References

Brunnermeier, M. and Landau J.P., (2020). Central banks and climate change, Vox EU column, available at https://voxeu.org/article/central-banks-and-climate-change

de Grauwe, P. (2019). Green Money Without Inflation, blog post on Social Europe, available at https://www.socialeurope.eu/green-money-without-inflation

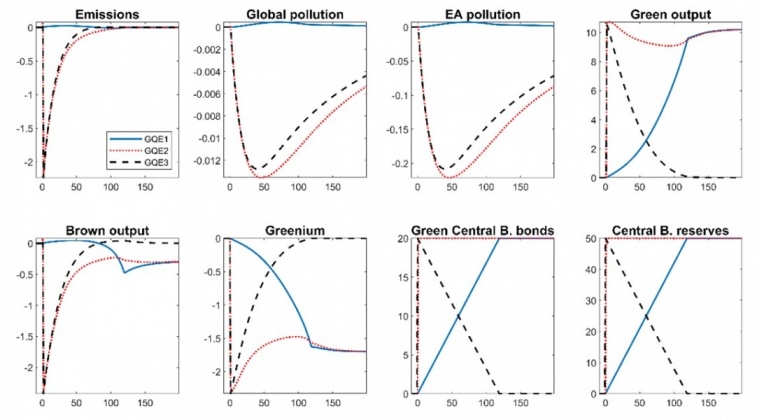

Ferrari, A. and Nispi Landi, V., (2021). Whatever it Takes to Save the Planet? Central Banks and Unconventional Green Policy, Temi di discussione (Bank of Italy economic working papers), 1320.

Ferrari, A. and Nispi Landi, V., (2022a). Toward a Green Economy: The Role of Central Bank’s Asset Purchase, Temi di discussione (Bank of Italy economic working papers), 1358.

Ferrari, A. and Nispi Landi, V., (2022b). Will the Green Transition be Inflationary: Expectations Matter, Questioni di Economia e Finanza (Bank of Italy occasional papers), 686.

Schoenmaker, D., (2019). Greening Monetary Policy, Bruegel Working Paper, No. 2019/02.

Wallace, N., (1981). A Modigliani-Miller Theorem for Open-Market Operations”, American Economic Review, Vol. 71, No 3, pp. 267-274.