Disclaimer: This brief is based on Gregori and Ramos (2024). The views expressed are purely those of the authors and may not in any circumstances be regarded as stating an official position of Banco de Portugal or the Eurosystem.

Our study explores empirically the effects of monetary and macroprudential policy shocks on key policy-relevant macroeconomic variables, namely credit, consumer price, and economic growth. The analysis relies on a Bayesian TVP-SVAR model with monthly frequency data in the period 2010-2022 for Portugal. Macroprudential policy shocks are based on two microfounded intensity indicators, for capital and borrower-based measures. Results show that a monetary policy tightening reduces credit growth, especially in periods of high inflation, suggesting a cross-policy effect. In addition, a macroprudential policy tightening does not lower macroeconomic aggregates, highlighting that the implemented measures did not disrupt credit or economic growth.

Do monetary policy (MP) and macroprudential policy (MaPP) affect key policy relevant macroeconomic variables, namely credit, consumer price and economic growth? Are there cross-policy effects? Do high inflation periods have an impact on policy transmission channels? These are the key questions that this study1 intends to address. Starting from 2021 economies worldwide experienced high inflationary pressures attributable to different factors, such as the disruption of global supply chains, the materialisation of energy shocks, and the recovery in global demand (IMF, 2023; Ari et al., 2023). The European Central Bank (ECB) reacted by increasing its policy rates after a prolonged period of historically low levels, highlighting the ECB goal of reducing the inflation rate to reach the 2% medium-term target.

To address inflationary pressures and foster financial stability, policymakers can resort to MP and MaPP. While the main goal of MP is price stability, the core objective of MaPP is to safeguard financial stability by mitigating systemic risks. However, MaPP may also affect aggregate demand (Teixeira and Venter, 2023), potentially impacting price and output levels. In the same vein, MP may go beyond price stability by influencing financial stability through credit effects (e.g., Tovar et al., 2012; Claessens et al., 2013; Aiyar et al., 2014; Kuttner and Shim, 2016; Bruno et al., 2017; Cerutti et al., 2017). These policy tools could create challenges for policymakers especially during times when high (low) inflation coincides with low (buoyant) credit growth. Under such circumstances, contractionary (expansionary) MP would increase the disinflationary (inflationary) pressures, while accommodative (tightening) MaPP may increase (decrease) credit growth and inflationary (disinflationary) pressures, therefore pushing in the opposite direction of MP. Private-sector agents would then be simultaneously encouraged to both decrease and increase borrowing, due to the contrasting policy incentives. Thus, a coordination between monetary and macroprudential policies may be required to better achieve both price and financial stability goals (Paoli and Paustian, 2017; Agénor and Jackson, 2022).

The euro area (EA) is characterised by countries sharing a single currency and MP, but despite the high level of integration among EA countries, there can still be significant heterogeneity affecting financial stability risks, such as variations in the business and credit cycles (Maddaloni and Peydró, 2013). In this context, MaPP can play a central role (Buch et al., 2021), as in a monetary union where MP encompasses area-wide developments, country-level MaPPs gain importance to counteract possible adverse effects on financial stability of the “one-size-fits-all” MP. Indeed, MaPPs that complement MP by targeting national financial imbalances can deliver welfare benefits in terms of smaller business cycle fluctuations (Martin et al., 2021).

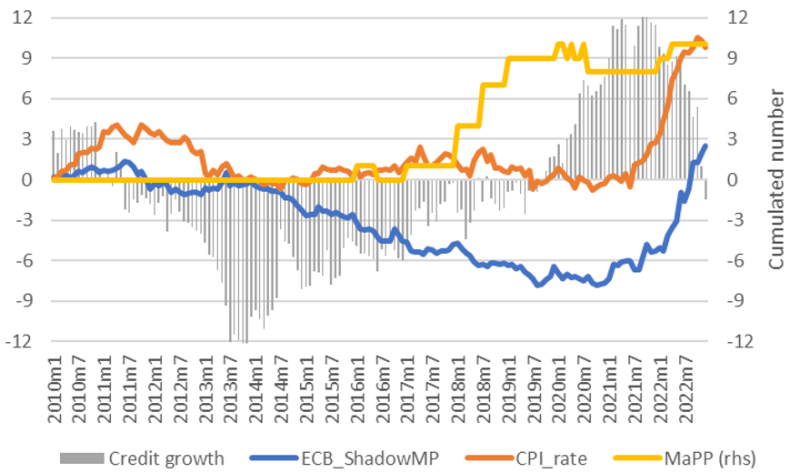

The role of MaPP may be considered especially relevant for small-open economies in a common monetary area, as the “one-size-fit-all” MP may be misaligned with the country financial or business cycle, and MaPP can better focus on country-specific factors. This study focuses on the Portuguese economy, as it represents a case study of interest to deepen monetary and macroprudential policy effects. Indeed, Portugal is a small-open economy characterised by a high share of real estate floating rate loans to households, with a ratio among the highest in the EA2, possibly leading to a stronger and quicker MP transmission compared to other EA countries. Furthermore, in 2018 borrower-based measures (BBM) have been introduced in the form of a Recommendation as a response to easing credit standards, high levels of indebtedness, and low saving rates of households. The Recommendation targets new loans to households, including mortgages as well as consumer credit, by setting limits to some of the criteria that are used by financial institutions when assessing the creditworthiness of borrowers. This measure aims to prevent credit institutions from taking on excessive risk when granting credit to households. Ultimately, this should lead to a more resilient financial sector as well as affordable access to finance for borrowers (Leal and Lima, 2018). Interestingly, Portugal was among the first countries to introduce a stressed DSTI ratio limit in BBM.3 In addition, in the time span analysed (years 2010-2022) Portugal is characterised by a dynamic credit cycle with both boom and bust periods, and an increase in inflation rate from the end of 2021 (Figure 1 presents graphically these features.

Figure 1: Credit growth, inflation rate, MP and MaPP in Portugal

Notes: Gray bars refer to total credit growth (i.e. households and non-financial corporations); the yellow line refers to the cumulative number of macroprudential policy measures implemented (i.e. MaPP indicator), constructed using the Integrated Macroprudential Policy database (Alam et al., 2019) considering both capital and borrower-based measures; the orange line refers to Consumer Price Index (CPI) rate. Data refer to Portugal. The blue line to the ECB shadow monetary policy (ECB_ShadowMP), as elaborated by Wu and Xia (2020); see also: https://www.atlantafed.org/cqer/research/wu-xia-shadow-federal-funds-rate).

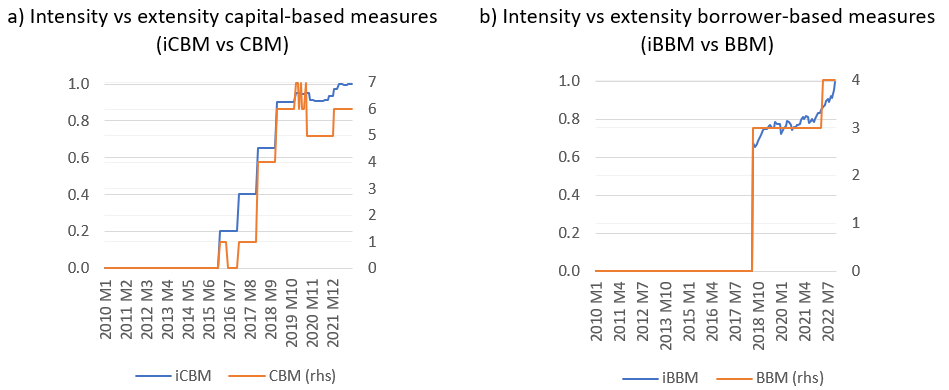

To investigate the effect of MaPP, a common approach used in the literature is to construct a so-called “extensity indicators”, imposing that all MaPPs have an equal weight. A different and more recent approach generates “intensity indicators”, and it is based on the fact that different MaPPs may have dissimilar effects, therefore the weight of each policy should be related to its intensity (Eller et al., 2020). We contribute to this latter approach constructing the CBM and BBM intensity (iCBM and iBBM) indicators for Portugal, to investigate separately the effects of CBM and BBM on macroeconomic aggregates.

The iCBM indicator focuses on macroprudential capital buffers. Capital buffers are funds that financial institutions are required to hold, in addition to the minimum capital, in the form of Common Equity Tier 1 (CET1) capital expressed in percentage of total risk exposure amount (TREA). While some capital buffers apply to all institutions, such as the capital conservation buffer and the countercyclical capital buffer, the O-SII buffer applies only to systemically important ones, and the calibration of the buffer is institution specific. The systemic risk buffer can either be applied to all institutions and exposures, or to one or more subsets of those institutions and exposures (i.e. sectoral systemic risk buffer).

The iBBM indicator captures the relative effectiveness of the imposed quantitative limits. It is calculated for each policy instrument separately, i.e., there are different intensity-adjusted indices for LTV, DSTI, and maturity limits. The characteristics used to compute these intensity-adjusted indices are the quantitative limits and the scope. The latter is measured by the importance of each loan segment to which the limit is applied to in the total household loans. The larger the scope, the broader the lending segment that is targeted and the higher the share of the economy that is potentially affected by the instrument. A larger scope contributes to a larger value for the index. Since there are different LTV and maturity limits depending on the loan category, we also calculate different indices for each of those loan categories. For each loan category and period, the relative effectiveness of the imposed borrower-based limits is computed by the deviation between each limit of the specific macroprudential measure, and the average (weighted by loan amount) of the related variable of interest (i.e. LTV, DSTI and maturity). By comparing the limit to the average, we get an indication of how effective each limit is over time, and not only when the measure is introduced or changed, as in the case of a dummy indicator. Figure 2 shows the constructed Intensity indicators vs extensity ones.

Figure 2: Intensity vs extensity indicators

Notes: Capital-based measures (CBM) and borrower-based measures (BBM) refer to the extensity capital and borrower-based indicators, constructed using the Integrated Macroprudential Policy database (Alam et al., 2019), while intensity capital-based measures (iCBM) and intensity borrower-based measures iBBM refer to intensity capital-based (i.e. Capital Conservation Buffer, Other Systemically Important Institutions capital buffer, Countercyclical capital buffer, Systemic Risk buffer) and borrower-based (i.e. Loan-to-value LTV and Debt service-To-Income ratio limits, and maturity limits) indicators.

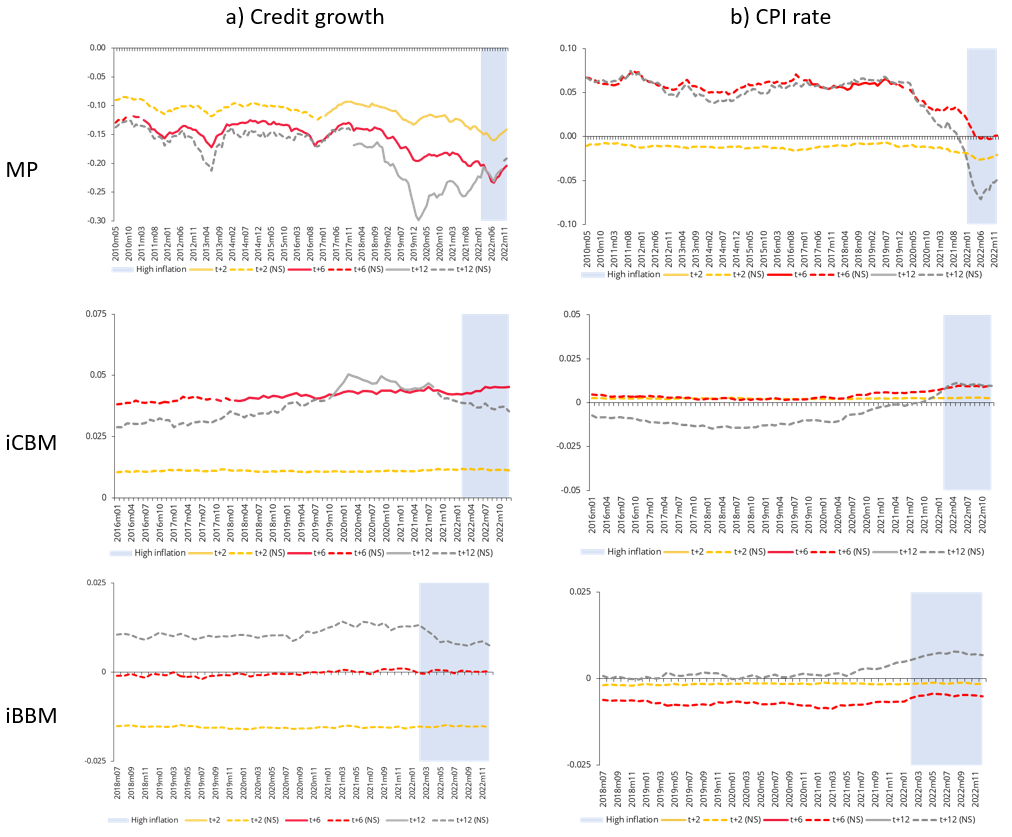

We are interested in detecting possible differences in policy effects through time, considering that macroeconomic variables could react differently to policy shocks, for instance in relation to the business cycle or in a period with high inflation, changing the magnitude of transmission channels. To capture this aspect, the parameters of the model should not be constant, but be allowed to change over time, and time-varying coefficient VAR models are well suited for this purpose. In addition, the intensity of the policy shocks may also change over time, such as in periods in which policymakers are more active (higher volatility) vis-à-vis periods in which they are less prone to undertake policy measures (lower volatility). To include this feature in the model, the error term shall be characterized by a time-varying volatility (i.e. stochastic volatility). Therefore, the analysis relies on a Bayesian TVP-SVAR model with monthly frequency data in the period 2010-2022. This approach allows to disentangle the evolution of macroeconomic relationships between those impacting coefficients’ variations, and those related to volatile changes. Macroprudential policy shocks are based on two microfounded intensity indicators, for capital and borrower-based measures, as discussed in the previous section. Results are based on impulse-response functions obtained from the estimated Bayesian TVP-SVAR.4 For simplification and illustration purposes, results focus on time-varying effects of policy shocks after two, six, and twelve months. Solid lines indicate results confirmed by credibility intervals, while dashed lines results that are not statistically significant.

Figure 3 shows how credit growth reacts to policy shocks. MP shocks are found to negatively affect credit growth. The effect is statistically significant in all the reported impulse-response functions (after two, six, and twelve months) from January 2018 onwards. In terms of magnitude, the six-months impulse-response function has the strongest negative impact in July 2022, where the one standard deviation shock of MP generates a decrease of 23 basis points in credit growth. Rescaling this result from standard deviation to percentage shocks, 100 basis points of MP tightening result in a credit growth decrease of 48 basis points. Interestingly, in Portugal the share of real estate floating rate loans to households is among the highest in the EA (in August 2023 floating rate loans accounted for 85% of housing loans in terms of stocks and 56% in terms of flows5), signalling that this transmission channel of the MP on credit dynamics may be particularly relevant. Regarding MaPP shocks, we find that they do not disrupt credit growth. CBM are positively related to credit growth, also during the COVID-19 period. This result could be attributable to a correlation effect, considering that the introduction of capital buffer requirements (such as CCoB and O-SII buffers) did not negatively affect banks in a significant way, since the period from 2016-20 was characterized by a negative credit growth (as shown in Figure 1). These capital buffers were introduced with relatively long phasing-in periods and with the intention of building up resilience and not to disrupt credit. BBM negatively affects credit growth in the short-term (after two months), has no significant effects after six months, and positively affects credit growth after twelve months, but all these effects are not statistically significant. These results could be attributable to the fact that BBMs applied in Portugal only target new credit agreements to households and only significantly affect higher-risk loans (tail risk). In addition, BBM have been implemented to promote the adoption of prudent credit standards on loans and not to mitigate excessive credit growth (Leal and Lima, 2018). Furthermore, as already identified in the literature as an effect of the interaction between MP and MaPP (Alpanda and Zubairy, 2017; Karadi and Nakov, 2021), the loosening of MP may lower the effectiveness of MaPP’s tightening, highlighting the importance of policy coordination. Policy shocks’ effects on inflation rate, but negative MP effects may get significant in the near future, as the impulse responses entered in the negative territory (Figure 3, right column, grey and yellow lines).6

Figure 3: Effects of Policy shocks on macroeconomic variables

Notes: Figures show the IRFs after 2, 6 and 12 months of one standard deviation shock of policy variables, namely monetary policy (MP), capital-based measures (CBM) and borrower-based measures (BBM), on credit growth (left column, in basis points) and Consume Price Index (CPI, right column). Solid lines represent results where 68% credibility intervals confirm the median outcome, while dashed lines represent results not significant (NS), meaning that they are not confirmed by 68% credibility intervals. The period of the analysis ranges from January 2010 to December 2022, but the first four observations are lost due to lags (Akaike criterion). The shaded area highlights the period of high inflation, where the Harmonised Index of Consumer Prices in Portugal is above 4%. For CBM and BBM, results are reported since the implementation of the first measures, January 2016 and July 2018 respectively.

This paper studies empirically the effects of monetary and macroprudential policy shocks on key policy-relevant macroeconomic variables, namely credit, consumer price and economic growth. The analysis focuses on Portugal during the period 2010-2022 with monthly frequency data, to better capture short-term effects, relying on a Bayesian TVP-SVAR model. Macroprudential policy shocks are based on two micro-founded intensity indicators, for capital and borrower-based measures. Results show that a monetary policy tightening reduces credit growth, especially in periods of high inflation, suggesting a cross-policy effect. In addition, a macroprudential policy tightening does not lower macroeconomic aggregates, suggesting that the implemented measures did not disrupt credit or economic growth.

The main policy implication of the evidence provided by this study relies on the role of monetary policy in addressing financial stability concerns. In fact, in a period where there is a monetary policy tightening, the extent to which macroprudential policy should also be tightened shall be carefully examined, to balance financial stability needs and adverse effects on economic growth.

Agénor, Pierre-Richard and Timothy Jackson (2022). “Monetary and macroprudential policy coordination with biased preferences.” Journal of Economic Dynamics and Control, 144, 104519.

Aiyar, Shekhar, Charles Calomiris, and Tomasz Wieladek (2014). “Does macroprudential regulation leak? Evidence from a UK policy experiment.” Journal of Money, Credit and Banking, 46(s1), 181–214.

Alam, Zohair, Adrian Alter, Jesse Eiseman, Gaston Gelos, Heedon Kang, Machiko Narita, Erlend Nier, and Naixi Wang (2019). “Digging deeper-Evidence on the effects of macroprudential policies from a new database.” Working Paper 2019/066.

Alpanda, Sami and Sarah Zubairy (2017). “Addressing household indebtedness: Monetary, fiscal or macroprudential policy?” European Economic Review, 92, 47–73.

Ari, Anil, Carlos Mulas-Granados, Victor Mylonas, Lev Ratnovski, and Wei Zhao (2023). “One Hundred Inflation Shocks: Seven Stylized Facts.” Working paper, International Monetary Fund.

Bruno, Valentina, Ilhyock Shim, and Hyun Song Shin (2017). “Comparative assessment of macroprudential policies.” Journal of Financial Stability, 28, 183– 202.

Buch, Claudia, Manuel Buchholz, Katharina Knoll, and Benjamin Weigert (2021). “Why macroprudential policy matters in a monetary union.” Oxford Economic Papers, 73(4), 1604–1633.

Cerutti, Eugenio, Ricardo Correa, Elisabetta Fiorentino, and Esther Segalla (2016). “Changes in prudential policy instruments – A new cross-country database.” Working Paper 2016/10, International Monetary Fund.

Claessens, Stijn, Swati Ghosh, and Roxana Mihet (2013). “Macro-prudential policies to mitigate financial system vulnerabilities.” Journal of International Money and Finance, 39, 153–185.

EBA (2020). “Final report – Guidelines on loan origination and monitoring.” https://www.eba.europa.eu/regulation-and-policy/credit-risk/ guidelines-on-loan-origination-and-monitoring.

Eller, Markus, Reiner Martin, Helene Schuberth, and Lukas Vashold (2020). “Macroprudential policies in CESEE–an intensity-adjusted approach.” Focus on European Economic Integration, (Q2/20), 65–81.

ESRB (2016). “Macroprudential policy issues arising from low interest rates and structural changes in the EU financial system.”

ESRB (2023). “Assessment of a Portuguese notification in accordance with Article 133 of Directive (EU) 2013/36/EU.”

Gregori, W. D., & Ramos, Â (2024). Time-varying effects of monetary and macroprudential policies: does high inflation matter?. Banco de Portugal, Working Paper, 2024/1.

IMF (2023). “World Economic Outlook: Navigating Global Divergences.” Washington, DC.

Karadi, Peter and Anton Nakov (2021). “Effectiveness and addictiveness of quantitative easing.” Journal of Monetary Economics, 117, 1096–1117.

Kuttner, Kenneth and Ilhyock Shim (2016). “Can non-interest rate policies stabilize housing markets? Evidence from a panel of 57 economies.” Journal of Financial Stability, 26, 31–44.

Leal, Ana Cristina and Diana Lima (2018). “Macroprudential policy in Portugal: experience with borrower-based instruments.” Financial stability review, Banco de Espana.

Maddaloni, Angela and José-Luis Peydró (2013). “Monetary policy, macroprudential policy and banking stability: evidence from the euro area.” International Journal of Central Banking.

Martin, Alberto, Caterina Mendicino, and Alejandro Van der Ghote (2021). “On the interaction between monetary and macroprudential policies.” Working Paper 2527, European Central Bank.

Paoli, Bianca de and Matthias Paustian (2017). “Coordinating monetary and macroprudential policies.” Journal of Money, Credit and Banking, 49(2-3), 319– 349.

Teixeira, André and Zoë Venter (2023). “Macroprudential policy and aggregate demand.” International Journal of Central Banking, 19(4), 1–40.

Tovar Mora, Camilo Ernesto, Mercedes Garcia-Escribano, and Mercedes Vera Martín (2012). “Credit growth and the effectiveness of reserve requirements and other macroprudential instruments in Latin America.” Working Paper 2012/142, International Monetary Fund.

This policy brief is based on Gregori and Ramos (2024).

In August 2023 floating rate loans accounted for 85% of housing loans in terms of stocks and 56% in terms of flows (source: Banco de Portugal). For further details, see: ESRB (2016, 2023).

The DSTI ratio for the purpose of the macroprudential Recommendation includes interest rate and income shocks. The numerator of the ratio considers the impact of an interest rate increase, depending on the loan’s original maturity and the interest rate scheme. The denominator includes a reduction in borrowers’ income by at least 20% if the borrower’s age at the end of the loan contract is higher than 70 years old, given that a material income decrease is expected in the transition from working life into retirement. These shocks are in line with European Banking Authority’s Guidelines on loan origination and monitoring. For more information, see EBA (2020) and Leal and Lima (2018).

Computations are performed using the Bayesian Estimation, Analysis and Regression (BEAR) Toolbox available here: https://www.ecb.europa.eu/pub/research/working-papers/html/bear-toolbox.en.html.

Source: Banco de Portugal. For further details, see: ESRB (2016, 2023).

Policy shocks’ effects on economic growth are not statistically significant and are not reported here for brevity. For further details, see Gregori and Ramos (2024).