The COVID-19 pandemic poses risks, but also an opportunity for Europe’s economy. Lock-downs, sudden drops in demand and widespread uncertainty contributed to a massive shock for European firms. In the short term, such shock could only be countered via substantial policy intervention, both on the monetary and the fiscal front. In the long term, however, Covid-19 is a game changer: it will lead to structural changes in the global economy and most aspects of human life – see, inter alia, Jorda, Singh, and Taylor (2020) and Brookings (2020). It obliges firms to adapt to a “new normal”, which requires more digitalisation, more innovation and updating production settings. Combined to the reconfirmed EU climate ambition, this means a call for a radical shift and, in fact, more investment.

The 5th edition of the EIB Investment Survey, sheds light on the challenges ahead. Large sections of Europe’s economy will remain behind, if they fail to transform. Weakening internal finance and the nature of the required investment call for long-term patient investors – combining equity and patient debt instruments. As traditional SMEs often lack the skills to innovate, more technical assistance and/or advisory is needed, to accompany financial incentives and accelerate re-skilling. Policy support has to evolve as the crisis advances, from liquidity provision to a more targeted push to structural transformation.

The Covid-19 crisis has been a massive shock for European firms.

Despite the massive policy stimulus in the EU, both on the monetary and fiscal front, real GDP is contracting by levels unrivalled since the WWII. An investment slump is underway. Aggregate investment contracted by 19% yoy in Q2 2020, with all components of investment affected – see IMF (2020) and EIB (2021, forthcoming). The COVID-19 crisis will lead to structural changes in the global economy and most aspects of human life – see, inter alia, Jorda, Singh, and Taylor (2020) and Brookings (2020). In this note, we present the results of the 2020 EIB investment survey, detailing the impact of the crisis as felt by European and US corporates at the end of the virus first wave.

The EIB Investment survey (EIBIS) sheds light on the crisis impact on EU firms.

EIBIS is an annual survey, targeting 13,000 EU and US firms, built to be representative for each EU member states, for firms size and sector. At its 5th edition, it was administrated during the Summer of 2020, just at the end of the first wave of lockdowns.

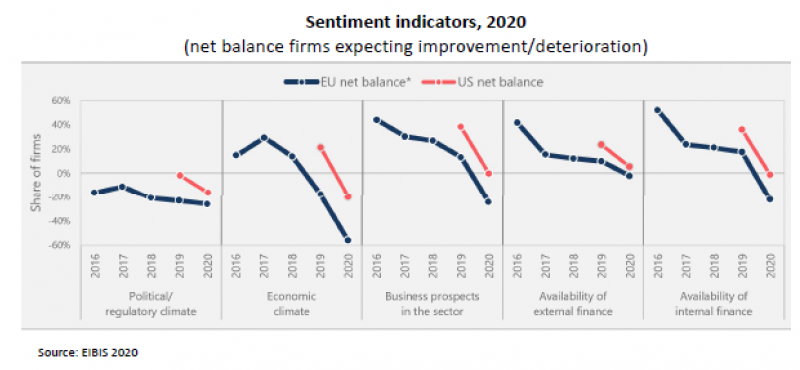

According to EIBIS, in the first half of 2020, 55% of EU firms reduced employment in some ways, via layoff, redundancies, temporarily leaves and working hours, due to Covid-19. Sentiment indicators reveal a substantial deterioration in the economic environment, the regulatory environment and the business prospects. Firms experience deteriorating internal finance, while external finance remains more muted, mostly associated to debt, with liquidity secured via massive public sector guarantee schemes ad liquidity provisions to banks.

Covid-19 is a shock in the short term and a game changer in the medium-long.

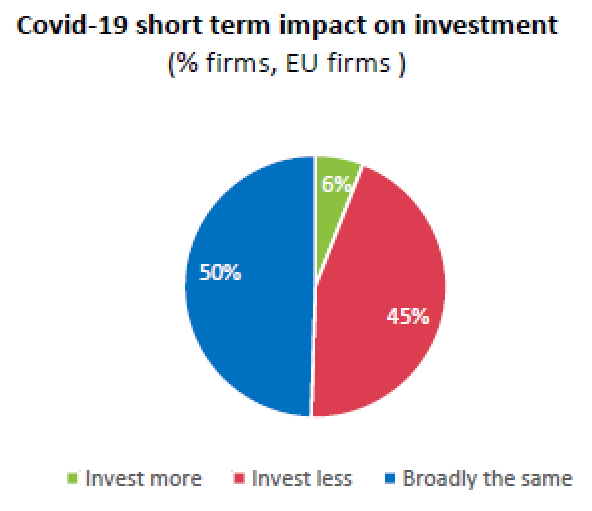

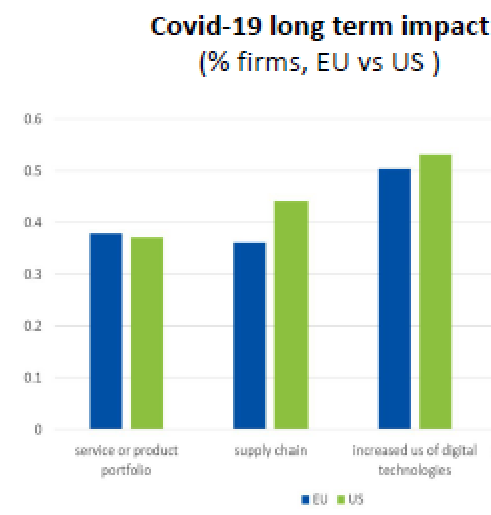

In such circumstances, 45% of EU firms say they are investing less due to the pandemic, with investment plans either delayed or abandoned. However, what is even more important, the Covid-19 crisis is a game changer in the medium to long term. Firms foresee the needs to adapt to a “new normal”, post Covid-19. 50% of EU firms say that more investment in digitalisation will be needed because of the pandemic. 40% of firms see a long-term need to adapt their product/services portfolio because of the pandemic. 40% predict an impact on their supply chain. The discrepancy between reducing investment today and need to invest to adapt to the new normal is a clear source of concern.

|

|

| Source: EIBIS 2020 | |

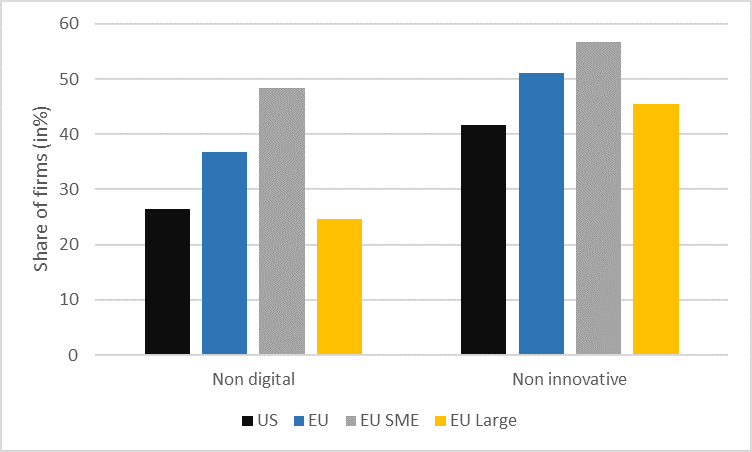

Compared to US firms, EU firms – particularly SMEs – innovate less and lag behind in digitalisation.

According to EIBIS 2020, 37% of EU firms have not adopted any digital technology, vs 26% in the USA. However, innovation and digital adoption has been expanding overtime, with the share of firms which have introduced innovations or implemented at least one digital technology increasing both in the EU and in the US vs EIBIS 2019. Larger firms have higher rates of digital adoption than smaller firms. Only 52% of SME’s in the EU have adopted at least one digital technology, vs 75% among the large firms. The status of digitalisation in the EU parallels that of innovation: 51% of EU firms did not introduced any innovations (products, processes or services) as part of their investment activities, vs. 41% in the US. Larger firms are also more likely to innovate than smaller firms (55% vs 43%).

EU vs US firms – digitalisation and innovation, by size

Source: EIBIS 2020

EU firms risk being left behind.

With investment collapsing, many firms – particularly the smaller – may fail to adapt to the new normal, becoming ever less competitive. Non-digital firms invest less, innovate less and grow less. There is a growing knowledge gap on digitalisation. Firms that haven’t yet invested in digital technology fail to perceive the urgency. Diffusion of digitalization requires awareness of the opportunity and investing in the background infrastructure. Failing to invest, those firms will also be left exposed to the risks posed by the climate transition.

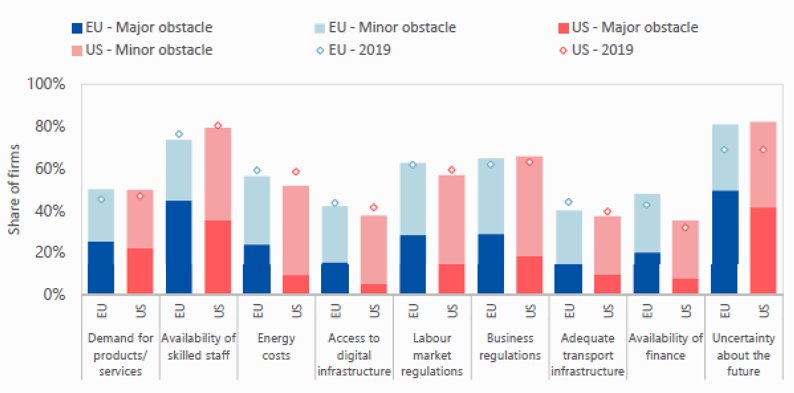

Uncertainty, skills and finance present critical constraints to investment.

Long term barriers to investment

Source: EIBIS 2020

Action is needed at a critical juncture.

Brookings (2020), “Reimagining the global economy: Building back better in a post-COVID-19 world,” Available at https://www.brookings.edu/wp-content/uploads/2020/11/Reimagining-Global-Economy.pdf

EIB (2021), “Investment Report 2020/2021: Towards a Smart and Green Europe, in the Covid-19 era.” EIB, Luxembourg (forthcoming).

IMF (2020), “Global Prospects and Policies.” Washington: International Monetary Fund.

Jorda, O., S. R. Singh, and A. M. Taylor. 2020. “Longer-Run Economic Consequences of Pandemics,” Federal Reserve Bank of San Francisco Working Paper 2020-09. Available at https://doi.org/10.24148/wp2020-09.