I study the impact of labor market tightness on wages. Using Danish data on vacancies and unemployment at the occupational level and firm data on the occupational composition of employees, I construct novel firm-specific measures of labor market tightness. Using these measures, I estimate the impact of labor market tightness on wages at the firm level. I find that a doubling of tightness leads to a 1-2 pct. increase in real wages. This implies an upwards-sloping but relatively flat wage-setting curve. The results are in line with the qualitative implications of the canonical search-and-matching model of the labor market.

How do aggregate labor market conditions affect wages? Standard search-and-matching models such as the ones developed by Diamond, Mortensen, and Pissarides (Pissarides (2000)) (the DMP model), predict that higher labor market tightness makes it easier for job-searchers to find a new job. This improves their outside option and in turn, they demand a higher wage.

While the aggregate co-movement of wages and tightness has been studied extensively, we still lack evidence on the firm- and worker-level responses to tightening labor markets. A clear reason for this is that labor market tightness is an aggregate concept. It is therefore not obvious how to capture the firm- and worker-level variation in tightness needed to estimate these responses. In a new working paper (Hoeck (2022)) I create a novel measure of labor market tightness at the firm level. To do this, I use the fact that firms hire workers from different occupations and that labor market tightness differs across these occupations. Firms will therefore differ in how exposed there are to changes in occupational tightness. If a firm hires many engineers, it will be more affected if the labor market for engineers tightens. This provides me with the firm-level variation in labor market tightness.

In the aggregate, wages and tightness are also often thought of as being determined simultaneously. In the DMP model, for example, they are determined jointly by a vacancy-creation curve, governed by the firms’ incentives to post vacancies, and a wage-setting curve resulting from bargaining between workers and firms over the surplus of a match. In an aggregate setting, there will be feedback between these two mechanisms. In the paper, I argue that if firms are small relative to the labor market, they will take tightness as given when bargaining over wages. Conducting the analysis at the firm level, therefore, disentangles the wage-setting and vacancy-creation curve by blocking the feedback from the vacancy-creation to tightness. I also argue that my estimates pin down the slope of the wage-setting curve. To do this I of course need firm-level variation in tightness, and this is where the firm-level measures of labor market tightness come in.

I construct the firm-level measures of labor market tightness using two components based on Danish data: Occupation-level tightness, measured as the ratio of vacancies to job searchers, and firm-level employee occupation-shares, capturing the occupational composition of employees at each firm. I obtain data on the number of vacancies across occupations from a large government-run job-posting site. I then calculate the number of job-searchers in an occupation based on the number of unemployed who have previously held a job in that occupation using administrative data. (In the paper, I also extend the number of job-searchers to allow for on-the-job search and occupational mobility). This provides me with the needed data to calculate occupational tightness. Using a matched employer-employee dataset, which includes the occupation of each employee, I can also calculate the share of employees belonging to each occupation. I can then simply combine the firm-specific shares with the occupational tightness measures to get a firm-level measure of labor market tightness. This measure captures tightness in the occupations the individual firm is hiring from.

In practice, I do not use the weighted average of the level of occupational tightness, but the weighted average of the change in log occupational tightness instead. This measure has the form of a shift-share measure as in Adão et al. (2021) and I draw on their work for identification and inference. To account for wage rigidity I examine the effect of tightness on wages over different horizons, constructing the measure using changes in occupational tightness calculated using 1-year and 5-year differences.

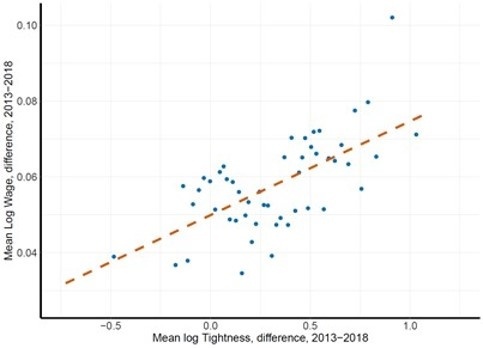

I start by simply comparing the tightness measure with the change in mean log wages at the firm level over the sample period (2013-2018). Figure 1 contains a binned scatterplot of the 5-year tightness shift-share measure and the change in mean log wages in the same 5-year span. From the figure, two things are clear. First, I do find the expected positive association between tightness and wage growth at the firm level. Second, the slope is relatively flat. A fifty percent increase in tightness is associated with a wage increase of around 1 pct.

Figure 1: Firm-level correlation between wage and tightness growth

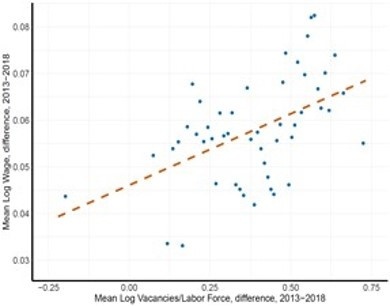

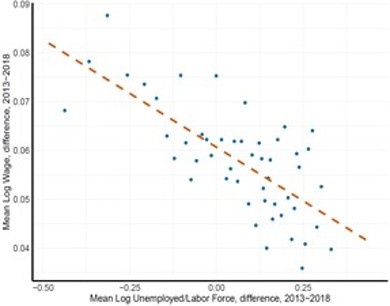

Figure 2 and 3 contains binned scatterplot comparing the change in wages to the change in the subcomponents of tightness, vacancies, and unemployment. The firm-level vacancy and unemployment rates are constructed in the same way as the firm-level tightness measure.

In the figures, we again find the expected correlations: An increase in the firm-level vacancy rate is associated with higher wage growth, while an increase in the firm-level unemployment rate is associated with lower wage growth.

Figure 2: Firm-level correlation between wage and vacancy rate growth

Figure 3: Firm-level correlation between wage and unemployment rate growth

In practice, these associations might be driven by other factors and not by outside options improving when tightness increases. In the DMP model, for example, an increase in productivity will both affect wages directly by generating a larger surplus and indirectly through tightness, since firms will post more vacancies. I, therefore, need to control for productivity when estimating the effect of tightness on wages. I do this using administrative data on value added per worker at the firm level. In addition to the productivity measure, I also control for year fixed-effects and industry and region trends in the estimation. Note, that since the estimation is done using wages, tightness, and productivity expressed in changes, any possible time-invariant confounders at the firm level will not affect the estimate.

These estimations also produce the expected results (See paper for regression tables). An increase in tightness leads to statistically significant increases in wages at the firm level. Again, the estimates also imply a relatively flat wage-setting curve, with a doubling of tightness leading to a wage increase of around 1 pct. when using the 1-year differences. The effect increases when using 5-year differences. This is consistent with wages being more rigid in the short run. However, even in the 5-year-difference specification, the effects are still relatively small.

In the paper, I also recover key parameters from the DMP model based on my estimates and relate them to calibrations used in the literature. I find that the standard calibration where the bargaining power of workers is set to match the efficiency condition from Hosios (1990) will lead to a wage-setting curve with a slope that is five times larger than what is implied by my estimates. This will in turn lead to higher wage volatility and lower unemployment volatility.

I also relate the estimates to the literature on the interplay between precautionary savings and the wage-setting curve through earnings risk, as in Ravn and Sterk (2021). Here, earnings risk is defined as the gap in earnings between employed and unemployed times the probability of staying unemployed given a separation. While the earnings gap is increasing in tightness, the probability of staying unemployed is decreasing in tightness. A flatter wage-setting curve makes it more likely that the second effect is larger than the first. If this is the case, earnings risk is counter-cyclical since it is decreasing in tightness. In the model presented in Ravn and Sterk (2021), a fall in tightness will therefore increase earnings risk. This will trigger a precautionary savings motive, which will reduce demand. In turn, firms will post fewer vacancies, causing tightness to drop even more, leading to a contractionary spiral. In the paper, I show that my estimates imply that earnings risk is counter-cyclical in the Danish economy.

Adão, R., Kolesár, M., and Morales, E. (2019). “Shift-Share Designs: Theory and Inference”. The Quarterly Journal of Economics, 134(4):1949–2010.

Hoeck, C. P. 2022. “Wage Effects of Labor Market Tightness”, Danmarks Nationalbank Working Paper No. 187.

Hosios, A. J. (1990). “On the Efficiency of Matching and Related Models of Search and Unemployment”. The Review of Economic Studies, 57(2):279–298.

Pissarides, C. A. (2000). “Equilibrium Unemployment Theory”, MIT Press.

Ravn, M. O. and Sterk, V. (2021). “Macroeconomic Fluctuations with HANK & SAM: an Analytical Approach”. Journal of the European Economic Association, 19(2):1162–1202.