References

Adams, P. A., Adrian, T., Boyarchenko, N. and Gianonne, D. (2021), “Forecasting Macroeconomic Risks”, International Journal of Forecasting, 37(3), 1173-91.

Adrian, T., Boyarchenko, N. and Gianonne, D. (2019), “Vulnerably Growth”, American Economic Review 109(4), 1263-89.

Angeletos, G.-M., Collard, F. and Dellas, H. (2020), “Business-Cycle Anatomy”, American Economic Review 110(10), 3030-70.

Caldara, D., Scotti, C. and Zhong, M. (2021), “Macroeconomic and Financial Risks: A Tale of Mean and Volatility”, International Finance Discussion Papers, No. 1326, Board of Governors of the Federal Reserve System (U.S.).

Delle Monache, D., De Polis and A., Petrella, I. (2021), “Modeling and Forecasting Macroeconomic Downside Risk”, Bank of Italy Temi di Discussione (Working Paper), No. 1324.

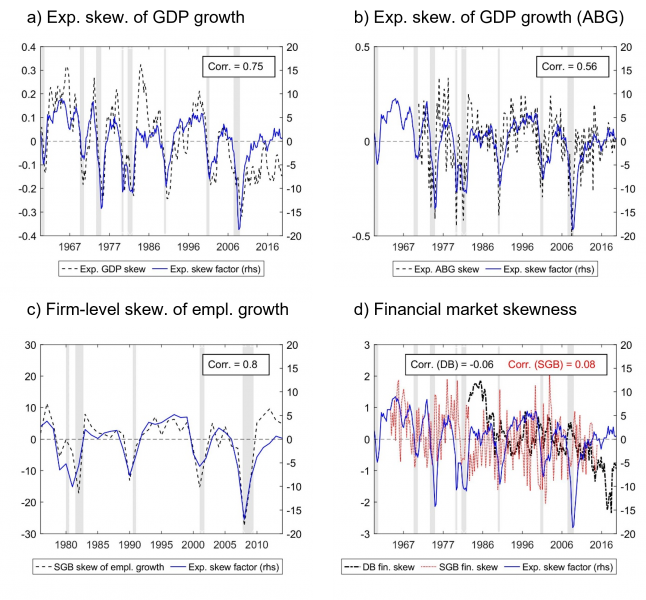

Dew-Becker, I. (2021), “Real-time forward-looking skewness over the business cycle”, Mimeo.

Engle, R. F. and Manganelli, S. (2004), “CAViaR: Conditional Autoregressive Value at Risk by Regression Quantiles”, Journal of Business & Economic Statistics 22(4), 367-381.

Forni, M., Gambetti, L. and Sala, L. (2021), “Downside and upside uncertainty shocks”, CEPR Discussion Papers, No. DP15881, Centre for Economic Policy Research.

Giglio, S., Kelly, B. and Pruitt, S. (2016), “Systemic risk and the macroeconomy: An empirical evaluation”, Journal of Financial Economics, 119(3), 457-471.

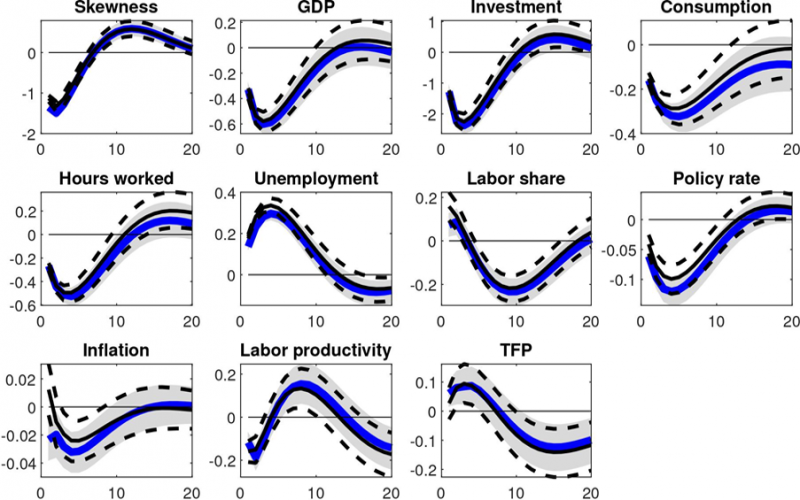

Iseringhausen, M., Petrella, I. and Theodoridis, K. (2022), “Aggregate Skewness and the Business Cycle”, ESM Working Papers, No. 53, European Stability Mechanism.

Jurado, K., Ludvigson, S. C. and Ng, S. (2015), “Measuring Uncertainty”, American Economic Review 105(3), 1177-1216.

López-Salido, J. D. and Loria, F. (2020), “Inflation at Risk”, Finance and Economics Discussion Series, No. 2020-013, Board of Governors of the Federal Reserve System (U.S.).

McCracken, M. W. and Ng. S. (2016), “FRED-MD: A monthly database for macroeconomic research”, Journal of Business & Economic Statistics, 34(4), 574-89.

McCracken, M. W. and Ng. S. (2020), “FRED-QD: A quarterly database for macroeconomic research”, Federal Reserve Bank of St. Louis Working Paper, No. 2020-005.

Salgado, S., Guvenen, F. and Bloom, N. (2019), “Skewed Business Cycles”, NBER Working Papers, No. 26565, National Bureau of Economic Research.