This policy brief is the short version in English of a paper forthcoming in Revue française d’économie, titled “Dénouer les achats d’actifs – Pourquoi et comment”. The views expressed are those of the author and do not commit the University of Orléans. The author would like to thank Françoise Drumetz, Pierre Jaillet, and Nicolas de Sèze for their remarks and remains solely responsible for any error.

Abstract

Central banks have lengthened their balance sheets as a result of large scale asset purchases. I first briefly describe how monetary policy is implemented, then explain why keeping large central banks’ balance sheets has not delivered the expected benefits that had been advocated. I finally outline an approach to restore lean central banks’ balance sheets without destabilising financial markets.

The balance sheets of most central have ballooned following their large scale asset purchases (LSAPs, also called “Quantitative Easing” – QE – in the media) in the wake of the Great Financial Crisis (GFC) and of the pandemic crisis. However, reversing this sort of monetary policy easing, i.e. “unwinding”, was not prioritised when inflationary pressures resurfaced. Instead, central banks first raised interest rates and kept large balance sheets, making this feature part of a “New Normal” (Pfister and Sahuc, 2020). Currently, central banks’ portfolios have dwindled from their peaks. However, no major central bank, and specifically neither the Federal Reserve (FED), nor the European Central Bank (ECB), has announced an objective to “unwind”.1 I first briefly remind some basics of monetary policy implementation, then explain the reasons for unwinding and finally outline an approach to do it.

Monetary policy is implemented by creating and destroying reserves (i.e., deposits of the banks with the central bank). The sum of reserves is referred to as “banking liquidity”, or more simply “liquidity”. Banks can recycle reserves in the interbank market. Reserves are created by the central bank by buying assets (essentially, foreign currency and securities) and by lending to banks against collateral, labelled “refinancing”. They are destroyed when the assets held by the central bank are redeemed or sold, or when the loans to the banks mature. The demand for reserves can be reinforced by a reserve requirement system, with interest paid on required reserves to avoid financial repression.

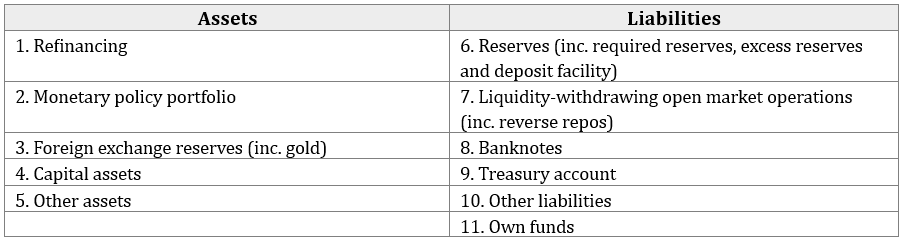

A central bank’s simplified balance sheet helps illustrate these mechanisms, keeping in mind that a balance sheet is always balanced (i.e. assets equal liabilities).

Simplified central bank’s balance sheet

One can neglect items 3, because the central bank usually does not intervene in the foreign exchange or gold markets, as well as items 4, 5, 9, 10 and 11, because they are negligible and/or shocks on them are easily neutralised (“sterilised” in the jargon of central bankers) through open market operations (items 1 and 7), so that they do not influence the volume of reserves. Consequently, there are two possibilities:

By unwinding, the central bank moves back from an ARS to an SRS2.

Not only did the expected benefits of an ARS not materialise, but ARSs have costs.

Expected benefits

An ARS can be expected to bring benefits in implementing both monetary policy and financial stability policies (see, e.g., Board of Governors, 2019, Borio, 2023, Hauser, 2023, Schnabel, 2023).

Monetary policy

In comparison with an SRS, an ARS can be expected to present three main advantages:

However, as exemplified by the ECB and the FED, central banks have maintained open market operations, which makes their operational frameworks less readable. Furthermore, in contrast with the essence of an ARS, open market operations have repeatedly been used not just to withdraw but also to provide liquidity, and routinely so in the case of the ECB. Finally, the rate on reserves did not act as a floor to the overnight rate, with instead the latter lying most of the time below the former, in the euro area as well as in the U.S., since an ARS has been in place. This reflects the arbitrage between reserves and other monetary assets, in particular short-term Treasury securities (Martin et al., 2020). The latter have the advantage of being accessible to a much wider range of investors than reserves, which are accessible only to banks, while being as safe.

Financial stability

An ARS could contribute to financial stability in three ways:

Costs

ARSs have five sorts of costs:

Unwinding should avoid destabilising financial markets. With this objective in mind, I first describe general orientations, then the main steps of a possible path toward an SRS.

General orientations

To avoid destabilizing financial markets, unwinding should process in a credible and transparent manner. This presupposes that:

The main steps

In order not to destabilize bond markets, the reference scenario could be one in which the central bank holds the bonds in its portfolio, without rolling it, until they are redeemed. The restoration of an SRS may thus be a lengthy process. Caveats could also state that, in case of financial crisis and the reaching of the ELB, LSAPs could resume, or alternatively, in case of high economic growth threatening price stability, bonds could be sold in the markets, while taking care not to destabilise them. In that regard, the precedent of the so-called “taper tantrum” in May 2013 should not obscure the fact when, two weeks earlier, Ben Bernanke had announced to Congress the intention of the FED to unwind, possibly by selling bonds in the markets, the latter had not reacted.

The possible main steps could be, in chronological order:

Afonso G., Logan L., Martin A., Riordan W., Zobel P. (2022), How the Fed’s Overnight Reverse Repo Facility Works, 11 January, Liberty Street Economics.

Bindseil U. (2004), Monetary Policy Implementation – Theory – Past – Present, New York, Oxford University Press Inc.

Board of Governors of the Federal Reserve System (2019), Statement Regarding Monetary Policy Implementation and Balance Sheet Normalization, January 30.

Borio C. (2023), Getting up from the floor, BIS Working Paper 1100.

Byrne D., Foster S. (2024), Transmission of monetary policy: Bank interest rate pass-through in the euro area, Suerf Policy Brief 771.

Caballero R. J., Farhi E., Gourinchas P.-O. (2017), The Safe Assets Shortage Conundrum, Journal of Economic Perspectives, 31, 29-46.

Cipollone P. (2025), Striking the right balance: the ECB’s balance sheet and its implications for monetary policy, 18 February.

Diamond W. F., Jiang Z., Ma Y. (2023), The Reserve Supply Channel of Unconventional Monetary Policy, NBER Working Paper 31693.

Eser F., Carmona Amaro M., Iacobelli S., Rubens M. (2012), The Use of the Eurosystem’s Monetary Policy Instruments and Operational Framework since 2009, Occasional Paper Series, n° 135.

European Central Bank (2022), The Transmission Protection Instrument, Press release, 21 July.

European Central Bank (2024), Changes to the operational framework for implementing monetary policy.

Gravelle T. (2025), The end of quantitative tightening and what comes next, 16 January.

Hauser A. (2023), ‘Less is more’ or ‘Less is a bore’ – Recalibrating the role of central bank reserves, 13 November.

Martin A., McAndrews J. J., Palida A., Skeie D. (2020), Explaining the Puzzling Behavior of Short-Term Money Market Rates, 24 August, Liberty Street Economics.

Pfister C., Sahuc J.-G. (2020), Unconventional Monetary Policies: A Stock-Taking Exercise, Revue d’économie politique, 130(2), 136-168.

Schnabel I. (2023), Back to normal? Balance sheet size and interest rate control, 27 March.

Schnabel I. (2024), The ECB’s balance sheet reduction: an interim assessment, 7 November.

One exception is the Bank of Canada, whose Deputy Governor Toni Gravelle has announced it would have unwound, although he does not use the word, and returned to the pre-QE monetary policy framework in the course of third quarter of 2025 (Gravelle, 2025).

The central bank can also restore an SRS by issuing bonds, if it has this capacity (this is the case of the ECB, but not of the FED). However, this means it would not unwind and is thus out of the scope of this paper.