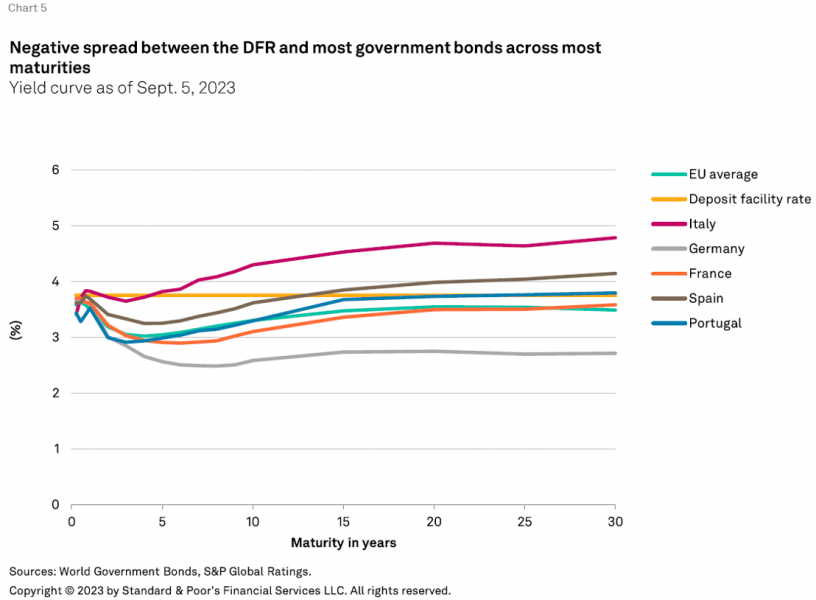

The final uncertainty for the ECB will be the impact of QT on yields and the capacity of financial and nonfinancial actors to manage the ECB’s withdrawal from the bond markets. We do not expect the impact of QT on yields to mirror that of QE decisions, which were taken in times of acute crisis. For instance, we do not expect a return to the yields and spreads just before the ECB made its QE decisions. That said, QT’s actual impact on yields remains particularly hard to predict.