Exploring the most recent US Small Business Lending Survey reveals that banks tightened their collateral conditions in response to heightened uncertainty, particularly during the Covid-19 Crisis. This tightening of collateral requirements was followed by a contraction in business lending. To assess the implications of collateral requirements shocks on the real economy, I estimate a medium-scale dynamic stochastic general equilibrium model. The model assigns an important role for collateral in the shock decomposition, explaining nearly half of the variance in business credit.

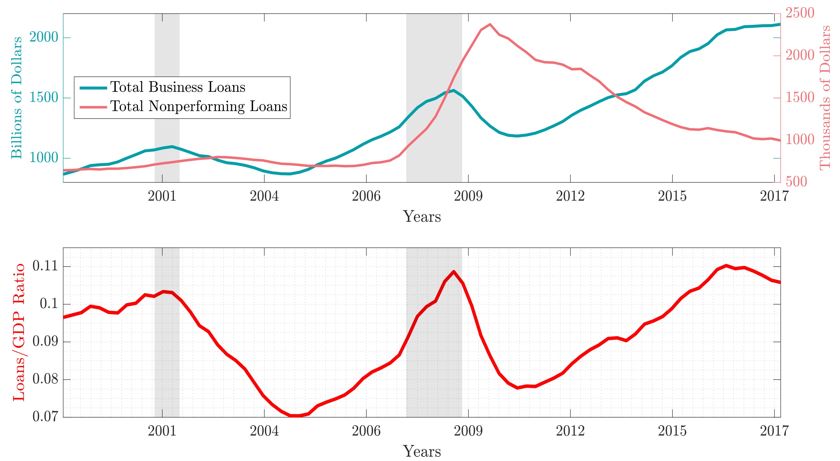

The role of collateral in the financial system has attracted the attention of economists more than ever. The lack of collateral during the global banking crisis of 2008 had a considerable effect on banks’ lending activities. Since then, multiple waves of major bank regulations have been implemented, which affected the way banks evaluate and process collateral. By means of macro-prudential instruments such as borrower-based measures, banks can place stricter conditions, ask for high-quality collateral, and lend less. The total business loans and non-performing loans displayed in Figure 1 highlight the fact that firm debt as a share of GDP decreases substantially following the 07-09 global financial crisis and the 2011 recession. At the same time, firm debt patterns clearly exhibit contraction or slowdown when the level of non-performing loans is very high. This co-movement reflects a common feature of a post-crisis economy when financial institution tend to set a tight (low) loan-to value ratio making borrowing for firms harder.

Figure 1: Total Loans, Nonperforming Loans, and Loan/GDP Ratio

Note: Data from Federal Reserve Economic Data (FRED) (01/04/1998–01/01/2018): Total nonperforming loans for commercial banks (USNP). Total stock of commercial and industrial loans issued by all commercial banks (BUSLOANSNSA) divided by gross domestic product (GDP).

In principle, strict collateral conditions would likely inhibit credit growth when the economic crisis occurs, and this may explain changes in credit supply. To be more clear, a tight collateral requirement (low loan-to-value ratio) reduces credit supply, whereas a collateral requirement relaxation (high loan-to-value ratio) increases credit supply. In either case, credit supply is driven by changes in collateral terms. One can argue that the contraction and expansion of loans over the past decade are due to changes in collateral conditions and that the collateral channel exerts an influence on the economy.

Numerous studies have investigated the implications of macro-prudential tools, including Alpandaa and Zubairy (2017), who emphasize the importance of collateral requirements in addressing household indebtedness. Other papers focus on the regulatory loan-to-value ratio. For example, Lambertini et al. (2013) provide an alternative empirical specification for loan-to-value ratio, which is countercyclically dependent on credit growth, as does (Rubio and Carrasco-Gallego, 2014). Prominent papers by Ottonello and Song (2022) and Mendicino et al. (2020) consider the optimal collateral requirements, while Christensen et al. (2009) examine bank regulatory changes and explore the implication of loan-to-value ratio. Other recent studies include, e.g., Kim and Mehrotra (2018), Franz (2020), Aikman et al. (2021), Martin et al. (2021), Van der Ghote (2021), Drechsel and Kim (2022), and Ottonello et al. (2022).

The existing literature on credit constraints postulates that the scarcity, the quality and amount of collateral that an agent must hold to secure their debt can imply restrictions on financing activities, in a way that induces significant social inefficiency. In particular, Geanakoplos and Zame (2007) claim that market outcomes depend on collateral through many channels. Guerrieri and Lorenzoni (2017) evaluate the channel by which the shock to the borrowing limit propagates to the economy in an incomplete market framework. Justiniano et al. (2015) study the macroeconomic implications of leveraging cycle. Their model accounts for the housing sector and heterogeneity among households. Iacoviello and Pavan (2013) delve into how changes in credit conditions, with high down-payments, have made the recession worse. In a different model with pecuniary externality, Bianchi and Mendoza (2018) find a significant effect of collateral constraints on the real economy.

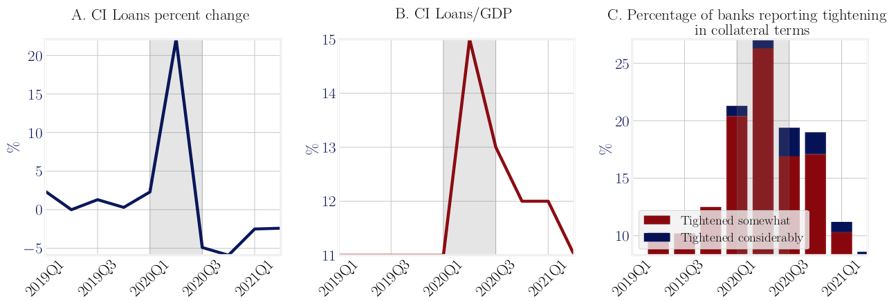

Collateralized Business Loans. Figure 2 presents in detail the tightness of the collateral conditions and the dynamics of business loans, using both aggregate and survey data. According to this data, 27% of surveyed banks reported a tightening of collateral conditions on business loans in the second quarter of 2020,1 signaling a potential decrease in loan-to-value ratio and limited access to credit amid the Covid-19 crisis. The contraction of business lending is perhaps the most common feature of the post-crisis economy. Yet, the uncertainty and deterioration of borrower’s condition could lead to changes in collateral conditions, causing a sharp business credit crunch for a long period of time.

Figure 2: Collateral Requirements Amid the Recession

Note: Data from Federal Reserve Economic Data (FRED) and the Small Business Lending Survey from the Federal Reserve Bank of Kansas City.

Additionally, credit supply to the business sector experienced a remarkable increase in the second quarter of 2020, even though banks report a tightening in collateral conditions. Note that over the course of the pandemic, the US government provides financial relief to firms in an effort to support firms with depressed revenues and preserve small business resilience. Zooming at the dynamics of credit supply after the recession, there is a large decline in loan supply, which might be linked to the tightness in collateral conditions, as banks reporting tighter collateral conditions were the highest. The contraction in credit supply to firms is in line with the observation in Figure 1, which depicts the fluctuation in credit supply between 1998 and 2018. However, it is hard to tell if the collateral conditions were tighter after the panic of 2007-2009 because there is no such available information during the global financial crisis. Despite that the global financial crisis and the covid-19 crisis differ substantially in terms of characteristics and origin, they share a common feature which is the drop in firms borrowing. Departing from Figure 2 it is clear that the decline in business loan supply after the Covid-19 recession is associated with more banks reporting tighter collateral terms.

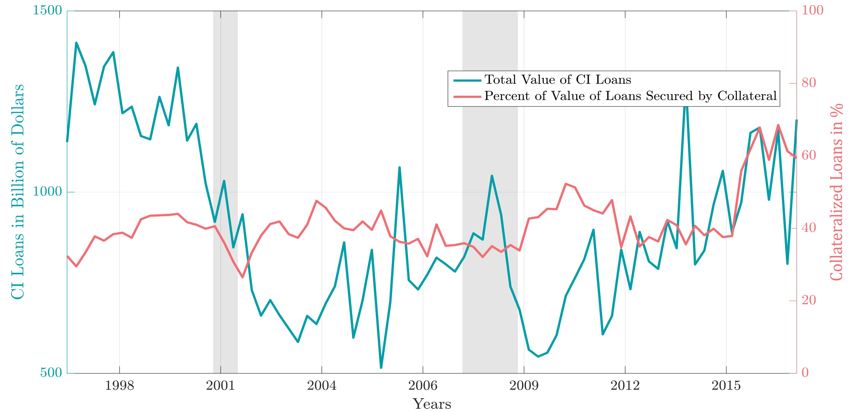

Understanding the Macroeconomic Effects of Collateral Requirements. To argue that the collateral channel itself is economically significant. I now turn to explore how important collateralized debt might be. Figure 3 shows the percentage of loans secured by collateral and the volume of loans. The share of secured loans continuously increases to reach more than 60% of total business loans in 2017. This tendency does not necessarily lead to a drop or a rise in lending activity; however, one may argue that banks tend to prefer and approve loans that are secured by collateral, as they can recover the pledged asset in case of default. Furthermore, there are two events in 2008 and 2014 with a surge in loan supply, while the level of collateralized loans remains the same. Between 2009 and 2013, the percentage of loans approved by banks that were secured by collateral varied between 40% to 50%. An increase in the share of asset-based lending reflects that business assets can be leveraged to secure the loan. As shown in Figure 2, banks tend to set tighter collateral conditions during uncertain times.

Figure 3: Loans with Pledged Collateral

Note: This survey data is retrieved from FRED, Federal Reserve Bank of St. Louis. The “Survey of Terms of Business Lending” reports a quarterly collection of quantitative and qualitative information on bank lending to small businesses.

To support the case, I explore the implications of borrower’s side collateral constraints on the real economy. Entrepreneurs, which are collateral constrained, face a shock to the amount of revenues that a bank can recover after a default. I use US aggregate data to estimate the medium-scale DSGE model with collateral shock and a non-fundamental component in the price of capital model over the period 1998-2018. I analyze the economy model through the shock decomposition of the entire time horizon 1998–2018 with all shocks included. The main finding of the analysis is that collateral requirements are an important source of aggregate fluctuations in the model. The shock accounts for 48% of fluctuations in external financing, 36% of the variance of capital price, and 26% of the variance of net worth. This is technically expected since the shock to collateral constraints affects mainly the financial sector.

Typically, the changes in the collateral requirement are interpreted as a shock to collateral constraints and the amount of revenues that a bank can recover after a default. When there is an exogenous increase in collateral requirements (relaxing the collateral constraint), the demand for collateral increases, and collateral price can be expected to rise, subsequently boosting investment and output. On the other hand, a tightening of the borrowing constraint can lead to an inability to channel efficiently capital to firms, as well as putting a strain on available capital for investment, leading to a decline in output.

Policy Implications. Some policy implications can be drawn from this study. First, the objective of banks’ collateral policies is to control and avoid damages that may come from unsecured loans and improve bank stability. If banks foresee a high risk originating from some segments of the economy, such as the high level of loan charge-offs, then banks would be concerned about the liquidity of the collateral and will scramble for better collateral. Banks tend to tighten their collateral requirements during uncertain times, causing a drop in credit supply. Second, a tight loan-to-value ratio that puts downward pressure on credit supply, induces collateral price deflation, causing a general decline in investment and output. Finally, the lack of collateral can amplify the severity of financial distress. Financial regulators can intervene using borrower-based macroprudential instruments that can potentially support collateral markets and mitigate the consequences of the disruption in the financial system.

Aikman, D., Kelly, R., McCann, F., and Yao, F. (2021). The Macroeconomic Channels of Macroprudential Mortgage Policies. Financial Stability Notes, Central Bank of Ireland., 11.

Alpandaa, S. and Zubairy, S. (2017). Addressing Household Indebtedness: Monetary, Fiscal or Macroprudential Policy? European Economic Review, 92:47–73.

Bianchi, J. and Mendoza, E. G. (2018). Optimal Time-consistent Macroprudential Policy. Journal of Political Economy, 126(2):588–634.

Christensen, I., Corrigan, P., Mendicino, C., and Nishiyama, S.-I. (2009). Consumption, Housing Collateral, and the Canadian Business Cycle. Bank of Canada Working Paper, 26.

Drechsel, T. and Kim, S. (2022). Macroprudential Policy with Earnings-based Borrowing Constraints.

Franz, T. (2020). The Effects of Borrower-Based Macroprudential Policy: An Empirical Application. International Journal of Central Banking, 64.

Geanakoplos, J. and Zame, W. R. (2007). Collateralized Asset Markets. Discussion Paper, Yale University.

Guerrieri, V. and Lorenzoni, G. (2017). Credit Crises, Precautionary Savings and the Liquidity Trap. Quarterly Journal of Economics, 132(3):1427–1467.

Iacoviello, M. and Pavan, M. (2013). Housing and Debt Over the Life Cycle and Over the Business Cycle. Journal of Monetary Economics, 60(2):221–238.

Justiniano, A., Primiceri, G., and Tambalotti, A. (2015). Household Leveraging and Deleveraging. Review of Economic Dynamics, 18(1):3–20.

Kim, S. and Mehrotra, A. (2018). Effects of Monetary and Macroprudential Policies—Evidence from Four Inflation Targeting Economies. Journal of Money, Credit, and Banking, 50(5):967–992.

Lambertini, L., Mendicino, C., and Punzi, M. T. (2013). Leaning Against Boom–bust Cycles in Credit and Housing Prices. Journal of Economic Dynamics & Control, 37.

Martin, A., Mendicino, C., and Van der Ghote, A. (2021). On the Interaction between Monetary and Macroprudential Policies. ECB Working Paper Series, 2527.

Mendicino, C., Nikolov, K., Rubio-Ramirez, J., Suarez, J., and Supera, D. (2020). Twin Defaults and Bank Capital Requirements. Working Paper.

Ottonello, P., Perez, D. J., and Varraso, P. (2022). Are Collateral-constraint Models Ready for Macroprudential Policy Design? Journal of International Economics, page 103650.

Ottonello, P. and Song, W. (2022). Financial Intermediaries and the Macroeconomy: Evidence from a High-Frequency Identification. Working Paper.

Rubio, M. and Carrasco-Gallego, J. A. (2014). Macroprudential and Monetary Policies: Implications for Financial Stability and Welfare. Journal of Banking & Finance, 49.

Van der Ghote, A. (2021). Interactions and Coordination between Monetary and Macroprudential Policies. American Economic Journal: Macroeconomics, 13(1):1–34.

See the recent release of the Small Business Lending Survey – Aggregate Data (Section D.2) from the Federal Reserve Bank of Kansas City.