Macroeconomic dynamics strongly depend on expectation processes. Monetary policy consists for a large part in managing inflation expectations of different agents (households, firms, professional forecasters). It is therefore of utmost importance for central bankers to know the strength of informational frictions that affect inflation expectations within and across different categories of economic agents.

These informational frictions can be characterized by the frequency of forecast revisions and cross-sectional disagreement in inflation expectations (see among others Andrade and Le Bihan, 2013, Andre et al., 2022, Coibion and Gorodnichenko, 2012, 2015, Link et al., 2021, Savignac et al., 2021). Because the cost of collecting and processing information may be different for individuals, the strength of information frictions within and across various categories may vary dramatically.

In a recent study (Cornand and Hubert, 2022), by harmonizing the characteristics of different surveys to make them as comparable as possible, we compare the frequency of inflation forecast revisions and the cross-sectional disagreement in inflation expectations among five categories of agents: households, firms, professional forecasters, policymakers and participants to laboratory experiments.

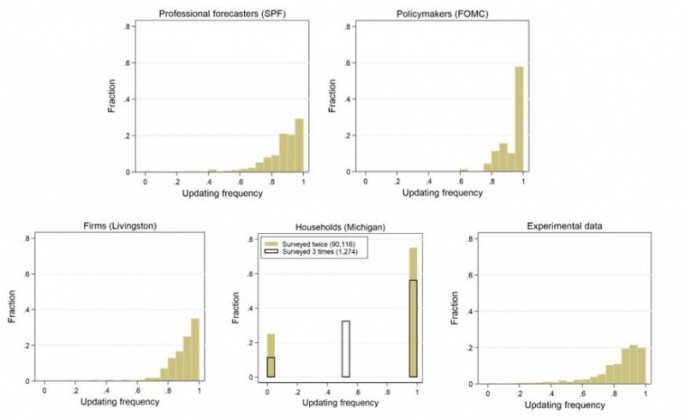

We document a strong heterogeneity in the frequency of forecast revisions across the five categories of agents, with policymakers revising more frequently than participants to laboratory experiments, firms and professional forecasters, who themselves revise much more frequently than households. We also show that the volatility of inflation shocks are found to be an important driver of the frequency of forecast revisions, suggesting that inflation dynamics play the role of an attention shock to agents.

More specifically, Figure 1 presents the distribution of individual frequency of forecast revisions for each category of agents. A vast majority of policymakers revise with probability 1, while only a few revise their forecast much less. Regarding professional forecasters and firms about 30% revise with probability 1, while the large majority revises their forecast with a probability between 0.6 and 1. A disclaimer applies to the Michigan survey: in this survey, households are only observed twice or thrice and then are dropped out of the sample, so no proper comparison can be made with other categories of agents. However, it is possible to compare within this survey what happens when households are surveyed twice rather than thrice. More than 20% of households who are observed twice do not revise their forecast, while a bit less than 80% revise with probability 1. The proportion of individuals not revising is smaller when households are observed thrice, as about 30% of them revise with probability 0.5. Finally, the distribution of the frequency of forecast revisions for participants to experiments has a shape that resembles that of professional forecasters and firms. To summarize, there is some heterogeneity in the frequency of forecast revisions across the five categories of agents, but, except for the households (and for the reason above-mentioned), there is a relative homogeneity in the frequency of revisions within each category of agents.

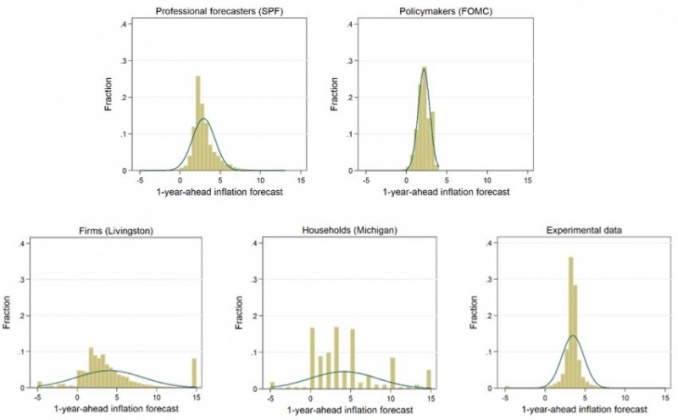

We also provide evidence of disagreement within all categories of agents, although there is a strong heterogeneity across categories: while policymakers, professional forecasters and participants to experiments exhibit low disagreement, firms and households show strong disagreement. More specifically, Figure 2 presents the distribution of inflation expectations across the different categories of agents. The distribution of inflation expectations is flatter for firms and households than for policymakers and professional forecasters. The distribution of inflation expectations of participants to experiments is more consistent with that of policymakers and professional forecasters than with that of firms and households.

Figure 1: Individual frequency of forecast revisions

Note: These subfigures show the distribution of the average, by individual, of his/her frequency of forecast revisions. For the Michigan survey, because we observe individuals only 2 or 3 times, they can either not revise (so the updating probability P=0), revise 1 over 2 times (P=0.5) or revise all the time (P=1).

Figure 2: Distribution of inflation expectations

Note: These subfigures show the distribution of inflation forecasts for each dataset truncated at -5% and 15%, with the fraction that represents each bin on the y-axis. The blue line represents the normal density approximation.

What lessons can we draw from these observations? Our results provide insights in terms of macroeconomic theory, survey design, external validity of macroeconomic experiments, and central bank communication.

While a frictionless model would predict no disagreement and a continuous frequency of forecast revisions for all agents, there is evidence of limited probability adjustment and disagreement, which plaids in favor of models of information friction. In terms of interpretation, the study allows us to shed light on the quantitative relevance of two theories of information friction. First, the sticky information model is rejected, on the grounds (i) the frequency of forecast revisions evolves over time, (ii) this frequency is affected by the variance of inflation, (iii) disagreement among forecasters who update their forecast is non-null, and (iv) disagreement is not positively affected by inflation shocks. By contrast, these elements are compatible with the noisy information model. The fact that the frequency of forecast revisions is affected by the conditional variance of inflation is especially in favor of the noisy information model.

By considering five categories of agents, we give a broader view on information frictions than the sole comparison between firms and households on which the literature recently focused. Avoiding the magnifying glass effect associated with the opposition between firms and households, we observe that there is more difference between firms and households on the one hand and policymakers, professional forecasters, and participants to experiments on the other, than between firms and households themselves.

Some heterogeneity in information frictions across different field groups has to be accounted for in macroeconomic models, as different categories of agents may respond to shocks, monetary policy or fiscal policy in a different manner. Moreover, it is particularly important to account for heterogeneity within categories of field agents in macroeconomic models, especially for households, but also professional forecasters.

To deal with differences in data sources and make these data as comparable as possible, in our analysis we provide robustness tests of our findings to an adjusted frequency to a comparable time unit (since in the different surveys the considered data have different frequencies of observations). To circumvent the concern about the nature of the underlying units of the inflation forecast (the fact that, in the Michigan survey, households are requested to formulate their forecasts using integer values, while this is not the case for our other categories of agents), we also standardize the threshold for a forecast revision to an integer value (rounding all forecasts of policymakers, professional forecasters and firms to the closest integer value and re-computing the frequency of forecast revisions). Finally, we also check robustness about growth rate rounding (to deal with the potential concern that in the Livingston survey participants form forecasts about the price level rather than its growth rate).

The challenges encountered in an attempt to compare different datasets of inflation expectations can serve as a basis to design surveys that allow to more properly test and quantify theories of information frictions. In particular, individuals should be interviewed repeatedly (at least more than twice), the inflation rate (rather than the CPI level) should be elicited directly, and decimal-point precision levels should be asked for. Finally, it is also important to harmonize the frequency at which surveys are conducted.

Laboratory experiments are increasingly used to test the predictions of macroeconomic models or their assumptions. Establishing the external validity of experimental inflation forecasts is essential if laboratory experiments are to be used as decision-making tools for monetary policy. Conclusions that can be drawn from experiments would only be valid if the experimental expectations present similarities with those observed in field data – in particular regarding information frictions. While crucial for laboratory experiments to be useful for policymakers, the issue of the external validity of experimental inflation expectations has not been much studied.

By considering experimental data in the data set, we are able to explore the external validity of experimental inflation expectations in terms of frequency of forecast revisions and disagreement relative to four categories of field expectations. The results of our study question this external validity: in terms of disagreement, the behavior of participants to experiments is closer to that of central bankers; in terms of frequency of forecast revisions, the behavior of participants to experiments is relatively close to that of professional forecasters or firms. Yet, the comparison between experimental and field data can be valuable for experimenters to improve the design of their macro-experiments in order to mimic real world situations.

In terms of policy implications, our study may inform central banks about the public they should target to improve their communication strategy in order to cope with information frictions, both within and across categories of economic agents. In particular, acknowledging the size of disagreement within and across each category of agents (implying that the information released by the central bank may not reach all categories of agents and also all agents within each category in the same manner), targeted communication towards each category and towards specific groups of agents (presenting the same characteristics) within each category might represent a useful tool.

Andrade, P., Le Bihan, H., 2013. Inattentive professional forecasters. Journal of Monetary Economics 60 (8), 967–982.

Andre, P., Pizzinelli, C., Roth, C., Wohlfart, J., 2022. Subjective Models of the Macroeconomy: Evidence from Experts and Representative Samples. Review of Economic Studies, forthcoming.

Cornand C., Hubert, P., 2022. Information Frictions across various types of Inflation Expectations. European Economic Review 146, 104175.

Coibion, O., Gorodnichenko, Y., 2012. What Can Survey Forecasts Tell Us About Informational Rigidities? Journal of Political Economy 120 (1), 116–159.

Coibion, O., Gorodnichenko, Y., 2015. Information Rigidity and the Expectations Formation Process: A Simple Framework and New Facts. American Economic Review, 105 (8), 2644–2678.

Link, S., Peichl, A., Roth, C., Wohlfart, J., 2021. Information Frictions Among Firms and Households. CESifo Working Paper, No. 8969.

Savignac F., Gautier, E., Gorodnichenko, Y., Coibion, O., 2021. Firms’ Inflation Expectations: New Evidence from France”, Working Paper Banque de France, No. 840.