Whilst progress has been made on understanding climate-related financial risks (CRFR), less attention has been paid to financial risks related to the loss of nature and biodiversity. This policy note reviews the emerging evidence and policy action on these nature-related financial risks (NRFR). As well as facing financial risks from environmental threats, financial actors must contend with the negative impacts facilitated by their financing activities. A key challenge faced by financial institutions and policymakers is that frameworks for understanding NRFR are far less advanced compared to progress made for CRFR. The dynamics and drivers of NRFR are also more complex to estimate quantitatively, whilst some nature-related threats are emerging within a shorter time frame than CRFR. Financial authorities may need to consider interventions on a precautionary basis, justified by judgements and discretion rather than quantitative data.

In recent years, financial institutions and policymakers have made great strides in understanding how climate change interacts with the financial system. However, far less attention has been paid to the emergence of financial risks from environmental threats beyond climate change, particularly those related to the loss of nature and biodiversity. The Covid-19 pandemic has demonstrated the hugely important interaction between nature, the economy and the financial system. All economic activity is ultimately dependent on the services provided to us by nature, including food, water, climate and disease regulation, and oxygen production. Yet the stock of natural capital per person has fallen by nearly 40% since 1992, current extinction rates are between 100 and 1000 times higher than the baseline rate, and many critical ecosystems are close to ‘tipping points’ beyond which catastrophic outcomes become unavoidable and irreversible [1]. For example, some parts of the Amazon ecosystem are on the verge of switching from rainforest to savannah [2]. The economic repercussions of nature loss are already materialising within time horizons relevant to policymakers and business leaders.

By financing the real economy, financial institutions face potentially significant exposures to both nature loss and to actions intended to mitigate those losses: nature-related financial risks (NRFR). Financing activities are vulnerable to both physical risks, resulting from acute or chronic disruptions to business inputs, operating environments or consumer demand triggered by nature loss, and transition risks, resulting from shifts in policy, regulation, technology, trade, or consumer preferences that may come as part of a broader economic transition to mitigate nature loss. The interaction and propagation of such physical and transition risks may give rise to systemic risks [3]. Together these risks comprise channels of dependency between nature and the real economy which ultimately feed through to the financial system.

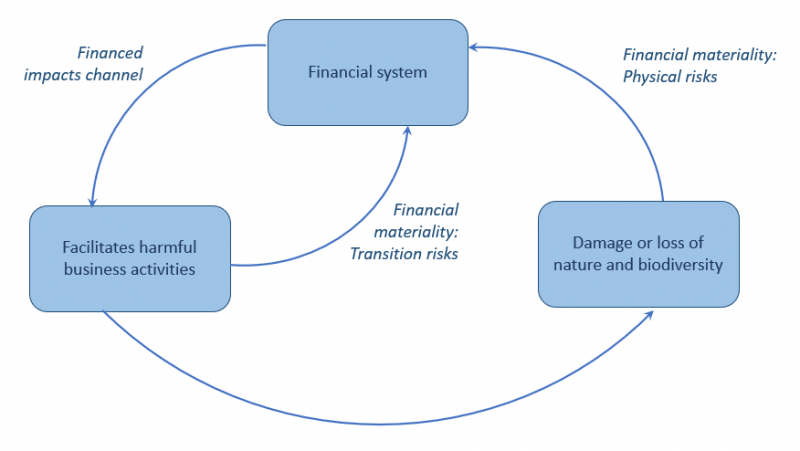

Yet, the emergence of NRFR is not a one-way street; dynamics of double materiality are also relevant [4]. As well as facing financial materiality from environmental threats on their own balance sheets, financial institutions must also contend with the environmental impacts facilitated by their financing activities. As an enabler of economic activity, the way capital is allocated and governed can determine the extent of human demands on nature. According to the influential Dasgupta Review on the Economics of Biodiversity, “existing private financial flows that are adversely affecting the biosphere outstrip those that are enhancing natural assets, and there is a need to identify and reduce financial flows that directly harm and deplete natural assets” (p.474) [1]. The continued financing of harmful activities ultimately contributes to the emergence of further financial materiality through a feedback loop: exposure to both transition risks and physical risks that arise from the facilitation of negative environmental impacts (Figure 1). Understanding and managing channels of financial impact upon nature is hence also critical to financial institutions and policymakers.

Figure 1. Financing harmful impacts causes financial materiality through feedback loops

The facilitation of harmful activities gives rise to financial materiality through exposure to transition risk factors, but also to physical risks caused by the harmful activity. One firm’s damage to nature can lead to financial losses for other firms who depend upon that nature.

The existence of NRFR is supported by some emerging empirical evidence. On the dependencies side, the Dutch central bank (DNB) has estimated that 36% of Dutch financial institutions’ portfolios are highly or very highly dependent upon at least one ecosystem service [5]. On the impacts side, investigative data analysis by civil society organisations has found that the world’s largest banks provided more than $2.6 trillion of financing linked to the destruction of ecosystems in 2019, more than the GDP of Canada [6]. Further analysis into the scale and breadth of NRFR is complicated by data gaps, methodological challenges, and a widespread lack of understanding about financial materiality related to nature loss. Recent initiatives such as the Taskforce for Nature-related Financial Disclosures and the Network for Greening the Financial System (NGFS)-INSPIRE Joint Study Group on Biodiversity and Financial Stability aim to fill these gaps [3; 7].

A key challenge that financial institutions and policymakers face is that the conceptual framework for measuring and understanding NRFR is far less advanced compared to progress made for climate-related financial risk (CRFR). In addition, the dynamics and drivers of NRFR are even more complex to estimate quantitatively in financial terms.

Challenges in estimating nature-related physical risks

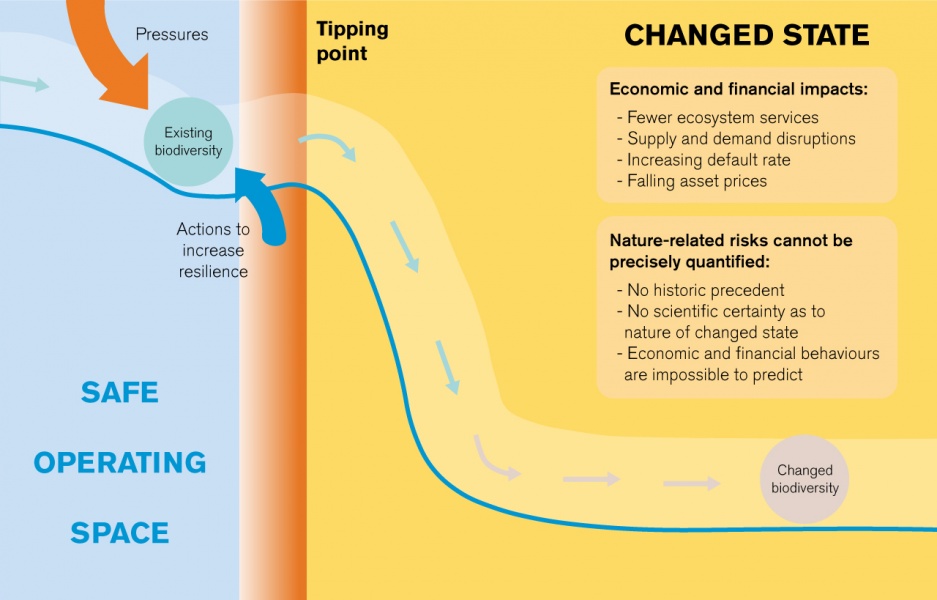

The estimation of climate-related financial risks benefits from established indicators for measuring drivers of change (the tonnes of CO2 equivalent metric) and overall outcomes (global mean average temperature change). By contrast, nature loss and biodiversity loss encompass multiple distinct phenomena (e.g., loss of soil fertility, pollinator declines, eutrophication) which are the result of multiple anthropogenic drivers (e.g., intensive agriculture, chemical pollution, habitat loss) acting upon various scales (from local ecosystems to planetary processes). Estimating both impact drivers and progress outcomes hence requires multiple metrics, often with location-specific data, and there is no consensus yet on the most comprehensive and relevant set of indicators [8].2 It is encouraging that a number of initiatives are underway that aim to estimate nature-related dependencies and impacts in financial terms [10], although the various frameworks are highly heterogenous and none are yet widely established. Risk assessment is further complicated by radical uncertainty: transmission channels are interconnected and governed by complex dynamics, involving non-linear cause-and-effect, emergent phenomena, rapid regime shifts, and unpredictable tipping points (Figure 2) [1]. Quantitative methodologies aiming to estimate NRFR in financial terms (such as scenario analysis and stress testing) may not be able to easily or fully account for these effects, and may fail to capture key tail risks [11].

Figure 2. Nature-related financial risks will increase as anthropogenic pressures push biodiversity loss towards and beyond an irreversible tipping point

Challenges in estimating nature-related transition risks

In the absence of reliable quantitative estimates with which to adjust prices, policy action has the potential to create signals that incentivise financial actors to reallocate capital. Yet nature-related policy lags far behind the climate agenda, which itself is hampered by slow progress. Unlike the 2015 Paris Agreement, which sets the ambition to limit global average temperature rises to well below 2°C, there are currently no internationally agreed headline targets for resolving nature loss,3 although the COP15 biodiversity conference in Kunming, China in October 2021 aspires to change that. For financial institutions and policymakers, estimating the transition risks associated with policy solutions is complicated by the fact that there is no obvious ‘carbon price equivalent’ for nature loss. Unlike CO2 emissions, biodiversity is not a fungible concept – gains in one location cannot fully offset losses elsewhere via a ‘compensation scheme’ – making it an inherently less manageable concept for financial analysis [12]. Emerging policy initiatives, such as the EU’s Biodiversity Strategy for 2030, instead demonstrate that reversing nature loss will require a mixture of regulatory, policy, and institutional reforms. The Dasgupta Review has also noted that quantity restrictions (i.e., regulation) will be far more effective than pricing mechanisms in preventing nature-related tipping points in the face of deep uncertainty [1]. These sorts of policy tools, which are unavoidably deeply political, will vary in their implementation across sectors and jurisdictions. This raises important questions, therefore, about the feasibility of selecting meaningful assumptions in the design of transition pathways for scenario-based financial risk modelling.

Central banks and financial supervisors increasingly recognise that the loss of nature and biodiversity present risks that intersect with their mandates to protect price and financial stability. The insights above present several implications for financial policymakers expanding their agenda on these issues.

Firstly, financial authorities face a trade-off between knowledge-building and policy action. On the one hand, considerable data gaps and lack of understanding on the extent of NRFR means policymakers must build up a clearer picture of risks in order to act on them. On the other hand, there is the reality that NRFR are emerging within a much shorter time frame than some longer-term climate risks. Complex reporting, accounting, and risk modelling methodologies may take years to become fully operational, during which time some nature-related threats may become financially material, potentially at a systemic level. A key question that financial policymakers must ask is: what constitutes sufficient information to justify policy intervention? And how much time do we realistically have left to dedicate to just information-building exercises?

Secondly, and relatedly, supervisors and regulators should be aware of the inherent limitations of quantitative tools in dealing with radical uncertainty. It may not be feasible for biodiversity risk reporting and disclosure initiatives to ever obtain sufficiently good data, and scenario-based stress testing cannot be relied upon to capture all tail risks. The substantial ‘unknown unknowns’ involved mean that the relevant information is likely to never be known to financial markets until far too late. Such limitations mean that whilst quantitative approaches will be important in exploring NRFR, they alone will not be sufficient to manage NRFR.

In their exploratory assessments, supervisors and regulators might consider how to complement quantitative exercises with qualitative approaches that can better proxy for increased complexity and uncertainty. Lessons can be drawn from macroprudential policymaking here, where quite simple indicators are routinely used to assess systemic exposures such as credit to GDP ratios, and bank size and interconnectedness. Following the logic of double materiality, financial authorities should also account for harmful financing activities – those that are directly contributing to accelerated biodiversity loss – to get a fuller picture of risks to the financial system. A first step might be to focus on deforestation and unsustainable land use as financed activities linked to the worst drivers of both climate change and biodiversity loss.

In terms of managing risks, there may be gains from policy interventions taken in advance of having full certainty about the extent of the risks in question. The most effective way to safeguard risks to the financial system may require interventions to be implemented on a precautionary basis, justified by judgements and discretion rather than concrete data [13]. Given that radical uncertainty impedes the full internalisation of NRFR into market prices, financial policy can and should be used – in coordination with broader government policy – to encourage a controlled regime shift towards more sustainable capital allocation. To operationalise such an approach, financial authorities might explore how biodiversity factors aiming to actively discourage the financing of harmful activities could be incorporated into microprudential supervision, macroprudential frameworks and operations, and the management of monetary policy portfolios. Such interventions would complement and build upon efforts already underway to incorporate climate-related factors into central bank and supervisory toolkits. One example of an existing biodiversity-related intervention is Resolution 3545, implemented by the Brazilian central bank in 2008, which restricted access to subsidized rural credit to firms compliant with environmental regulations. The policy resulted in a material reduction in deforestation between 2003 and 2011, according to econometric estimations [14]. In addition to managing the build-up of NRFR within the financial system, such interventions may also send a strong signal to financial market actors on the need to account for NRFR.

It is increasingly acknowledged by senior central bankers that the principle of ‘market neutrality’ – which aims to minimize the influence of financial authorities on any economic sector – may have to be reconsidered where there is clear evidence of significant market failures. Given the challenges facing financial markets in pricing in NRFR, there is a clear need for financial authorities to take a more proactive, market-shaping approach to effectively manage risks to both price and financial stability. A more market-shaping role for central banks and supervisors vis-a -vis the financial system does not have to infringe upon central bank independence. Indeed, many central banks, including the ECB and the Bank of England, already have secondary mandates to support the broader goals of economic policy, which includes the needs of the ecological transition. Financial authorities also already utilise a number of sector-targeting tools, to which adjustments could be made to account for nature-related risk factors [15]. However, as has recently been argued for the net-zero transition, some degree of policy coordination with broader government strategy may be the most effective approach to minimise risks to the financial system [16]. Central banks cannot prevent nature loss without interventions from the government. However, it is also true that government policy changes are unlikely to be successful if the financial system remains blind to nature-based risks. As governments begin to formulate their biodiversity strategies in the run-up to the COP15 Biodiversity Conference in Kunming in October 2021, central banks should ensure their environmental risk-related research efforts reflect upon how to design financial policy to manage NRFR.

[1] Dasgupta, P. The Economics of Biodiversity: The Dasgupta Review.

https://assets.publishing.service.gov.uk/government/uploads/system/uploads/attachment_data/file/962785/The_Economics_of_Biodiversity_The_Dasgupta_Review_Full_Report.pdf (2021).

[2] Staal, A. et al. Hysteresis of tropical forests in the 21st century. Nature Communications 11, 4978 (2020).

[3] Vivid Economics & Global Canopy. The Case for a Task Force on Nature-related Financial Disclosures. https://www.globalcanopy.org/publications/the-case-for-a-tnfd (2020).

[4] European Commission. Guidelines on reporting climate-related information. https://ec.europa.eu/finance/docs/policy/190618-climate-related-information-reporting-guidelines_en.pdf (2019).

[5] DNB. Indebted to nature Exploring biodiversity risks for the Dutch financial sector. https://www.dnb.nl/media/4c3fqawd/indebted-to-nature.pdf (2020).

[6] Portfolio Earth. Bankrolling Extinction: The Banking Sector’s Role in the Global Biodiversity Crisis. https://portfolio.earth/wp-content/uploads/2021/01/Bankrolling-Extinction-Report.pdf (2020).

[7] Robins, N. & Jun, M. Exploring the links between biodiversity loss and financial stability. Grantham Research Institute on Climate Change and the Environment, London School of Economics https://www.lse.ac.uk/granthaminstitute/news/exploring-the-links-between-biodiversity-loss-and-financial-stability/ (2021).

[8] Mace, G. M. et al. Aiming higher to bend the curve of biodiversity loss. Nature Sustainability 1, 448–451 (2018).

[9] Schipper, A. M. et al. Projecting terrestrial biodiversity intactness with GLOBIO 4. Global Change Biology 26, 760–771 (2020).

[10] Finance for Biodiversity. Finance and Biodiversity: Overview of initiatives for financial institutions. https://www.financeforbiodiversity.org/wp-content/uploads/Finance_and_Biodiversity_Overview_of_Initiatives_April2021.pdf (2021).

[11] Kedward, K., Ryan-Collins, J. & Chenet, H. Managing nature-related financial risks: a precautionary policy approach for central banks and financial supervisors. https://www.ucl.ac.uk/bartlett/public-purpose/publications/2020/aug/managing-nature-related-financial-risks (2020).

[12] Chenet, H. Planetary Health and the Global Financial System. https://www.planetaryhealth.ox.ac.uk/wp-content/uploads/sites/7/2019/10/Planetary-Health-and-the-Financial-System-for-web.pdf (2019).

[13] Chenet, H., Ryan-Collins, J. & van Lerven, F. Finance, climate-change and radical uncertainty: Towards a precautionary approach to financial policy. Ecological Economics 183, 106957 (2021).

[14] Assunção, J., Gandour, C., Rocha, R. & Rocha, R. The Effect of Rural Credit on Deforestation: Evidence from the Brazilian Amazon. The Economic Journal 130, 290–330 (2020).

[15] Colesanti Senni, C. & Monnin, P. Central Bank Market Neutrality is a Myth. Council on Economic Policies Blog https://www.cepweb.org/central-bank-market-neutrality-is-a-myth/ (2020).

[16] Robins, N., Dikau, S. & Volz, U. Net-zero central banking: A new phase in greening the financial system. Grantham Research Institute on Climate Change and the Environment, London School of Economics (2021).

Katie Kedward, Policy Fellow in Sustainable Finance, UCL Institute for Innovation and Public Purpose, Corresponding author: k.kedward@ucl.ac.uk; Josh Ryan-Collins, Head of Finance and Macroeconomics, Senior Research Fellow, UCL Institute for Innovation and Public Purpose; Hugues Chenet, Honorary Senior Research Fellow, UCL Institute for Sustainable Resources.

Mean Species Abundance (MSA) is a measure of local biodiversity intactness that has been used within scenario-based biodiversity modelling to estimate the impacts of anthropogenic pressures – although one such analysis has also noted that MSA is not a comprehensive metric; complementary analysis with indicators accounting for spatial diversity and turnover are also needed [9].

With the exception of the Aichi biodiversity targets which were non-binding and which were all missed by the deadline of 2020.