The views expressed are strictly ours and do not necessarily reflect the views of the Bank for International Settlements.

We explore under what circumstances increases in US Treasury yields spill over into declines in emerging market economy (EME) asset prices. We identify episodes of sharp increases in US 10-year Treasury yields and explore under which conditions these are associated with reductions in EME local currency yields, exchange rates and equity prices. We find that rising US yields are more likely to go hand in hand with adverse outcomes in emerging markets when they reflect (i) a rise in the US term premium, (ii) dollar appreciation and (iii) rising EME inflation expectations. The effects of these variables are highly non-linear and economically significant as well as robust to a variety of sensitivity checks.

What happens to emerging market economies (EMEs) when US yields go up? This is a recurring question in policy-making circles whenever US yields increase. The financial press then gets flooded with headlines such as “The Bernanke panic”, “EM currencies on the ropes as 10-year bond yield tops 3.1%” and “Which emerging markets are most exposed to a Treasury tantrum?”.

The last two decades, however, show that sharp increases in US yields can have very different effects on EMEs. The 2013 taper tantrum resulted in a significant retrenchment of investors from EME assets, leading to sharp depreciations of exchange rates, drops in asset prices and large capital outflows. But in most cases, for instance during the rapid increase in US long-term yields after the Covid-19 pandemic, spillovers were negligible. In Caballero and Upper (2023) we explore the reasons behind these differences.

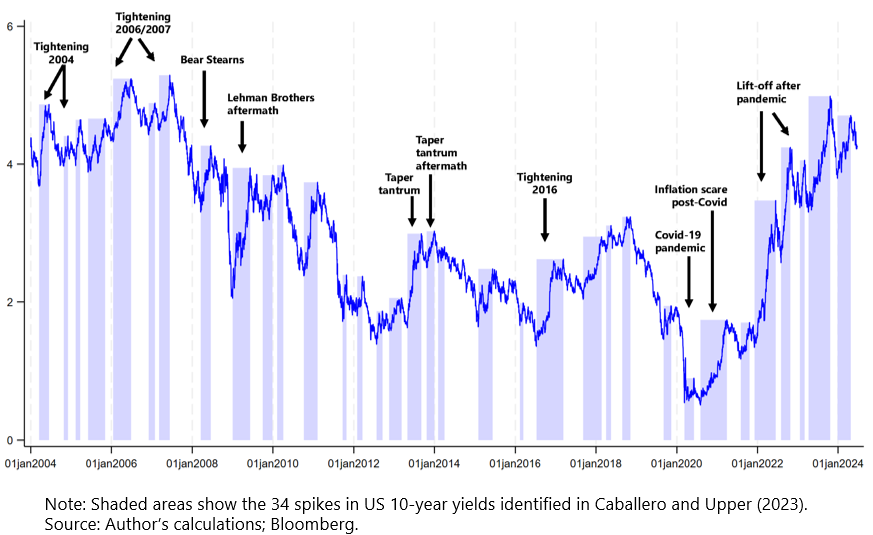

We identified all episodes of rapid increases in US 10-year Treasury yields between January 2004 and June 2024. The identification only depends on the time series of yields and not on why they went up or what impact this had. This resulted in 34 episodes (Graph 1), which we term “yield spikes” and which form the basis of our analysis. For each of the episodes of yield increases, we then computed the start to peak changes in local-currency (LC) bond yields, the exchange rate, and equity prices in a set of 17 EMEs.

Graph 1. Sample of yield spikes in 10-year Treasuries 2004-2024

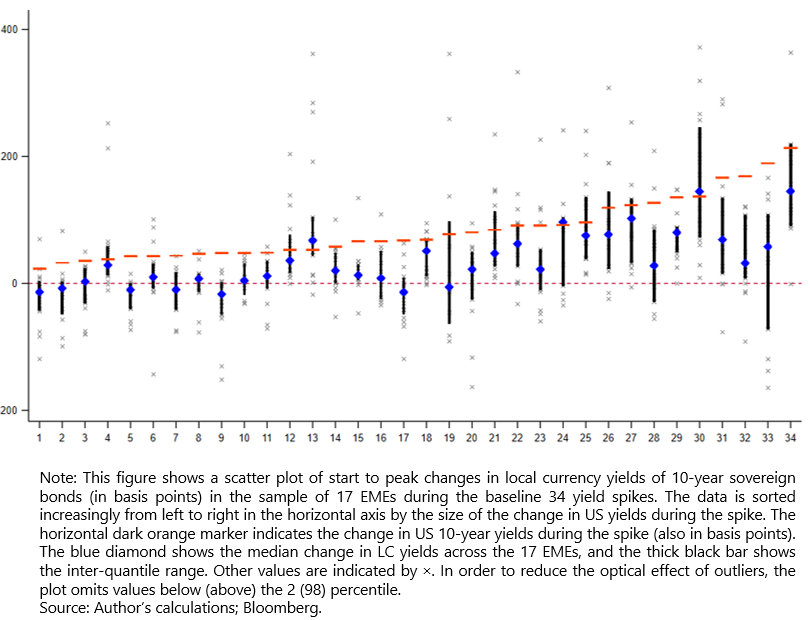

In our set of US yield spikes, EME LC yields went up during most spikes, but not in all. And even when they went up, they mostly increased less than one-for-one with US yields (Graph 2). Only three out of the 34 yield spikes in the baseline sample did the median change in LC yields exceed the rise in US yields (ie blue diamonds above the horizontal dark-orange markers). And larger US yield spikes did not necessarily result in larger increases in EME LC yields. The results for the other EME asset prices are similar.

This, however, does not mean that EME asset prices are immune to rapid increases in US yields. Some yield spikes are associated with very negative outcomes in EMEs, but the question is why these and not others.

Graph 2. Changes in local currency yields in EMEs during US yield spikes

In the main part of the analysis in Caballero and Upper (2023), we relate the changes in EME asset prices to a large set of possible drivers. We grouped these into five categories: (i) characteristics of the yield spike itself, (ii) changes in global financial conditions and risk appetite, (iii) changes in US financial conditions during the yield spike, (iv) US macroeconomic conditions at the start of the yield spike, and (v) domestic conditions in EMEs, including indicators for financial imbalances and for macroeconomic fundamentals. We had a total of 30 explanatory variables. To allay concerns about inference with a reduced number of degrees of freedom, we employed the recently-developed covariate selection techniques from (Belloni et al, (2016)) that are specifically designed for making valid inference in settings with a high number of covariates.

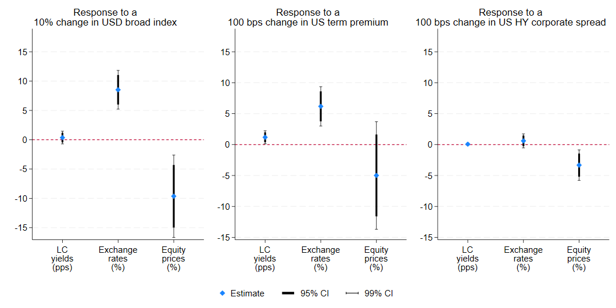

We found that changes in EME asset prices are related to a surprisingly small number of key variables, above all the US term premium and the value of the US dollar against a broad basket of currencies (Graph 3). A 100 basis points (bps) increase in the US term premium is correlated with a 6 percent EME currency depreciation. Similarly, a 10 percent appreciation of the US broad dollar index is associated with a currency depreciation in EMEs of about 9 percent and a similarly-sized fall in equity prices. This goes well beyond the mechanical effect of currencies being included in the broad dollar index, both because of the size of the dollar decline and the fact that the vast majority of countries in our sample are relatively minor trading partners of the United States and thus have small or zero weights in the index. A 100 basis points increase in high-yield corporate spreads during a yield spike is correlated with a fall of about 3 percent in equity prices across EMEs. For reference, the average change in these variables across the sample of US yield spikes is as follows: 53 bps for the US term premium, a small appreciation of the US dollar broad index (0.3 percent change), a fall in high-yield corporate spreads of 103 bps.

Graph 3. Baseline results

It is not clear what drives the prominent role of the US term premium. It could be related to US unconventional monetary policy, which played an important role during most of our sample and tends to affect long term yields by compressing the term premium (Curcuru et al, 2018). Increases in the US term premium may also spill over to EMEs by increasing risk perceptions of global investors, as in the narrative of Kalemli-Ozcan (2019), or by increasing term premia in EMEs, as documented by Albagli et al. (2019) around FOMC announcement days. That said, the precise mechanisms are not clear.

The important role of the US dollar exchange rate is very much in line with the existence of a risk-taking channel of the exchange rate and an important role for the value of the US dollar (Bruno and Shin (2015), Avdjiev et al (2019) and Obstfeld and Zhou (2022)).

Somewhat surprisingly, EME fundamentals seem to matter little. Ratings or rating changes and the level of international reserves do not appear to matter at all. Current account deficits and large equity portfolio flows before the yield spike are associated with steeper falls in equity prices, but not with changes in exchange rates or LC yields. Revisions in the consensus forecasts for growth and inflation only enter significantly in some of the regressions. Only higher levels of domestic inflation are robustly associated with worse EME outcomes, except for LC yields. That said, EME asset prices tend to be associated with increases in domestic policy rates. This probably reflects reverse causality: EME central banks increase interest rates in response to adverse outcomes. That said, at the moment we do not have the means to test for this.

Our results are robust to several checks, including dropping influential yield spikes, such as the taper tantrum, using longer window sizes and alternative estimation procedures and extending the sample back to the 1990s.

In the paper we also complement our baseline outcome-by-outcome analysis by combining LC yields, exchange rates and stock prices into a single measure for the severity of EME outcomes: the number of variables with realisations in the (adverse) tail of the distribution (“co-exceedances”). We model the number of joint negative realisations (ie the number of co-exceedances) via a multinomial logistic approach and find the likelihood of moving from a bad outcome in one variable to bad outcomes in several variables increases rapidly as the change in the US term premium or appreciation of the dollar steepens. Interestingly, those effects are highly non-linear.

Albagli, E, L Ceballos, S Claro and D Romero (2019): “Channels of US monetary policy spillovers to international bond markets”, Journal of Financial Economics, 134 (2), 447–473.

Avdjiev, S, W Du, C Koch and H S Shin (2019): “The dollar, bank leverage, and deviations from covered interest parity”. American Economic Review: Insights, 1(2), 193–208.

Belloni, A, D Chen, V Chernozhukov, and C Hansen (2016): “Inference on Treatment Effects after Selection among High-Dimensional Controls”. The Review of Economic Studies, 81 (2), 608–650.

Bruno, V and H S Shin (2015): “Capital flows and the risk-taking channel of monetary policy”, Journal of Monetary Economics, 71, 119–132.

Caballero, J and C Upper (2023): “What happens to EMEs when US yields go up?”, BIS Working Papers, No 1081, March.

Curcuru, S E, S B Kamin, C Li and M del Giudice-Rodríguez (2018): “International Spillovers of Monetary Policy: Conventional Policy vs. Quantitative Easing”, Board of Governors of the Federal Reserve System, International Finance Discussion Papers, 1234.

Kalemli-Özcan, S. (2019): “US Monetary Policy and International Risk Spillovers”, CEPR Discussion Papers, No 14053.

Obstfeld, M and H Zhou, (2022): “The global dollar cycle”, Brookings Papers on Economic Activity, Conference draft, The Brookings Institution.