Central bank digital currency (CBDC) literature is evolving very fast. Central banks embark on a CBDC journey at an increasing rate. Technologies change very fast, and so do policy implications, not only on the payment system side, but also on the monetary and financial stability sides. Yet this strand of the literature is also quite new in its current form, content and areas it tries to research. Hence, there naturally are parts of the topic that need more scrutiny. In this article, we discuss some key under-researched areas, hoping that it will lay some ground for future work to shed more light on them.

One of the most important missing pieces in the CBDC literature is analyzing three-dimensional interlinkages between CBDC benefits, costs and design choices in a structured way. Many papers have underlined some of the trade-offs that central banks may face, but this has not been done in a systematic manner, by incorporating all the trade-offs and their interlinkages in a unifying framework (even if static). For example, if one wants to fight currency substitution with a CBDC, its remuneration should be generous enough. However, this then raises the question of financial disintermediation (in addition to other issues like being incompatible with a high degree of anonymity). The latter risk may be dealt with quantitative limits. However, those kind of caps may be against the aim of fighting currency substitution (i.e. trade-off). Then, if instead of caps we try to head off disintermediation by unlimited supply of central bank liquidity, this, in turn, leads to concerns around collateral policy and a too high state footprint in financial intermediation.

These are just a few examples from a very rich set of linkages between all three benefits, costs and design choices. Understanding these three-dimensional interlinkages is a necessary input for an optimal design of a CBDC based on priorities of each authority. Namely, it will help them identify the necessary design choices that strikes the right balance (for them) among all the benefits and all the costs of a CBDC.

Another part of the literature that may contain some confusion is around a CBDC’s impact on the cost of credit. The literature seems to not have identified a clear mechanism through which a CBDC can affect the degree of competition in the business of extending credit. Some papers have argued that, because CBDCs can increase the degree of competition for money/funding (e.g. CBDC versus commercial bank deposits), they will necessarily squeeze banks profit margins. However, competition for money/funding is a different thing than competition for extending credit. Put differently, it’s one thing for households and businesses to realize that now they have more options in terms of how many forms their existing money can take (e.g. swapping deposits for newly introduced CBDC), but it’s totally different thing whether now there are more options in terms of ways new money is created or not. Households and businesses can’t create new money1 on their own. They can only change the form their existing money takes. In contemporary systems it’s only financial intermediaries that can create new money mostly through the act of lending2 (obviously, lending implies that there should be someone who wants to borrow). That is, if the public wants to create new money, they should make sure they obtain a credit from financial intermediaries. And unless credit can now be extended by (new additional) players at a lower cost (as a result of CBDC introduction), we can’t really argue that the competition will on its own lead to more money creation.

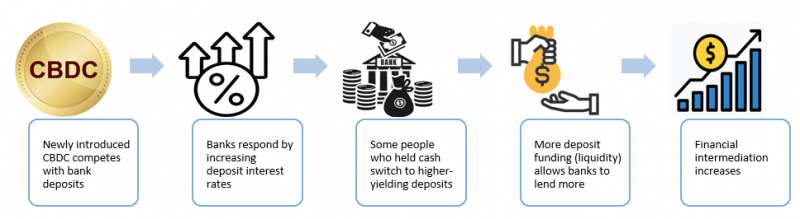

This is important, since not acknowledging this difference may result in erroneous conclusions. For instance, if we believe that a CBDC will increase the degree of competition for credit extension between financial intermediaries (defined broadly, i.e. those that can extend credit and create new purchasing power or money in the process), then this may make us think that a CBDC may actually increase lending. After all when there’s more competition for a product, there should be more of it produced. That is, we may think in this scenario a CBDC may actually increase and not decrease intermediation. Indeed, this is the result that Chiu et al (2019) get. See also Andolfatto (2021), which gets the same result under liquidity-constrained banks. This line of argument stresses that because CBDC may compete with deposits, interest rates on deposits will increase and this will cause higher amount of deposits (because more consumers will want them). Based on this, they conclude that CBDCs may actually increase intermediation. See Figure 1 for the summary of their argument’s causal flow from issuing CBDC to fostering financial intermediation.

Figure 1: (Questionable) Reasoning for CBDC increasing financial intermediation

Source: authors’ construction

But as we discuss below, (under interest rate targeting frameworks as pursued by most central banks) that conclusion is a result of a confusion between competition among the forms existing money can take and competition among intermediaries that can create new money3. Hence, one may question the fourth step in Figure 1. Namely: even if deposits do increase (because of higher deposit interest rates, as a result of CBDC introduction), this just happens at the expense of cash with the total money supply M1 and M24 (in the hands of non-financial agents) c.p. being unchanged. One may argue that now banks will have more cash (liquidity) to “lend-out”. But this isn’t true in interest-rate-targeting frameworks. For more liquidity to be able to generate more lending, it should cause (at least temporarily) lower interest rates on money markets and, by arbitrage, on lending markets. However, today (at least during times when a liquidity crisis doesn’t seem imminent) it’s central banks deliberate decisions (e.g. through Monetary Policy Committee meetings) that can reduce interest rates on money markets. Otherwise, if additional liquidity doesn’t result in lower interest rates, new loan extensions aren’t likely to happen – meaning that new money creation won’t take place5. Hence, more research is needed whether an introduction of a CBDC helps more players become financial intermediaries or not. Or, as noted by CPMI-MC (2018) “[f]urther research on the possible effects on interest rates, the structure of intermediation, financial stability and financial supervision is warranted”. What’s at stake is whether CBDCs would generate financial disintermediation or not.

The implications of CBDCs for central bank collateral policy is also very much under-researched. This is of crucial importance, since collateral policy has direct implications for a risk that central banks fear the most: bank runs. As OMFIF-IBM (2019) puts it, “a CBDC could exacerbate the risk of a system-wide run, though mechanisms exist to prevent this and provide liquidity to a bank in a crisis. For example, there is no upper limit to how much liquidity the central bank can provide, depending on the creditworthiness and collateral of the receiving institution”. Yet, the idea that central banks can limitlessly provide liquidity is counteracted by the very next sentence in that same quote: collateral. Collateral constraint in central banks’ monetary operations means that there, indeed, is an upper limit to how much liquidity central banks can provide6. CMPI-MC (2018) is one of few exceptions that explicitly, yet concisely, discusses the role of collateral policy and possible related changes in financial conditions as a side effect of CBDCs. As we discussed in our more elaborate paper (see Mkhatrishvili and Boonstra, 2022), central banks expanding their collateral bases with risky assets is essentially a form of credit allocation. Given that central banks are less efficient in allocating credit, overall efficiency of the financial system could suffer. On this topic, another exception is the speech by First Deputy Governor of the Bank of France, where it is briefly mentioned that “collateral availability would also need to be checked” (Beau, 2021), when thinking about CBDCs.

Collateral sufficiency issues may be less important if a CBDC take-up is not big enough. According to some calculations of Group of Central Banks (2021) “[assuming] that CBDC take-up is driven by monthly incomes of people over 14 years old, and three macroeconomic metrics (income distribution, population size, and banks’ share of funding from households), suggests that the domestic demand for CBDC could range between 4% and 12% of bank funding, although these figures would be lower if part of the demand reflected substitution from cash”. Demand for central bank liquidity provision coming from this is probably not big enough for central banks not to be able to satisfy with the existing collateral base. However, under some estimates the demand for a CBDC can be as high as 55% of bank funding, which is already too high a number for collateral bases of most (if not all) of central banks. It will be clear that this would result in a drastic decline of these banks’ liquidity ratios (LCR and NSFR). As emphasized in the same report “[w]hile central banks can in principle also be a source of alternative funding, such funding – whether temporary or structural – may need to be provided against lower quality collateral as only that would increase HQLA for banks. The long-term implications of any structural central bank funding as well as the monetary subsidy of funding would need to be carefully considered further” (Group of Central Banks, 2021).

Many central banks think that if CBDCs wouldn’t pay interest, this may boost seigniorage income, because it would substitute at least some part of private money, meaning more assets on central bank balance sheet (that generate interest income) as well as more liabilities in the form of CBDCs (that wouldn’t generate interest expenses). However, the relationship between seigniorage income and the rate of remuneration is a bit more subtle. It’s like an optimal choice of price by a monopolistically competitive firm that internalizes the demand schedule. Namely, if money holders are sensitive to interest they earn on their holdings, then it might be optimal (in terms of seigniorage revenues) to remunerate CBDCs just a little bit to attract more people to hold CBDCs (boosting seigniorage). Clearly, this would have to happen at the expense of either private money (deposits and, possibly, stablecoins) or foreign central bank monies (like the USD). As discussed in Mkhatrishvili and Boonstra (2022) it may be a good thing after all to compete with either stablecoins or foreign monies, but it may be problematic if CBDCs compete with domestic deposits too much. Hence, the topic of interest rate sensitivity (and its updated estimates) should be taken to the forefront when discussing CBDCs and their implications, especially for people that have a tendency to use foreign currencies as a means of payment or store of value.7

Some papers have argued that account-based systems, like bank deposits, are too expensive to make micropayments attractive, while token- or value-based approaches that transmit money peer-to-peer in a decentralized way may be more cost-efficient (e.g. OMFIF-IBM, 2019). However, as underlined by Garratt et al (2020), it’s not just “tokenization” that does the job, since digital currencies can be token-based, while also being account-based at the same time (like Bitcoin8). It seems that, to make it look like an electronic cash, a CBDC needs to be instant, offline and anonymous. But given the conflicting stories from the account versus token literature, this part of the technology could benefit from a bit more research. In other words, while it seems intuitive to make a clear distinction between a token- and account-based approaches, because one seems to require the verification of an object while the other that of a person (see Kahn and Roberds, 2008 or Bech and Garratt, 2017), it’s not as applicable in electronic money as it is with physical one. Physical notes can be stored anywhere, but digital ones, even when represented as token, require a device, wallet or, well, an account (address). All those latter things will be linked to a person (explicitly or implicitly through pseudonyms like in case of Bitcoin). Moreover, a high degree of anonymity is probably at odds with remuneration. Hence, while token-based systems are still different from account-based systems, the distinction is much more blurry than usually appreciated.

Arguing that CBDCs should function as just medium of exchange may be misleading, since the two functions could be intertwined – a currency may be a good medium of exchange precisely because it’s a good store of value or vice-versa. In fact, Mises (1949) argues that “[m]oney is the thing which serves as the generally accepted and commonly used medium of exchange. This is its only function. All the other functions which people ascribe to money are merely particular aspects of its primary and sole function, that of a medium of exchange”. If so, the implications of this would be interesting. Namely, if a CBDC with the property of being “a medium of exchange but not a store of value” is not feasible, what does this imply for the incumbent private banks (e.g. financial disintermediation) is important.

The implications of CBDCs for cross-border capital flows is also under-researched. This will be important for economies that rely heavily on exchange rate movements. One of few exceptions is OMFIF-IBM (2019), which (only briefly) mentions that during stress times, the presence of a (foreign) CBDC could spark capital outflows from more vulnerable countries, depreciating their exchange rates. In other words, the ease of this happening means that capital flows and, hence, exchange rate movements may become more volatile. See also Ferrari et al (2020).

“A question that is hardly ever asked is which effects the introduction of CBDC would have on the institutional position of the central bank” (Boonstra, 2019). In a distant past businesses actually held a payment account with some central banks. Then central banks left this private sphere to focus squarely on the aggregate financial system as it was only natural for them to not compete with private banks they would supervise. However, it is less well studied how CBDC may change this status quo. Namely, the more the central bank becomes involved in the lending process, the larger the risk that it has to give up its position as a supervisor. Even if central banks don’t lend directly to non-financial sector, collateral policy may still result in they affecting credit allocation (Mkhatrishvili and Boonstra, 2022). In addition, as emphasized by Boonstra (2019), if central banks were to become “responsible for continuous monitoring of the payments system to prevent illegal transactions and/or tax evasion… it would have to meet all [AML/CFT] regulations… which agency would monitor the central bank to ensure it was doing this job adequately?”. Alternatively, understanding how a CBDC system can be designed so that it’s still mostly private players that do these AML/CFT tasks is important.

To conclude, CBDC involves a lot of trade-offs. Prioritizing some objectives of CBDC necessarily involves making specific design choices, which, in turn, rule out a possibility of achieving other objectives. These type of interlinkages are yet to be modeled in a systematic manner. That is one key missing piece in the CBDC literature. Studying CBDC’s impact on financial intermediation and private money creation deserves more attention too, in addition to topics underlined above. Given limited time resources and a fast-evolving nature of the field, understanding where specifically we lack sufficient knowledge of an issue is sometimes as important as understanding what we do know about it. We hope this article spurs more research on the facets of CBDC outlined here.

Andolfatto, D., 2021. Assessing the impact of central bank digital currency on private banks. The Economic Journal, 131(634), pp.525-540.

Beau, D., 2021. New technologies and monetary policy frameworks. Opening remarks by Mr Denis Beau, First Deputy Governor of the Bank of France, at the IMF / RBWC Seminar on “New Technologies, Financial Inclusion and Monetary Policy in CCA Countries”, Session 3: New technologies and monetary policy frameworks, 12 July 2021.

Bech, M.L. and Garratt, R., 2017. Central bank cryptocurrencies. BIS Quarterly Review September.

Boonstra, W., 2019. Central bank digital currency: Institutional issues. SUERF Policy Note Issue No 101, September 2019.

Chiu, J., Davoodalhosseini, M., Jiang, J. and Zhu, Y., 2020. Bank Market Power and Central Bank Digital Currency: Theory and Quantitative Assessment. Staff Working Paper No. 2019-20. Bank of Canada.

CPMI-MC, 2018. Central bank digital currencies. March. Committee on Payments and Market Infrastructures and Markets Committee.

Ferrari, M.M., Mehl, A. and Stracca, L., 2020. Central bank digital currency in an open economy.

Garratt, R., Lee, M., Malone, B., and Martin, A., 2020. Token- or Account-Based? A Digital Currency Can

Be Both. Federal Reserve Bank of New York Liberty Street Economics, August 12, 2020.

Group of Central Banks, 2021. Central bank digital currencies: financial stability implications. Report no. 4. September 2021. Bank for International Settlements.

Kahn, C.M. and Roberds, W., 2009. Why pay? An introduction to payments economics. Journal of Financial Intermediation, 18(1), pp.1-23.

Mises, L., 1949. Human Action.

Mkhatrishvili, S. and Boonstra, W. 2022. What we know on Central Bank Digital Currencies (so far). (No. 01/2022). National Bank of Georgia

OMFIF-IBM, 2019. Retail CBDCs: The next payments frontier. Report by IBM Blockchain World Wire and OMFIF.

For instance, even if they decide to increase deposits (meant to increase total money supply), they can only do so at the expense of a decrease in other forms of money, e.g. cash (hence, rendering total money supply unchanged). Total money supply increases only after financial intermediaries decide (and borrowers have demand) to extend new credit. Note that here we consider money supply in the hands of non-financial agents.

Mostly, because they can also do this by buying other assets (other than loans, e.g. office buildings, etc.) or by shrinking their equity.

One can argue that if CBDCs reduce costs for banks (e.g. costs of AML/CFT regulation), then it might indeed result in more intermediation. But that’s a cost-efficiency, not competition, argument.

Under the assumption that CBDC will be part of both M0 and M1.

Once again, unless new entrants appear who can extend credit, or new entrants appear on the demand side.

Of course, governments issuing new bonds or guaranteeing a private debt, could relax the collateral constraint on central bank operations, but those are decisions beyond the central banks’ remit.

Also worth mentioning here, if a central bank is to make substantial costs for AML/CFT duties, these costs may soon eat away that extra seigniorage.

As per Garratt et al (2020) , Bitcoin address is an account, while an UTXO is a token.