Covid-19 is a public health emergency. Economic activity has been suspended due to the necessary confinement measures taken almost everywhere in the world. The targeted policies of major central banks to address this economic crisis share many common features but differ in details and labels.

Covid-19 is a highly virulent and deadly coronavirus that is propagating rapidly. Left to spread without government intervention, the pandemic would have overwhelmed health systems with people in need of medical attention.

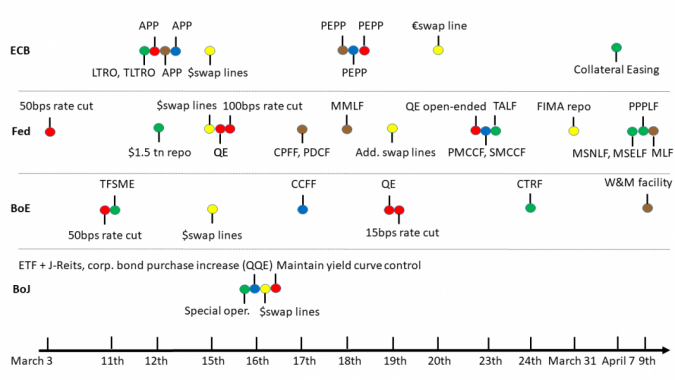

The medical imperative to impose a partial or general lockdown of the population has significantly reduced economic activity, with a risk of business failures and a sharp increase in unemployment. In such circumstances, providing additional and temporary liquidity to businesses and households proved essential. In parallel, an increase in volatility in financial markets caused by investors looking for liquidity required other targeted monetary policy interventions. Chart 1 presents a timeline of the actions taken by the four main G7 central banks between 3 March and 9 April: the European Central Bank (ECB), the Bank of Japan (BoJ), the US Federal Reserve (Fed), and the Bank of England (BoE). With the exception of the BoJ, which introduced a single package, the major central banks applied additional measures as estimates of the economic outlook worsened.

Chart 1: Timeline of central banks’ main responses to the Covid-19 crisis

Source: Banque de France.

Note: The chart is colour-coded by main channel (risk-free rate – red -, liquidity to bank clients – green -, support capital markets – blue -, contain spreads – brown -, swaps – yellow), see text. (Measures can have more than one channel.)

The unfolding economic crisis is different from the 2008 financial crisis …

The recession caused by Covid-19 could exceed that following the collapse of Lehman Brothers in 2008. The ultimate cost is very unclear and estimates vary widely (the global economy is forecasted to contract by -3 percent in 2020 by the IMF).

A key difference from the financial crisis is that banks and other financial institutions are healthier and not the origin of the shock. Although there have been very large falls in stock markets and increases in risk spreads, the financial system continues to function smoothly.

Instead, the focus of this crisis is primarily on firms, as well as on households in countries where welfare safety nets and partial unemployment schemes are less developed. The confinement measures taken globally have suspended economic activity in all service industries requiring physical proximity, severely constrained production and supply chains elsewhere and disrupted labour supply everywhere. The resulting loss of income and spending power by households and firms will amplify the recession (Guerrieri et al., 2020).

It is natural for firms and households under strain to start hoarding cash. Firms demand payment from creditors but delay making payments to suppliers. However, this harms the liquidity position of the supplier and so on down the line. Likewise, the default of one firm could trigger a chain of further defaults. Many healthy firms could disappear before the lockdown ends, triggering a rapid increase in the unemployment rate.

… requiring more targeted responses

These unique circumstances call for targeted policy responses (Gopinath, 2020). The objective is not to bring forward demand from the future to today, as monetary policy would normally do, since there is little point in increasing demand immediately when there is a constraint on supply. Instead, the objective is to allow as many viable businesses and employment relationships to survive until normal conditions return. Monetary policy will not prevent an economic downturn, but it can alleviate the economic impact and contribute to a swift recovery.

Governments have been putting in place emergency measures to avoid mass lay-offs, allow so-called short-time working schemes, provide tax relief and credit guarantees, support small businesses, and increase public spending on health care.

Central banks across the world have taken action to support the economy

Central banks have also been very active in pursuit of their mandates, implementing within a month a variety of large-scale measures, a pace much quicker than in previous crises. Although modalities differ according to the structure of the economy, the measures are broadly convergent, as is reflected in the colour coding in Chart 1.

These measures support credit flows to the economy through financial markets and the banking system, with a common emphasis this time on safeguarding the financing of the business sector (while in 2008-09 the focus was more on mortgage finance).

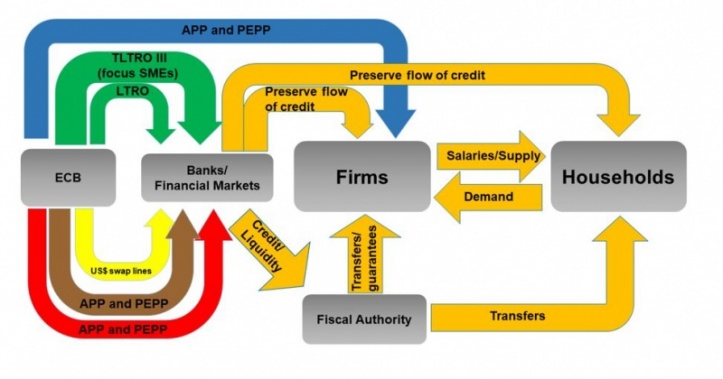

Chart 2, which focuses on the ECB case, illustrates that these actions work through several distinct channels: directly helping the real economy through lower risk-free interest rates; helping banks supply liquidity to their clients, especially SMEs; supporting capital markets and supplying credit; keeping dollar financing available; and in the euro area, maintaining the single transmission mechanism.

Keep risk-free interest rates low (red colour-code)

Those central banks with room to cut their short-term policy rates have done so. The Fed and the BoE cut their policy rates to what they regard as the effective lower bound, 0-0.25% and 0.1% respectively. The ECB and the BoJ were already running highly accommodative policy with negative interest rates, -0.5% and -0.1% respectively.

Even after short-term policy rates have reached zero or negative levels, central banks can still stimulate demand by lowering medium and longer-term risk-free rates through so-called “unconventional measures”. They have therefore restarted or extended their purchases of longer-term assets. The ECB has introduced a Pandemic Emergency Purchase Programme (PEPP) of EUR 750 billion in addition to the EUR 120 billion extension of the Asset Purchase Programme (APP). The Fed has announced an unlimited purchase programme and the BoE a GBP 200 billion programme. The Reserve Bank of Australia has innovated by announcing a government bond purchasing scheme to cap 3-year yields at 0.25%.

The purchases of longer-term assets lower risk-free interest rates along the curve, which should be passed on to firms and households, easing financial pressure during this period and helping the recovery when the confinement ends.

Help banks provide liquidity to their clients, especially SMEs (green colour-code)

The second channel is to provide abundant liquidity to banks and increase their incentives to pass this on to clients. This is particularly relevant for economies heavily dependent on bank credit, such as the euro area. To do so, central banks have increased the amounts available in regular refinancing operations. They have also increased the incentives for banks to extend loans to businesses by easing the conditions at which they can borrow if they expand credit (the TLTRO III for the ECB, the TFSME for the BoE, and the Main Street Loan Facility (MSELF and MSNLF) and the Paycheck Protection Program Lending Facility (PPPLF) for the Fed).

Central banks have also eased collateral requirements. This increases the amounts the banks can draw through their lending facilities and supports markets for those assets.

Help firms that rely on capital markets (blue colour-code)

Central banks are also supporting companies that raise finance through capital markets by buying their securities. These purchases lower corporate bond yields and increase the value of firms’ collateral and indirectly should help big companies make payments to small suppliers. The ECB has increased the amounts purchased under the Corporate Sector Purchase Programme (CSPP) and will buy additional corporate bonds under the PEPP. The Fed has launched for the first time facilities to buy corporate bonds through the Primary and Secondary Market Corporate Credit Facility, PMCCF and SMCCF respectively. The BoE has its Covid Corporate Financing Facility (CCFF).

The BoJ, which is the only central bank to purchase firms’ shares, has doubled its purchases of equity exchange traded funds (ETFs).

Maintain the transmission mechanism (brown colour-code)

In recent weeks, the transmission of central bank-controlled rates to other interest rates has been impaired and risk premia in many markets have soared. The Fed has targeted directly disrupted markets with its emergency liquidity programmes for money market mutual funds, state and local governments (via the Municipal Liquidity Facility, MLF) and corporate paper issuers. The BoE has temporarily extended its ways and means facility to ensure the smooth functioning of short-term money markets.

In the euro area, disparities have appeared in refinancing conditions for governments, banks and companies between member countries, putting at risk the single monetary policy. To prevent the disruption, the PEPP allows for “fluctuations in the distribution of purchase flows over time, across asset classes and among jurisdictions”.

Keep dollar financing flowing (yellow colour-code)

Central banks have also cooperated on easing the provision of US dollars through improved terms on standing dollar swap lines, extending temporarily their number, and through repurchase operations with the Fed (FIMA) (see Corsetti et al. (2020) for an analysis of recent dollar flows).

By acting swiftly and with instruments targeted at easing financing constraints on firms, the world’s central banks are helping governments, firms and households to survive this exceptionally difficult period.

Chart 2: Stylised flow chart of monetary policy intervention.

Source: Banque de France.

Note: The chart shows the stylised flows of the ECB’s monetary policy actions (colour-coded as in Chart 1). Orange arrows show the intended consequences of the policy interventions.