The views expressed are those of the author and do not necessarily represent those of the University of Nottingham.

The information on socioeconomic diversity in Europe is limited, but under-representation of those from lower socioeconomic backgrounds seems greater in economics and finance compared to many other disciplines and professions. Dismantling class barriers and class ceilings would enable firms and institutions to harness the abundant talents across the whole of society – rather than limiting the talent pool to the more privileged sections of our populations. This could enhance both productivity and policymaking in economics and finance, benefitting all. After summarising and synthesising the findings of various studies on the lack of socioeconomic diversity in economics and finance, this note suggests that this is a crucial issue which European institutions, firms and organisations could consider addressing by better understanding their class mix and advancing socioeconomic diversity through appropriate recruitment and promotion policies, internships, summer schools, proactive remedies and targeted outreach programmes.

‘Many economists are actually a tribal clique’…….’bring in people who are not members of the tribe’

Christine Lagarde, President of the European Central Bank (ECB), Davos 20241

President Lagarde’s recent remarks at Davos suggested that the economics profession could be improved by opening it up to the ideas of other disciplines. But is it such a surprise that economic (and financial sector) thought may tend to be homogeneous when so many in the profession share the same background characteristics? The information on Europe is sparse, but economics and the financial sector seem to be characterised by a considerably more marked lack of social diversity than many other disciplines and professional occupations.2 A limited number of studies find that both employment and pay levels in the financial sector strongly favour those from more advantaged backgrounds, while economics is studied mainly by those from managerial and professional family backgrounds. Economics and the financial sector are strongly linked together as economics is the largest single subject studied at university by recruits in the financial sector and both play important roles in policymaking. Recruitment in many parts of the financial sector tends to target elite universities, while economics degrees tend to be geographically concentrated which is another factor which disfavours those from lower socioeconomic groups who tend to study closer to home where economics may not be offered as a subject.3 Overlooking this talent can be a misallocation of ability which damages productivity: bringing in people who are not members of the current economics and finance ‘tribe’, by dismantling class barriers and class ceilings, would allow those from non-privileged backgrounds both a voice to influence policy for the better and to achieve their potential, leading to a more productive allocation of talent. Avoiding ‘groupthink’ by ‘thinking outside of the box’ is difficult when analysis and policy decisions are made in a box where socioeconomic barriers may stop ideas coming in from outside. After summarising and synthesising the findings of various studies on the lack of socioeconomic diversity in economics and finance, this note suggests that gathering more information on the issue, as well as implementing appropriate programmes which increase socioeconomic diversity, can deliver substantial benefits to Europe by improving productivity, policymaking and fairness.4

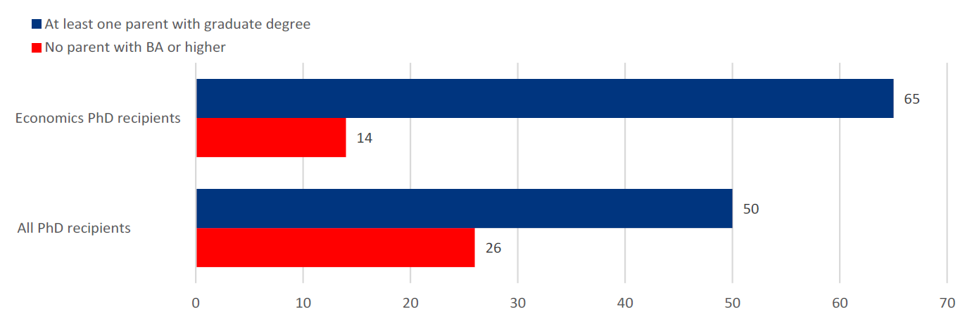

Evidence suggests that economics is an elite discipline. Although evidence is limited, it seems that economics is generally dominated by those from higher socioeconomic backgrounds. For example, Schultz and Stansbury (2022, 2023)5 find that U.S.-born economics PhD recipients are typically substantially more likely to have highly educated parents (almost two-thirds have at least one parent with a graduate degree), and significantly less likely to have parents without a university (‘’college’’) degree (14%), than PhD recipients in other disciplines (50% and 26% respectively) [Chart 1]. Meanwhile, it’s the exact opposite situation for the average American of similar age: two-thirds have parents without a college degree, while only 13% have at least one parent with a graduate degree.6

Chart 1: Education of parents of US-born economics PhD recipients relative to other US groups

Notes: All numbers are in percentages; Source: R. Schultz and A. Stansbury (2022), ‘Socioeconomic diversity of economics PhDs’, Peterson Institute for International Economics, Working Paper 22-4.

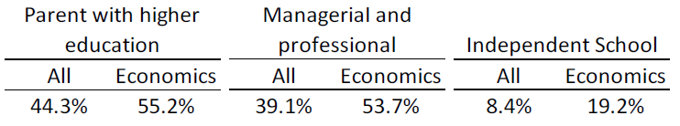

Economics undergraduates in the UK are more likely to have studied in independent/private schools, and to have parents in managerial and professional occupations, compared to the entire UK university undergraduate student population. Almost one fifth of undergraduate economics students in the UK were educated in independent schools (private schools),7 which is more than double that of the total UK undergraduate student population, while more than half have parents in managerial and professional occupations which is significantly higher compared to all UK undergraduates (39%) [Table 1]. Economics undergraduates are also substantially more likely than other disciplines to have parents who received higher education.8

Table 1: Parental education, parental profession and school of UK economics undergraduates compared to all UK undergraduates

Source: Paredes Fuentes, S., Burnett, T., Cagliesi, T., Chaudhury, P. and Hawkes, D. (2022), ‘Diversity Report Royal Economic Society: Who studies Economics? An analysis of Diversity in the UK Economics Pipeline’, Royal Economic society. https://res.org.uk/wp-content/uploads/2023/03/Who-studies-economics-Diversity-Report.pdf.

In Australia, more than 55% of university students studying economics come from high socioeconomic backgrounds, which is substantially more than closely related subjects such as banking and finance, management and commerce, as well as the general student population.9 In Australian schools, four times as many pupils at selective schools study economics in comparison to those from comprehensive schools (which most pupils attend).10

The UK financial sector is characterised by under-representation of those from lower socioeconomic backgrounds – particularly in top jobs – and by substantially slower career progression and lower pay relative to those from higher socioeconomic backgrounds. The financial sector tends to recruit from elite universities, while the proportion of students from lower socioeconomic backgrounds who attend some of these universities can be as low as 10%.11

Even when less advantaged individuals manage to get a job in the financial sector, their chances of career progression may be limited. A report by one large firm finds that among its own employees ‘socioeconomic background has the strongest effect on an individual’s career progression, compared to any other diversity characteristic’.12 The same report finds that individuals from lower socioeconomic backgrounds take on average 19% longer to progress to the next grade, when compared to those from higher socioeconomic backgrounds. Another firm finds that the mean wage of those from lower socioeconomic backgrounds is 9% below that of those from intermediate and higher socioeconomic backgrounds, while the bonus gap is almost 8%.13

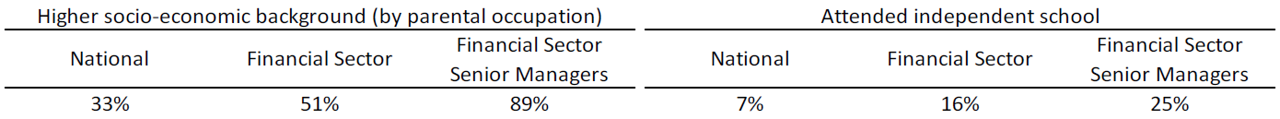

A broader analysis of 8 UK financial services organisations (Bridge Group, 2021)14 shows that those from higher socioeconomic backgrounds dominate senior roles (51%),15 and especially higher-level senior roles (89%) [Table 2], while employees from lower socioeconomic backgrounds take around 25% longer to progress through grades. Meanwhile, 16% of employees in financial services organisations attended an independent/private school compared to the national figure of 7%.16

Table 2: Percentages in UK financial services from higher socioeconomic background (by parental occupation) and attended independent school compared to national UK population

Notes: data based on 8 UK financial services organisations; Source: Bridge Group (2021), ‘Who gets ahead and how? Socioeconomic background and career progression in financial services: a study of 8 organisations’. https://static1.squarespace.com/static/5c18e090b40b9d6b43b093d8/t/5fbc317e96e56f63b563d0f2/1606168962064/Socio-economic_report-Final.pdf.

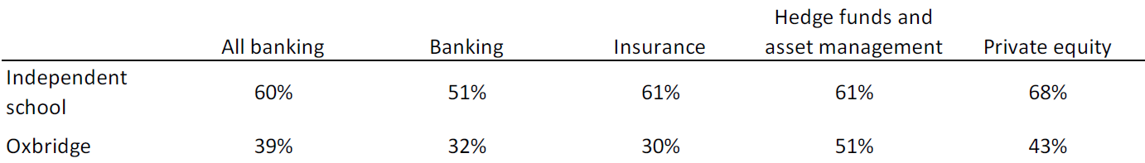

Banking, private equity, hedge funds and asset management reflect the domination of higher socioeconomic backgrounds of leaders in the UK financial sector (Sutton Trust, 2014).17 Averaging across these four areas of the financial sector shows that 60% of leaders went to private school, rising to 68% in private equity (Table 3). Meanwhile, almost 40% of leaders in the financial sector are Oxford or Cambridge alumnae, while more than half of the leaders in hedge funds and asset management went to those universities.18,19

Table 3: UK financial sector percentages of leaders who attended independent school and those who attended Oxford or Cambridge university (i.e., ‘Oxbridge’)

Notes: ‘All banking’ is the sum of banking, insurance, hedge funds and asset management, and private equity; Source: Sutton Trust (2014), ‘Pathways to banking: Improving access for students from non-privileged backgrounds’. Report by the Boston consulting Group for the Sutton Trust.

Raising socioeconomic diversity in economics and the financial sector is important not only because fairness and equality of opportunity are at the heart of democracy, but also because widening the talent pool in economics and the financial sector could enhance productivity, economic growth and policymaking. Expanding the talent pool and increasing the diversity of teams in the workplace brings benefits in terms of productivity, creativity and innovation.20 More importantly, the currently overlooked and underdeveloped talents of individuals from less privileged backgrounds, and the missed human capital investment opportunities they represent, is likely to mean that aggregate productivity is below the levels that could be achieved if the talents of the economically less-advantaged could be fully harnessed.21 If individuals from certain groups choose occupations not based on their abilities – due to, for example, impediments to human capital formation (perhaps resulting from high costs of education and limitations in parental wealth or inadequate schooling, etc) or/and discrimination in the labour market – this results in inefficiencies which damage productivity as it represents a misallocation of talent.22 Policymaking can also be improved by drawing on a greater range of experiences: raising socioeconomic diversity in economics and the financial sector could avoid the problems with ‘groupthink’ where all participants come from the same privileged background.23 Given the importance of economic and the financial advice in policymaking, understanding the impacts of policy from the widest possible perspective (and life experiences) would likely provide broader insights into the possible consequences of a given course of action.

Socioeconomic diversity in economics and the financial sector can be increased across EU countries and Europe more broadly by building on existing initiatives and learning from best practice. There are a range of ongoing initiatives to increase socioeconomic diversity in economics and the financial sector which could be adopted by European firms, large institutions and organisations.24 Detailed templates and toolkits are available which outline the various steps for incorporating more socioeconomic diversity in the workplace.25 Although it seems clear that economics and finance tend to lack socioeconomic diversity, information and data seem to be very limited across European firms and institutions on this crucial issue. An important first step is to improve our knowledge of socioeconomic diversity – or the lack of it! – in these areas. In terms of concrete actions aimed at raising socioeconomic diversity in economics and finance across Europe, the following suggestions may be useful:

Excerpt from Christine Lagarde’s contribution to Davos 2024: Town Hall: How to Trust Economics: https://www.weforum.org/podcasts/agenda-dialogues/episodes/davos-2024-town-hall-lagarde-how-to-trust-economics/.

There is general lack of socioeconomic diversity across many professions, not just economics and finance, as a growing body of analysis suggests that those from less privileged backgrounds face persistent barriers to elite universities, many high-paying occupations, and top positions. For a summary, see Anderton, R (2023), ‘Socioeconomic diversity in the workplace and education: smart, underprivileged and overlooked means missed opportunities for all’, VoxEU column, 26 May 2023. https://cepr.org/voxeu/columns/socioeconomic-diversity-workplace-and-education-smart-underprivileged-and-overlooked.

See, for example, Paredes Fuentes, S., Burnett, T., Cagliesi, T., Chaudhury, P. and Hawkes, D. (2022) ‘Diversity Report Royal Economic Society: Who studies Economics? An analysis of Diversity in the UK Economics Pipeline’ (2022). https://res.org.uk/wp-content/uploads/2023/03/Who-studies-economics-Diversity-Report.pdf.

This is not implying that socioeconomic diversity is more important than gender or ethnic diversity as these are not independent, or working separately, to each other given that they are frequently intertwined and overlap each other, often resulting in multiplicative impacts on disadvantage.

Schultz, R. and Stansbury, A. (2022), ‘Socioeconomic diversity of Economics PhDs’, Peterson Institute for International Economics Working Paper 22-4. https://www.piie.com/sites/default/files/documents/wp22-4.pdf. Stansbury, A. and Schultz, R. (2023), ‘The economic profession’s socioeconomic diversity problem’, Journal of Economic Perspectives, Volume 37, No. 4, Fall 2023, pp. 207-230. https://www.aeaweb.org/articles?id=10.1257/jep.37.4.207. As well as Stansbury (2022), ‘Economics needs more socioeconomic diversity’, Harvard Business Review; and Stansbury, A. (2023), ‘The US economics profession’s socioeconomic diversity problem’, VoxEU Column, 9 November 2023. https://cepr.org/voxeu/columns/us-economics-professions-socioeconomic-diversity-problem.

All information in this paragraph and Chart 1 based on Schultz, R. and Stansbury, A. (2022, 2023) and Stansbury, A. (2022, 2023).

Independent schools are private schools which are not dependant on national or local government to finance their financial endowment.

All information in this paragraph and Table 1 based on Paredes Fuentes, S., Burnett, T., Cagliesi, T., Chaudhury, P. and Hawkes, D. (2022) ‘Diversity Report Royal Economic Society: Who studies Economics? An analysis of Diversity in the UK Economics Pipeline’ (2022). https://res.org.uk/wp-content/uploads/2023/03/Who-studies-economics-Diversity-Report.pdf.

‘What happened to the study of Economics?’, Dwyer, J. (2018), Reserve Bank of Australia. Address to the Business Educators Australasia Annual Meeting. https://www.rba.gov.au/speeches/2018/pdf/sp-so-2018-05-26.pdf.

All information in this paragraph based on Dwyer, J. (2018), op. cit.

Social Mobility Commission (2016), ‘Socioeconomic Diversity in Life Sciences and Investment Banking’, Table 3.4, p.76. https://assets.publishing.service.gov.uk/government/uploads/system/uploads/attachment_data/file/549994/Socio-economic_diversity_in_life_sciences_and_investment_banking.pdf.

Statement based on analysis of career progression of KPMG partners and employees: KPMG and Bridge Group (2022), ‘Social mobility progression report 2022: mind the gap’, https://assets.kpmg.com/content/dam/kpmg/uk/pdf/2022/12/social-mobility-progression-report-2022-mind-the-gap-brochure.pdf.

See PwC, Diversity Pay Report: https://www.pwc.co.uk/who-we-are/our-purpose/empowered-people-communities/inclusion/diversity-pay-report.html#socioeco.

Bridge Group (2021), ‘Who gets ahead and how? Socio-economic background and career progression in financial services: a study of eight organisations’. Note that the 8 financial services organisations included 3 regulators (including Bank of England, Financial Conduct Authority) and 5 financial services entities (eg, Investment Managers Blackrock and Santander). https://static1.squarespace.com/static/5c18e090b40b9d6b43b093d8/t/5fbc317e96e56f63b563d0f2/1606168962064/Socio-economic_report-Final.pdf.

‘This proportion is also higher compared with most elite professions in the UK’: Bridge Group (2021), op. cit.

All information in this paragraph and Table 2 based on Bridge Group (2021), ‘Who gets ahead and how? Socioeconomic background and career progression in financial services: a study of 8 organisations’. https://static1.squarespace.com/static/5c18e090b40b9d6b43b093d8/t/5fbc317e96e56f63b563d0f2/1606168962064/Socio-economic_report-Final.pdf.

See Sutton Trust (2014), ‘Pathways to banking: Improving access for students from non-privileged backgrounds’. Report by the Boston consulting Group for the Sutton Trust. https://www.suttontrust.com/wp-content/uploads/2019/12/pathwaystobankingreport-24-jan-2014-1.pdf.

All information in this paragraph and Table 3 based on Sutton Trust (2014), op. cit.

The prevalence of an Oxford or Cambridge university background in the financial sector seems particularly acute considering that less than 1% of the UK population are educated at these two universities.

See: Cooper, C, A Hamilton, C Shaw and L York (2023), ‘Fixing the ladder: how UK businesses benefit from better social mobility’, McKinsey and Company, 25 January. https://www.mckinsey.com/industries/public-sector/our-insights/fixing-the-ladder-how-uk-businesses-benefit-from-better-social-mobility#/; and Financial Conduct Authority, UK (2021), ‘Review of research literature that provides evidence of the impact of diversity and inclusion in the workplace’. https://www.fca.org.uk/publication/research/review-research-literature-evidence-impact-diversity-inclusion-workplace.pdf.

For example, increasing social mobility and reducing inequality can lead to productivity gains, see: Oxera (2017), ‘Social mobility and economic success: how social mobility boosts the economy’, prepared for the Sutton Trust, 12 July. https://www.oxera.com/wp-content/uploads/2018/07/Social-mobility-and-the-economy.pdf.pdf ; and Cingano, F (2014), “Trends in income inequality and its impact on economic growth”, OECD Working Paper no. 163.

See, for example: Chang-Tai Hsieh, Erik Hurst, Charles I. Jones and Peter J. Klenow (2019), ‘The allocation of talent and US economic growth’, Econometrica, Vol. 87, No. 5 (September 2019), pp. 1439-147; and Almgren, M., Kramer, J. and Sigurdsson (2023), ‘It runs in the family: occupational choice and the allocation of talent’, https://jvkramer.github.io/Misallocation_of_talent.pdf.

See: Nedd, R. and Bailey, A (2022), ‘Increase socioeconomic diversity and reduce risk’, Oliver Wyman. https://www.oliverwyman.com/our-expertise/insights/2021/dec/increase-socio-economic-diversity-reduce-risk-financial-services.html.

For example: Progress Together (UK) aims to improve socioeconomic diversity and inclusion at senior levels in the UK financial services industry: https://www.progresstogether.co.uk/; KPMG (UK) has various initiatives aimed at increasing the socioeconomic diversity of its workforce: https://assets.kpmg.com/content/dam/kpmg/uk/pdf/2021/09/KPMG-Socio-Economic-Background-Pay-Gap-Report.pdf. Pathways to Banking and Finance (Sutton Trust, UK) is available to those who satisfy certain criteria and ‘is completely free and provides support in accessing higher education and understanding careers in banking and finance with incredible work experience opportunities’. (89% of applicants would be the first generation in their family to attend university): https://pathwaysprogrammes.suttontrust.com/career-pathways/banking-finance#:~:text=Pathways%20to%20Banking%20and%20Finance,with%20incredible%20work%20experience%20opportunities.

See, for example, Bridge Group and Social Mobility Commission (2021), ‘Socioeconomic diversity and inclusion: employer’s toolkit cross-industry edition’, https://socialmobilityworks.org/wp-content/uploads/2021/07/SMC-Employers-Toolkit_WEB_updated_July2021.pdf.

Such internships and summer schools can, for example, describe the economic and financial frameworks, methods and tools the institutions use, as well as expanding the knowledge and functions of their institutions to a broader cross-section of the population they serve.

See the ‘ESCB and SSM Equality, Diversity and Inclusion Charter’ – launched in 2022 by the European Central Bank together with the national central banks and national competent authorities in the European System of Central Banks (ESCB) and the Single Supervisory Mechanism (SSM) – which has common goals including aiming to: ‘reflect the diversity of the societies we serve’; and ‘harness the diversity of our people to improve our workplaces and results’.

See, for example, p. 11 of KPMG and Bridge Group (2021), ‘Socioeconomic background pay report 2021’, https://assets.kpmg.com/content/dam/kpmg/uk/pdf/2021/09/KPMG-Socio-Economic-Background-Pay-Gap-Report.pdf.

See, for example: Discover Economics (UK) ‘is on a mission to increase the diversity of economics students’; https://www.discovereconomics.co.uk/about; Advani, A., Griffith, R. Smith, S. (2019), ‘Economics in the UK has a diversity problem that starts in schools and colleges’, VoxEU Column October 2019. https://cepr.org/voxeu/columns/economics-uk-has-diversity-problem-starts-schools-and-colleges.

See, for example, the ECB Scholarship for Women which ‘is specifically designed to help EU women from low-income backgrounds to pursue postgraduate studies in the fields of economics, statistics, engineering and computing’: https://www.ecb.europa.eu/careers/what-we-offer/wecs/html/index.en.html.