Climate risks are now fully recognized as financial risk. As a result, the integration of climate risk metrics into risk management frameworks is moving up agendas worldwide. In that context, a rapidly growing number of central banks and financial supervisors are exploring which metrics to use to capture climate risks, and to what extent the use of different metrics delivers heterogeneous results. Against this background, this policy brief summarizes the results of an analysis of climate-related transition risk metrics, for a sample of firms based on the ECB corporate bond portfolio. It highlights that climate risk metrics display a significant degree of diversity, which reflects the complexity of assessing climate risks, as well as the different methodologies and data underpinning these metrics. It also emphasizes that risk assessments across metrics tend to converge on which firms are most and, to a lesser extent, least exposed to transition risks. It concludes that central banks and financial supervisors can and should use available metrics to better integrate climate risks into monetary policy operations and financial supervision.

Climate risks are a source of financial risk. As such, they need to be accounted for in asset managers’ and investors’ decisions, as well as – crucially – in central bank operations and financial supervision. Yet climate risks are currently not adequately reflected in the ratings and risk metrics that underpin prevailing risk management frameworks. As a result, the use of specialized climate risk metrics is moving up agendas worldwide.

Against this background, a rapidly growing number of central banks and financial supervisors are exploring which metrics to use to capture climate risks, and to what extent different metrics and scenarios deliver heterogeneous results. A key question on their agenda zooms in on whether different climate risk metrics give a drastically different risk assessment for the same firm, and if so, why. Our recent research on convergence and divergence across climate risk assessments contributes to providing an answer to these questions (Bingler et al. 2020). It highlights that the climate risk metrics currently available can and should be applied by central banks and financial supervisors to better account for climate risks in monetary policy operations and financial supervision.

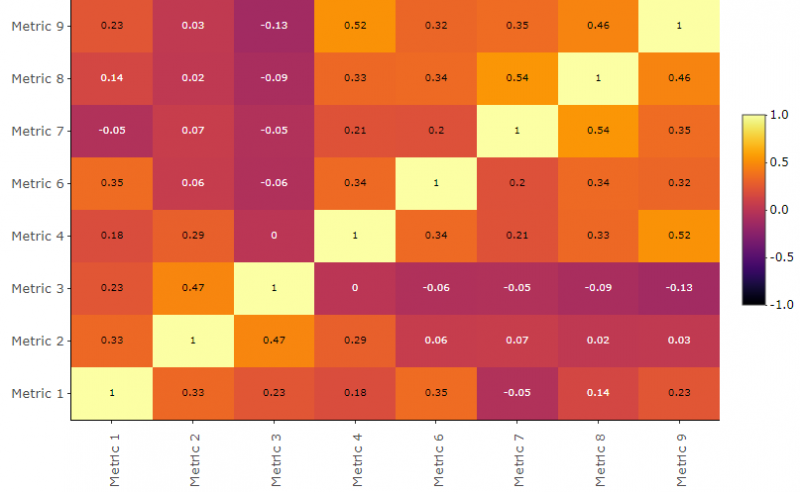

Our research ranks the assessments of 12 transition risk metric providers for 287 companies owned by the ECB in its CSPP (Corporate Sector Purchase Program) portfolio as of 28 August 2020. Figure 11 presents the pairwise correlations between providers’ assessments.

Figure 1: Correlation of ranks between climate transition risk metrics

Figure 1 shows that the overall convergence in the assessment of firms’ risk exposures between metrics is relatively low. Such degree of heterogeneity in assessments should not come as a surprise. It reflects the different approaches, modelling assumptions and data inputs used by the different providers. More fundamentally, we believe this heterogeneity is a feature of assessing climate risks, not a bug. Even as methodologies develop and data improves, climate risk metrics are very likely to remain relatively diverse given the complexity of assessing climate risks and the uncertainty related to them. In such a context, diversity is rather welcomed: it allows to capture different dimensions of exposure to climate risks. It also represents an incentive for constant development and improvement of the methodologies.

While we find low convergence in general across metric providers, climate risk metrics tend to converge more strongly on the firms most and, to a lesser extent, least exposed to transition risks.

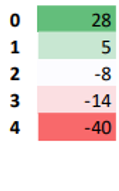

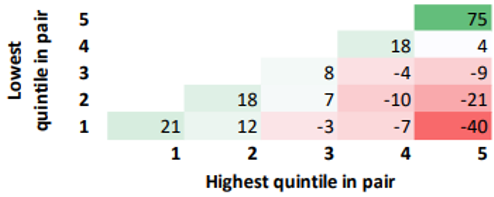

To see that, we ranked our risk assessments in quintiles, from the lowest to the highest estimated risk exposure. Figure 2 presents the excess frequency with which we observe a pair of risk assessments by two risk metrics for a specific firm, related to the frequency which we would observe if assessments were not related at all.

Figure 2: Excess frequency of observed risk assessments pairs vs. independent metrics (in %)

| (a) Difference in pair | (b) Per quintile pairs |

|

|

Panel (a) shows that pairs of assessments in which two metrics agree – i.e. two metrics rank a firm in the same quintile – occur more often than with an independent distribution. This indicates that risk metrics tend to agree more often than they disagree on the risk exposure of the same firm.

Panel (b) shows that the highest excess frequency is observed for the pairs falling both in the fifth quintile. This indicates that convergence in assessments between metrics is more pronounced for firms with the highest exposure to transition risks.

Our research also provides a first exploration of the reasons behind the observed divergence in assessments across metrics.

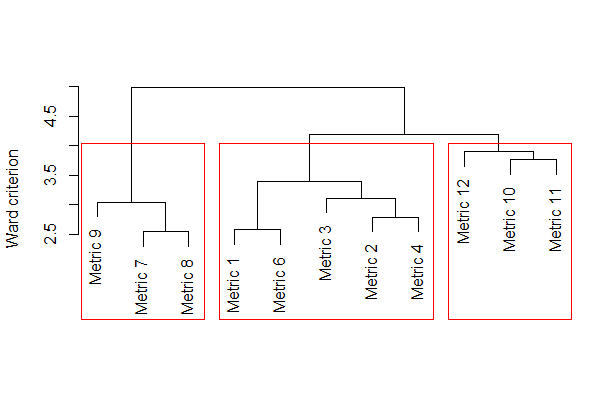

First, a cluster analysis identifies three groups of metrics (see Figure 3)2. The first group (on the left-hand side of Figure 3) is composed of metrics that aggregate several indicators of exposure to transition risks to form a rating or a score indicator; the second group (in the middle of Figure 3) comprises metrics that rely on the estimation of a specific financial indicator (e.g. future earnings, value-at-risk, change in stock price); the last group (on the right-hand side of Figure 3) is more heterogenous and includes metrics which are not based on a forward-looking or firm-level analysis. The results of the cluster analysis show that part of the observed heterogeneity in assessments can be attributed to differences in methodologies across the providers.

Second, we find that specific characteristics of the methodologies underpinning risk metrics affect the assessment of companies’ exposure to transition risks. We look, for instance, at the impact of adopting different temperature targets and time horizons within the same metric. It emerges that both elements can change the relative assessment of the exposure to transition risks of the companies in our sample. This highlights the importance for users to understand the assumptions and methodologies that underpin the metrics they use.

Figure 3: Cluster analysis

Given the degree of heterogeneity we observe, and the complementarity in information different metrics deliver, we recommend that central banks and financial supervisors rely on a set of risk metrics to assess the exposure of a firm and thus to obtain a more complete and robust picture of their exposure to climate risks. We also argue that central banks and financial supervisors must build a thorough understanding of the methodology underlying the metrics they use, in order to choose the one that is aligned with their needs and assumptions, and to correctly interpret the results.

Furthermore, our study shows that, although significant heterogeneity exists between risk metrics, they tend to converge on companies that are most and, to a lesser extent, least exposed to transition risks. Central banks can and should use this information on highly exposed firms to reduce their own exposure to climate risks. Similarly, financial supervisors can and should rely on existing metrics to set prudential regulations for exposures to most risky firms.

As emphasized in our study, diversity in climate risk assessments is a feature, not a bug. In this context, central banks and financial supervisors should not wait for further convergence between risk metrics before starting to use them. The divergence fosters the need to correctly understand the drivers of the results – which eventually increases the overall understanding of the risks. As the Governor of the Bank of England Andrew Bailey rightly said: “uncertainty and lack of data is not an excuse” (Bailey 2020).

Bailey, A. (2020). The time to push ahead on tackling climate change. Speech given at the Corporation of London Green Horizon Summit, Mansion House, November 9.

Bingler, J., Colesanti Senni, C., Monnin, P. (2020). Climate Financial Risks: Assessing Convergence, Exploring Diversity. CEP Discussion Note.

Note that our pairwise correlation analysis only includes eight metrics. We excluded the metrics that are not based on a forward-looking or firm-level analysis.

The cluster analysis statistically groups metrics according to the Ward criterion, which is a measure for the degree of convergence between metrics.