This policy brief is based on Deutsche Bundesbank, Discussion Paper, No 03/2025. The views expressed in this Policy Brief are those of the authors and do not necessarily reflect those of the Deutsche Bundesbank or the Eurosystem.

Abstract

In recent years, geopolitical risks have risen in many places. This not only has a direct impact on the countries affected, but also on international trade. In a new study, we show that rising geopolitical risks in trade partner countries dampen imports of goods, make them more ex-pensive and impair supply chains. In addition, they are likely to be conducive to a fragmentation of global trade. Risks associated with China are particularly significant in this context.

Geopolitical risks have intensified in recent years. Russia’s persistent aggression towards Ukraine, which led to the Russian war of aggression in 2022, drove an ever deeper wedge between Russia and western countries. China’s territorial claims fuelled tensions with neighbouring countries and the United States. There was also a dramatic increase in conflicts in the Middle East. Many of the countries affected are important exporters in the global trade and production network. The question therefore arises as to what extent the procurement of goods from these countries and thus also the supply chains are affected.

In a new study (Khalil, Osten and Strobel, 2025), we investigate this question taking the perspective of the US and the euro area. We identify geopolitical risk shocks for 44 countries using the index for geopolitical risks proposed by Caldara and Iacoviello (2022), which is based on the frequency of newspaper articles on intergovernmental conflicts, unrest and terrorism. Using local projections, we estimate the effect of geopolitical risk shocks in trading partner countries on import volumes and prices (based on unit values) in the US and the euro area in a detailed panel of product-level data of bilateral import flows from 1990Q1 to 2019Q4. To isolate the import channel for the transmission of geopolitical risk shocks, we exploit the cross-country dimension of our data set and focus on the effects of trading-partner-specific GPR shocks. In addition, we control for domestic demand development by including time-fixed effects in our regressions. As our observation period ends in 2019, our analysis does not examine the sharp increase in geopolitical risk worldwide as a result of the Russian war of aggression in Ukraine. Studies on the impact of this war come to similar conclusions (see, for example, Gopinath et al., 2025).

Our results indicate that in both regions (US and euro area), trading-partner geopolitical risk shocks act as import supply shocks. A shock that raises the geopolitical risk index of a US-trading-partner by roughly one standard deviation decreases price-adjusted US import from this country by about 0.3% on average. At the same time, US import prices rise by around 0.15%. The effect of a geopolitical risk shock on US imports recedes after six quarters. For the euro area, the findings are of a similar magnitude. On average across all products and countries, it is evident that heightened geopolitical risks can significantly disrupt imports from affected countries in the short term, while import prices rise.

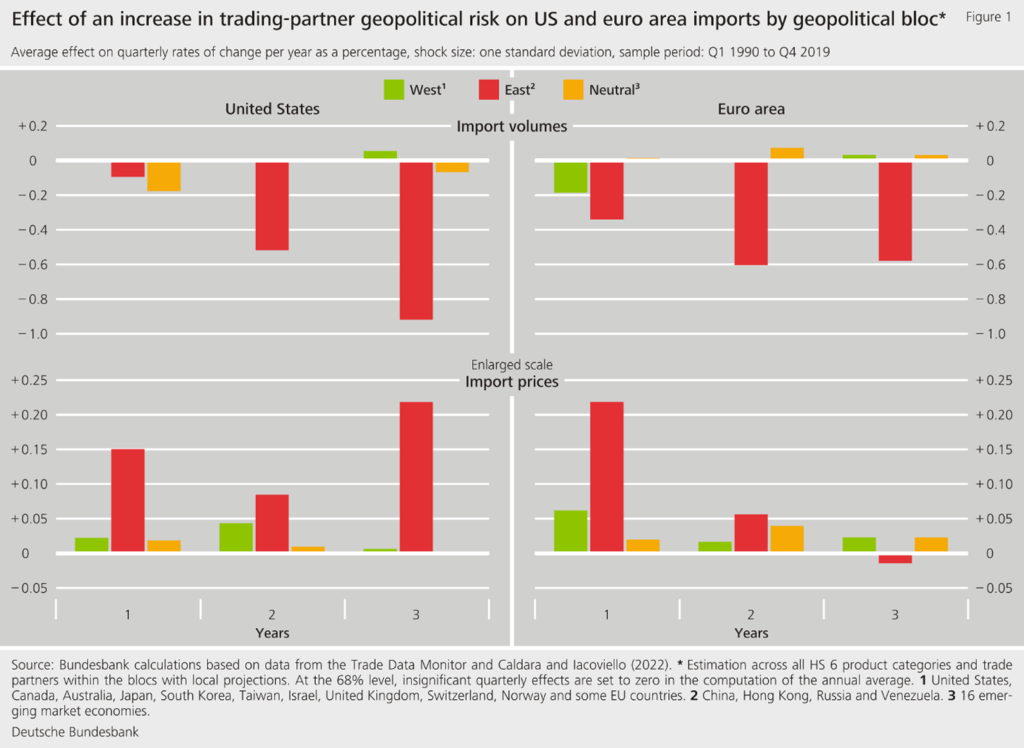

These effects are particularly strong for imports from countries with a greater geopolitical distance to the United States and the euro area or which are subject to US sanctions at the time of the shock. In our dataset, we group countries into three geopolitical blocs: “West” (including euro area countries and United States), “East” (including China and Russia) and “Neutral” (16 emerging market economies), in keeping with the literature (see, for example, ECB 2024). Geopolitical risk shocks in “East” bloc countries significantly reduce euro area and US import volumes from these countries and increase import prices, while similar shocks in the other blocs have far less of an impact (see Figure 1).

The stronger effect on geopolitically distant countries suggests that the rising geopolitical tensions seen in recent years have supported the fragmentation of global trade along geopolitical lines. In keeping with this, imports from trading partner countries react more strongly to growing geopolitical risks in these countries if their trade is subject to US sanctions. These sanctions appear to prompt firms in the euro area and the United States to reduce their import risks in a more decisive manner.

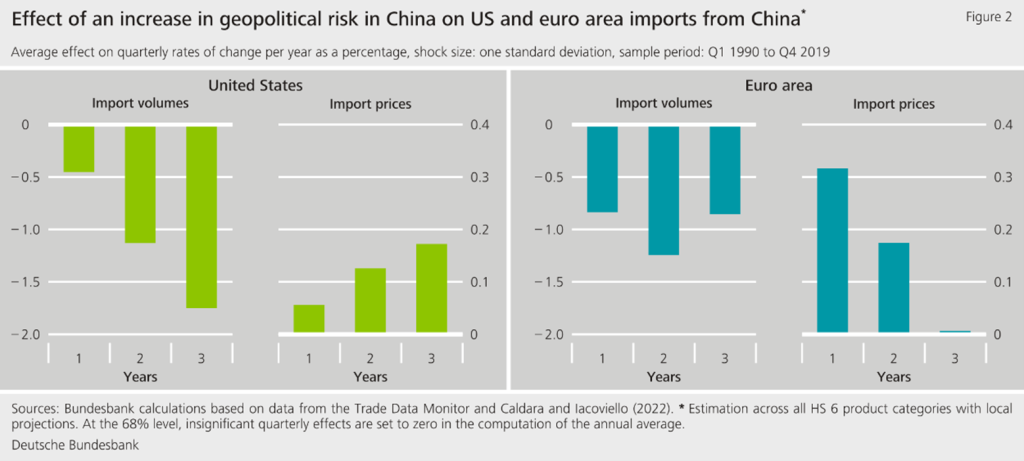

China has a considerable geopolitical distance to the euro area and the United States. In addition, it has been subject to US sanctions in a number of years of our sample period. Consistent with this, we show that rising geopolitical risk in China places a particular burden on imports to the euro area and US from China (see Figure 2). In addition, the Chinese economy has a large weight in the global economy. We show that rising geopolitical risks in China, probably also for this reason, markedly dampen global oil prices and lead to an appreciation of the US dollar. Since Chinese imports to the euro area are largely invoiced in US dollar, their prices in euro also rise via this exchange rate channel.

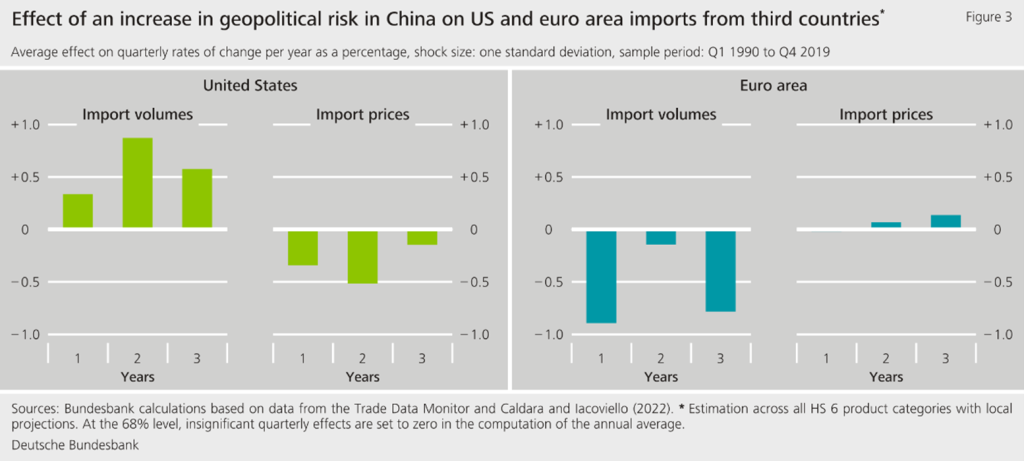

The appreciation of the US dollar makes imports from many third countries more expensive for the euro area, while strengthening the purchasing power of US importers. Accordingly, it is evident that US imports from third countries increase as a result of a rise in geopolitical risk in China, while euro area imports from third countries decrease (see Figure 3). As expected, euro area imports from countries with close linkages to Chinese supply chains decrease in particular. In the United States, by contrast, imports from countries with weaker linkages to Chinese supply chains benefit from increasing US purchasing power.

Growing geopolitical risks among trading partners are holding back imports to the euro area and the United States and are likely to exacerbate the fragmentation of global trade along geopolitical lines. Increased geopolitical risk in China is having particularly strong effects and is leading to markedly higher import prices in the euro area, partly due to the appreciation of the US dollar.

Caldara, D. und M. Iacoviello (2022), Measuring geopolitical risk, American Economic Review 112 (4), 1194–1225

Gopinath, G., P.-O. Gourinchas, A. F. Presbitero und P. Topalova (2025), Changing global linkages: A new Cold War?, Journal of International Economics, Volume 153, 2025, 104042

Khalil, M., D. Osten und F. Strobel (2025), Trade dynamics under geopolitical risk, Discussion Paper 03/2025. Deutsche Bundesbank