Transparency has become a prominent feature of monetary policymaking in recent decades. We have developed a monetary policy transparency index that distinguishes political, economic, procedural, policy and operational aspects for 112 central banks from 1998 to 2019. This shows a broad rise in transparency, regardless of the level of economic development and monetary policy framework. In particular, greater monetary policy transparency has not been confined to inflation targeting central banks in advanced and emerging countries but has extended to other monetary policy frameworks and low-income countries. The positive trend in monetary policy transparency has been a world-wide phenomenon.

In recent decades, there has been a remarkable increase in the transparency of monetary policy around the world. Central banks have become increasingly open about their monetary policymaking process, including their objectives, strategy, economic models and projections, and policy deliberations. Their central bank communications have made it easier to understand and thus anticipate monetary policy, speeding its transmission into expectations, asset prices and the rest of the economy. This improves the effectiveness of monetary policy. In addition, transparency enables accountability, which lends legitimacy to independent central banks and further enhances their credibility.

In earlier papers, we developed an index to document and analyse the rise in monetary policy transparency across central banks around the world (see Eijffinger and Geraats 2006; Dincer and Eichengreen 2014; Dincer, Eichengreen and Geraats 2019). In our latest paper, Dincer, Eichengreen and Geraats (2022), we provide an update that extends our monetary policy transparency index by four years, so that it now covers 112 central banks (and nearly 150 countries) from 1998 until 2019.

We find that monetary policy transparency has continued to rise overall across central banks. Broadly, this finding also holds when grouping central banks by level of economic development or by monetary policy framework. Central banks utilizing inflation targeting continue to be much more transparent than others and have further extended their lead. Central banks that engage in monetary aggregate targeting tend to be the least transparent, but they have noticeably improved and nearly caught up with exchange rate targeters, who barely showed an increase during the last decade. Monetary policy transparency continues to be increasing in the level of economic development, but low-income countries managed to catch up significantly in 2019, whereas those in higher income groups then stagnated on average.

To measure transparency we use the framework presented by Eijffinger and Geraats (2006), who proposed a transparency index based on the disclosure of particular types of information that are pertinent to understanding the monetary policymaking process. The transparency index distinguishes five aspects – political, economic, procedural, policy and operational transparency – each of which has three components that are scored 0, ½ or 1 based on the disclosure of specific information freely available in English, the language of international financial markets. The overall transparency index equals the sum across all components, resulting in a score between 0 and 15.

Eijffinger and Geraats (2006) compiled their transparency index for 9 major central banks from 1998 to 2002. In a series of papers (e.g. Dincer and Eichengreen 2014; Dincer, Eichengreen and Geraats 2019) the index was modified somewhat and the sample was greatly extended to include more recent years and over 100 central banks. In Dincer, Eichengreen and Geraats (2022) we use the formulation of the monetary policy transparency index of Dincer, Eichengreen and Geraats (2019), which featured several modifications. This transparency index more explicitly focuses on monetary policy to distinguish it from other central bank functions and policies, such as macroprudential policy or other financial stability measures, which became more common following the global financial crisis. The latter also showed the importance of clear and timely information, so some parts of the index accordingly now use tighter criteria. In addition, the transparency index features a more detailed coding of some aspects, including forward policy guidance, which has become more common with policy rates close to their effective lower bound. Overall, the 15 components of our transparency index identify 27 different information disclosure practices.

Our monetary policy transparency index captures the following aspects and components:

In Dincer, Eichengreen and Geraats (2022) we compiled the transparency index from 1998 to 2019 for 112 central banks, including those of monetary/currency unions in Europe, Central Africa, West Africa and Eastern Caribbean, so our sample covers nearly 150 countries. This allows us to analyse monetary policy transparency trends throughout the world.

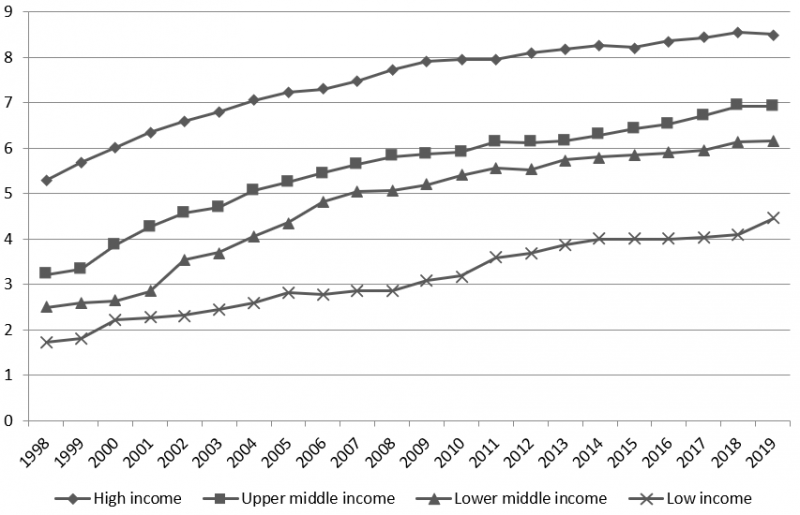

First, we analyse how monetary policy transparency has evolved depending on the level of economic development. Figure 1 shows the (unweighted) average of our transparency index from 1998 to 2019 across central banks grouped by their countries’ level of economic development, using the World Bank income classification for fiscal year 2019. It is clear that monetary policy transparency tends to be increasing in the level of economic development and has substantially risen since 1998 for all income groups. Central banks from high-income countries experienced the strongest increase in the first half of our sample period, with upper-middle-income and lower-middle-income countries starting to catch up in the early 2000s, and leaving low-income countries far behind until the latter started catching up in the early and late 2010s.

Figure 1. Transparency in Monetary Policy by Level of Economic Development

Note: Unweighted average monetary policy transparency index across central banks grouped by World Bank income classification for fiscal year 2019. Source: Dincer, Eichengreen and Geraats (2022)

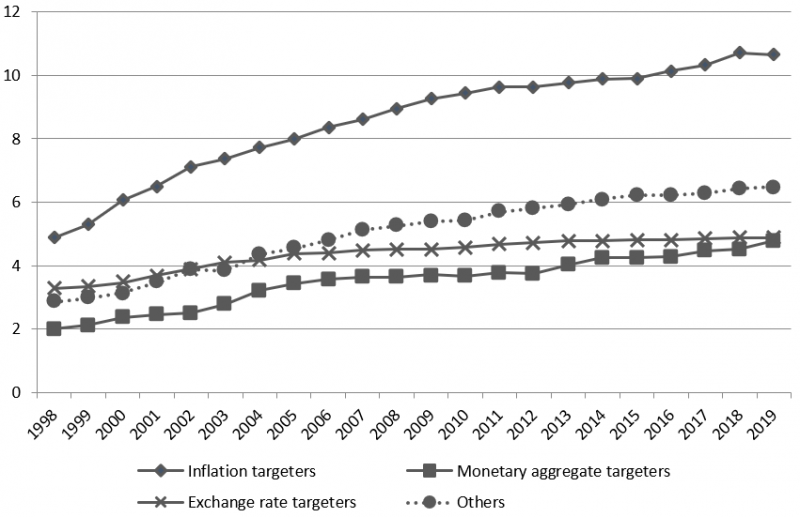

These trends partly reflect the adoption of inflation targeting, first in advanced economies and then also in emerging markets. Inflation targeters tend to display much greater transparency than central banks with other monetary policy frameworks. Figure 2 shows the (unweighted) average of our transparency index from 1998 to 2019 across central banks grouped by monetary policy framework, using the de facto classification of the International Monetary Fund for 2019. Monetary aggregate targeters tend to be the least transparent, although they have experienced a gradual increase and nearly caught up with exchange rate targeters, which saw only a small increase in their transparency score during the last decade. The other category includes certain advanced economies with their own monetary policy frameworks, in particular the United States, euro area and Switzerland, but also a diverse group of developing countries. Big advances by the former have contributed to the rise in average transparency in this other category. Although inflation targeters extended their lead, the other three categories have also experienced substantial transparency gains. Hence, the rise in monetary policy transparency is not restricted to central banks that have adopted inflation targeting, but is much more widespread.

Figure 2. Transparency by Monetary Policy Framework

Note: Unweighted average monetary policy transparency index by IMF de facto monetary policy framework for 2019.

Source: Dincer, Eichengreen and Geraats (2022)

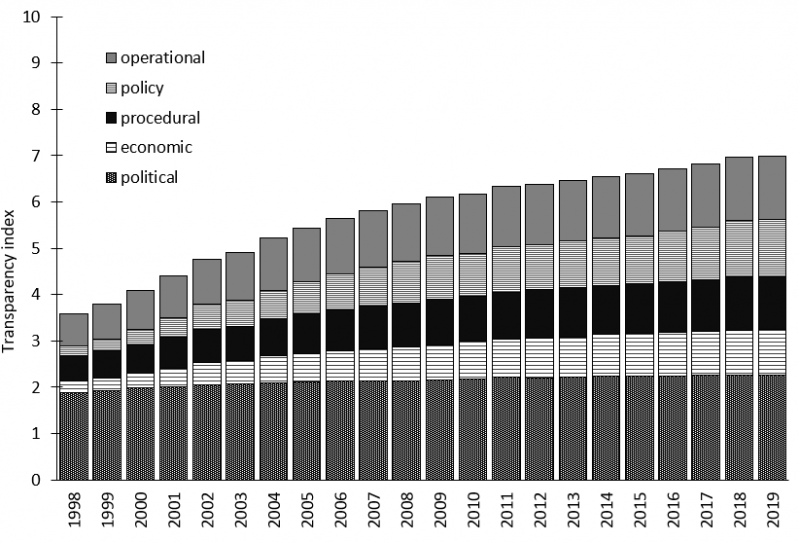

To analyse the increase in monetary policy transparency further, Figure 3 shows the decomposition of the (unweighted) average of our transparency index across all central banks during our 1998-2019 sample period. The strongest increases have been in policy and economic transparency, followed by procedural and operational transparency, with political transparency showing the smallest rise.

Figure 3. Decomposition of Monetary Policy Transparency by Aspect

Note: Unweighted average transparency index for all 112 central banks in the sample.

Source: Dincer, Eichengreen and Geraats (2022)

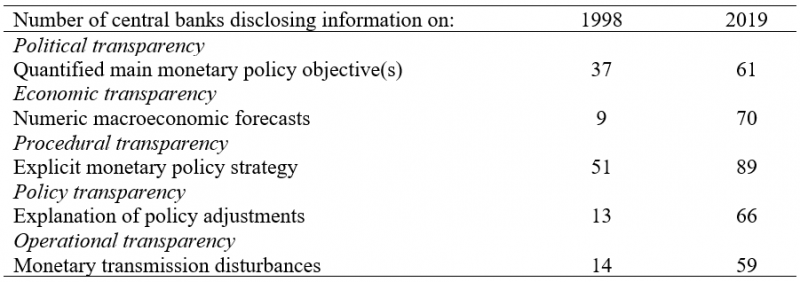

To understand how these trends have mainly manifested themselves, Table 1 shows for each aspect the component that has exhibited the largest increase during our sample period, based on the number of central banks that disclose the particular information according to the criteria of our transparency index. In our sample of 112 central banks, the relative frequency of a quantification of the main monetary policy objective(s) rose from around a third in 1998 to more than a half in 2019 (with similar numbers for explicit instrument independence), enhancing political transparency. In terms of economic transparency, publication of numeric macroeconomic forecasts by central banks jumped from less than 10% to more than 60%. Regarding procedural transparency, the prevalence of an explicit monetary policy strategy increased from 51 central banks in 1998 to 89 in 2019. Policy transparency greatly improved because of a rise in the proportion of central banks providing an explanation of their monetary policy adjustments, from just over 10% to nearly 60% (with similar numbers for the prompt announcement of monetary policy adjustments). Openness about monetary transmission disturbances rose from around 10% to around 50% of central banks, increasing operational transparency.

Table 1. Information Disclosure by Central Banks over Time

Note: Largest increase in information disclosure about monetary policymaking by aspect for full sample of 112 central banks.

Source: Dincer, Eichengreen and Geraats (2022)

Overall, the (unweighted) average level of our transparency index across our 112 central banks increased throughout 1998-2019, as shown in Figure 3, albeit at a slower pace during the second half of this period. This also holds for 2015-2019, when there was a further rise in policy transparency (with a notable increase in the number of central banks that always provide an explanation of their monetary policy decisions, from 40 in 2015 to 53 in 2019), with smaller rises in procedural, economic and operational transparency, and barely any further increase in political transparency. During 2015-2019, 41 central banks showed a net increase in our monetary policy transparency index and only 6 a net decrease. The latter were mostly due to delayed or less frequent releases of central bank publications.

Building on our earlier research, we have constructed a monetary policy transparency index based on the disclosure of information that is pertinent to understanding monetary policymaking, distinguishing its political, economic, procedural, policy and operational aspects. In Dincer, Eichengreen and Geraats (2022), we analyse the results for 112 central banks, covering nearly 150 countries, from 1998 until 2019.

We find that monetary policy transparency has continued to rise overall and broadly also by level of economic development and monetary policy framework. Although inflation targeting central banks tend to be by far the most transparent, those that engage in monetary aggregate targeting, exchange rate targeting or other monetary policy frameworks have also experienced a significant increase in transparency, with monetary targeters nearly catching up with exchange rate targeters. Monetary policy transparency continues to be increasing in the level of economic development. Although the pace of transparency rises has slowed since 2008 for higher income groups, low-income countries have managed to close the gap significantly since then.

According to our index, the strongest increases have been in terms of policy transparency (including the prompt announcement and explanation of monetary policy adjustments) and economic transparency (in particular the publication of numeric macroeconomic forecasts by central banks). There have also been significant rises in procedural transparency (including a greater prevalence of an explicit monetary policy strategy) and operational transparency (mainly manifesting itself through more openness about monetary transmission disturbances). The smallest increase has been in political transparency (mostly through a quantification of the main monetary policy objective(s) and explicit instrument independence).

Overall, greater transparency appears to have become a lasting feature of monetary policymaking throughout the world, regardless of the level of economic development or monetary policy framework.

Dincer, Nergiz and Barry Eichengreen (2014), “Central Bank Transparency and Independence: Updates and New Measures,” International Journal of Central Banking 10(1): 189-253.

Dincer, Nergiz, Barry Eichengreen and Petra Geraats (2019), “Transparency of Monetary Policy in the Post-Crisis World,“ in David Mayes, Pierre Siklos and Jan-Egbert Sturm eds., The Oxford Handbook of the Economics of Central Banking, New York: Oxford University Press, pp. 287-336.

Dincer, Nergiz, Barry Eichengreen and Petra Geraats (2022), “Trends in Monetary Policy Transparency: Further Updates”, International Journal of Central Banking 18(1): 331-348.

Eijffinger, Sylvester and Petra Geraats (2006), “How Transparent are Central Banks?” European Journal of Political Economy 22(1): 1-22.