In this Policy Brief, we study the effect of having a greater management capital buffer on banks’ lending during a crisis. Using loan-level data merged with detailed supervisory data on banks’ balance sheets and regulatory requirements, we find that Portuguese banks with greater headroom above the overall capital requirement lent more to firms after the Covid-19 shock than banks with lower headroom, i.e., banks used, at least to some extent, their management buffers. The introduction of public-guarantee schemes in this period mitigated this effect as banks with lower capital headroom had the incentive to lend under these schemes. Moreover, we find that the effect of management buffer on lending is stronger for banks with lower market funding and more vulnerable firms, highlighting the importance of market pressure and risk aversion, respectively.

In response to the Covid-19 shock, several prudential authorities reduced capital buffer requirements or relaxed restrictions related to breaching them (BCBS, 2020a). The rationale of these measures relates to the intended objective of capital buffers: the further a bank’s capital ratio is from its required minimum capital ratio, the more the bank could use its buffer to keep providing credit, especially in a crisis. However, despite the accumulated buffers, both required and voluntary, banks’ capital ratios did not decrease following the Covid-19 shock. Although several other factors could help explain it, such as fiscal measures, moratoria, as well as developments in credit demand, this observation raised the question of whether capital buffers have the expected positive effect on credit supply during a crisis (Abboud et al., 2021; ECB, 2020b). In this policy brief, we answer this question by studying whether banks with greater headroom above capital requirements lent more than banks with lower headroom in Portugal during the Covid-19 shock.

During the Covid-19 shock, Portuguese banks were allowed to operate temporarily below the level of regulatory capital buffers, although noncompliance with part of them was still subject to restrictions on distributions (ECB, 2020a; Banco de Portugal, 2020a). Hence, to have a clear-cut definition of the available capital buffer not subjected to regulatory penalties that banks could use for lending, we use the Management Buffer, which is the capital headroom above the regulatory requirements, i.e., above the sum of the minimum and the combined buffer requirement. Second, the Covid-19 shock impacted considerably credit demand. Many firms were forced to borrow to withstand the impact of several months with very low economic activity. To control for credit demand, we rely on loan-level information from the Portuguese Central Credit Register. This level of granularity allows us to use the estimator proposed by Khwaja and Mian (2008) to control for credit demand. Finally, we exploit the timing of the Covid-19 pandemic as an exogenous shock to credit supply. The deep economic recession, uncertainty, and the expectation of a deterioration in bank asset quality and profitability caused by the pandemic provided a first and unique setting to test the capital framework, in particular in what regards buffers´ usability. Putting all together, our estimations reflect the difference in lending between banks with different management buffers to the same borrower around an exogenous shock to credit supply.

We collect quarterly data on loans granted to firms from the Central Credit Register (CRC). We obtain quarterly supervisory data on banks’ balance sheets and regulatory requirements from the FINREP-COREP reporting models, considering banks on a consolidated basis where applicable, i.e., lending from affiliates operating in Portugal is assigned to the ultimate parent bank. Finally, data on firms’ characteristics are obtained from the Simplified Business Information for Portugal, which provides balance sheet information from the universe of Portuguese firms on a yearly basis at the unconsolidated level. We collapse the quarterly data into a period before and one after the Covid-19 pandemic outbreak in Europe because serial correlation in panel data models leads to meaningless standard errors and therefore to less efficient results (Bertrand et al., 2004). Our pre- and post-Covid-19 shock periods comprise the average values between the second and fourth quarters of 2019 and 2020, respectively. Dependent variables are in terms of the change from the pre-period to the post-period, such as the growth rate, while control variables are the pre-period value. We end up with a cross-section sample of 492,615 loans, for 271,601 firms, from 20 banks.1

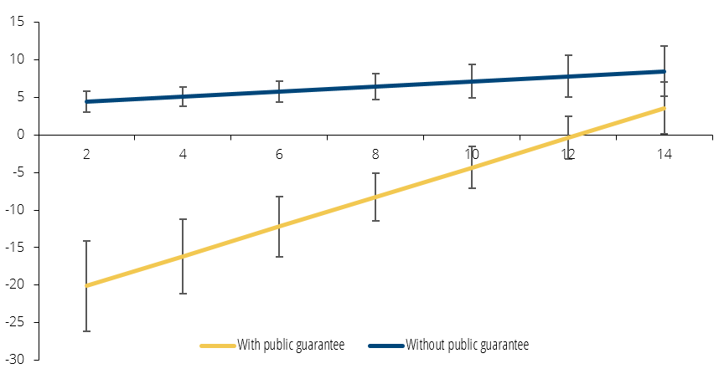

Results suggest the level of the management buffer had a positive impact on the change in lending to firms in the pandemic period (Figure 1). The effect is positive on both the extensive and intensive margins. At the extensive margin, the evidence suggests that the higher a bank’s management buffer, the less likely it is to stop lending to a client (exit) and the more likely it is to lend to a new client (entry). In addition, the effect of the management capital buffer on loans granted with a public guarantee is not statistically different from the effect on loans without a public guarantee, since, while the use of public guarantees reinforces the effect of the management capital buffer on the extensive margin, it eliminates the effect on the intensive margin.

Figure 1: Estimated marginal effect of the capital buffer on the credit growth rate (in percentage points)

Sources: COREP, FINREP and CRC (Banco de Portugal calculations). Notes: The chart plots the impact of an increase in the capital buffer equal to its standard deviation (2.8 p.p.) on the growth rate of credit to a firm between the pre-COVID19 period (Q2-Q4 2019) and the post-COVID19 period (Q2-Q4 2020). In all regressions, firm-level fixed effects are included to control for credit demand, as well as bank-level control variables (ratio of market funding to total liabilities, the average risk weight, the overall capital requirement ratio, the logarithm of total assets, and the ratio of provisions to total assets). The 99% confidence intervals are obtained by the delta method using standard errors calculated at the industry-location-bank level of the borrower. The results presented are statistically significant at the 1% level if the confidence intervals do not intersect the horizontal axis.

The results of this analysis suggest that banks with lower management buffers may have relied on public guarantees to maintain their lending relationships and market share at the expense of the lower expected profitability of publicly guaranteed loans, considering the low risk associated with this type of lending reflected in lower capital requirements. On the other hand, banks with higher capital buffers were able to maintain their risk exposure and rely less on publicly guaranteed loans. In line with this interpretation, Mateus and Neugebauer (2022) found that (i) the limits on credit line spreads under the public guarantee scheme (1%, 1.25%, and 1.5% on loans with a maturity of less than 1 year, between 1 and 3 years, and between 3 and 6 years, respectively) are reflected in an average interest rate of 1.4%, while the same is 3.6% for loans without public guarantees, and (ii) banks were more likely to grant credit with public guarantees to firms to which they already granted loans, which helps explain why the use of public guarantees only mitigates the effect of the management capital buffer on the intensive margin.

Market pressure to maintain or even increase capital ratios may prevent banks from using their capital buffers, especially during a crisis period (Behn et al., 2020, Schmitz et al., 2021, and Carvalho et al., 2022). Figure 2 shows the marginal effect of the management capital buffer on corporate lending conditional on the market discipline to which the bank may be subject. Market discipline is measured by the ratio of the bank’s market funding to total liabilities. The positive slope of both lines shows that the higher the market discipline, the greater the importance of the management capital buffer in the variation of corporate credit. However, the slope is steeper for loans under the public guarantee program. When market discipline is low, the effect of the management capital buffer is positive for the subset of loans without a public guarantee and negative for loans with a public guarantee. This reflects that banks with a higher buffer have lower incentives to lend under this government measure. But as market discipline increases, the difference in effect between these groups of loans narrows. The reduction is such that the difference is no longer statistically significant at the highest level of market discipline.

Figure 2: Estimated marginal effect of the management capital buffer on corporate credit growth conditional on the level of market discipline (in percentage points)

Sources: COREP, FINREP and CRC (Banco de Portugal calculations). Notes: The graph shows the impact, conditional on the level of market discipline (horizontal axis), of an increase in the management capital buffer by a magnitude equal to its standard deviation (2.8 p.p.) on the growth rate of credit to a firm between the pre-COVID19 period (second quarter to fourth quarter of 2019) and the post-COVID19 period (second quarter to fourth quarter of 2020). Market discipline is measured by the ratio of the bank’s market funding to total liabilities. The blue line plots the marginal effects for the subset of loans without public guarantees and the yellow line plots the marginal effects for the average value of the use of public guarantees. In all regressions, firm-level fixed effects are included to control for credit demand, as well as bank-level control variables (the average risk weight, the total regulatory minimum capital ratio, the logarithm of total assets, and the ratio of provisions to total assets). The 99% confidence intervals are obtained by the delta method using standard errors calculated at the industry-location-bank level of the borrower. The results presented are statistically significant at the 1% level if the confidence intervals do not intersect the horizontal axis.

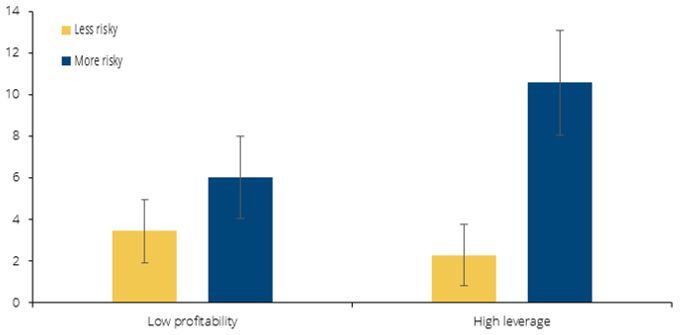

Another potential impediment to the use of capital buffers is increased risk aversion on the part of banks. Altunbas et al. (2017) document a high degree of heterogeneity in risk aversion across euro area banks, consistent with theories that treat banks as risk-averse agents operating in uncertain environments (Sealey, 1980; Ratti, 1980; Ho and Saunders, 1981; Koppenhaver, 1985; and Angbazo, 1997). Indeed, Figure 3 shows that the effect of the management capital buffer on credit growth is stronger for firms that are considered riskier in terms of profitability and leverage. The management capital buffer thus becomes an even more important factor in lending to riskier firms in a crisis context.

Figure 3: Estimated marginal effect of the management capital buffer on credit growth conditional on firm risk (in percentage points)

Sources: COREP, FINREP, CRC and IES (Bank of Portugal calculations). Notes: The chart shows the impact of an increase in the management capital buffer by a magnitude equal to its standard deviation (2.8 p.p.) on the growth rate of credit to a firm between the pre-COVID19 period (Q2-Q4 2019) and the post-COVID19 period (Q2-Q4 2020). More risky firms, in the case of profitability, are firms with an interest coverage ratio lower than 2 or a non-positive EBITDA and, in the case of leverage, firms with a debt-to-asset ratio higher than 1. In all regressions, bank-level control variables are included (ratio of market funding to total liabilities, the average risk weight, the total minimum regulatory capital ratio, the logarithm of total assets, and the ratio of provisions to total assets). The 99% confidence intervals are obtained by the delta method using standard errors calculated at the industry-location-bank level of the borrower. The results presented are statistically significant at the 1% level if the confidence intervals do not intersect the horizontal axis.

In this Policy Brief, we show that banks with a higher management buffer granted more credit to firms than banks with a lower buffer after the Covid-19 shock. In other words, banks used, at least to some extent, their management buffers to finance the economy. It is also found that the overall positive effect of having higher levels of management buffer on credit supply was largely driven by the extensive margin. In contrast, the effect was negligible on the intensive margin. This divergence is explained by the finding that while public guarantees reinforced the positive effect of the management capital buffer on lending at the extensive margin, public guarantees dampened the effect at the intensive margin. Finally, banks with a higher management buffer lend more the lower the market discipline they are subject to, and more to riskier or more vulnerable firms.

Abboud, A., Duncan, E., Horvath, A., Iercosan, D. A., Loudis, B., Martinez, F., … & Wix, C. (2021). COVID-19 as a stress test: Assessing the bank regulatory framework. Available at SSRN 3965801.

Adrian, T., & Shin, H. S. (2014). Procyclical leverage and value-at-risk. The Review of Financial Studies, 27(2), 373-403.

Altunbas, Y., Manganelli, S., & Marques-Ibanez, D. (2017). Realized bank risk during the great recession. Journal of Financial Intermediation, 32, 29-44.

Angbazo, L. (1997). Commercial bank net interest margins, default risk, interest-rate risk, and off-balance sheet banking. Journal of Banking & Finance, 21(1), 55-87.

Avezum, L., Oliveira, and D. Serra (2023). To use or not to use? Capital buffers and lending during a crisis. Banco de Portugal, Working Papers.

Banco de Portugal (2020a). Carta Circular n.º CC/2020/00000017. https://www.bportugal.pt/cartacircular/cc202000000017.

Banco de Portugal (2021). Financial Stability Report, June.

BCBS (2020). “Basel Committee coordinates policy and supervisory response to COVID-19. Basel Committee on Banking Supervision (BCBS)”. March 20, 2020. https://www.bis.orq/press/p200320.htm.

Behn, M, Rancoita, E., e Rodriguez d’Acri, C. (2020), “Macroprudential capital buffers – objectives and usability”, Macroprudential Bulletin, 11.

Carvalho, H., Avezum, L., & Silva, F. (2022). The solvency and funding cost nexus – the role of market stigma for buffer usability. Banco de Portugal, Working Papers.

European Central Bank. (2020a). ECB Banking Supervision provides temporary capital and operational relief in reaction to coronavirus.

European Central Bank. (2020b). Financial market pressure as an impediment to the usability of regulatory capital buffers. Macroprudential Bulletin, Issue 11. October 2020.

Ho, T. S., & Saunders, A. (1981). The determinants of bank interest margins: theory and empirical evidence. Journal of Financial and Quantitative analysis, 16(4), 581-600.

Koppenhaver, G. D. (1985). Bank funding risks, risk aversion, and the choice of futures hedging instrument. The Journal of Finance, 40(1), 241-255.

Mateus, M., & Neugebauer, K. (2022). Stayin’ alive? Government support measures in Portugal during the Covid-19 pandemic. Banco de Portugal, Working Papers.

Ratti, R. A. (1980). Bank attitude toward risk, implicit rates of interest, and the behavior of an index of risk aversion for commercial banks. The Quarterly Journal of Economics, 95(2), 309-331.

Schmitz, S., Nellessen, V., Posch, M., & Strobl, P. (2021). Buffer usability and potential stigma effects. SUERF Policy Note, (219).

Sealey, C. W. (1980). Deposit rate-setting, risk aversion, and the theory of depository financial intermediaries. The Journal of Finance, 35(5), 1139-1154.

For more methodological and data details, see Avezum, Oliveira e Serra (2023).