The views expressed in this Policy Brief represent only our own and should therefore not be reported as representing the views of the World Bank, the International Monetary Fund, its Executive Board, or IMF management.

Abstract

Monetary policy plays a key role in influencing economic activity in the short run, primarily by affecting the availability and cost of credit in the real economy. While traditional transmission channels, such as the bank lending channel, are well-documented, our research uncovers a new mechanism in the monetary policy transmission to nonfinancial corporates: the zombie lending channel. We find that unviable and unproductive “zombie” firms are less affected by contractionary monetary policy than healthier firms due to a more muted tightening in credit conditions. This occurs because lenders, seeking to avoid recognizing losses, extend additional credit to zombies through a practice known as “evergreening”. As a result, tighter monetary policy may fail to improve resource allocation in an economy burdened by zombie firms. Strengthening banks’ balance sheets and curbing risky lending practices are essential to mitigating the adverse effects of zombie lending.

The existence of unproductive and unviable zombie firms is not a new phenomenon: it dates back to Japan’s lost decade in the 1980/90s, a time when weak supervision and low bank capital drove banks to lend to zombie firms, potentially amplifying the contraction in economic activity. What we highlight is the increasing trend worldwide in the share of zombie firms, especially since the Global Financial Crisis (GFC), possibly motivated by a prolonged period of low interest rates, ample liquidity, and search for yield behavior (Banerjee and Hofmann 2022, Albuquerque and Iyer 2024). The presence of zombie firms may lead to important congestion effects on healthy firms that compete in the same sector as zombie firms. By not exiting the market, the survival of zombie firms reduces the profits of productive and healthy firms, and thus their investment and growth opportunities. The survival of zombie firms lead to reduced productivity, investment, and employment in an economy (Caballero et al., 2008; McGowan et al., 2018; Acharya et al., 2019; Banerjee and Hofmann, 2022; Albuquerque and Iyer, 2024).

The increased zombification of the nonfinancial sector raises an important question in the context of higher global interest rates—despite recent policy rate cuts by major central banks, interest rates are expected to remain substantially above pre-pandemic levels. In our research, we investigate if tighter financial conditions allow a better allocation of resources towards more profitable and viable firms (Albuquerque and Mao, 2024). Specifically, we analyze how zombie firms’ financial performance responds differently to contractionary monetary policy shocks compared to healthier firms. Our findings show that zombie firms are less sensitive to monetary tightening, as evergreening incentives lead banks to offer more favorable credit conditions to zombie firms relative to healthier firms. This raises concerns that productive and viable firms may bear the brunt of tighter financial conditions, especially in economies where regulatory oversight and bank supervision play a limited role in preventing zombie creation.

We follow Albuquerque and Iyer (2024), and identify zombie firms with indicators that capture financial distress and lack of profitability. We apply the following criteria on balance sheet data from S&P Compustat on nonfinancial listed firms for 47 countries (23 EMs and 24 AEs) over 2000-2019: (i) interest coverage ratio (ICR) below one, (ii) leverage ratio above the median firm in the same industry and country, and (iii) negative real sales growth. These three conditions need to be observed for at least two consecutive years. In addition, we allow zombie firms to exit the zombie status only if at least one of the indicators is reversed for two years in a row. The two-year horizon in the entry to, and exit from, zombie status minimizes misclassification from cyclical fluctuations.

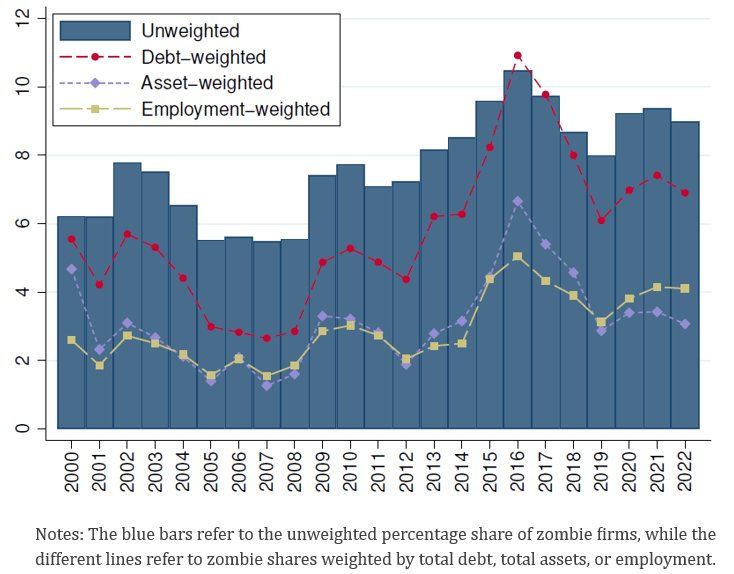

Figure 1 shows an upward trend in the share of listed zombie firms over the last 20 years, particularly since the GFC. After the decline recorded from 2016 to 2019, the share of zombie firms picked up again since the Covid-19 pandemic, presumably driven by the unprecedented policy support and easy financing conditions. We find that zombie shares vary widely across countries and industries, with a greater prevalence in nontradable industries, such as in energy, real estate, materials, information technology, and consumer discretionary.

Figure 1. World share of listed zombie firms

We identify exogenous variation in monetary policy conditions in our large sample of countries by resorting to US monetary policy shocks. Our choice is motivated by the well-established view that US monetary policy drives the global financial cycle, and is arguably exogenous to changes in economic conditions in the rest of the world (Rey 2013, Bruno and Shin 2015). We trace out the differential effects of monetary policy shocks on nonfinancial firms through a panel data Local Projection Instrumental Variable (LP-IV) setup. We add a rich set of control variables and fixed effects that allow us to compare the differential response of zombie firms relative to nonzombies operating in the same country and industry.

We conjecture that monetary policy may transmit differentially to zombie firms above and beyond the traditional bank lending channel of monetary policy. In particular, it is an open question whether banks’ incentives to evergreen loans to zombie firms may be stronger when interest rates increase, as banks may internalize a higher probability of zombie firms filing for bankruptcy when the cost of funding goes up. It is then plausible that banks may decide to extend the original loan to zombies to avoid the realization of losses; this implies that zombie firms would be less affected by a contractionary monetary policy shock—which we call the zombie lending channel. This incentive may be stronger for weaker banks who may go out of business if their capital is not sufficient to absorb the losses from zombie lending.

Figure 2 shows that zombie firms’ responses of investment and employment are positive and statistically significant, suggesting that zombie firms’ financial performance is less affected by higher interest rates relative to nonzombies. Focusing on the peak effects reached after roughly 2 years, the responses of zombies’ investment and employment are around 1.5 p.p. smaller relative to nonzombies. These are economically important results: a monetary policy shock calibrated to increase bond yields by 100 bps shrinks the investment growth differential between zombie firms and nonzombies by over 50%.

Figure 2. Differential effect of monetary policy shocks on zombies versus nonzombies: investment and employment

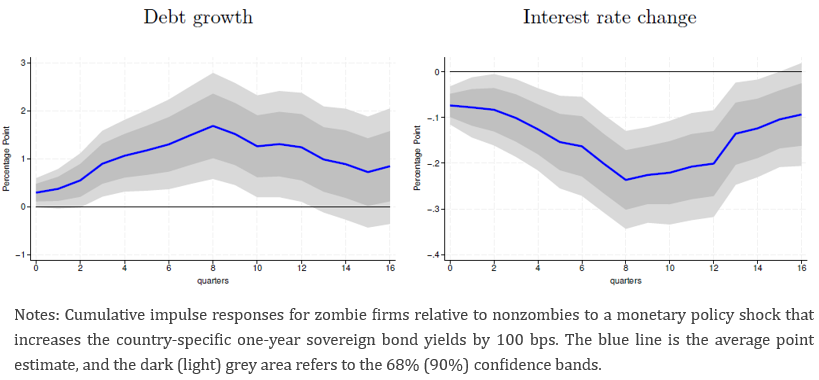

Figure 3 sheds some more light on the previous finding that zombie firms’ financial performance is less affected by interest rates increases. We find that credit standards tighten by less for zombie firms relative to other firms following a monetary policy shock: we find a statistically significant and positive effect on debt growth, and a negative effect on the interest rate of zombie firms relative to nonzombies. Overall, the fact that zombie firms get more favorable credit conditions when financial conditions tighten provides supporting evidence for the conjecture that lenders engage in evergreening practices by shifting lending to zombies—the zombie lending channel of monetary policy. Against this background, we interpret this as evidence that zombie firms are less responsive to monetary policy because of lenders’ zombie lending.

In the paper, we build on the theoretical model from Faria-e-Castro et al. (2024) to further rationalize our empirical findings. In this model, we show that when interest rates increase, lenders have incentives to offer better credit conditions to zombie firms relative to other firms to prevent them from defaulting. While evergreening motives may be stronger for weakly capitalized banks—who may have less room to absorb the losses in case a zombie firm defaults—our model suggests that zombie lending takes place irrespective of concerns about bank capital.

We also show in the paper that that our main result is robust to controlling for lender supply and borrower demand effects. Specifically, using syndicated loan data, we find that lenders extend more new loans to zombie firms relative to other firms following a contractionary monetary policy shock. Zombie lending is driven by undercapitalized banks, confirming the theoretical prediction that weaker capital leads banks to engage more in evergreening practices to avoid breaching regulatory capital limits.

Our results are not sensitive to using alternative zombie definitions, including when allowing for subsidized interest rates (Caballero et al. 2008, Acharya et al. 2019, 2024); using alternative country-specific monetary policy shocks; or using longer-dated bond yields as the monetary policy indicator. The robustness of our results thus reinforces our main narrative that lenders’ zombie lending practices affect the monetary policy transmission to nonfinancial firms.

Figure 3. Differential effect of monetary policy shocks on zombies versus nonzombies: credit conditions

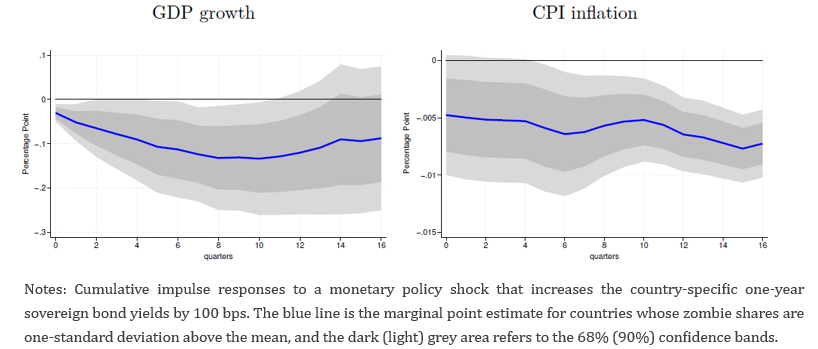

It is only natural to expect that shifting lending to zombie firms when interest rates increase may negatively affect overall economic growth. While we have seen that zombie firms’ financial performance is less affected by a tightening in monetary policy, the fact that zombie firms are less productive suggests that overall economic growth would be reduced in countries with a higher prevalence of zombie firms. To that end, we run regressions at the country-level to test how economic activity in countries with higher zombie share typically evolves after monetary policy shocks. We find that countries with higher zombie shares tend to experience lower economic growth and lower inflation following contractionary monetary policy shocks (Figure 4). This is suggestive evidence that the misallocation of capital and credit towards zombie firms during periods of interest rate increases has important detrimental aggregate effects on the real economy. The disinflationary effect we estimate in countries with higher zombie shares is consistent with the notion that excess supply puts downward pressure on prices (Acharya et al. 2024).

Figure 4. Effect of monetary policy shocks on aggregate outcomes for countries with higher zombie shares

Our research has shown that zombie firms experience a less pronounced impact from contractionary monetary policy compared to their healthier counterparts. This apparent counterintuitive result stems from a more muted tightening in credit conditions for zombie firms. We rationalize this through lenders’ evergreening motives—as interest rates increase, lenders extend credit to struggling firms to prevent defaults, which would otherwise force them to recognize losses and weaken their balance sheets.

Zombie lending behavior has important implications for monetary policy effectiveness and financial stability. If contractionary policy unintentionally leads banks to prop up unproductive firms, it could lead to resource misallocation, hinder economic dynamism, and suppress productivity growth by crowding out investment in more efficient enterprises. In this context, we argue that monetary policy alone is not the right tool to address zombification. Rather, mitigating zombie lending requires policies that strengthen banks’ balance sheets, reduce incentives for risky lending through stricter prudential supervision, and establish legal frameworks for the efficient resolution of weak firms.

Acharya, V. V., Crosignani, M., Eisert, T. and Eufinger, C. (2024), “Zombie Credit and (Dis)Inflation: Evidence from Europe”, The Journal of Finance 79(3), 1883–1929.

Acharya, V. V., T. Eisert, C. Eufinger, and C. Hirsch (2019), “Whatever It Takes: The Real Effects of Unconventional Monetary Policy”, Review of Financial Studies 32 (9), 3366–3411.

Albuquerque, B. and Iyer, R. (2024), “The Rise of the Walking Dead: Zombie Firms Around the World”, Journal of International Economics 136, 103606.

Albuquerque, B. and Mao, C. (2024), “The Zombie Lending Channel of Monetary Policy”, Available at https://ssrn.com/abstract= 4572534, SSRN.

Banerjee, R. and B. Hofmann (2022), “Corporate zombies: anatomy and life cycle”, Economic Policy 37 (112), 757–803.

Bruno, V. and Shin, H. S. (2015), “Capital flows and the risk-taking channel of monetary policy”, Journal of Monetary Economics 71, 119–132.

Caballero, R. J., T. Hoshi, and A. K. Kashyap (2008), “Zombie Lending and Depressed Restructuring in Japan”, American Economic Review 98 (5), 1943–77.

Faria-e-Castro, M., Paul, P. and Sanchez, J. M. (2024), “Evergreening”, Journal of Financial Economics 153, 103778.

McGowan, M. A., D. Andrews, and V. Millot (2018), “The walking dead? Zombie firms and productivity performance in OECD countries”, Economic Policy 33 (96), 685–736.

Rey, H. (2013), “Dilemma not trilemma: the global cycle and monetary policy independence”, Proceedings – Economic Policy Symposium – Jackson Hole.