Banks with substantial central bank reserves are earning income from their reserve holdings in the European Central Bank’s (ECB) recent rate hiking cycle. This could make their credit supply less sensitive to the monetary policy tightening compared to other banks. This hypothesis is examined in a new study (Fricke, Greppmair, Paludkiewicz, 2023) using the new AnaCredit dataset – a credit register harmonised across the euro area.

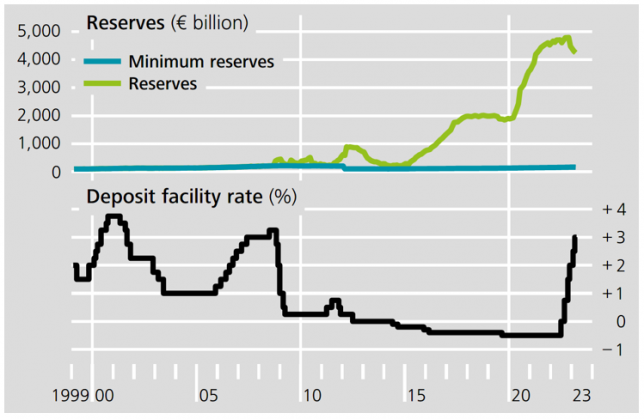

Since the second half of 2022, the Eurosystem has increased key interest rates significantly to curb inflation. The deposit facility rate, i.e. the interest rate banks receive when they hold overnight deposits (reserves) with the central bank, is shown in Figure 1 (black line). When this rate became negative in 2014, banks had to pay interest on their reserves. When this rate turned positive in September 2022, banks once again earned interest income from their reserve holdings. Compared with previous tightening cycles, it is striking that banks are holding substantial reserves with the Eurosystem in the current cycle. In June 2022, that is before the onset of the tightening cycle, total reserves held by euro area banks amounted to €4.7 trillion (see the green line in Figure 1), or 12.3 percent of their total assets. In 2008, this figure was only €0.1 trillion, or 0.75 percent of their total assets. This increase was driven, in particular, by non-standard monetary policy measures, such as the asset purchase programmes in the context of quantitative easing.

Central bank reserves are special in that they are the safest and most liquid asset available. Central banks largely determine the aggregate level of reserves, and unlike other assets, central bank reserves can only be held by banks – the traditional counterparties of central banks.

Figure 1: Central bank reserves and deposit facility rate

In conjunction with the unprecedentedly large reserve holdings, the interest rate hikes mean that banks with substantial reserves are earning considerable interest income from their reserve holdings for the first time in the history of the Eurosystem. Taken in isolation, this could affect the balance sheet channel of monetary policy transmission, the standard transmission channel of monetary policy. In this context, monetary policy affects banks’ lending decisions via their net worth. Due to banks’ maturity transformation, interest rate increases (in an environment without substantial reserves) typically affect the market value of banks’ assets more strongly than their liabilities, thus reducing banks’ net worth. This can dampen their credit supply, in particular for banks with low capital ratios.

In an environment with substantial reserves, however, the revaluation of bank assets could have a less significant impact on banks with a higher reserve ratio, as central bank reserves are, by nature, short-term assets. In addition, the cost of funding via liability-side counterparts rises less sharply if the interest rate increases are not fully passed on to bank depositors. Banks with higher reserve ratios, then earn additional interest income from holding reserves. When viewed in isolation, both effects could lead to a situation where large reserves may dampen the negative impact of monetary policy tightening on banks’ net worth and thus on credit supply. Moreover, the effect should be stronger for banks with low capital ratios, as balance sheet restrictions are more binding for these banks.

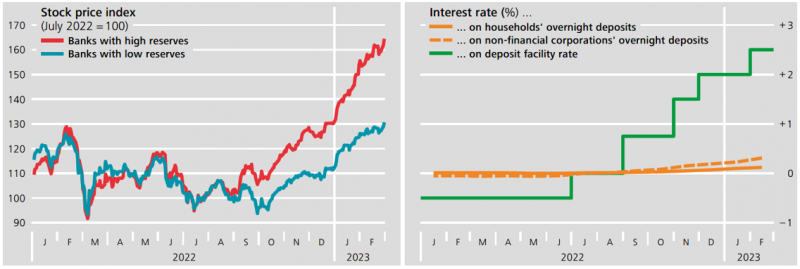

A new study (Fricke, Greppmair, Paludkiewicz, 2023) provides empirical evidence in line with this mechanism. First, the study documents that banks with higher reserves experience an increase in net worth. The left-hand chart in Figure 2 shows developments in stock prices of listed banks as a proxy for net worth, distinguishing between banks with high reserves (red line) and banks with low reserves (blue line). It can be seen that the stocks of banks with substantial reserves displayed significantly higher returns after the first interest rate hike. The effect is also visible in banks’ (net) interest income and, ultimately, in different measures of net worth.

In addition, the right-hand chart of Figure 2 shows that banks hardly passed on the interest rate hikes to their depositors. This is relevant because deposits are the most important source of funding for banks and thus the main liability counterpart to reserves. The development of the average bank interest rates on households’ and non-financial corporations’ overnight deposits (orange lines), along with the deposit facility rate (green line), indicates that overnight deposit rates increased only slightly.

Figure 2: Stock price and deposit interest rates

Consequently, the positive effect on banks’ net worth should, all other things being equal, work against potential lending restrictions. More than 40 million loans granted by banks to non-financial corporations throughout the euro area have been analysed on the basis of the AnaCredit dataset. An econometric estimate can be employed, inter alia, to separate the credit supply (the subject of the study) from credit demand. The central finding is that the credit supply of banks with higher reserves reacts less strongly to interest rate hikes than the credit supply of other banks. The effect is more pronounced among smaller banks and banks with lower equity ratios, reaching mainly smaller enterprises and enterprises with higher credit quality. The overall effect is also economically relevant: Based on the total outstanding pre-period credit volume of banks with reserve ratios above one standard deviation from the mean, this credit supply effect corresponds to 0.25% of euro area GDP in 2022. In addition, the effect is visible in the aggregate, suggesting that overall policy transmission is weakened.

One might consider different options that would alter banks’ interest income from reserve remuneration. We should stress that an in-depth evaluation of the different alternatives is beyond the scope of this column. We therefore only provide examples of current policy proposals on the matter. One option could be to shrink the central bank balance sheet and reduce the amount of reserves as for example implemented by the Bank of England. Another approach would be to increase (unremunerated) minimum reserve requirements. Such two-tier systems for minimum reserve requirements were proposed by e.g. De Grauwe and Ji (2023).

Banks with high reserves recorded an increase in net worth in the wake of the ECB’s recent tightening cycle. For these banks credit supply is less sensitive to the monetary policy tightening compared to other banks, especially for banks with low capital ratios. Monetary policymakers should take these findings into account.

De Grauwe, P and Y Ji (2023). Unremunerated Reserve Requirements Make the Fight Against Inflation Fairer and More Effective. VoxEU.org, 7 November.

D. Fricke, S. Greppmair, K. Paludkiewicz (2023), Excess Reserves and Monetary Policy Tightening, available on SSRN: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4432543.