This SUERF policy brief is based on speech held by Denis Beau, First Deputy Governor of the Banque de France, at the EUROCLEAR “CMU and Innovation” Conference, October 2024.

Abstract

This policy brief puts at the forefront the evolving role of post-trade infrastructures in Europe amidst rapid technological advancements and increasing global financial competition. It highlights the need for Europe to leverage its financial infrastructure to support key economic transitions, particularly in the areas of digitalisation and climate finance. The brief outlines the role of the Eurosystem in adapting its central bank money and associated infrastructures services, especially through the provision in the short run of a wholesale Central Bank Digital Currency (CBDC) to support payment processes for tokenised assets. The creation of a European Unified Ledger is proposed as a long-term solution to foster European financial sovereignty and market integration. It also stresses the importance of cooperation between public and private sectors, and the need for timely action to ensure a successful transition to the post trading landscape that contributes to the sovereignty and competitiveness of our financial system.

In a tougher and more fragmented world, an increasing body of analyses and reports are identifying Europe’s vulnerabilities – especially in the economic and financial sphere – and proposing ways of remedying these by leveraging and consolidating our key competitive advantages.

These levers include Europe’s financial firepower, which is not currently commensurate with its economic heft, even though it has to contend with major investment requirements for two necessary transformations in the digital and climate spheres that hold immense promise for the future.

From this perspective, the post-trading industry has a key role to play in harnessing these new digital technologies and processes which are developing before our eyes and transforming our financial system.

From my perspective as a central banker, tasked with overseeing the efficiency and security of the post-trading infrastructures that are so crucial to the stability of our financial system, these innovations constitute both opportunities and risks. Their deployment therefore raises strategic and operational questions that we need to answer collectively if we are to ensure that tomorrow’s post-trading infrastructures safeguard the competitiveness and sovereignty of our financial system, while maintaining the stability that the legislator has tasked us with preserving.

This raises the following two questions in particular:

To help move the debate over the potential solutions forward, I would like to talk about how we at the Banque de France see both the development of our service offering in terms of assets used to settle transactions and infrastructure that can help to shape the post-trading environment of tomorrow, and the cooperation arrangements and priorities that need to be established to ensure a smooth transition to this new environment.

To perform its financial stability mandate with regard to post-trading infrastructures, the Eurosystem uses three instruments: the provision of services, supervision and boosting market initiatives.

Within this toolbox, the provision of services has long played a key role. This has meant that infrastructure services T2 and T2S and central bank money take centre-stage in the functioning of our financial system for settling exchanges between intermediaries.

To preserve this central role, because of its benefits in terms of stability, in the face of the new infrastructures and settlement assets that may emerge with the increasing use of tokenisation and new digital technologies, our conviction at the Banque de France is that these services must evolve to support and promote transformations in the post-trading ecosystem that will deliver gains in efficiency and sovereignty, while preserving stability. This is why we have been engaged for several years in an ambitious experimentation programme, both in-house and within the Eurosystem.

In the short and medium term, extending the Eurosystem’s range of services to meet market needs and the challenge of European sovereignty

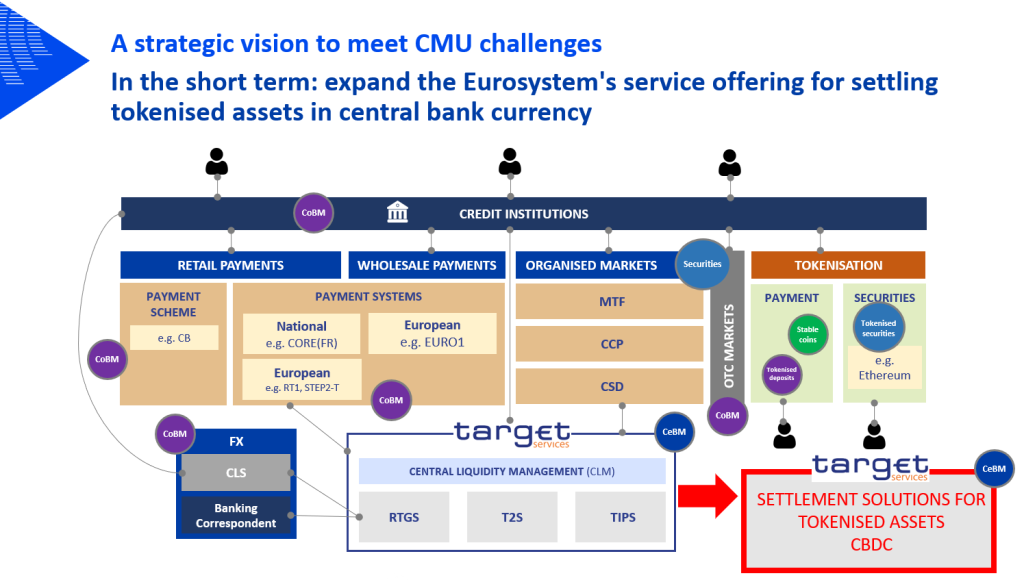

TARGET services currently provide efficient settlement infrastructures capable of covering a broad range of use cases. However, the growing importance of tokenisation and new technologies mean that this offering needs to be adapted and extended to cater to emerging market expectations. In the course of our experiments – both at national level and within the Eurosystem – we have actively collaborated with a wide range of private players, whose firm commitment has demonstrated their keen interest in these innovations, with a variety of objectives in mind, such as lower costs, better integration of products in the market or expanding into cross-border transactions.

In the light of past and current research, one approach would be to expand the service offering to guarantee the availability of a settlement asset in central bank money covering the new use cases related to the tokenisation of financial instruments, especially through the use of central bank digital currency (CBDC). This approach would meet the immediate needs of the market while safeguarding the role of central bank money as the predominant settlement asset for exchanges between financial intermediaries.

Time will be of the essence when implementing this change. Without a strong enough signal, there is a risk that non-European financial players will seize the initiative and impose their own settlement solutions, especially given the advantage conferred by being the ‘first-mover’. In addition to using settlement assets that are less secure than central bank money, this could lead the market to shift towards international financial centres offering advanced functionalities, to the detriment of the European market. Consequently, the responsiveness of both public and private players will be decisive, and the ability to rapidly deploy a given settlement solution – even one that just satisfies immediate needs in the short term – will be critical.

This first step would pave the way for a more long-lasting and robust solution. This would not only guarantee monetary sovereignty, it would also be a decisive factor in bolstering the euro’s international role.

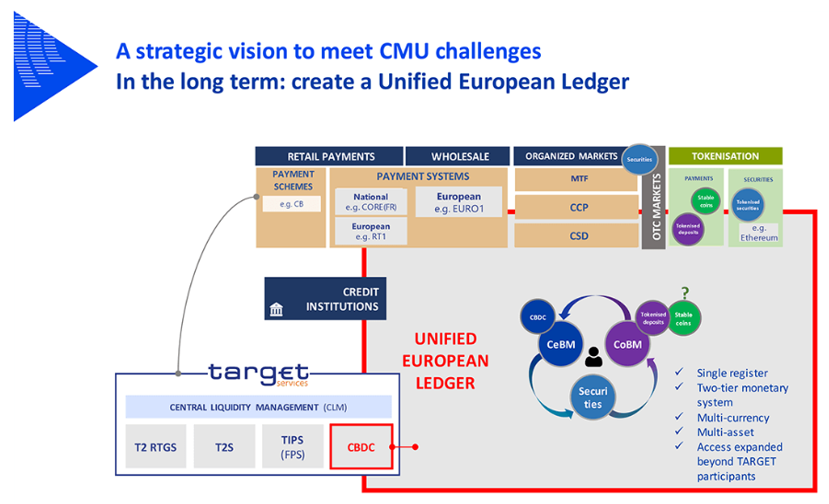

In the long term, creating a European Unified Ledger to integrate tokenised financial assets and settlements

Looking beyond this short-term solution, we need to develop a longer-term vision: that of a fully integrated European market structure capable of supporting the development of financial markets over the coming decades. For this purpose, the concept of a Unified Ledger is a logical way forward for the initial CBDC and tokenisation initiatives. It would enable settlement assets in central bank money and commercial bank money and tokenised financial assets to be grouped together in the same register, underpinned by strong European governance, possibly shared between the public and private sectors, as is currently the case for the T2S system, for example.

In this way, DLT technology and tokenisation can act as catalysts in a major transformation to a unified platform for tokenised assets that would mitigate the risks of fragmentation that could arise from multiple market DLTs.

A European Unified Ledger could therefore be a strategic lever for strengthening the integration of European financial markets and helping to consolidate Europe’s financial sovereignty. It could be developed alongside existing infrastructures, while being connected to them, with market needs ultimately determining their respective importance.

As we move into a new phase in the modernisation of our market infrastructures, regardless of the landscape that emerges, it is also essential to ensure a successful transition to the post-trading environment of tomorrow. This transition must be based not only on technological innovation, but also on enhanced cooperation between market participants and public authorities. In my view, the success of this modernisation will depend on our ability to synchronise our efforts and establish clear, shared priorities.

Consolidating experiments and strengthening cooperation between market participants

To ensure a smooth transition to the post-trading world of tomorrow, it is crucial to consolidate the experiments currently underway and to maintain cooperation. This starts with a shared vision – particularly at French financial sector level – of the future of market infrastructures. The work of the financial sector infrastructure group (GIP – Groupe des Infrastructures de Place) under the aegis of the Banque de France can play a key role in this process, with a blueprint expected to be published by the end of the year.

At European level, the framework proposed by the pilot programme can support this common vision by enabling the use of new distributed registry technologies to be tested in regulated and secure environments. This framework is an opportunity for market participants to start anticipating and adapting their businesses. Nevertheless, regardless of whether we are talking about multilateral trading facilities (MTF), securities settlement systems (SSS) or a combined solution (Trading and settlement systems), obtaining a licence is both a medium- and a long-term commitment. Many players seem reluctant to take this step because of the uncertainty surrounding the future of a central bank digital currency settlement solution for tokenised assets.

This uncertainty needs to be resolved and the authorities are working together to provide a clear perspective on what the central bank settlement solution will look like. In my view, a secure and liquid settlement asset available on the DLT is one of the keys to the success of the pilot programme. A CBDC-based solution would provide an important lever in supporting the transition enabled by the pilot programme, and we have already developed our own blockchain, DL3S, for this purpose. But trials are in progress and we shall see which solution is chosen.

This European challenge is rounded out by an international challenge. It is vital that the French and European financial sectors are well represented in the experiments being conducted on a global scale, such as the work being carried out by the Bank for International Settlements. I am thinking in particular of the Agorá project, which focuses on CBDC and commercial bank money for cross-border payments. Adequate representation of national players in these different projects is essential for defending our interests and ensuring that the international standards developed are in line with both our interests and our needs.

Setting priorities: maintaining the two-tier monetary system and modernising the market segments that are currently least well served

In this phase of the transformation, it is vital not only to cooperate but also to define clear priorities to guide the modernisation of our market infrastructures. The most important of these priorities is to retain the two-tier monetary system, in which central bank and commercial bank money each play a distinct but complementary role. This model has proved its worth in ensuring the stability and resilience of the financial system and must be preserved to help with the adoption of technological innovations without upsetting fundamental balances.

At the same time, it would be useful to prioritise those market segments that can, in the short term, benefit from technological progress and infrastructure modernisation. Among these, over-the-counter (OTC) markets, such as the commercial papers market and the settlement of investment fund units, represent immediate opportunities to enhance the efficiency and transparency of post-trading processes. Similarly, green finance subject to strict criteria, a rapidly-growing segment, could benefit greatly from the increased transparency that appropriate modernisation of market infrastructures could bring, thereby facilitating the financing of projects as part of the ecological and digital transition.

To conclude, it seems to me that today, as in the past, a mixture of competition and cooperation is needed if the post-trading environment is to make the expected contribution to developing Europe’s financial firepower. Important strategic and operational matters can be included within the scope of this cooperation. I have touched upon some of these and, as you will have understood, the Banque de France is ready to play its part in this cooperation and is always ready to listen to the views of Paris financial centre participants.