Central banks in many advanced economies enjoy a high degree of independence, which protects monetary policy decisions from political influence. But how should independent central banks react if pressured to change the course of policy by fiscal policymakers? We examine whether a central bank should design a monetary policy framework that prescribes acting conditionally on how fiscal policy behaves. Our analysis emphasizes how public debt influences the desirability of such a monetary policy framework.

Central banks in many advanced economies enjoy a high degree of institutional independence, which protects monetary policy decisions from political influence. Typically, a government’s fiscal policy is responsible for taxes, debt and deficits, while the central bank’s objectives focus on price stability. This policy arrangement – with its strict separation of assignments – is widely seen as having been instrumental in avoiding monetary policy decisions that could lead to undesirably high levels of inflation.

However, rising levels of public debt have triggered mounting political pressure and government interference with some central banks.2 This tension creates the risk of a shift away from the conventional policy arrangement to one in which monetary policy becomes subordinate to fiscal policy decisions. In Camous and Matveev (2022), we study how this risk affects the design of monetary policy. Specifically, we examine whether a central bank should design a monetary policy framework that prescribes acting conditionally on how fiscal policy behaves. We find that such a framework not only improves economic outcomes by providing appropriate incentives to the fiscal authority but also may enhance the central bank’s credibility to support price stability.

The Eurozone provides a prominent example of a monetary framework that includes provisions conditional on fiscal decisions. The Eurosystem collateral framework – a key mechanism determining the stance of monetary policy – effectively imposes conditions on fiscal sustainability. Indeed, eligibility and refinancing conditions for financial institutions are tied to a credit rating of public debt posted as collateral.3 This design not only protects the central bank balance sheet but also provides appropriate incentives for governments to ensure fiscal sustainability. These considerations are also at the core of the Outright Monetary Transactions (OMT) program of the European Central Bank (ECB), which was introduced in 2012 to preserve monetary policy transmission during the European debt crisis. An important feature of the OMT is the conditionality on participating in the European Stability Mechanism (ESM) program to promote incentives for sound fiscal policies.

The conditionality of the OMT program has triggered debates among economists and policymakers. On the one hand, the associated provision of incentives to treasuries is considered an important element required to preserve a regime, “in which governments retain the responsibility of balancing their budgets over the medium term and the ECB remains free to set the interest rate so as to ensure the maintenance of price stability” (Coeure 2012). In contrast, others argue that by connecting monetary policy to fiscal decisions through conditionality, the central bank increases its exposure to fiscal influence, which could undermine credibility: “One can question how independent monetary policy is when it links its actions in this way to economic and fiscal policy processes. How credible this conditional path remains to be seen” (Weidmann 2012).

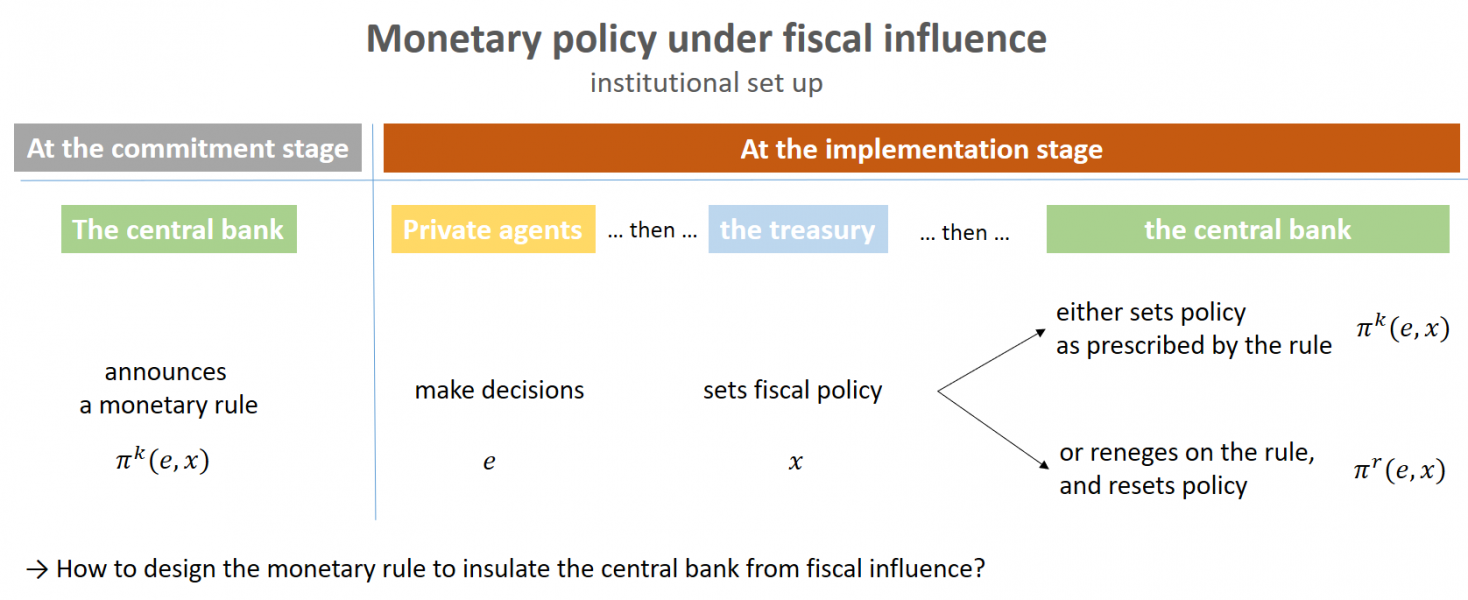

We contribute to this discussion by analyzing a model where a fiscal and a monetary authority make policy decisions independently. The interaction between the two authorities plays out in three consecutive stages that capture discretionary incentives of the fiscal authority to influence the independent conduct of monetary policy. First, at a commitment stage, the central bank announces a monetary rule. Then, at the second stage, the fiscal authority uses discretion to decide on its policy. Finally, at the third stage, the central bank makes a choice between following through on its promise by setting policy as prescribed by the rule or reneging on its promise by revising policy against a cost.

Figure 1.

The magnitude of this cost reflects the degree of commitment of the central bank to pursue a monetary rule against the temptation to revise policy. The central bank’s temptation of deviating from the rule depends on the state of the economy, and particularly on the decision made previously by the fiscal authority. Since the fiscal authority doesn’t commit in advance to any policy, it could set policy strategically to induce the central bank to renounce the monetary rule and pursue inflationary policy. Hence, a monetary rule is credible if the central bank would follow through on its promise in response to every attempt of fiscal influence. The minimum cost that is necessary for the central bank to follow a pre-announced rule is interpreted as a measure of credibility of this rule.

Our analysis contrasts the credibility and welfare implications of two types of rules. Under a standard rule – reflecting the conventional policy assignment – the central bank commits to an inflation target without conditioning it on fiscal decisions. A strategic rule instead prescribes to target inflation conditional on fiscal policy. Provided the fiscal authority follows a sound policy, the strategic rule targets the same inflation as the standard rule. Conditional adjustments of the inflation target are designed to discourage fiscal deviations. Hence, a strategic rule can be designed to achieve an economic outcome that is at least on par with, or even more desirable than that under the standard rule. However, the effect of tailored conditionality on monetary credibility is a priori unclear.

We find that in general the strategic rule may or may not be more credible than the standard rule. On the one hand, credible provision of incentives to the fiscal authority – built into the strategic rule in the form of conditionality – requires a nontrivial degree of monetary commitment. On the other hand, appropriately designed conditionality curbs incentives to renege on the strategic rule in response to fiscal pressure. Our key result then shows that the strategic rule enhances credibility of the central bank relative to the standard rule whenever economic circumstances require a high degree of commitment to implement price stability against the temptation to pursue inflationary policy.

An important factor of fiscal influence over monetary policy is the level of government debt. Through the lens of our analysis, the credibility gain from following a strategic rule with fiscal conditionality increases with the level of outstanding debt (more so when debt is nominal and its maturity is short-term). Furthermore, we show that the aftermath of events with high public spending – such as wars and pandemics – is the time that requires the largest degree of commitment to sustain the strategic rule so as to attain price stability and resist fiscal influence. Finally, an upward adjustment of the inflation target allows the central bank to improve its credibility against fiscal influence.

Overall, our analysis reminds one of the risk of tension between the incentive of the central bank to follow a rule and the discretionary incentive of the fiscal authority to influence the central bank against doing so. Our results show that the risk of fiscal influence warrants its consideration when designing new and evaluating existing monetary policy frameworks.

Binder, C., “Political Pressure on Central Banks,” Journal of Money, Credit and Banking, 2021, 53 (4), 715–744.

Camous, A. and D. Matveev, “The Central Bank Strikes Back! Credibility of Monetary Policy under Fiscal Influence,” Bank of Canada Staff Working Paper 2022-11.

Claeys, G. and I. Gonçalves Raposo, “Is the ECB Collateral Framework Compromising the Safe-Asset Status of Euro-Area Sovereign Bonds?” Bruegel Blog, 2018.

Coeure, B., “Le Rôle des Banques Centrales Après la Crise,” November 2012. Remarks at Les Journées de l’Économie.

Weidmann, J., “Ich muss nicht von allen geliebt werden,” December 2012. Interview with Jens Weidmann, Welt am Sonntag.

The views expressed in this note are solely those of the authors and no responsibility for them should be attributed to the Bank of Canada.

Emails: camous@uni-mannheim.de; matv@bankofcanada.ca

Binder (2021) studies political pressure on monetary authorities using a sample of 118 central banks between 2010 and 2018. The pressure is widespread: 39% of central banks experienced at least one event of pressure. In an average year, there are reports of political pressure on over 10% of the central banks.

See Claeys and Gonçalves Raposo (2018) for details on the collateral framework policies of the Eurosystem.