This policy brief is based on the authors’ research paper: “A Method for Uncovering Tokenisation Archetypes and their Effects: Thus Spoke Switzerland”. The paper has benefited from data, comments, and interviews with representatives from institutions involved in the Swiss digital bonds’ issuances, including project Helvetia Phase III. Views are solely those of the authors. The full paper can be accessed at https://ssrn.com/abstract=5017084.

Abstract

If a bond had been tokenised instead of using the traditional infrastructure, how would the outcomes, characterising its lifecycle processes, change? In this policy brief, we explore this question using Switzerland’s bond tokenisation experiments as subjects. First, we provide a technical conceptualisation of Switzerland’s standard tokenisation model and then estimate present tokenisation effects on efficiency and secondary market liquidity. As one of the leading centres in adopting tokenisation within the regulated financial system—including moving its w-CBDC activity from test environments into production, Switzerland has established its own archetype from which we draw novel insights.

What are the effects of tokenisation? This question is at the forefront of the asset tokenisation discourse but has so far been provided with little empirical evidence. There is also no standard process to furnish such evidence, starting with what is to be quantified, how is to be quantified, and how to approach quantification in distinct tokenisation models. In a recent research paper (see Plepi and Schwendner, 2024), we address each of these issues by developing a novel framework for aggregating and categorising viewpoints on fundamental issues concerning tokenisation and assessing the causal effects of tokenisation on market outcomes, using bonds as a case in point.

In this policy brief, using Switzerland’s bond tokenisation experiments as subjects, a counterfactual equivalent of the initial question is explored: If a bond had been tokenised instead of using the traditional infrastructure, how would the outcomes, characterising its lifecycle processes, change? First, based on our taxonomy, we conceptualise Switzerland’s standard approach to tokenising bond markets. Then, using our Causal Model of Tokenisation (CMT) and outcomes matrix, estimate the present effects of bond tokenisation in Switzerland, focusing on efficiency and liquidity.

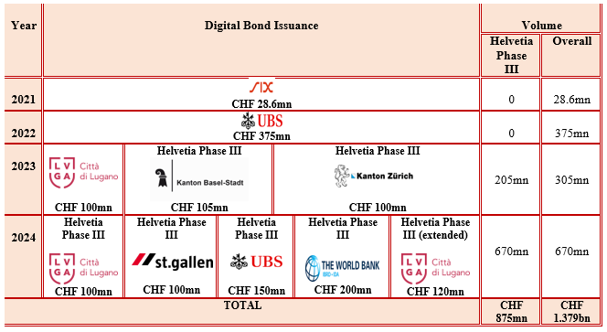

In the past few years, supported by a technology-neutral federal framework and a shared, regulated market infrastructure for digital assets, “Switzerland has emerged as one of the leading centres in adopting tokenisation within the regulated financial system” (Jordan, 2024). Since 2021, SIX Digital Exchange (SDX), which provides the financial market infrastructure supporting the exchange of digital assets —a fully integrated issuance, trading, settlement, and custody infrastructure based on distributed ledger technology, has facilitated the issuance of ten digital bonds, standing at nearly CHF 1.4bn (Table 1). Seven of these issuances are in the context of Helvetia Phase III, a pilot project in which, for the first time, the Swiss National Bank (SNB), in collaboration with commercial banks, pilots in a live production environment the settlement of primary market bond transactions in Swiss franc wholesale central bank digital currency (w-CBDC).

Table 1. The Swiss Digital Bonds’ Ecosystem

Source: Authors based on SDX’s press releases 2021-2024 (confirmed with SDX)

In Switzerland, the Digitally Native with Operational Link Model is the standard tokenisation model, followed in nine out of the ten distributed ledger-based bonds issued under Swiss law. Seven of these distributed ledger-based bonds are issued in the context of project Helvetia Phase III. Based on our taxonomy (see, Plepi and Schwendner, 2024), we conceptualise Switzerland’s standard approach to the tokenisation of bond markets, and supply a defining response to the questions:

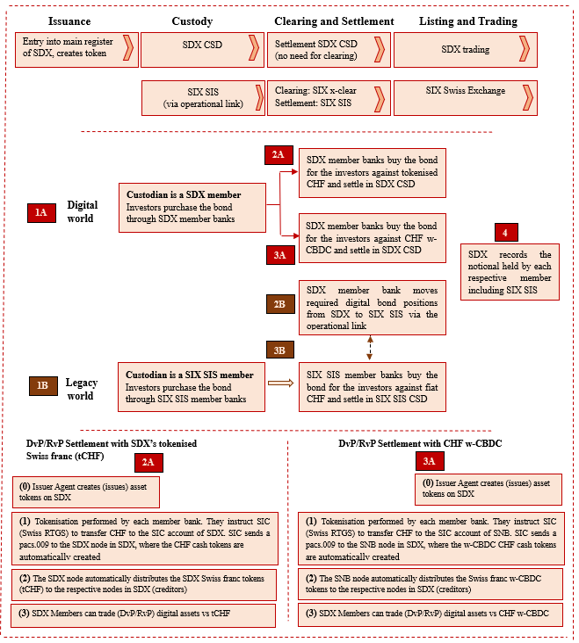

Once tokenised, how are the claims on the bond represented? The bond is solely born in the digital world by entry into the main register of the SIX Digital Exchange (SDX) and represented by digital tokens. The entry into the main register is based on uncertificated securities becoming intermediated, according to the Swiss Federal Act on Intermediated securities. It, therefore, stands as a native digital bond.

Figure 1. Switzerland’s Standard Tokenisation Model: The Digitally Native with Operational Link Model

Source: Authors based on materials provided by SDX (2024)

Once tokenised, can all the bond’s lifecycle processes be run on DLT? The platform facilitates end-to-end digitisation of the entire bond lifecycle, from issuance to secondary market trading and settlement, except the pre-issuance phase, which is carried out traditionally.

How do the buy and sell side interact in primary and secondary markets? The traditional intermediary role of banks is preserved; in the distributed ledger-based financial market infrastructure, similar to the traditional one, the banks are the ones onboarded rather than issuers or investors. In the primary market layer, all the processes—from bond term sheet preparation to sales and marketing, investor subscription applications, KYC checks, orderbook building, verification and allocation, are conducted through the intermediation of banks, mostly manually and in a fragmented way, with each bank responsible for their investor base. In the secondary market layer, atomic settlement within the distributed ledger-based infrastructure removes a layer of intermediation— the central clearing counterparty, SIX x-clear.

Once tokenised, where can the bond be held, traded, and settled? Even though digitally native, the same bond may simultaneously be held, traded, and settled in both financial market infrastructures: the distributed ledger-based and traditional one. An operational link— introduced in October 2022, acts as a “digital bridge”, providing interoperability between the two market infrastructures so that the bond may be seamlessly moved forwards and backwards in seconds. In the digital world, SDX member banks purchase the bond for their investors either against tokenised CHF (2A, Figure 1) (e.g., City of Lugano’s first digital bond issued in January 2023) or against w-CBDC (3A, Figure 1) (all the bonds issued under project Helvetia Phase III) and the bond is settled in the SDX CSD. Parallelly, in the traditional world, SIX SIS member banks may buy the bond for their investors against fiat CHF and settle in SIX SIS CSD. Since SIX SIS is a member of SDX, the required bond positions are seamlessly moved from SDX to SIX SIS through the operational link. SDX then records the notional held by each respective member, including SIX SIS.

Based on our Causal Model of Tokenisation (CMT) and the proposed outcomes matrix (see, Plepi and Schwendner, 2024), we estimate the present effects of bond tokenisation in Switzerland, focusing on efficiency and liquidity. Below an overview:

Operational efficiency? There are no operational downsides; presently, a distributed ledger-based bond is as good as a traditional one. This applies to all distributed ledger-based bonds, including those issued in project Helvetia Phase III. In the primary market layer, we find that from traditional to distributed ledger-based infrastructure, there are presently no changes in any outcome metrics characterising efficiency (manual workload, settlement cycle, intermediation degree). In the secondary market layer, from traditional to distributed ledger-based infrastructure, atomic settlement within the distributed ledger-based infrastructure saves 48 hours in settlement for the transacting parties and removes a layer of intermediation — the central clearing counterparty, SIX x-clear. However, although feasible, these gains remain unrealised, since the secondary market activity is currently entirely concentrated in the traditional market.

Costs? Regarding the issuer and investors, there have been no changes in costs from traditional to distributed ledger-based infrastructure. When banks are concerned, the coexistence of the two financial market infrastructures implies additional annual fixed costs for those onboarded onto the distributed ledger-based infrastructure despite activity.

Secondary market liquidity? Interoperability with the traditional infrastructure provides access to other liquidity pools, so that liquidity is not constrained by the number of banks onboarded onto the distributed ledger-based infrastructure, presently thirteen. However, since all the distributed ledger-based bonds are dual listed —simultaneously listed on the distributed ledger-based SDX Trading and the traditional SIX Swiss Exchange, it opens up the possibility for fragmentation in liquidity between market infrastructures. Currently, secondary market liquidity is entirely absorbed by the traditional infrastructure. However, the results are inconclusive since most bonds are issued in the last two years (2023-2024), and the behaviour of market participants may, therefore, change.

In conclusion, beyond “digital equivalence”, the materialisation of the gains feasible within a distributed ledger-based infrastructure requires the market participants’ active participation and commitment, particularly banks in the Swiss case. Distributed ledger-based technology per se is necessary but not sufficient. Banks’ perception of the distributed ledger-based infrastructure as a means for pursuing the gains is crucial. Once onboarded, full commitment from pre-issuance to secondary market trading and settlement is necessary. This way, the capabilities within the distributed ledger-based infrastructure may be fully explored.

Transitioning from traditional market infrastructures to distributed ledger-based ones may not necessarily require gains. ‘Digital equivalence’ may suffice when accompanied by technology-neutral legislation and a collaborative change approach in which, for example, the central bank plays a live role through pilot projects like the Swiss National Bank with Project Helvetia Phase III. This is particularly relevant for cases such as Switzerland, where the traditional financial infrastructure is electronic and already supports a high degree of automation.

Plepi, Anisa and Schwendner, Peter, A Method for Uncovering Tokenisation Archetypes and their Effects: Thus Spoke Switzerland (November 11, 2024). Available at SSRN: https://ssrn.com/abstract=5017084.