In the current context of monetary policy tightening, the question of spillovers from monetary shocks is back to the forefront. We take a new perspective on this question, studying the reaction of a trade financing tool at the crossing between trade and finance, namely trade credit. We conduct a panel data analysis on trade credit amounts at the firm level, using a proprietary database from a worldwide trade credit insurer. We highlight how trade credit can act as a financial buffer against the negative impact of US monetary policy tightening in emerging economies, in particular for firms that are more financially constrained.

In the aftermath of the Covid-19 crisis, we entered in a new monetary policy phase, with all the major central banks increasing their policy rate. From March 2022 to July 2023, the Fed hiked its policy rate by 525 bps to 5.5%, its highest level since 2001. In this context, the question of spillovers from monetary policy shocks becomes once again a major issue. In particular, emerging economies have been historically sensitive to changes in Fed’s monetary policy, because of their financial and trade links with the US.

On the financial side, the literature has often highlighted the impact of US monetary policy on portfolio flows, especially during what we call ‘Sudden Stop’ episodes (Mishra et al. (2014), Koepke (2019), Fratzscher et al. (2018)). The impact on banking flows through cross-border lending is also well-acknowledged (Bruno and Shin (2015), Morais et al. (2019)). On the trade side, the US are the main trade partner of most emerging markets, making emerging suppliers very sensitive to any change in US demand resulting from monetary shocks (Arbatli et al. (2022), Chen et al. (2016) or Caldara et al. (2022)).

At the cross-road of trade and financial flows, lies a very specific trade financing tool, namely trade credit. Widely used by firms to finance their trade activity, trade credit is an inter-firm credit provided by a supplier to its client. It is particularly common in emerging economies where the access to other traditional financial tools is more limited (Demirguc-Kunt, A., & Maksimovic, V. (2001)). However, due to a lack of data, literature has only recently started to study this type of flow and its reaction to monetary shocks (Adelino et al., 2022).

In a recent paper, we take a new perspective on spillovers from the US to emerging markets, studying the reaction of trade credit to US monetary policy shocks. Using a proprietary database from a worldwide trade credit insurer, we study how foreign-supplied trade credit in Mexico can substitute for other financing tools and act as a financial buffer against the negative impact of US monetary policy tightening.

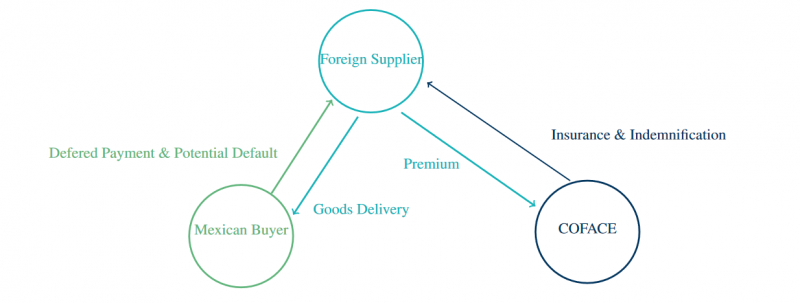

Trade involves high capital needs for firms. To bear the different trade costs, several options are available. A firm can use bank intermediation with letters of credit. It can also chose cash-in-advance terms where the buyer finances directly at the order the purchase of the good or service. A last option are open account terms, or trade credit, where the supplier provides a credit to its client by paying for the production of the good or service and allowing the buyer to pay with some delay after delivery. According to Antras and Foley (2015), and in line with numbers by the International Credit Insurance & Surety Association, around 41% of international trade is done under trade credit terms. However, while such open account terms are highly attractive for buyers, suppliers bear a risk of default from their customer, exposing their balance sheet. To control for such a risk, some suppliers insure themselves with trade credit insurers to be reimbursed in case their buyer defaults.1 Figure 1 highlights the functioning of such insured trade credit and the relationships among the three market actors.

Figure 1: Insured trade credit functioning

We use proprietary data from one of the three main trade credit insurers worldwide, Coface, to study the reaction of trade credit to US monetary policy. Coface collects data on trade credit amounts for a supplier-buyer pair on a monthly basis for all insured trade credit sales done by foreign suppliers to Mexican buyers, from July 2010 to June 2019. The micro-level data allows to control for a wide variety of trade credit determinants, at the supplier’s and buyer’s country level, for the supplier-buyer pair, as well as at the sector level. A key requirement in trade credit insurance is the need for a supplier to declare all its trade credit buyers. This means both low and high-risk buyers are insured. To measure risk, Coface assessments on buyers’ credit quality mirror Coface perception of payment default risk from this buyer. We classify buyers in three categories based on their assessment, from bad, to medium and good credit quality. Having all trade credit buyers allows to focus on demand-driven mechanisms and study the impact of monetary policy on the different buyers of a supplier, controlling for the supplier’s characteristics across time.

We analyse the reaction of foreign-supplied trade credit towards Mexican firms to unexpected US monetary policy shocks.

To identify unanticipated US monetary policies, we look at changes in a US monetary indicator in a narrow window surrounding the Fed’s policy announcements (as in Kuttner (2001), Gürkaynak et al. (2005) or Bernanke and Kuttner (2005)). This approach assumes that any variation in the policy indicator during an hour or a thirty-minute window relates to monetary policy news. We look at a medium-term indicator, the 2-year Nominal Treasury yield (Hanson and Stein (2015), Gilchrist et al. (2015)), which is more susceptible to vary given the Zero Lower Bound (ZLB) that characterizes the period.

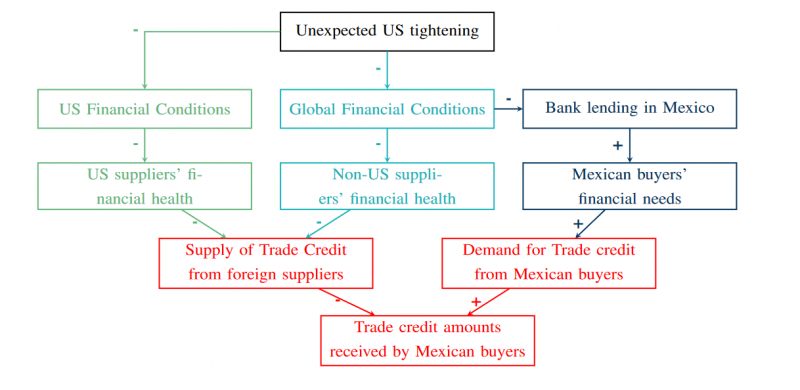

We conduct a panel data analysis on trade credit amounts at the firm level, from July 2010 to June 2019. Because trade credit is at the intersection of both finance and trade, it can be influenced by changes in trade volumes—if more trade, more trade credit is required—as well as changes in the firm’s financing, based on its financial needs and the use of other tools such as banking loans. Moreover, given that we use trade credit exposure, i.e. the maximum amount of trade credit insured, it can also vary according to insurance decisions. In our study, we want to focus on the financial mechanisms. For this purpose, we control for a trade effect including import flows in our estimation. We also control for a potential insurance effect at the insurer and supplier levels. Figure 2 shows the financial mechanisms we are interested in. In particular, it distinguishes the channels by which the supply and demand for trade credit may be affected by US monetary policy shocks under a financial point of view.

Figure 2: Impact of US monetary shocks on trade credit through financial mechanisms

We show that an unexpected tightening in the US monetary policy increases the amount of trade credit provided by foreign suppliers to Mexican buyers with a 3-month delay. This impact is robust to the inclusion of trade and insurance effects. This effect is not limited to trade credit supplied by US firms as it also increases for credit provided by Eurozone suppliers. Based on the mechanisms portrayed in figure 2, the demand-side effect appears to dominate. Looking at the currency used, we see a larger impact for trade credit denominated in USD, highlighting a specific role for the dominant currency.

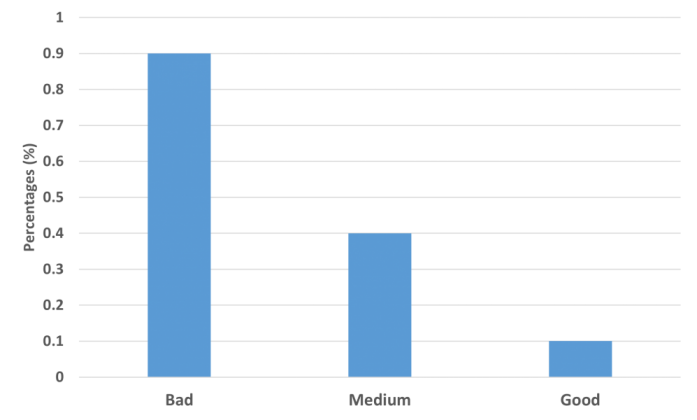

We investigate further the demand mechanism and the financing role of trade credit by allowing heterogeneous impacts based on buyers’ financial needs. We distinguish across buyers of a supplier based on their assessment of credit quality. Controlling for supplier’s characteristics across time, we find a higher positive effect for bad-credit-quality buyers, i.e. those that are more financially-constrained. Figure 3 pictures the impact in percentages for each buyer category. Following a one-standard-deviation monetary shock, trade credit increases by 0.9% for bad-credit-quality buyers and by 0.1% for good-credit-quality ones after three months. This positive albeit small significant effect should be understood in the context of overall low level of surprises during the period, characterized by few movements in Federal funds rate. This points towards a demand-driven effect. More financially constrained buyers—whose access to banking loans is even more restrained after a US monetary policy shock—ask for more trade credit after such a shock.

Finally, we want to investigate further this financial substitution mechanism. We know that US monetary policy has a significantly larger impact than ECB monetary policy on real and financial variables in emerging markets (Ca’Zorzi et al., 2020) and especially in Mexico. Therefore, it is likely that in the case of unanticipated ECB monetary policies the buyer side will react less to the shock given the limited spillovers of ECB monetary policy shocks to Mexico. We replicate our analysis on ECB monetary shocks.2 We find that trade credit decreases following an ECB shock. This result does not significantly vary across buyers’ financial constraints. This means that for ECB shocks, we do not find such positive demand-driven effect from low-credit quality buyers: as unanticipated ECB policies do not significantly affect financing conditions in Mexico, they do not spark strong demand for trade credit to substitute for other financing tools.

Figure 3: Average effect of US monetary shocks by buyers’ credit quality

Note: Total response of insured trade credit amounts to a one-standard-deviation shock in US monetary policy that happened three months before, for each category of credit quality, in percentages. Source: London and Silvestrini (2023).

There is growing evidence showing how US monetary policy has important effects on financial conditions globally and especially in emerging economies. The literature has already emphasized the role of the banking sector in transmitting US monetary shocks internationally. However, it says little on how trade credit respond to these shocks. Theoretically, the direction of the response is ambiguous, either following the downward trend in bank lending or increasing to compensate for the banking decrease. In our paper, we show how US and ECB monetary policy shocks have distinct impacts on trade credit, based on the different spillovers they spark in emerging markets. Overall, our results suggest that trade credit can act as a shock absorber of US monetary policy tightening, in particular for more financially-constrained firms. This complements the recent findings of Elliott et al. (2023) on non-bank lending reactions to US monetary shocks. Thus, financial spillovers of US monetary policies extend outside the conventional financial sector. While policy-makers could leverage such inter-firm support mechanisms in times of monetary tightening, they should not forget these ’creditors of last resort’ when designing support schemes in these periods.

Adelino, M., M. A. Ferreira, M. Giannetti, and P. Pires (2022, 06). Trade Credit and the Transmission of Unconventional Monetary Policy. The Review of Financial Studies 36(2), 775–813.

Antras, P. and C. F. Foley (2015). Poultry in Motion: A Study of International Trade Finance Practices. Journal of Political Economy 123(15 May 2014).

Arbatli, E. C., M. Firat, D. Furceri, and J. Verrier (2022). Us monetary policy shock spillovers: Evidence from firm-level data. Technical report, IMF working paper.

Bernanke, B. S. and K. N. Kuttner (2005). What explains the stock market’s reaction to federal reserve policy? The Journal of finance 60(3), 1221–1257.

Berne Union (2021). Export credit & investment insurance industry report 2020: Annual report of the export credit and investment business of berne union members.

Bruno, V. and H. S. Shin (2015). Cross-border banking and global liquidity. The Review of Economic Studies 82(2 (291)), 535–564.

Caldara, D., F. Ferrante, and A. Queralto (2022). International spillovers of tighter monetary policy.

Ca’Zorzi, M., L. Dedola, G. Georgiadis, M. Jarocinski, L. Stracca, and G. Strasser (2020). Monetary policy and its transmission in a globalised world.

Chen, Q., A. Filardo, D. He, and F. Zhu (2016). Financial crisis, us unconventional monetary policy and international spillovers. Journal of International Money and Finance 67, 62–81.

Demirguc-Kunt, A. and V. Maksimovic (2001). Firms as Financial Intermediaries : Evidence from Trade Credit Data. World Bank Policy Research Working Papers (October 2001).

Elliott, D., R. Meisenzahl, and J.-L. Peydró (2023). Nonbank lenders as global shock absorbers: evidence from us monetary policy spillovers.

Fratzscher, M., M. Lo Duca, and R. Straub (2018). On the international spillovers of us quantitative easing. The Economic Journal 128(608), 330–377.

Gilchrist, S., D. López-Salido, and E. Zakrajšek (2015). Monetary policy and real borrowing costs at the zero lower bound. American Economic Journal: Macroeconomics 7(1), 77–109.

Gürkaynak, R. S., B. Sack, and E. Swanson (2005). The sensitivity of long-term interest rates to economic news: Evidence and implications for macroeconomic models. American economic review 95(1), 425–436.

Hanson, S. G. and J. C. Stein (2015). Monetary policy and long-term real rates. Journal of Financial Economics 115(3), 429–448.

Koepke, R. (2019). What drives capital flows to emerging markets? a survey of the empirical literature. Journal of Economic Surveys 33(2), 516–540.

Kuttner, K. N. (2001). Monetary policy surprises and interest rates: Evidence from the fed funds futures market. Journal of monetary economics 47(3), 523–544.

London, M. and M. Silvestrini (2023). US monetary policy spillovers to emerging markets: the trade credit channel. Technical report, Banque de France Working paper Series.

Mishra, M. P., M. K. Moriyama, P. M. N’Diaye, and L. Nguyen (2014). Impact of fed tapering announcements on emerging markets. International Monetary Fund.

Morais, B., J.-L. Peydró, J. Roldán-Peña, and C. Ruiz-Ortega (2019). The international bank lending channel of monetary policy rates and qe: Credit supply, reach-for-yield, and real effects. The Journal of Finance 74(1), 55–90.

We change the variable of interest but keep the same sample and the same control variables. See London and Silvestrini (2023) for details.