References

Albacete, N., and P. Fessler (2010): Stress Testing Austrian Households. Österreichische Nationalbank Financial Stability Report 19, June.

Albacete, N., Fessler, P., and P. Lindner (2018): One policy to rule them all? On the effectiveness of LTV, DTI and DSTI ratio limits as macroprudential policy tools. Financial Stability Report 35, Österreichische Nationalbank, June.

Ampudia, M., H. van Vlokhoven, and D. Zochowski (2016): Financial fragility of euro area households. Journal of Financial Stability, 27, 250–262.

Bańbuła, P., Kotuła, A., Przeworska J., and P. Strzelecki (2016): Which households are really financially distressed: How micro data could inform the macroprudential policy. IFC Bulletins chapters, Bank for International Settlements (eds.), Combining micro and macro statistical data for financial stability analysis, vol. 41, Basel.

Detken, C., Weeken, O., Alessi, L., Bonfim, D., Boucinha, M., Castro, C., Frontczak, S., Giordana, G., Giese, J., Jahn, N., Kakes, J., Klaus, B., Lang, J., Puzanova, N., and P. Welz (2014): Operationalising the countercyclical capital buffer: indicator selection, threshold identification and calibration options. ESRB Occasional Paper Series, 5, 1-95.

Giordana, G. and M. Ziegelmeyer (2020): Stress testing household balance sheets in Luxembourg. Quarterly Review of Finance and Economics, 76, 115-138. Previous version published as BCL Working Paper 121. July 2018.

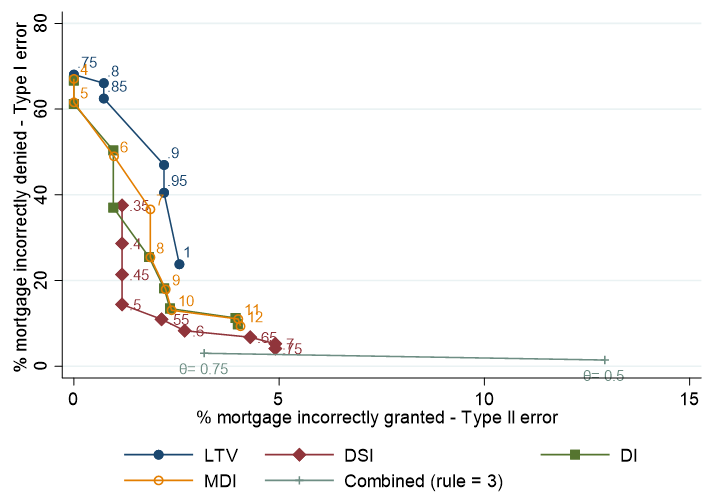

Giordana, G., and M. Ziegelmeyer (2022): Using household level data to guide borrower-based macro-prudential policy. BCL working paper 161.

Hanley, J.A., and B. McNeil (1982): The meaning and use of the Area under a Receiver Operating Characteristic (ROC) Curve. Radiology, 143(1), 29-36.

Kaminsky, G., Lizondo, S., and C. Reinhart (1998): Leading indicators of currency crises. IMF Staff Papers, 45(1), 1–48.

Meriküll, J., and T. Rõõm (2020): Stress tests of the household sector using microdata from survey and administrative sources. International Journal of Central Banking, 16(2), 203-248.

Sangaré, I. (2019): Housing sector and optimal macro-prudential policy in an estimated DSGE model for Luxembourg. BCL Working Paper 129.