This Brief draws on Holzmann, Robert, (2024), Unconventional monetary policy under review: past, present and future challenges. OeNB Occasional Paper No. 8, October 2024. Opinions expressed do not necessarily reflect the official viewpoint of the OeNB or the Eurosystem. I thank Patrick Gyasi and Karen Spisso for helpful research assistance, and Anna Stelzer for support, comments and suggestions.

Abstract

After the global financial crisis and until 2021, central banks in advanced economies implemented policies aimed at increasing inflation, given that inflation had been below their targets for too long. Having reached the effective lower bound (ELB) of nominal interest rates, monetary policy resorted to unconventional monetary policy (UMP) measures, which were not without negative side effects. In response to the rise in inflation in 2021, central banks returned to policy interest rates as their primary monetary policy tool and began to unwind UMP measures. This SUERF Policy Brief provides an overview of intended – and unintended – effects of UMP. It touches upon the apparent regime-dependent link between UMP and the money supply, on the one hand, and inflation on the other. It concludes with some thoughts on implications for future monetary policy approaches.

The global financial crisis (GFC), the sovereign debt crisis in the euro area and the covid pandemic led central banks worldwide to take bold actions to prevent deflation and support economic growth. Initially, major central banks focused on lowering interest rates to stimulate their economies. However, as nominal interest rates neared zero and failed to achieve inflation targets, the effectiveness of conventional monetary policy declined. To overcome these limitations, central banks expanded their monetary policy toolkit by introducing unconventional monetary policy (UMP) measures to stimulate the economy, overriding the effective lower bound (ELB) on nominal interest rates.

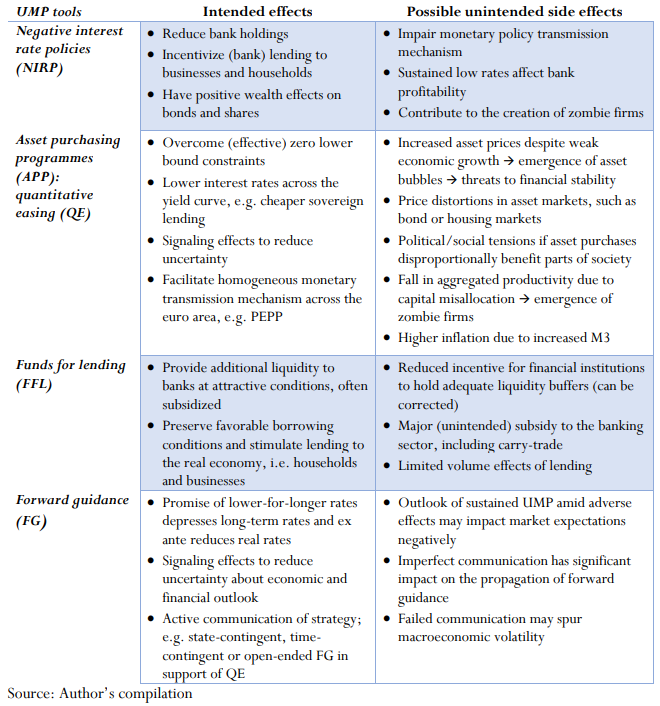

In the euro area, the UMP measures included negative interest rate policies (NIRP), asset purchase programs (APP), funding for lending (FFL) and forward guidance (FG). The objective of these UMP instruments was manifold. For one thing, they were intended to support the expansionary monetary policy efforts, i.e., to contribute to price stability, to anchor inflation expectations and stimulate economic growth. For another, they were also designed to overcome disruptions of the transmission mechanism during crises. However, these measures were controversial and untested, which raised concerns about potential negative side effects already at the time of their implementation. There were concerns about how policies such as NIRP or APP may affect the efficient allocation of resources in the economy, or if UMP tools may have negative distributional effects. In addition, there were strong concerns that some of these measures will have a negative impact on central bank profitability, and hence on financial stability, in the medium to long term.

From the very beginning, the use of UMP measures was controversial because of the risks involved. Even when their theoretical effect was clear ex ante, most UMP measures were uncharted territory and carried the risk of unintended side effects. This fact has inspired a large body of economic literature venturing to assess both the intended and unintended effects of UMP. Table 1 offers a (non-exhaustive) overview of both types of effects.

Spisso et al. (2024) systematically evaluate the results of many papers investigating APP, FG, NIRP and FFL. Their survey focuses on economic outcomes and suggests that most papers find the expected theoretical effects and that, overall, all UMP instruments studied seem to have broadly achieved their primary objectives of supporting economic activity and raising inflation. However, these conclusions are far from unanimous. Several papers also disagree with these findings, while other papers find no effect of the policies at all, casting doubt on the true efficacy of these measures.

Even if UMP overall seems to have succeeded at stimulating the economy, it is crucial to recognize that this perceived success came at considerable costs. Employing these monetary policy tools may have numerous and potentially severe negative consequences. Alarmingly, the survey by Spisso et al. (2024) indicates that there is a notable lack of comprehensive research on the unintended side effects of UMP, such as distributional effects or resource allocation. Consequently, the full extent of these negative impacts may be underestimated.

The limited literature available on these side effects paints a troubling picture. NIRP, for instance, was found to be potentially detrimental to financial stability. The banking sector’s health and stability could have been affected in a lasting way by the adverse impact that negative interest rates had on banks’ net interest margins and by banks’ increased risk-taking as they sought to find new sources of income. Moreover, evidence from the literature also suggests that QE and FFL may have contributed to significant resource misallocation in the economies studied (Spisso et al., 2024). Some studies suggest a non-zero probability of zombification in the economy due to QE, while FFL programs appear to have increased zombie lending, especially in euro area countries under stress. These results are particularly concerning in light of the already troubling slowdown in productivity growth. Such developments not only potentially hinder both economic recovery and competitiveness in the long term, but also contribute to the negative feedback loop of declining productivity growth, declining r* and the necessity of ever more UMP.

Table 1. Intended – and unintended – effects of UMP

Another area of concern are the distributional effects of UMP. While the literature does not agree on a uniformly positive or a negative distributional effect, strong evidence links monetary policy to the value of one of the most important assets of a household, namely housing. First, expansionary monetary policy can lead to increased house prices, both in absolute terms and relative to income and rent (see, for example, Lenza et al., 2024; Weale and Wieladek, 2022). Despite perhaps increased lending for home purchases, this trend makes homeownership less affordable and widens the wealth gap between property owners and renters. This can exacerbate existing economic inequalities. Second, these effects on house prices also have adverse implications for financial stability. Overvalued real estate and relaxing real estate lending standards because of UMP could set the stage for future financial crises (Berg et al., 2022).

In conclusion, while UMP measures may have provided short-term economic stimulus, the long- term costs and risks associated with these policies are substantial and potentially underestimated. The wisdom of relying heavily on such measures is being challenged by the lack of comprehensive research on their unintended consequences, coupled with the evidence of risks to financial stability, resource misallocation and widening economic inequalities.

An obvious but relatively little discussed aspect of UMP is its impact on the quantity of money and inflation. According to the quantity theory of money, inflation rises when money supply growth outpaces economic growth (see Friedman, 1963, for a seminal contribution on the topic). However, the strength of this link between money growth and inflation has faded as major central banks have shifted from money to interest rate targeting and as economies have become more complex (Stock and Watson, 2006). Still, the recent episode of ultralow interest rates and the emergence of unconventional instruments provide a new laboratory for studying this relationship.

The newly created unconventional instruments have caused central banks’ balance sheets to expand substantially, which increased money aggregates. Such increases were observed in a variety of monetary aggregates. It appears puzzling that during the recent period of low inflation, inflation remained subdued despite the elevated money growth, and thus the relationship between the two was virtually non-existent.

Using money growth as a direct predictor of future inflation stopped making sense given the complexity of this relationship and the unique economic circumstances since the GFC. Starting from the 2000s, it has largely disappeared from economic analysis. In the aftermath of the COVID- 19 pandemic and the subsequent economic shocks, however, inflation gained momentum along with elevated money growth. This could indicate that money growth has strong lagged effects on inflation or that it induces changing inflation dynamics.

Recent research by Borio et al. (2023 and 2024) explores possible nonlinearities in the relationship between money growth and inflation. The authors find that the relationship between money growth and inflation seems to depend on the regime. In their papers, they estimate the relationship between inflation and excess money growth in a large sample of countries for the years 1960–2022. They find a one-to-one relationship for a high-inflation regime, but the relationship is less clear when inflation is low. While remaining silent on causality, one can conclude that this relationship should not be dismissed for the conduct of monetary policy. What these studies suggests is that, in high-inflation regimes, it is indeed helpful to include money growth in inflation forecasts, as this improves them significantly. It is important to emphasize, however, that raw money growth itself is generally and not surprisingly a poor basis for further analysis, as it must be adjusted for trends in output growth and changes in the velocity of money (Orphanides and Porter, 2001; Ringwald and Zörner 2023). Amisano and Fagan (2013) find that adjusted money growth can serve as a useful warning indicator of an imminent change of the inflation regime.

Finally, although little attention has been paid to the role of money growth in the UMP period, some channels might be specifically important for the transmission of inflationary effects through money growth to the economy. In particular, the portfolio rebalancing channel, which has been found to be very important for the transmission of UMP (Lane, 2024), may act as an amplifier through monetary aggregates.

Despite varying degrees of evidence, UMP instruments have generally succeeded in achieving their intended monetary policy goals, but not without tradeoffs and unintended costs. These findings underscore the need for informed policymaking that adapts to the evolving economic landscape. Central banks face significant challenges in achieving their inflation targets while preserving financial stability, which points to the need for ongoing evaluation and potential adjustment of monetary policy strategies in the future.

When we draw parallels with historical episodes such as the Great Depression and the Volcker shock, it is clear that bold policy action, coupled with effective communication, played a key role in successfully shaping inflation expectations and improving economic outcomes after a crisis. Indeed, the ECB’s response to the global financial crisis, while substantial, may have lacked the decisiveness and credibility necessary for effective expectation management, possibly due to hesitancy and institutional constraints. Furthermore, history has shown that the effectiveness of monetary policy can be enhanced or hindered by fiscal policy decisions. Better coordination between fiscal and monetary policies, especially during economic crises, may lead to more effective policy interventions while creating problems of its own.

Moreover, as central banks grapple with the financial implications of UMP and seek to maintain credibility and independence, exploring financially sustainable UMP approaches for the future gains in importance. The ECB’s use of UMP, particularly QE and TLTROs, has had a significant impact on its balance sheet and financial sustainability. Strategies such as adjusting the design of the MRR or UMP instruments, active QT, changes to the design of the operational framework and maintaining a high seigniorage base could mitigate losses and ensure the financial sustainability of the central bank. However, central banks face a daunting challenge of balancing such measures while fulfilling their mandate.

Central banks are required to maintain an adaptable monetary policy framework amid an ever- changing economic environment that includes both prolonged periods of low inflation and interest rates and unexpected inflation surges. This implies that central banks should review their policy frameworks regularly to ensure that they remain effective in the face of new challenges. Moreover, central banks should ensure that they have a diverse set of UMP tools ready for use when conventional monetary policy becomes ineffective. Learning from the lessons of the recent and more distant past may help them improve the effectiveness and efficiency of such tools.

Last but certainly not least, a comprehensive rethinking of monetary policy is needed as economic considerations suggest a further fall in the equilibrium interest rate that makes hitting the ELB more likely. The level, direction and dynamics of the equilibrium interest rate are closely linked to factors that are not fully within the realm of economic policy but also not totally outside. Cases in point are productivity – and here most importantly total factor productivity – and demography – and here most importantly labor supply growth. Exploring policy options in this area looks promising (Holzmann et al., 2024).

Amisano, G. and G. Fagan. 2013. Money growth and inflation: A regime switching approach, In: Journal of International Money and Finance 33(C). 118–145.

Berg, T., R. F. H. Haselmann, T. K. Kick and S. Schreiber. 2022. Unintended Consequences of QE: Real Estate Prices and Financial Stability. LawFin Working Paper No. 27.

Borio, C., B. Hofmann and E. Zakrajsek. 2024. Money growth and the post-pandemic inflation surge: updating the evidence. https://www.bis.org/speeches/sp240124.pdf

Friedman, M. and A. J. Schwarz. 1963. A Monetary History of the United States 1867-1960. Princeton: Princeton University Press.

Holzmann, R., A. Breitenfellner, W. Pointner, A. Raggl, R. Sellner, M. Silgoner, A. Stelzer and A. Stiglbauer. 2024. How could a decline in r* be reversed? Productivity, retirement age, and green transition. OENB Occasional Papers No. 9, November.

Lane, P. 2024. Modern monetary analysis, Speech by Philip R. Lane at the Bank of Finland’s

International Monetary Policy Conference. Helsinki. 26 June 2024.

Lenza, M. and J. Slacalek. 2024. How does monetary policy affect income and wealth inequality? Evidence from quantitative easing in the euro area. In: Journal of Applied Econometrics.

Orphanides, A. and R. D. Porter. 2001. Money and inflation: the role of information regarding the determinants of M2 behaviour. In Monetary Analysis: Tools and Applications. 77–97.

Ringwald, L. and T. O. Zörner. 2023. The money-inflation nexus revisited. In: Journal of Empirical Finance 73. 293–333.

Spisso, K., A. Stelzer and T. O. Zörner. 2024. Unconventional Monetary Policy: A Critical Impact Assessment of the Empirical Literature. (November 15, 2024). Available at SSRN: https://ssrn.com/abstract=5021894 or http://dx.doi.org/10.2139/ssrn.5021894

Stock, J. H. and M. W. Watson. 2006. Why has U.S. Inflation Become Harder to Forecast? In: Journal of Money, Credit and Banking 39(1). 3–33.

Weale, M. and T. Wieladek. 2022. Financial effects of QE and conventional monetary policy compared. In: Journal of International Money and Finance 127. 102673.