References

Beeson, M. (2010). The coming of environmental authoritarianism. Environmental politics 19(2), 276–294.

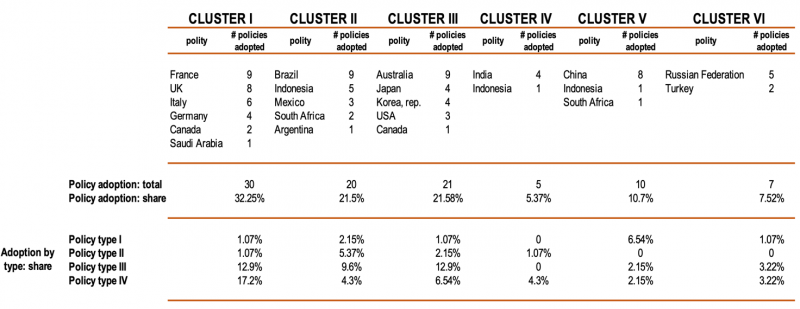

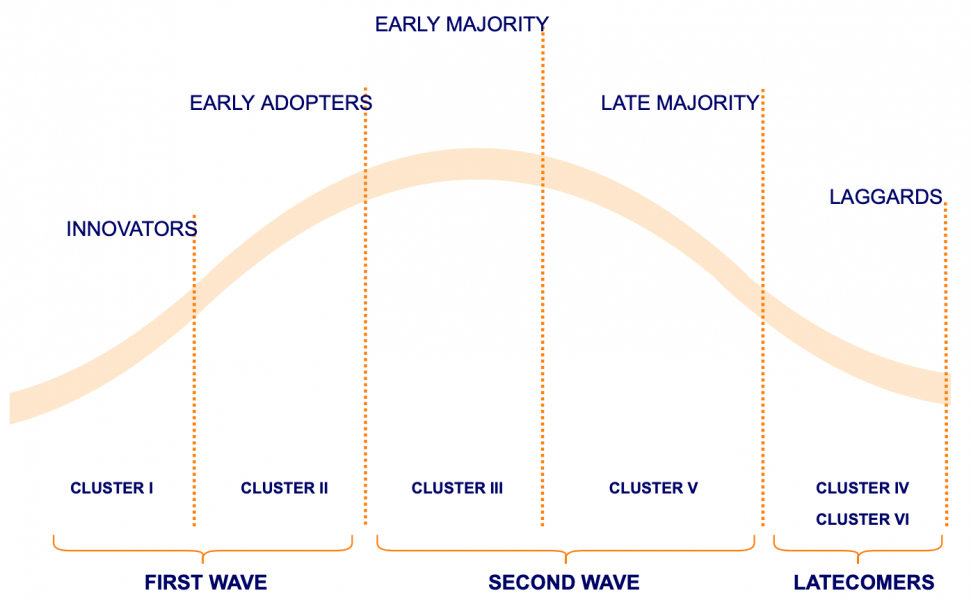

D’Orazio, P. (2021a). Mapping the emergence and diffusion of climate-related financial policies: evidence from a cluster analysis on G20 countries, International Economics, https://doi.org/10.1016/j.inteco.2021.11.005.

D’Orazio, P., (2021b) Towards a post-pandemic policy framework to manage climate-related financial risks and resilience, Climate Policy, DOI: 0.1080/14693062.2021.1975623.

Gilley, B. (2012). Authoritarian environmentalism and china’s response to climate change. Environmental politics 21(2), 287–307.

Lema, R., X. Fu, and R. Rabellotti (2020). Green windows of opportunity: latecomer de- velopment in the age of transformation toward sustainability. Industrial and Corporate Change 29(5), 1193–1209.

Li, X., X. Yang, Q. Wei, and B. Zhang (2019). Authoritarian environmentalism and environmental policy implementation in China. Resources, Conservation and Recycling 145, 86–93.

Pegels, A. and T. Altenburg (2020). Latecomer development in a “greening” world: Introduction to the special issue. World Development 135, 105084.

Unruh, G. C. (2000). Understanding carbon lock-in. Energy policy 28(12), 817–830.

Van der Meijden, G. and S. Smulders (2017). Carbon lock-in: the role of expectations. International Economic Review 58(4), 1371–1415.