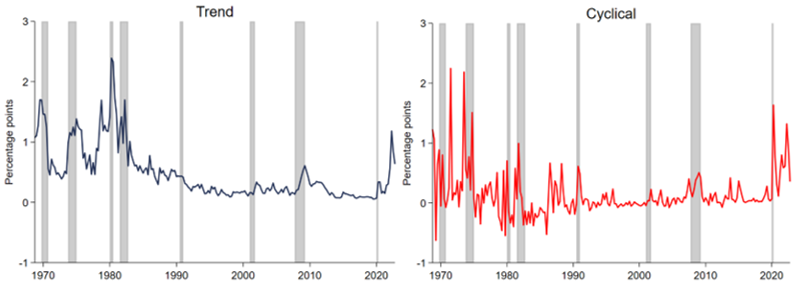

Most existing literature focuses on inflation forecasts disagreement over a particular forecasting horizon. We take one step further and exploit information from the term structure of inflation forecasts disagreement. Specifically, we decompose the term structure of inflation forecasts disagreement to disagreement about the trend inflation and disagreement about the cyclical inflation. These two disagreement factors have different impacts on monetary policy transmission. Lastly, we show central bank communication can tame inflation disagreement.

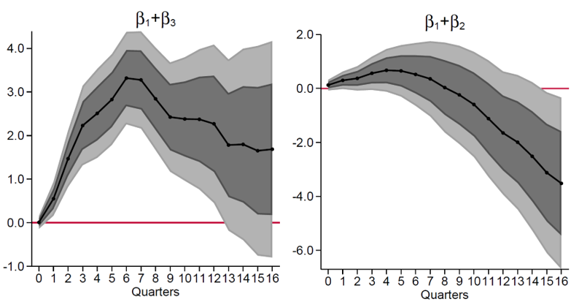

Note: Shaded areas indicate 68% (dark grey) or 90% (light grey) confidence intervals of the estimated coefficients. Left panel shows the impulse response for periods with high cyclical (and low trend) inflation disagreement. Right panel shows the impulse response for periods with high trend (and low cyclical) inflation disagreement. The economy is under a high-disagreement regime when the seven-period moving average of inflation disagreement exceeds its median.