We present evidence on how bank managers’ systematic over-optimism or over-pessimism (bank manager sentiment) affects the amount of credit that they supply to the real sector. We show that bank manager sentiment is related to past fundamentals, implying that loan growth and contemporaneous economic fundamentals might be systematically disconnected. Finally, we show that bank manager sentiment spills over to their equity investors, who seem to perceive banks with high bank manager sentiment as having a lower systemic risk, and conversely. To estimate bank manager sentiment, we proceed in two steps. We first use textual analysis methods (using both dictionary and machine learning approaches) to build a textual score measuring the tone of bank earnings press release documents. We then use this measure to define bank manager sentiment as the variation in the textual tone score which is orthogonal to bank-specific and macroeconomic fundamentals.

Since the seminal work of Keynes (1936), the sentiment (i.e. animal spirits) of economic agents is known to have an impact on economic behaviour. However, little is known about how the sentiment of bank managers impacts banks’ lending and risk profiles. The answer to this question is important both for financial stability as well as for firms’ access to credit. If bank managers are too optimistic, they may extend too many loans and take on too many risks compared to the economic and financial fundamentals, resulting in an excessive build-up of systemic risk. If, in contrast, bank managers are too pessimistic, they may lend not enough given the economic and financial fundamentals and are hence not fulfilling their role of financing the economy. In Brueckbauer and Cezanne (2022), we provide evidence on how systematic over-optimism on the part of banks may affect the amount of credit they supply to the real sector.

The textual tone of bank earnings press release documents forms the basis for the measure of bank manager sentiment in Brueckbauer and Cezanne (2022).1 We implement state-of-the-art textual analysis methods to build a textual tone score for each bank earnings press release. The more positive the tone employed in the earnings press release, the higher is our textual tone score, and conversely.

Our sample of bank earnings press releases comprises all English language press releases of banks from developed European markets that are available in the database of data provider S&P Global Market Intelligence. The sample comprises over 200 banks and covers the period between 2006 and 2019.

As we show in Brueckbauer and Cezanne (2022), the resulting textual tone scores are strongly correlated with the fundamentals of banks, i.e. measures of their performance, business models, and the economic environments in which they operate, but also contain interesting variation that goes beyond fundamentals. We thus remove the variation in textual tone that is explained by economic fundamentals and interpret the resulting variable as bank manager sentiment.

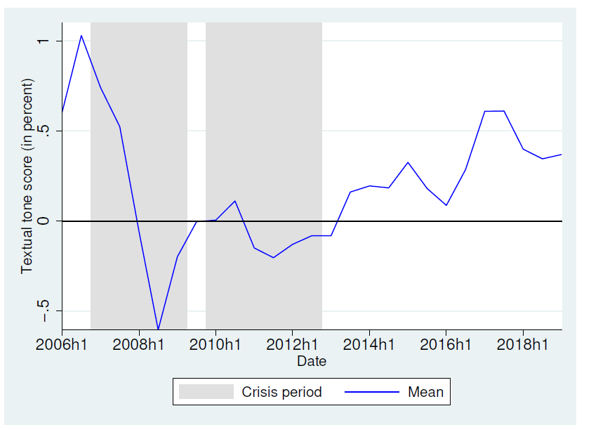

Figure 1: Average textual tone over time

Figure 1 shows the evolution of the average textual tone score from Brueckbauer and Cezanne (2022) over the sample period. The average textual tone score is pro-cyclical. Consistent with global events, it is negative in the crisis years 2008 and 2009 (i.e. during the global financial crisis) and 2011 to 2013 (i.e. during the European sovereign debt crisis) and positive in boom periods, i.e. before the year 2008 and after the year 2013. Overall, average tone starts to decrease in 2007, remains around zero between the end of 2009 and 2013 and recovers afterwards.

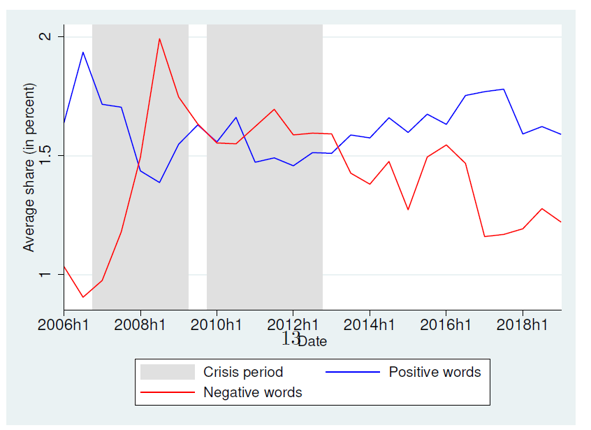

Figure 2: Average shares of positive and negative words over time

In Figure 2, we investigate whether the variations in textual tone score are rather due to optimism or pessimism. To do so, we use textual analysis methods to decompose the textual tone score of each bank earnings press release into a share of words with a positive connotation and a share of words with a negative connotation. Figure 2 reveals that the decrease in average tone before the financial crisis is predominantly driven by an increase in shares of negative words, which doubles between 2007H1 and 2008H2, while the average share of positive words only decreases by about 19%. The upward trend in the average of tone, which starts in the 2013, is driven by opposing trends in both variables.

Equipped with bank manager sentiment, we directly tackle the question of whether higher sentiment is associated with the subsequent actions of the banks and their risk profiles as perceived by the financial markets. We do this by implementing two exercises. First, we study whether a higher bank manager sentiment is associated with a higher lending amount in the next six months. We find that a one percentage point increase in bank manager sentiment is associated with an increase in loans by 0.59% in the next six months. Moreover, we document that the predictive power of bank manager sentiment for loan growth is mainly driven by the share of negative words bank managers use in their earnings press release documents. Second, we study whether a higher bank manager sentiment is associated with the systemic risk of the bank in the next six months. We estimate the systemic risk of a bank using the SRISK measure introduced by Brownlees and Engle (2016), which captures how equity investors perceive the riskiness of a bank. We find that a one percentage point increase in bank manager sentiment is associated a decrease in the SRISK by 0.12 percentage points in the next six months. In summary, our empirical results suggest that bank manager sentiment is significantly and positively associated with subsequent lending amount growth but also with a lower subsequent risk perception of the bank by equity investors.

Our finding that bank manager sentiment includes information about future lending amount and systemic risk that goes beyond economic fundamentals raises new questions. Does bank manager sentiment capture over-optimism/-pessimism on the part of bank managers? If this is the case, the positive association between bank manager sentiment and loan growth would be suggestive for lending behaviour that is not fully consistent with economic fundamentals. Or does bank manager sentiment capture private information of bank managers that is not yet observable in contemporaneous fundamentals of the banks? The latter would not be problematic from a financial-stability-perspective, but would nevertheless be an interesting result for researchers and practitioners.

We tackle both questions in our paper. To check for over-optimism /-pessimism, we test whether bank manager sentiment has an extrapolative structure, i.e. whether it is associated with past realizations of economic and financial fundamentals. An extrapolative structure implies that sentiment is backward-looking and hence is too high or too low relative to current bank and macroeconomic fundamentals. We do this by running regressions of bank manager sentiment on past realizations of economic fundamentals and past realizations of bank manager sentiment. If we find that some of the latter variables predict future bank manager sentiment, bank manager sentiment has an extrapolative structure.

In order to check whether bank manager sentiment captures private information, we test whether it predicts future bank performance. If bank managers have a rational reason to be optimistic on top of fundamentals and convey this optimism in earnings press releases, bank manager sentiment should be positively associated with future measures of bank performance.

The results of both tests suggest that bank manager sentiment indeed captures over-optimism/-pessimism and not private information. More specifically, we document that increases in past realizations of GDP growth rates, interbank interest rates, and bank manager sentiment are associated with subsequent increases in bank manager sentiment. These positive relationships imply that bank manager sentiment is always backward-looking and therefore not fully in line with current fundamentals. With respect to bank performance, depending on the indicator, we either find no or a negative association between bank manager sentiment and subsequent financial performance for banks.

In Brueckbauer and Cezanne (2022), we provide evidence on how systematic over-optimism and over-pessimism on the part of banks affect the amount of credit they supply to the real sector. We extract a measure of tone from bank earnings press release documents and show that the resulting bank manager sentiment predicts higher lending amount, lower systemic risk, does not predict better bank performance and is partially backward-looking. Taken together, the results suggest that banks’ lending behaviour is not fully in line with economic fundamentals: relative to economic fundamentals, banks lend too much in good times and not enough in bad times.

A key implication of our findings for bank supervisors, investors, and bank managers is that they encourage counter-cyclical decisions. For bank supervisors, our findings strengthen the case for counter-cyclical capital regulations that were added to the Basel Framework after the Great Financial Crisis. The extrapolative structure in bank manager sentiment suggests that, during economic expansions, bank manager sentiment moves further and further away from economic fundamentals, requiring increasingly strict bank capital rules to safeguard financial stability. During long economic contractions, when bank managers are excessively pessimistic and lend less than supported by bank and macroeconomic fundamentals, supervisors might even think about softening capital rules. As bank manager sentiment varies across banks, these counter-cyclical capital rules will be more effective when they are tailored to the individual banks.

For investors and bank managers, counter-cyclical behaviour implies that their risk management systems should become increasingly restrictive during economic expansions and decreasingly restrictive during economic contractions. As expected returns on various asset classes vary across economic cycles and are usually lower in expansions and higher in contractions, stronger counter-cyclical risk management mechanisms promise a better long-term performance for banks and their investors.

Brownlees, C., & Engle, R. F. (2017). SRISK: A conditional capital shortfall measure of systemic risk. The Review of Financial Studies, 30(1), 48-79.

Brückbauer, F., & Cezanne, T. (2022). Bank manager sentiment, loan growth and bank risk. ZEW-Centre for European Economic Research Discussion Paper, (22-066).

Davis, A. K., J. M. Piger, and L. M. Sedor (2012). Beyond the numbers: Measuring the information content of earnings press release language. Contemporary Accounting Research 29 (3),845–868.

Jiang, F., Lee, J., Martin, X., & Zhou, G. (2019). Manager sentiment and stock returns. Journal of Financial Economics, 132(1), 126-149.

Keynes, J. M. (1936). The General Theory of Employment, Interest and Money. Macmillan. 14th edition, 1973.

Li, F. (2010). The information content of forward-looking statements in corporate filings—a naive bayesian machine learning approach. Journal of Accounting Research 48 (5), 1049–1102.

This approach is motivated by Jiang et al. (2019) and the finding from the accounting literature that managers use corporate disclosures to signal their expectations about future firm outcomes (see e.g. Li, 2010; Davis et al., 2012).