicates the share of emissions and employment represented by the 20 % most emissions intensive firms (figures 2019).

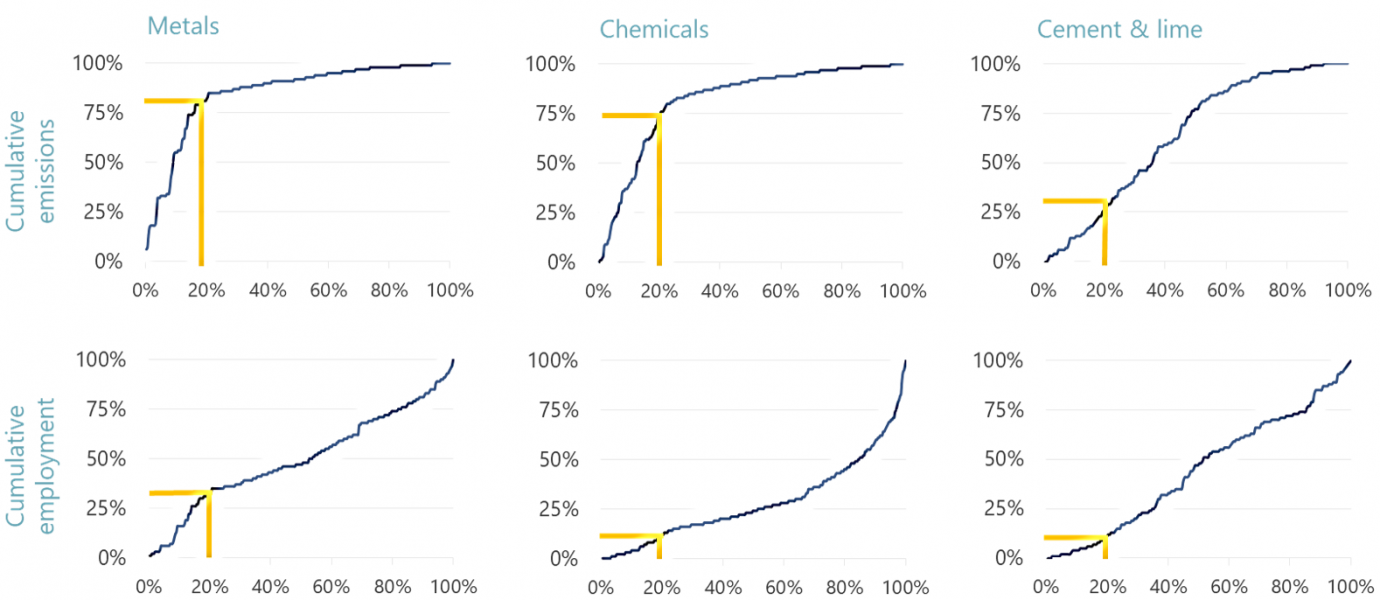

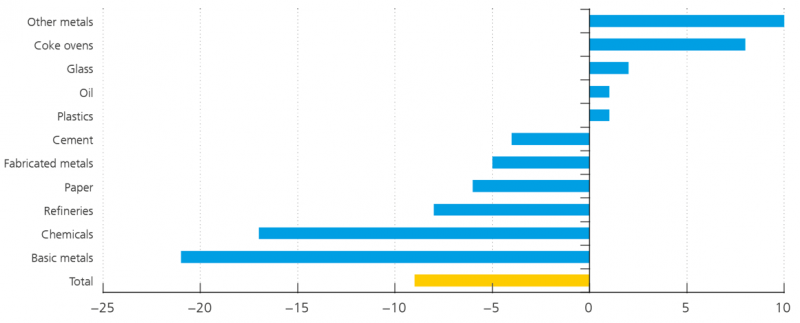

A rising carbon price can drive this reallocation process, as it puts some firms at risk of negative cashflow. We consider a theoretical scenario where the carbon price increases to € 150/tCO2. Since the carbon price was effectively € 130 lower throughout 2019 (or approx. € 20/tCO2) compared to this € 150/tCO2, a firm that had a cashflow below € 130 per emitted tonne in 2019 would become unprofitable, ruling out any freely allocated emissions and keeping all other things equal.5 We now investigate what would happen if the output of the firms that have become cash flow negative is redistributed over the remaining cash-flow positive firms within the EU ETS. This cash flow driven reallocation scenario is not necessarily the optimal reallocation to reduce emissions (figure 3). This scenario would reduce overall emissions just below 10 %, although the effect differs substantially between sectors. The basic metals industry would reduce its emissions by 20 %, but other sectors such as other metals and coke ovens would see an increase in their emissions. This means that firms with the lowest cashflows per emitted tonne are not necessarily the ones with the highest carbon intensity.

A broader mix of policy measures will therefore be needed to decarbonise the manufacturing sector in time. Carbon pricing could be accompanied by carbon efficiency targets so that highly profitable sectors or low-carbon efficient firms are also incentivised to green their operations and output is reallocated to lower-emitting firms.

Figure 3: A reallocation scenario away from firms with low cashflow does not necessarily lead to large emission savings (emissions saved in percentage of sectoral emissions based on a cashflow-driven reallocation scenario, figures 2019)

Sources: EUETS.info, ORBIS, NBB analysis.

Bijnens G. and C. Swartenbroekx, C (2022), Carbon emissions and the untapped potential of activity reallocation. Lessons from the EU ETS. National Bank of Belgium Economic Review, 1-29.

Colmer J., R. Martin, M. Muûls and U. J. Wagner (2022), Does pricing carbon mitigate climate change? Firm-level evidence from the European Union emissions trading scheme, CEPR, DP16982.

De Beule F., F. Schoubben and K. Struyfs (2022), The pollution haven effect and investment leakage: The case of the EU-ETS, Economics Letters, 215, 110536.

De Jonghe O., K. Mulier and G. Schepens (2020), Going green by putting a price on pollution: Firm-level evidence from the EU, NBB, Working Paper 309.

Foster L., J. C. Haltiwanger and C. J. Krizan (2001), “Aggregate productivity growth: lessons from microeconomic evidence”, In: New developments in productivity analysis, University of Chicago Press, 303–372.

Hintermann B., M. Žarković, C. Di Maria and U. J. Wagner (2020), The effect of climate policy on productivity and cost pass-through in the German manufacturing sector, CRC TR 224 Discussion Paper 249.

Teixidó J., S. F. Verde and F. Nicoll (2019), The impact of the EU Emissions Trading System on low-carbon technological change: The empirical evidence, Ecological Economics, 164, 106347.

Marcu A., E. Alberola, J. Y. Caneill, J. Olsen, S. Schleicher and D. Vangenechten (2021), 2021 State of the EU ETS Report, European Roundtable on Climate Change and Sustainable Transition.

Vieira L. C., M. Longo and M. Mura (2021), Are the European manufacturing and energy sectors on track for achieving net-zero emissions in 2050? An empirical analysis, Energy Policy, 156, 112464.

According to the European Environmental Agency (EEA), the EU27+UK countries reduced their greenhouse gas emission intensity of electricity generation from 394 gCO2eq/kWh in 2005 to 250 gCO2eq/kWh in 2019.

See Marcu et al. (2021) for an overview of the literature. Studies that find a causal reduction in emissions driven by the EU ETS generally focus on the period 2008 – 2012. This early positive effect of the EU ETS might well be attributable to securing easy wins rather than an indication of a deeper decarbonisation trend.

Colmer et al. (2022) find that French ETS regulated manufacturing firms reduced carbon emissions by 8-12 % compared to unregulated firms. De Jonghe et al. (2020) observe that emission trading schemes do improve the emission efficiency of highly polluting firms.

For the sake of simplicity, this scenario does not assume any pass-through of carbon prices into sales prices, nor any reduction of emissions driven by an increasing carbon price, nor any change in the sold volumes. Hintermann et al. (2020) find that firms pass on shocks to materials costs completely, or even more than completely, whereas pass-through of energy costs is around 35-60 %. Cost pass-through, however, could well be an additional source of suboptimal reallocation where the ability to pass-through carbon costs rather than carbon intensity drive reallocation. De Beule et al. (2022) find that sectors with low carbon cost pass-through appear more likely to relocate their activities.