This Policy Brief is based on European Central Bank Working Paper Series No. 2902. The views expressed are those of the authors and do not necessarily reflect those of the ECB.

When deciding to which firms to lend, banks consider both their own situation and the characteristics of their borrowers. Using a new, large bank-firm panel dataset, we find that, in general, less capitalised banks adjust their credit standards more than healthier banks, especially for firms with a higher default risk. This is also true in reaction to macroeconomic developments, such as an increase in bank funding costs or a sudden deterioration in banks’ corporate loan portfolios due to an increase in firms’ default risk. Weaker banks respond more forcefully by tightening their credit standards more than better capitalised banks. The tightening is particularly pronounced when banks are linked to riskier firms. These results point to heterogeneity in the bank lending channel, depending on the situation of the lenders and the borrowers.

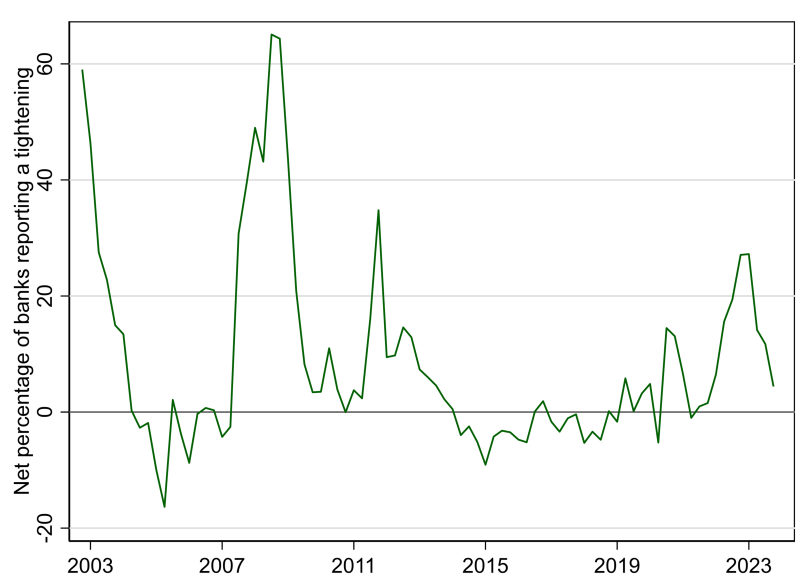

How do banks decide which firms to lend to and how does this decision depend on their own situation and firms’ characteristics? It is not a priori clear how banks set their credit standards for firms and how this depends on their own characteristics and the characteristics of the firms to which they are connected. Healthy, well-capitalised banks may feel more comfortable in financing risky business, on account of their ability to absorb potential losses, compared with less healthy banks. The latter may be more risk sensitive, taking account of their more limited loss absorption capacity. On the contrary, weaker banks could be more prone to adopt looser credit standards, with the aim of increasing their revenues. To answer these questions, we analyse the determinants of banks’ credit standards, i.e., their internal guidelines or loan approval criteria applied when deciding on granting credit as reported in the euro area bank lending survey (BLS) (see Figure 1). Studying how banks set their credit standards is particularly important for understanding the evolution of financing conditions in a bank-based financial system like the euro area, as banks’ credit standards are a key determinant of credit supply for firms.

Figure 1: Changes in credit standards for loans to firms in the euro area

(Net percentages of banks reporting a tightening)

Source: European Central Bank (euro area bank lending survey).

Notes: Net percentages are defined as the difference between the sum of the percentages of banks responding “tightened considerably” and “tightened somewhat” and the sum of the percentages of banks responding “eased somewhat” and “eased considerably”.

To investigate which bank and firm characteristics matter for euro area banks’ lending decisions to firms, in Faccia, Hünnekes and Köhler-Ulbrich (2024), we rely on a large bank-firm panel. We construct a unique quarterly dataset by linking confidential bank-level information from the BLS to around 1.8 million firms operating in ten euro area countries for the period from 2008 to 2020, covering around 90% of the BLS banks in these countries. We also use publicly disclosed financial data (provided by SNL) to obtain bank-level capital ratios, CDS spreads and loan loss provisions and rely on the annual Orbis Europe dataset for data on firm balance sheets and their profitability provided by Bureau van Dijk (BvD). This reduces our dataset somewhat, but it still remains large with around 15 million observations included in the regression analysis.

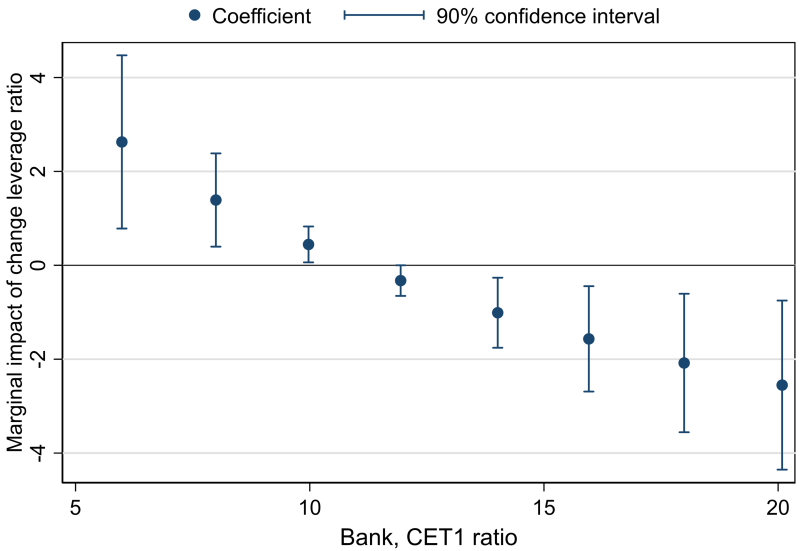

We find that euro area banks tighten their credit standards more when linked to riskier firms, measured via firms’ leverage and default risk. In other words, banks reflect the higher riskiness of the firms they are associated with in their loan approval criteria, in line with what banks themselves also report in the BLS. However, credit standards are tightened less by healthier banks. Specifically, a sound bank capital position implies less tightening of lending criteria, possibly reflecting the fact that banks can afford to adjust their credit standards more moderately (see Figure 2).

Figure 2: Higher firm leverage leading to tighter credit standards for banks with lower capital ratios

(Marginal impact of a change in firms’ leverage ratio, by bank capital ratio)

Notes: The chart shows the marginal impact of a change in firms’ leverage ratios on banks’ credit standards (positive values showing a tightening impact) for different levels of bank capital (CET1) ratios, based on a regression controlling for firm and bank characteristics, and time and country fixed effects (see Section 4, Figure 2, and Table 2 in Faccia at el. (2024)). Coefficients represent the impact of a one standard deviation change of firm leverage ratios in terms of standard deviations of credit standards.

Beyond our baseline analysis of the drivers of banks’ credit standards, we also consider how changes to the macroeconomic environment, namely a change in bank funding costs and an adverse shock to firm health, affect banks’ loan approval decisions.

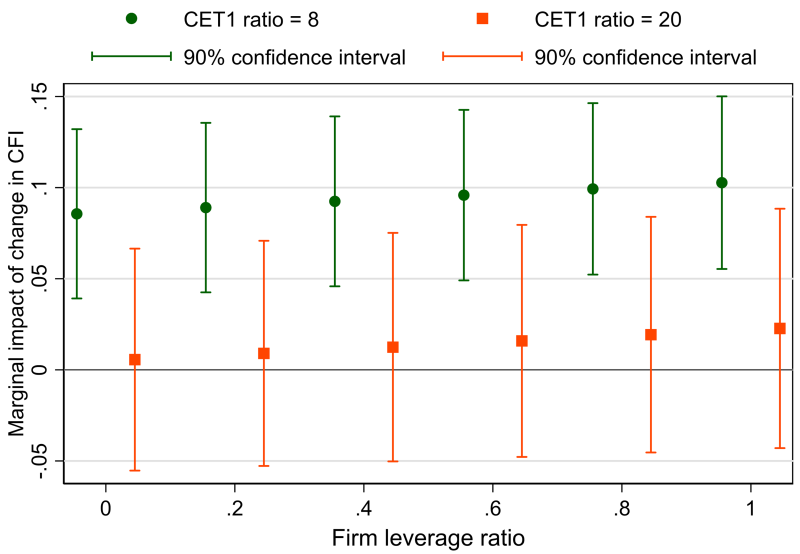

First, we focus on the impact of a change in bank funding costs on banks’ lending decisions, depending on the characteristics of banks and firms. Here we find that less healthy banks, which are less well-capitalised or have higher CDS spreads, tighten their credit standards more in reaction to an increase in their funding costs. This is the case especially if they are linked to weaker firms with higher leverage (see Figure 3; in the paper we also consider direct measures of default risk). Banks with a weaker capital position therefore appear more sensitive to an increase in interest rates, related to their more limited capacity to absorb potential losses. Consequently, weaker firms, especially when linked to weaker capitalised banks, are the ones which face a stronger deterioration of credit conditions in response to an increase in bank funding costs.

Figure 3: Stronger tightening of credit standards in response to higher bank funding costs by banks with lower capital ratios, especially for firms with higher leverage

(Marginal impact of a change in bank funding costs, by bank capital ratio and firm leverage)

Notes: The chart shows the impact of changes in bank funding costs on banks’ credit standards (positive values showing a tightening impact) for different levels of bank capitalisation (green/red) across firm leverage ratios (see Section 5, Figure 4, and Table 3 in Faccia at el. (2024)). Coefficients represent the impact of a one standard deviation change in bank funding costs in terms of standard deviations of credit standards. Based on a regression controlling for firm and bank characteristics, and time and country fixed effects.

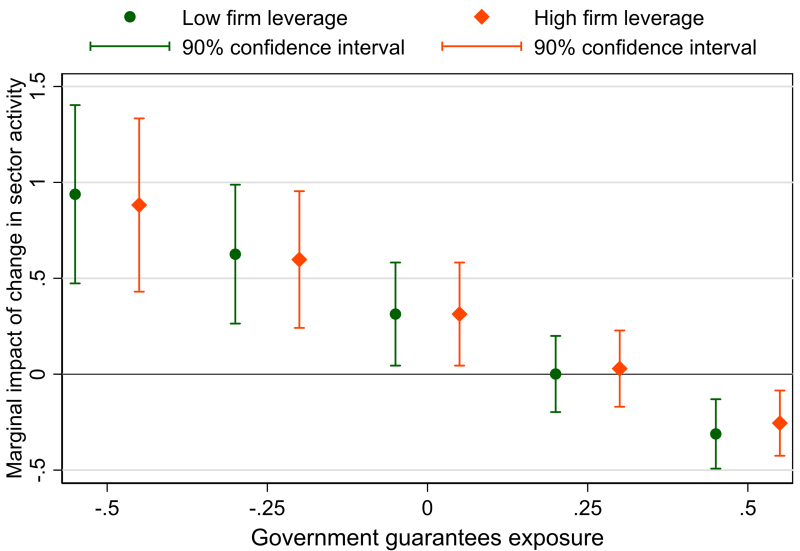

Second, we consider a sudden deterioration in the quality of banks’ corporate loan portfolios. While we study this effect during the COVID-19 pandemic, our results should be relevant as well for other shocks to borrowers’ creditworthiness, for instance due to a sudden rise in input costs. We assess how euro area banks adjusted their credit standards in response to the negative COVID-19 pandemic shock, also taking into account possible mitigating effects owing to government support measures. We find that banks which were more exposed to sectors strongly affected by the pandemic, were more likely to tighten their credit standards, but that indeed the tightening effect was mitigated for banks with a larger exposure to loans backed by pandemic-related government guarantees (see Figure 4).

Figure 4: Stronger tightening of credit standards in response to the COVID-19 pandemic by banks with lower exposure to government guarantees

(Marginal impact of a change in sector activity during COVID-19, by banks’ exposure to guarantees and firm leverage)

Notes: The chart shows how the impact of the COVID-19 pandemic on firms affected banks’ credit standards (positive values showing a tightening impact) across different levels of banks’ exposure to COVID-19 related government guaranteed loans (based on banks’ responses in the BLS) and different levels of firm leverage ratios (‘low firm leverage’ being equal to 25% (green), ‘high firm leverage’ being equal to 75% (red); see Section 6, Figure 5, and Table 4 in Faccia at el. (2024)). Based on a regression controlling for firm and bank characteristics, and time and country fixed effects.

Our paper is closely related to the broader literature investigating the transmission of monetary policy via the bank lending channel. We contribute to this research by relying on a survey-based measure of credit supply, using banks’ qualitative replies in the euro area bank lending survey and combining them with firm-level data. This allows us to consider both the impact of the bank and firm characteristics on credit standards in general, as well as in reaction to changes in interest rates or a sudden change in the macroeconomic environment.

Our paper is related to work by Jiménez et al. (2012), using credit register data from Spain, who find that an increase in interest rates reduces the probability that a loan is granted, and more strongly for less well-capitalised banks. We also expand on the analysis by Altavilla et al. (2021) who show that a short-term interest rate shock decreases both loan supply and demand as measured via individual BLS responses, but more for less healthy banks. In addition, by considering the situation of firms, our work is also closely related to Jiménez et al. (2014) who show that less well-capitalised banks grant more loans to ex ante riskier firms when short-term interest rates decrease. Finally, our results are related to Altavilla et al. (2023) who find for the early phase of the pandemic a stronger reduction in lending for banks with a capital ratio that is closer to the minimum requirement.

Overall, we provide evidence of heterogeneity in the bank lending channel, depending on the situation of the lenders and the borrowers. When deciding on their credit standards, banks assess risks based on both their own loss absorption capacity and the credit risk of their borrowers. This implies that the balance sheet health of both banks and firms matters for bank lending conditions. Understanding the link between bank funding costs, the macroeconomic outlook and banks’ lending policy is very important for conducting monetary policy. This is true especially in the current environment in which central bank policy rates have increased from historically low levels in response to inflation above the ECB’s two percent target, in a context of weak euro area economic growth.

We see two important policy implications. First, while the stronger reaction of weaker banks to changes in their funding costs may indicate higher risk taking in a low interest rate environment, these banks may also be more prudent in their lending decisions when funding costs increase. Second, the results obtained for the pandemic period could potentially be generalised to other negative economic shocks, such as the war in Ukraine and the steep rise in energy prices in 2022. Again, fiscal support has helped firms – and banks – to cope with the adverse economic shock and the sudden deterioration of corporate balance sheets. Still, weaker firms which have borrowed from weaker capitalised banks are the ones which are likely most affected in their capacity to conduct their business and to generate revenues.

Altavilla, C., F. Barbiero, M. Boucinha, and L. Burlon. 2023. “The Great Lockdown: Pandemic response policies and bank lending conditions.” European Economic Review 156: 104478.

Altavilla, C., M. Boucinha, S. Holton, and S. Ongena. 2021. “Credit Supply and Demand in Unconventional Times.” Journal of Money, Credit and Banking 53 (8): 2071-2098.

Faccia, D., F. Hünnekes, and P. Köhler-Ulbrich. 2024. “What drives banks’ credit standards? An analysis based on a large bank-firm panel”. ECB Working Paper No. 2902.

Jiménez, G., S. Ongena, J.-L. Peydró, and J. Saurina. 2012. “Credit supply and monetary policy: Identifying the bank balance-sheet channel with loan applications.” American Economic Review 102 (5): 2301–2326.

Jiménez, G., S. Ongena, J.-L. Peydró, and J. Saurina. 2014. “Hazardous times for monetary policy: What do twenty-three million bank loans say about the effects of monetary policy on credit risk-taking?” Econometrica 82 (2): 463–505.