Using unique real time quarterly macroeconomic projections of the Eurosystem/ECB staff, we estimate competing specifications of the monetary policy reaction function for the ECB. We consider specifications, which include inflation and output growth projections, past inflation gap, time varying natural real rate and different de facto inflation targets. Our first key finding is that the de facto inflation target of the ECB lies between 1.6% and 1.8%. Our second key finding is that the ECB reacts both to the short-term macroeconomic projections and to the past deviation of inflation from its de facto target.

In recent years monetary policy strategies have been under review in many economies and central banks. In the case of the European Central Bank (ECB), there has also been a vivid debate on the precise numerical target for inflation and possible asymmetry of the ECB’s policy responses. The debate on the ECB’s price stability objective stems from the fact that in the current strategy, the inflation aim is not precisely defined. In 1998, the ECB’s Governing Council defined price stability as a “year-on-year increase in the Harmonised Index of Consumer Prices (HICP) for the euro area of below 2%.” In 2003, the Governing Council clarified that “in the pursuit of price stability it aims to maintain inflation rates below, but close to, 2% over the medium term.” Even with this reformulation, the inflation aim has remained nevertheless ambiguous.

In a recent paper (Paloviita et al. 20212), we assess the ECB’s own interpretation of the price stability objective and its reaction function. In particular, we attempt to quantify the gist of the expression “below, but close to 2%.” In our empirical study we use a subset of the very same information the Governing Council has available when it decides on the monetary policy stance. The data consist of unique real-time quarterly macroeconomic projections of the Eurosystem/ECB staff over the sample period 1999-2016.

We present three sets of evidence. First, we consider the levels toward which the ECB inflation projections converge in the medium term. One can plausibly argue that the projected inflation rates at the end of the forecast horizon give the public a good guideline for inflation, which the ECB considers consistent with its mandate, even if the ECB inflation projections are conditioned on market expectations of the interest rate (since June 2006), and not on some “optimal state contingent path of the interest rates”.

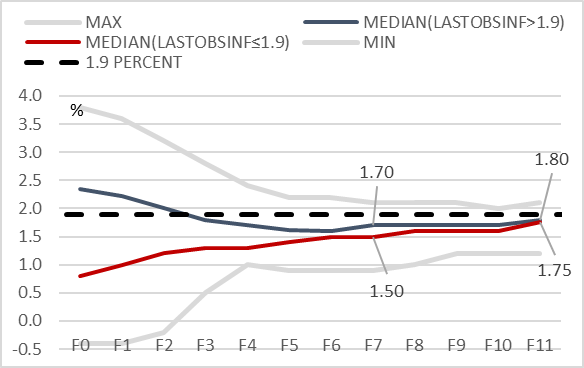

Figure 1. Median inflation projections conditioned on the latest observed inflation rate

during each projection exercise

Note: On the horizontal axis, the label “F0” refers to real time current quarter nowcasts and the label “F1” to one-quarter-ahead projections, etc. The curves “MAX” and “MIN” refer to the highest and lowest inflation projections made in 1999Q4 – 2016Q4.

Sources: ECB and authors’ own calculations.

Figure 1 illustrates the ECB’s inflation projections. It shows two separate medians based on whether the latest observed inflation rate during each projection exercise has been above or below 1.9%. In addition to the medians, figure 1 also presents the highest and lowest inflation projections for different forecast horizons. Figure 1 shows that the medians of projections made at times when the recent observed inflation rate is high (i.e. higher than 1.9%) converge to 1.70 – 1.80% after six quarters. At the same time, however, the medians of projections starting from lower inflation conditions (i.e. 1.9% or lower) converge to slightly lower rates around 1.60 – 1.75%. It is notable in figure 1 that regardless of the current level of inflation, after about six quarters the median inflation projections are already in the proximity of their levels at the end of the forecast horizon. When compared to the actual realized inflation, the projected inflation exhibits stronger and faster mean reversion.

Second, we estimate a large number of alternative monetary policy rules, where the central bank reacts to current or expected future inflation (with alternative forecast horizons), and to a measure of the (current or expected future) growth gap, where the output growth gap is the difference between actual and potential output growth. The estimated specifications involve interest rate smoothing, and they may also involve the central bank reacting to a measure of the natural rate of interest. These specifications allow us to directly infer the ECB’s de facto inflation target, as well as its confidence interval.

Among the large number of estimated policy rules, we select the most plausible specifications using the following selection criteria: First, the inferred inflation target must have a bounded 95% confidence interval, which is in our case actually equivalent to requiring that the Taylor principle holds at the 5% level. Second, the 95% confidence interval of the inflation target should include some values between 1.5% and 2.0%. If this is not the case, we conclude that the estimated reaction function is not consistent with the definition of price stability and therefore it is not a good description of euro area monetary policy.3

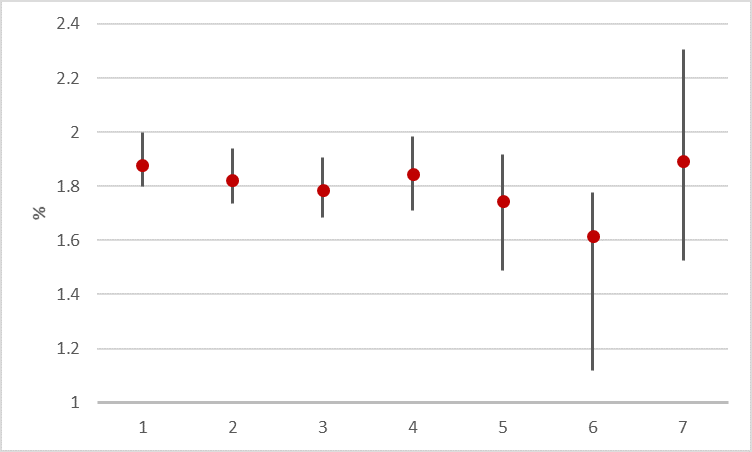

Figure 2. Inflation target: Point estimates and 95% confidence bands

Sources: ECB and authors’ own calculations.

Altogether 13 model specifications meet the selection criteria described above. Figure 2 shows the computed inflation targets and their 95% confidence intervals based on sampling uncertainty from those seven model variants where the width of the confidence band is 100 basis points or narrower. In figure 2, the implied point estimate for the inflation target typically lies close to 1.8%. In the wider set of 13 specifications where the maximum width of the confidence band is 200 basis points, there are also a few rules with the inflation target at or below 1.6%. A rule with an inflation target of 2% or above is a rare exception. Furthermore, while the lower bound of the 95% confidence interval can be rather low in some rules, the upper bound typically lies below 2%.

Third and finally, using primarily the real gross domestic product (GDP) growth as a cyclical variable, we estimate more general reaction function specifications, which allow the ECB to react (either symmetrically or asymmetrically) also to past inflation gaps, determined by the deviations of realized inflation from the de facto target. Past inflation developments may play a role in monetary policy setting because of various reasons.

First, if the actual inflation rate has been below (above) the inflation target over a long period of time, the central bank may need to aim for a slightly faster (slower) rise in prices in the near future in order to achieve the inflation target in the medium term. Second, if inflation has persistently deviated from the target, the central bank may react more aggressively than would be required by information based on purely macroeconomic forecasts to maintain its credibility. The third possible interpretation relates to unconventional monetary policy and, above all, to forward guidance: in the context of persistently low inflation, the central bank may promise to keep monetary policy accommodative even after monetary policy should be tightened according to the current economic outlook. This kind of forward guidance may appear in the reaction function as a link between the current policy rate and past inflation. These specifications allow us to indirectly infer the ECB’s de facto inflation target.

We assess the performance of the estimated reaction functions by comparing their in-sample predictions against the key interest rates. In the analysis of the most recent period when standard interest rate policy has approached its effective lower bound, we evaluate the performance of our estimated functions by comparing their out-of-sample predictions against shadow interest rates estimated by Kortela (2016) and by Wu and Xia (2016).4

Overall, our analysis leads to the following conclusions. First, the de facto inflation target of the ECB is well below 2%, perhaps even as low as 1.6–1.8%. We also find that the ECB conditions its interest rate decisions not only on short-term macroeconomic projections but also on past inflation developments. This is also consistent with ECB communication over the past few years, according to which the launch of asset purchase programs can be justified as a response to too-prolonged a period of low inflation. Finally, we find some evidence of asymmetry in policy rules in which we fix the inflation target to 2%. However, the out-of-sample predictions of the symmetric reaction function with a low de facto target outperform the asymmetric reaction function during the effective lower bound period.

The ECB’s low de facto inflation target, and possibly asymmetric response to inflation, may hamper its ability to achieve price stability. First, when approaching the inflation target from below, the central bank may need to tolerate inflation rates above the target. Overshooting the target for a limited time may facilitate the central bank to achieve its price stability objective faster and more efficiently, when the interest rates are at the effective lower bound. Under credible monetary policy, overshooting the target raises inflation expectations and lowers the ex-ante real interest rate. This boosts consumption and investment and therefore reduces economic slack. Second, for a given equilibrium real interest rate, anchoring of inflation expectations to a relatively low level also leads to low nominal rates over the business cycle. This increases the likelihood of hitting the zero lower bound and reduces the scope to absorb shocks in severe economic downturns, like the ones the euro area has experienced since the global financial crisis.

Corresponding author: Email maritta.paloviita@bof.fi

All authors are from the Bank of Finland.

Paloviita, M., Haavio, M., Jalasjoki, P. and Kilponen, J. (2021): What does ”below, but close to, 2%” mean? Assessing the ECB’s reaction function with real-time data. International Journal of Central Banking Vol 68 (June 2021), 125-169.

However, we do not (automatically) exclude policy rules with a point estimate of inflation target below 1.5% or above 2.0%, as long as the 95% confidence interval includes some values between 1.5% and 2.0%.

Kortela, T. (2016), A shadow rate model with time-varying lower bound of interest rates, Bank of Finland Research Discussion Paper No. 19. Wu, C. & Xia, F. D. (2016), Measuring the Macroeconomic Impact of Monetary Policy at the Zero Lower Bound, Journal of Money, Credit and Banking, Vol. 48, No. 2-3 (March-April).