The views expressed in this policy brief are those of the authors and not those of the National Bank of Belgium.

We propose a new model to decompose inflation-linked swap rates into genuine inflation expectations and risk premiums. We develop a no-arbitrage term structure model with stochastic endpoints, separating macroeconomic variables into transitory parts and long-run, economically grounded determinants, such as the equilibrium real interest rate and the inflation target. Our estimations deliver new insights into how macroeconomic variables affect market-based inflation expectation measures.

Central banks in advanced economies aim to keep inflation stable around their targets. The ECB, for instance, has a medium-term inflation target of 2%. When deciding how to change their monetary policy instruments, central banks pay great attention to analyzing the behavior of inflation expectations, as they are an important determinant of the inflation outlook. When households, firms, or financial markets expect future inflation to not be in line with the central bank’s target, risks are large that inflation will not stabilize around the central bank’s aim.

While inflation expectations are key to assessing the outlook for price stability, monitoring them in detail is challenging. Surveys conducted with households, firms, or professional economists are one source of inflation expectations. Unfortunately, they are conducted only infrequently and may give conflicting signals regarding the private sector’s inflation expectations. Financial markets offer another source of information on inflation expectations: inflation-linked swaps (ILS), whose payouts are directly linked to the level of inflation and available for a wide range of maturities, have become an increasingly liquid asset class. Their availability at a very high frequency and the fact that traders have “skin in the game” when trading inflation products are obvious advantages of this information source. However, market participants also require compensation for the uncertain returns of investing in these products. That means their prices also contain risk premia and not only “pure” expectations of future inflation.

In Boeckx, Iania and Wauters (2024), we propose a new tool to understand what factors drive the market for inflation protection. Specifically, our method separates risk premia from “pure” expectations in the observed inflation-linked swap rates. Building on Dewachter and Iania (2011) and Bauer and Rudebusch (2020), our approach innovates by allowing for time-variation in trend inflation and the equilibrium real interest rate in the decomposition of ILS rates. We do so because both variables have been trending down since the mid-80s, with signs of upward movements over the last few years. Disregarding the pronounced low-frequency movements in these variables risks overestimating the importance of risk premia. The model also incorporates macroeconomic data to provide intuition on what economic variables and shocks drive the pricing on inflation markets.

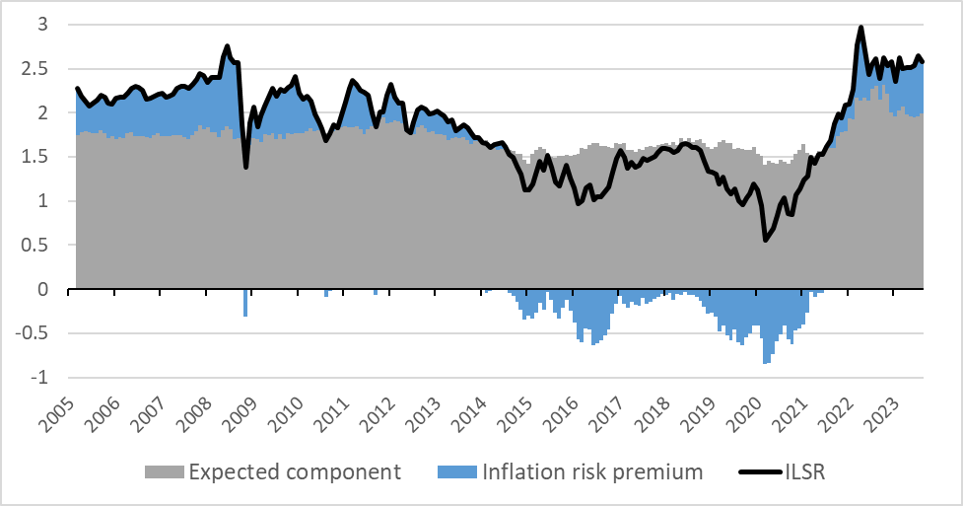

We estimate the model for the euro area and the US using data from January 2005 until August 2023, thus including the recent inflation spike. Chart 1 shows the evolution of the ten-year ILS rate for the euro area, a measure of average inflation over the next ten years. This ILS rate is decomposed into an expected component – the “pure” measure of inflation expectations – and the inflation risk premium.

Chart 1: Euro area 10-year ILS rate and its decomposition (Percentages)

Sources: Bloomberg and authors’ calculations.

Notes: The chart depicts the euro area 10-year ILS rate and its decomposition into an expected component (capturing “pure” inflation expectations; grey bars) and the inflation risk premium (blue bars).

The inflation risk premium is an important driver of inflation-linked swap rates. For instance, during the low inflation period in the euro area, risk premia switched signs from positive to persistently negative numbers between 2014 and 2021 for some segments of the ILS markets. So, although the expected component was below the 2% target, it remained above the observed ILS rate due to the negative risk premium. Therefore, a careful reading of inflation swaps is needed to draw firm conclusions regarding the anchoring of inflation expectations.

As of August 2023, the expectations component in 10-year inflation swaps stood at 1.99% for the euro area, and the risk premium was positive again.

Our model explains the evolution of ILS rates and its expected and risk premium components using groups of shocks. We identify these shocks based on their transmission speed to macroeconomic variables and ILS rates. The groups are:

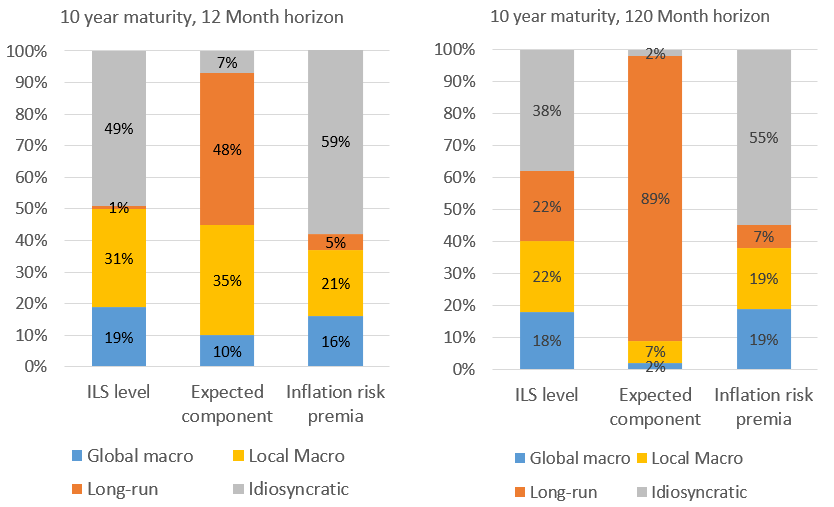

Chart 2: Variance decomposition of the Euro area 10-year ILS rate and its decomposition (Percentages)

Sources: Authors’ calculations.

Notes: The variance decomposition is shown for the short-term (left panel, 12-month horizon) and long-term (right panel, 10-year horizon) for the ILS, expected component, and risk premium for different shocks. These shocks are grouped into (i) global macroeconomic shocks, (ii) local macroeconomic shocks, (iii) trend movements (long-run), and (iv) idiosyncratic movements in the ILS market.

Chart 2 shows the variance decomposition with the contribution of these four groups of shocks to the variation in ten-year ILS rates and their expected and inflation risk premium components. We select a 12-month horizon to reflect short-term fluctuations (left panel) and a 10-year horizon for long-term fluctuations (right panel).

There are three key takeaways. First, global and local macroeconomic shocks play an important role, explaining half of the short-term variations of the 10-year ILS rate and 40% of the long-term fluctuations. Their contributions are also important for the expected and risk premium components separately, particularly for high-frequency fluctuations. Second, the contribution from long-term shocks, affecting trend inflation and the equilibrium real interest rate, is the main driver of the expected component’s short-term fluctuations. Moreover, this group of shocks is the dominant driver of the expected component’s long-term fluctuations. Third, while idiosyncratic shocks in the ILS market have a small role in explaining the expected component’s fluctuations, they are a crucial driver of fluctuations of the inflation risk premium in the short and long term. As a result, they also contribute importantly to the variation of the ILS rate.

The above discussion provides a bird’s-eye view of the contribution of different shocks in our full sample. In our paper, we also zoom in on the contributions across four historical episodes: the Great Financial Crisis, the 2014 oil glut, COVID-19, and the Ukraine invasion.

Measuring inflation expectations is important for central banks aiming for price stability. Doing so allows them to monitor whether expectations are anchored to their inflation target and steer policy accordingly. One source of information on expectations is inflation-linked swap rates, as quoted on financial markets. These series are available at a high frequency and reflect market activity. However, the series also contain a risk premium component, which implies that they are not a pure measure of inflation expectations.

Our research proposes a new model to decompose financial market indicators of inflation compensation into genuine inflation expectations and risk premiums. This no-arbitrage term structure model with stochastic endpoints distinguishes short-term determinants of inflation risk premia from economically grounded long-run determinants, such as the equilibrium real interest rate and the inflation target. By doing so, it delivers plausible estimates and policy-relevant insights.

Bauer, M. D. and G. D. Rudebusch (2020, May). Interest rates under falling stars. American Economic Review 110 (5), 1316–54.

Boeckx, J., L. Iania, and J. Wauters (2024), Macroeconomic drivers of inflation expectations and inflation risk premia, Working Paper Research 446, National Bank of Belgium.

Dewachter, H. and L. Iania (2011). An extended macro-finance model with financial factors. Journal of Financial and Quantitative Analysis 46 (6), 1893-1916.