We investigate whether forward guidance (FG) and large scale asset purchases (LSAP) are effective in steering economic expectations in the US. Using the series of monetary policy shocks recovered in Swanson (2020), local projections, and an algorithm to select the best empirical model, we show that unconventional monetary policies are effective in tilting economic expectations in a direction consistent with the central bank’s desired outcomes. Our empirical findings provide two more insights: responses to LSAP shocks are stronger than those following a FG shock; responses to both types of policies are larger after contractionary shocks as compared to expansionary ones.

In response to the great financial crisis first and the Covid-19 pandemic recently, and after interest rates hit the zero lower bound (ZLB), central banks around the world heavily relied on unconventional monetary policies (UMP). Forward guidance (FG) and large scale asset purchases (LSAP) are by now well established tools.

In our paper (Anzuini and Rossi (2021)), we estimate the causal effect of unconventional monetary policy interventions onto expectations on future economic activity. We find that (on average) both Forward Guidance and Large-Scale Asset Purchases have been effective in steering expectations in the right direction. Importantly, however, LSAP shocks cause responses to be much greater, more front-loaded, and more precisely estimated than FG shocks do. Moreover, digging deeper into the possible existence of non-linearities in the transmission mechanism, we find that not taking asymmetry explicitly into account may lead to an overestimation of the impact of UMP on the economy.

As we show next, a key result of our research suggests that contractionary shocks to UMPs entail a stronger and more precisely estimated response of economic expectations than expansionary shocks imply. This means that caution must be taken when the time for monetary policy normalization comes, as its effects could be stronger than expected.

We borrow the monthly unconventional monetary policy shocks from Swanson (2020), which estimates them by joining the high frequency identification approach together with further structural schemes.2 We instead rely on Consensus Economics to retrieve monthly expectations on various economic variables.

Since we are interested in assessing whether expansionary monetary shocks have had a different effect on expectations than contractionary ones, we estimate a state-dependent model where the control variables are the monetary policy shocks (separated into positive and negative ones by appropriate dummy variables), the autoregressive component of the dependent variable, the one-, two-, and ten-years yield on US bonds, the excess bond premium from Gilchrist and Zakrajšek (2012), actual values for industrial production growth, inflation, and the unemployment rate. In order to show the benefits of introducing state contingencies, we also estimate and show results from a linear model where we assume that the effect of a positive shock is the same as the one stemming from a negative shock.

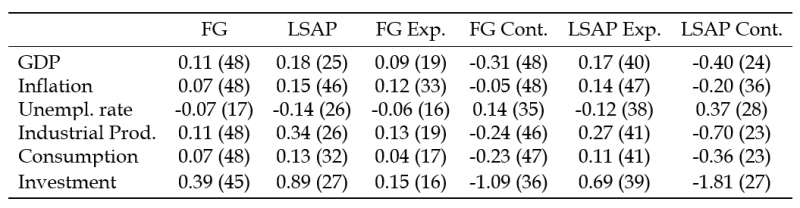

Table 1: Peak Responses

The first column reports peak values of the impulse response functions in the linear model for expectations of economic variables following a one standard deviation shock in forward guidance (corresponding months are in parenthesis). The second column reports peak results for large scale asset purchases in the same model. Columns from third to sixth report results when the model is split to take into account expan- sionary and contractionary shocks in both UMPs.

Table 1 reports estimated peak responses for both the linear and the non-linear model when a one-standard-deviation shock to either FG or LSAP occurs. In the linear model, variables are responding to an expansionary shock.

In general, one can see that expectations respond in a much stronger way to LSAP shocks than they do to FG ones. Peaks in the linear model show that LSAP shocks cause expectations to be revised roughly by twice as much as they do under FG shocks. Moreover, both UMPs feature very delayed responses, even though (apart from the unemployment rate) responses to LSAP tend to peak earlier than those occurring after FG policies are enacted.

We then show that IRFs estimated in the linear model hide an important source of heterogeneity, namely the one stemming from the sign of the shock. In particular, the strength of the majority of the responses mainly comes from contractionary shocks, whereas expansionary ones yield smaller, although still significant, responses especially as what concerns FG shocks.

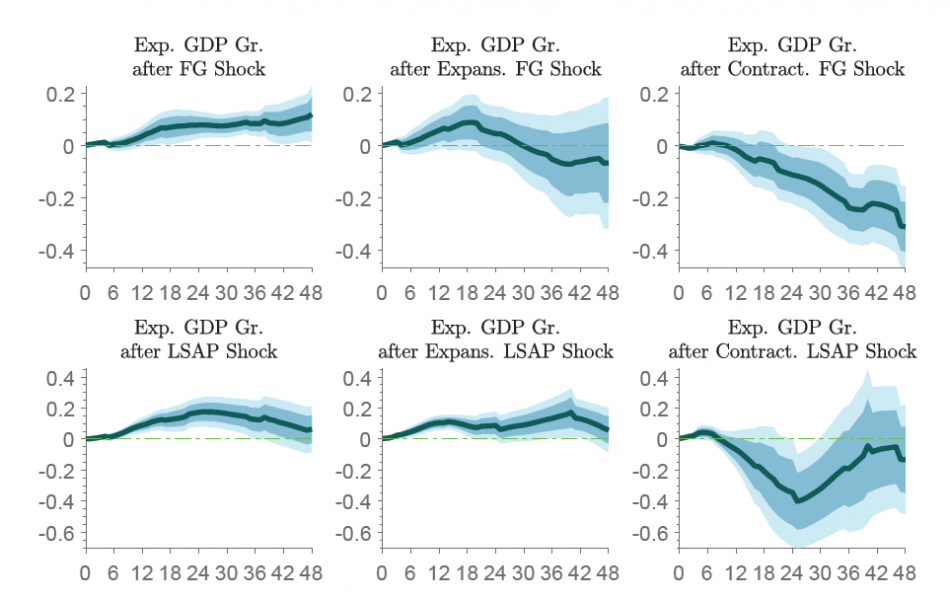

Figure 1 plots IRFs for expected GDP. One can see that expansionary Forward Guidance has a somehow short-lived impact on expectations. Indeed, expected GDP increases up to 0.17 percentage points (pp) within the first 18 months, but it then becomes insignificantly different from zero at longer horizons. Contractionary FG does instead have lasting effects on expected economic activity, whereby GDP is revised down a significant 0.3 pp after 4 years. IRFs after LSAP seem to behave slightly differently: expansionary shocks have a stronger and more persistent effect than they do under FG, whereas contractionary ones peak well before, and their effect vanishes by the end of the horizon.

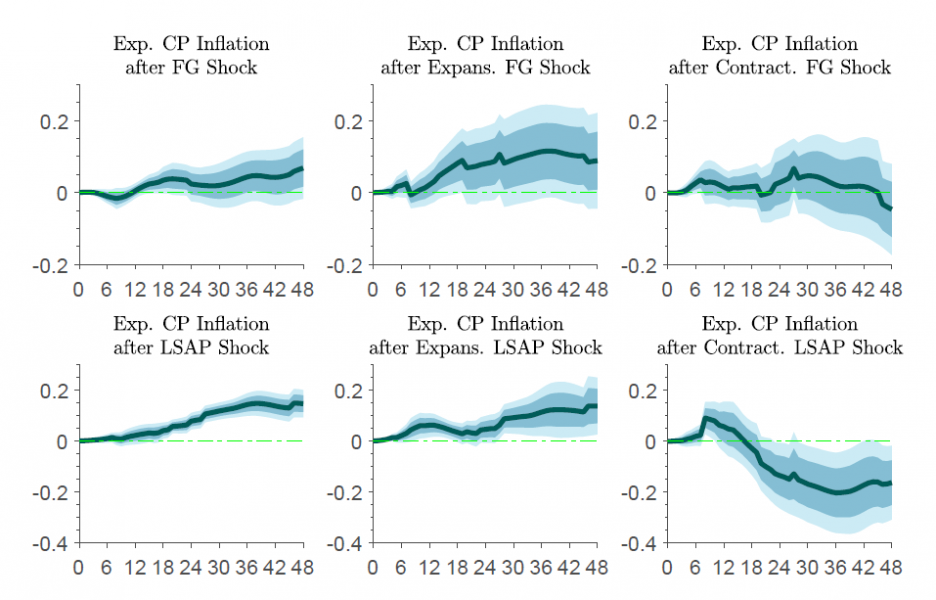

As for prices, Figure 2 shows that expansionary FG and LSAP are able to raise expectations by 0.12 and 0.14 pp respectively, with the latter displaying a much higher significance level. Contractionary FG does not curb inflation expectations much throughout the whole time horizon, as opposed to contractionary LSAP which does lower expected prices by as much as a 0.2 pp after three years (at 90% significance level).

Figure 1: Cumulative IRFs, GDP

The figure plots one-year-ahead expected GDP response together with 68% and 90% confidence intervals. The first column displays the responses to an expansionary FG and LSAP shocks in the linear model. The second and the third columns the asymmetric responses to an expansionary and a contractionary FG and LSAP shocks.

Figure 2: Cumulative IRFs, CPI inflation

The figure plots one-year-ahead expected CPI inflation response together with 68% and 90% confidence intervals. The first column displays the responses to an expansionary FG and LSAP shocks in the linear model. The second and the third columns the asymmetric responses to an expansionary and a contractionary FG and LSAP shocks.

Our results can be used to shed some light on debates regarding the conduct of monetary policy. Some authors argue that acting pre-emptively with conventional monetary policy is the right thing to do because avoiding hitting the ZLB (or at least reducing the probability of hitting it) is of first order importance; others say that ammunitions must be preserved for bad times when an economic slowdown is clearly turning into a recession.

Our findings show that UMPs are effective and can be used as a tool in the conduct of monetary policy. However, their capability to boost economic activity and inflation might be overestimated by previous studies that do not take asymmetries into account, so that the central bank should, in principle, try to avoid a situation where the only tool left to stimulate the economy are UMP. Therefore, we believe our results lend some support to monetary policy acting in a pre-emptive manner.

Our evidence also suggests that LSAP policies, by delivering concrete actions, bring with themselves a stronger (credibility) effect than others where policymakers report their own (potentially imprecise) forecast of what they think they are most likely to do in the future (as it happens with FG).

Finally, we show that UMPs have been effective in sustaining economic activity through their impact on expectations, and we are therefore confident that they could be deployed successfully to counter the impact of future recessions, with a caveat: because of the fact that asymmetry has not been taken into account, some of their estimated expansionary capability detected by past literature might have been overestimated.

To conclude, at the current juncture, our findings of stronger contractionary effects of unconventional monetary policy should put a word of caution to the management of post-Covid monetary policy normalizations: exiting too early or too abruptly may be very costly in terms of lost economic growth.

Anzuini, A., Rossi, L., 2021. “Unconventional monetary policies and expectations on economic variables,” Temi di discussione (Economic working papers) 1323, Bank of Italy, Economic Research and International Relations Area.

Gilchrist, S., Zakrajšek, E., 2012. Credit Spreads and Busyness Cycle Fluctuations. American Economic Review 102, 1692–1720.

Swanson, E.T., 2020. Measuring the Effects of Federal Reserve Forward Guidance and Asset Purchases on Financial Markets. Journal of Monetary Economics.

Bank of Italy, Directorate General for Economics, Statistics and Research. We would like to thank Eric Swanson for sharing his monetary policy shocks. We also thank participants at the 14th South-Eastern European Economic Research Workshop at the Bank of Albania for useful comments. The views expressed in this paper are those of the authors and do not necessarily reflect those of the Bank of Italy. All the remaining errors are ours. E-mail: alessio.anzuini@bancaditalia.it; luca.rossi@bancaditalia.it.

Swanson computes the high-frequency (30-minute) response of asset prices to FOMC announcements to identify the immediate causal effect of those announcements on financial markets. He then tests for the number of dimensions underlying those announcement effects and shows that they are well described by three dimensions over the period from 1991 to 2019. These represent the three aspects of FOMC announcements that had the greatest systematic effect on asset prices over the sample; intuitively, the three dimensions are likely to correspond to changes in the federal funds rate, changes in forward guidance, and changes in LSAPs. The three factors are estimated as the first principal components of those asset price responses. To provide structural interpretation of the factors, Swanson searches over all possible rotations of the three principal components to find one in which the first factor corresponds to the change in the federal funds rate, the second one to the change in forward guidance, and the third to the change in LSAPs. Rotations are recovered conditional on three identifying assumptions: i) changes in LSAP have no effect on the current federal funds rate, ii) changes in FG have no effects on the current federal funds rate, iii) LSAP had no significant role before the ZLB period.