This paper studies the pricing of climate-risks in European equity markets. Using text-analysis, we construct two novel physical and transition risk indicators for the period 2005-2021. Our results document the emergence of economically significant transition and physical risk premia post-2015. We investigate which information investors use as a gauge for firms’ exposure to climate-risks running a firm-level analysis, using firms’ GHG emissions, environmental, and ESG scores, and a sectoral-analysis. We find that, while firm-level information appears to be used as a proxy for firms’ climate-risks exposure, especially for transition risk since 2015, the sectoral classification appears to proxy firms’ exposures to physical risk.

As climate change progresses, investors are increasingly reported to reflect climate-related risks in firms’ valuations. While this observation may seem obvious in light of the overarching evidence that climate change and the measures taken to fight it represent source of financial risks, documenting climate risk pricing or the presence of climate risk premia is not as trivial, as demonstrated by conflicting results throughout the green finance literature (see e.g. Bolton & Kacperczyk, 2021; In et al., 2019). Several factors might impede climate risk informed investment decisions, such as the lack of agreed-upon metrics for firms’ exposure to climate-related risks, alongside the difficulty of identifying and measuring climate risk events over time. It follows that investors might not be able to easily screen firms exposed to climate risks, failing to detect climate risky investment. In contrast, there is the possibility that market participants are insensitive to shocks in climate change, which would suggest that they do not perceive these risks as a source of financial risk. Both scenarios could lead to a mispricing of climate change risks, with relevant consequences for the functioning of the financial sector as such and as a vehicle to transmit climate mitigation policies.

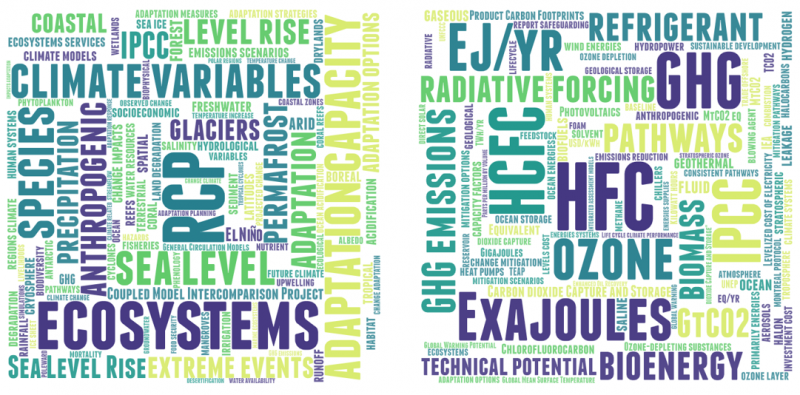

The climate change can affect asset prices through changes in physical or transition risk. Physical risk materialises in the form of financial losses/increased costs from the impact of chronic and acute physical events. Transition risk arises from the costly adjustment towards a low-carbon economy and it is typically prompted by changes in climate and/or environmental policy, technological advances, and/or shifts in public preferences. Against this backdrop, we propose to distinguish between these two risk types using a text analysis approach in line with Engle et al. (2020). We then document the impact of both risks on asset prices. To this end, we first examine scientific texts on climate change and build two novel climate vocabularies on physical and transition risk. These vocabularies – which rely on the term frequency-inverse document frequency (tf-idf) statistics- have the ability to rank terms by relevance and to capture the multifaceted characteristics of both risk types (see Figure 1).

Figure 1: Word cloud summaries for physical and transition risk vocabularies

(a) Physical risk vocabulary (b) Transition risk vocabulary

Note: Word cloud summaries for the physical risk (a) and transition risk (b) vocabularies. Term sizes depend on the relative importance of the term according to the individual tf-idf score. Reported terms are the reconstructed stemmed terms. Major acronyms: Representative Concentration Pathways (RCP), hydrofluorocarbon (HFC), hydrochlorofluorocarbon (HCFC).

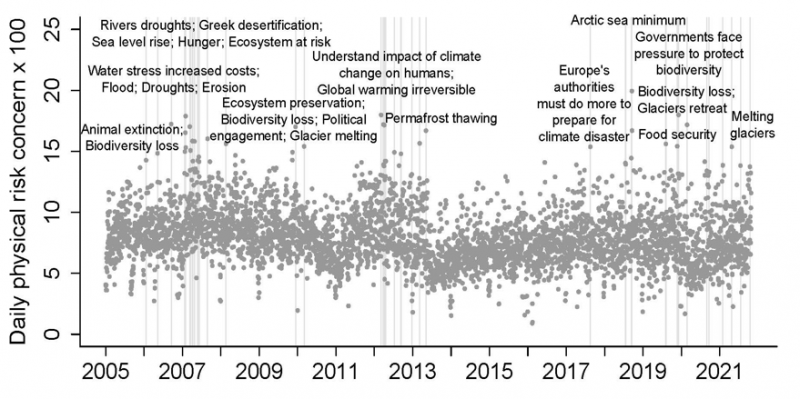

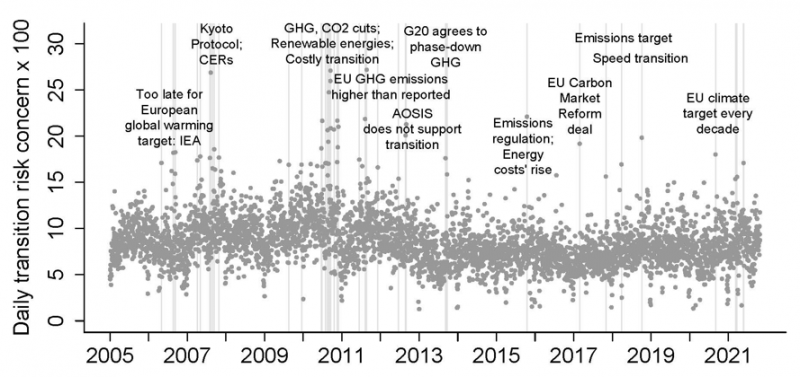

We then construct a physical risk and a transition risk index by comparing the vocabularies with a corpus of news sourced from Reuters News. The text approach is based on the idea that investors use these news as a source of information to update beliefs about gyrations in climate change risks. It assumes that news coverage on climate change intensifies if as climate risks rise (see Figure 2). Risk indices are indeed found to spike during days where the discussion on either risk type increases substantially. The transition risk indicator shows spikes for many important events which determined transition and regulatory action, one of the most important ones being the Paris Agreement. For what concerns physical risk, the vocabulary allows to capture both extreme and chronical physical hazards caused by climate change. This sets the physical risk index apart from many other physical risk databases which collect only extreme events or look at physical events that may not be caused by climate change. In general, an important advantage of the proposed methodology is that the phraseology associated with each risk is extracted from authoritative texts rather than being defined ex-ante by the authors.

Figure 2: Physical and transition risk concern timeseries 2005-2021

(a)

(b)

Note: Daily physical risk concern (a) and daily transition risk concern (b) with the major risk shock topics (vertical bars) for the period Jan 2005-Oct 2021.

We then use these climate risk indices to investigate the presence of physical and transition climate risk premia within European equity markets. We adopt a standard portfolio sorting approach covering the period from January 2005 to October 2021. This period is further divided in two sub-periods, before and after 2015 since recent studies document an increase in the importance of climate risks since the time of the Paris Agreement. Results indicate the emergence of economically significant physical and transition climate risk premia since 2015, implying that a relatively higher return is required for stocks which provide a bad hedge against climate risk.

In our paper we also investigate which information, or metrics, may be used by investors to proxy a firm’s exposure to either physical or transition risk. To this end, our climate risk series are included into a Fama & French (2015) five factors asset pricing model to test how equity reacts to climate risks. We perform a firm-level analysis such that firms are sorted according to their Greenhouse Gases (GHG) emissions levels, GHG emissions intensity, Environmental (E) scores, and Environmental, Social, and Governance (ESG) scores, with returns being aggregated into green and brown portfolios. In parallel, we run a sectoral analysis by aggregating returns of firms belonging to the same sector (NACE Rev. 2 classification), to study whether investors may simply pigeonhole firms into the industry they operate in to screen firms exposed to climate risks. Our main findings indicate that firm-level information appears to be mainly used as a gauge for transition risk exposure, in particular since 2015. In contrast, sectoral classifications, in the light of many investors, appears to be sufficient to identify exposures to physical risk.

Bolton, P., & Kacperczyk, M. (2021). Do investors care about carbon risk? Journal of Financial Economics, 142, 517–549. doi:10.1016/j.jfineco.2021.05.008.

Bua, G., Kapp, D., Ramella, F. & Rognone, L. Transition Versus Physical Climate Risk Pricing in European Financial Markets: A Text-Based Approach (June 4, 2021). ECB Working Paper No. 2677, Available at SSRN: https://ssrn.com/abstract=3860234 or http://dx.doi.org/10.2139/ssrn.3860234

Engle, R. F., Giglio, S., Kelly, B., Lee, H., & Stroebel, J. (2020). Hedging Climate Change News. The Review of Financial Studies, 33, 1184–1216.

In, S., Park, K., & Monk, A. (2019). Is “Being Green” Rewarded in the Market? An Empirical Investigation of Decarbonization Risk and Stock Returns. February. Stanford Global Projects Center Working Paper