References

Andreasen, M. M., Fernández-Villaverde, J., and Rubio-Ramírez, J. F. (2018). The pruned state-space system for non-linear DSGE models: Theory and empirical applications. The Review of Economic Studies, 85(1), 1-49.

Kiyotaki, N. and Moore, J. (1997). Credit Cycles. Journal of Political Economy, 105(2):211–248.

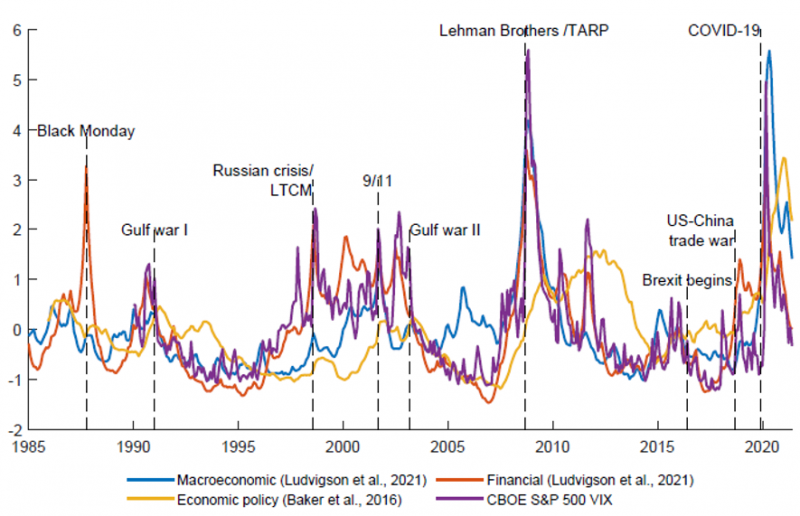

Ludvigson, S. C., Ma, S., and Ng, S. (2021). Uncertainty and Business Cycles: Exogenous Impulse or Endogenous Response? American Economic Journal: Macroeconomics, 13(4):369–410.

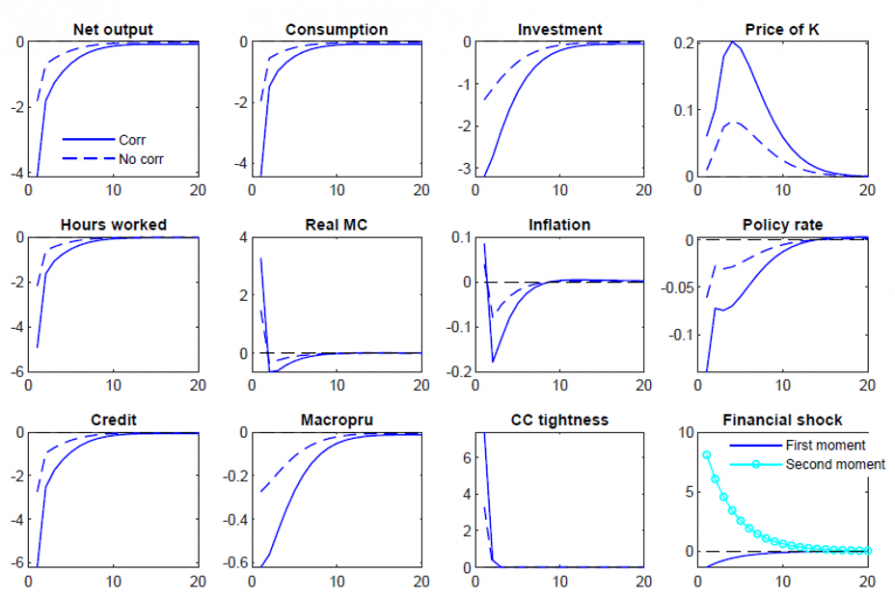

Nalban, V., and Smădu, A. (2022). Uncertainty shocks and the monetary-macroprudential policy mix, De Nederlandsche Bank Working Paper, No. 739.