How do central bank collateral frameworks affect bank credit supply, cross-border lending and the non-financial sector? This column builds on a recent paper (Huettl and Kaldorf, 2024) that studies how a change to the Eurosystem collateral framework affects the behaviour of euro area banks on the syndicated loan market. Specifically, we exploit that the ECB added cross-border bank loans to the list of assets that banks can pledge as collateral. Banks respond by supplying more credit and increase their risk-taking, while firms that are in relationship with such banks experience an increase in their total debt growth and investment. At the same time, this policy change only had a very modest effect on direct cross-border lending. This points towards strong real barriers to cross-border lending, such as cultural and language differences and heterogeneity in corporate bankruptcy laws. Our results suggest that collateral frameworks contribute only little to financial market integration in a currency union.

A key principle of central banking is that all central bank lending is collateralized: banks need to pledge financial assets to obtain funding from the central bank. How changes to central bank collateral frameworks affect banks is not fully understood yet. Several recent studies point to substantial effects on credit supply, see for example Van Bekkum et al. (2017) or Mesonnier et al. (2021). However, it is less clear how (much) it affects bank risk-taking, real activity at the firm level and whether it has positive effects on cross-border lending.

In this paper, we exploit that the European Central Bank (ECB) replaced national collateral frameworks by a single list in January 2007. The ECB announced the single list in June 2005. After the collateral framework change, banks were able to pledge loans extended to borrowers in the whole euro area. Before 2007, each national central bank specified different collateral eligibility criteria, but cross-border loans were not included in any of those. By expanding the pool of eligible assets, this shock enhances the overall liquidity of bank assets. This allows us to interpret the collateral framework change as a positive bank liquidity shock.

Using the introduction of the single collateral list as exogenous shock to the liquidity of bank assets is appealing from an empirical perspective. Its implementation in January 2007 clearly precedes the Great Financial Crisis and the onset of the European debt crisis. By exploiting a collateral framework change outside a crisis period, we argue that our results are unlikely to be confounded by generally tight credit conditions.

To test the effects of the collateral framework shock, we first need to identify banks that were most affected by it. Therefore, we use loan-level data from the syndicated loan market, which is the dominant form of cross-border lending in the euro area (Doerr and Schaz, 2021). For each bank, we compute the share of cross-border loans that it issued prior to the announcement of the single list in June 2005. If this share is above the median of all banks, assets held by this bank experience a large improvement in their liquidity under the single list, and we classify such a bank as “affected”.

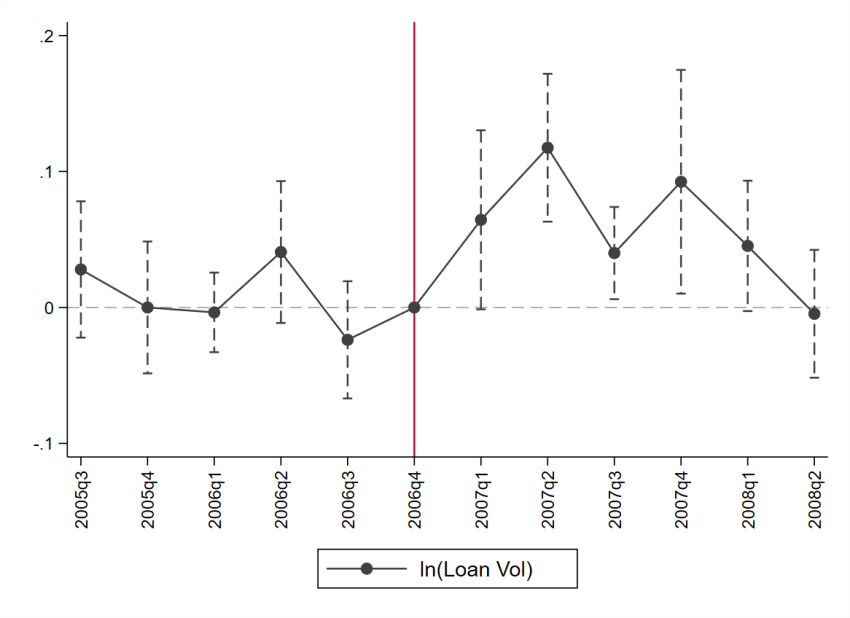

We then adopt a canonical difference-in-difference strategy to test for a statistically different credit supply of “affected” bank vis-à-vis the control group of unaffected banks after the collateral framework shock. Our baseline empirical specification includes loan and bank level controls, as well as a rich set of fixed effects to absorb loan demand (Khwaja and Mian, 2008). Figure 1 shows that credit supply of affected banks and unaffected banks did not differ significantly prior to the shock and increases by around 10% afterwards. The opposite picture emerges for credit spreads, which decline by around 15 basis points after the shock. More specifically, credit supply increases at the intensive and extensive margin: firms are more likely to receive credit after the shock and credit volumes are larger, conditional on firms receiving a loan.

Figure 1: Dynamic Effect of Collateral Framework Shock on Bank Lending

Notes: Bars indicate 95% confidence intervals. The vertical red line indicates last pre-shock quarter.

We provide additional support for our empirical strategy by showing that internationally active banks in the EU but outside the euro area do not increase their credit supply in response to the collateral framework change. Similarly, internationally active banks that predominately lend in the form of revolving credit lines do not respond to the shock in a different way than their peers: credit lines did not become eligible as collateral, such that we would not expect an effect on bank lending.

As a next step, we turn to the effects of expansionary collateral policy beyond credit supply. Specifically, we show that affected banks increase their risk-taking on the syndicated loan market. Firms in the non-tradable sector receive more additional credit and the distance-to-default of affected banks’ loan portfolio increases after the shock. Notably, firms do not simply switch from unaffected to affected banks but instead experience total loan growth. This is consistent with a risk-taking channel of collateral policy documented for residential mortgages by Van Bekkum et al. (2017). Furthermore, firms that were borrowing heavily from affected banks prior to the shock experienced an increase in employment and investment: collateral policy has real effects in the non-financial sector. These two results suggest that the risk-taking and real effects of unconventional monetary policy are also at play in conventional times. This potentially bears implications for future implementation of monetary policy in the euro area, which continues to rely on “fixed-rate tenders with full allotment against broad collateral” (ECB, 2024).

As a final step, we demonstrate that the lion’s share of additional credit supply was targeted at previously eligible domestic firms. To show this, we re-estimate our baseline specification on three different sub-samples, based on firm location. Firms residing outside the euro area do not receive a significantly larger inflow of bank credit, since their loans have not become eligible under the single list regime. While firms located in another euro area country receive significantly more credit from affected banks, the effect is around ten times larger for (previously eligible) domestic firms.

The low level of direct lending relationships between banks and firms across the euro area has been identified as major obstacle to financial market integration. For example, Hoffmann et al. (2022) show that, prior to the Great Financial Crisis, cross-border lending in the euro area was largely restricted to the interbank market, while firms kept relying on domestic banks. It is however not clear which instruments effectively contribute to financial market integration.

Our study zooms into one potential instrument to increase direct cross-border lending. The single collateral list removes the benefit of extending domestic loans stemming from their collateral eligibility in the national collateral framework regime prior to 2007. By removing this advantage relative to cross-border loans, the single list aimed to “enhance the level playing field in the euro area, further promoting equal treatment for counterparties and issuers” (ECB Monthly Bulletin, May 2006). However, our results suggest that central bank collateral frameworks only have a small impact on financial market integration; at least as far as cross-border lending through the syndicated loan market is concerned. Central bank collateral policy can hardly overcome the large real barriers to cross-border lending, such as country-specific corporate bankruptcy laws or a lack of geographic proximity.

Doerr, S. and Schaz, P. (2021). Geographic Diversification and Bank Lending During Crises. Journal of Financial Economics 140(3), 768-788.

ECB (2006). The Single List in the Collateral Framework of the Eurosystem. Monthly Bulletin May 2006, 75-87.

ECB (2024). Changes to the Operational Framework for Implementing Monetary Policy. Link: https://www.ecb.europa.eu/press/pr/date/2024/html/ecb.pr240313~807e240020.en.html.

Huettl, P. and Kaldorf, M. (2024). The Transmission of Bank Liquidity Shocks: Evidence from the Eurosystem Collateral Framework. Bundesbank Discussion Paper 04/2024.

Hoffmann, M., Maslov, E., and Sorensen, B. (2014) Small firms and domestic bank dependence in Europe’s great recession. Journal of International Economics 137, 103623.

Khwaja and Mian, A. (2008) Tracing the Impact of Bank Liquidity Shocks: Evidence from an Emerging Market. American Economic Review 98(4), 1413–1442.

Mésonnier, J., O’Donnel, C. and Toutain, O. (2021). The Interest of Being Eligible. Journal of Money, Credit and Banking 54(2), 425-458.

Van Bekkum, S., Gabarro, M. and Irani, R. (2017). Does a Larger Menu increase Appetite? Collateral Eligibility and Credit Supply. Review of Financial Studies 31(3), 943-979.