The scientific community is inviting policy makers to take concrete actions against climate change. Elected governments are the main responsible for designing environmental policies and they also have the most appropriate tools to deal with the issue. However, several commentators are urging also central bankers to implement policies with a direct impact on climate change. One of the options is a Green QE, defined as a policy that temporarily tilts the central bank’s balance sheet toward green bonds, i.e. bonds issued by firms operating in nonpolluting sectors. We set up a macroeconomic-environmental model to study the effect of a Green QE. We find that this measure is effective only if there are frictions that limit arbitrage between green and brown bonds. Under such frictions, a temporary Green QE can mitigate detrimental emissions in the short term, but its impact on the stock of pollution is limited.

In the last decades there has been a worrying increase in global temperature. A broad consensus in the scientific community relates global warming to the emission of greenhouse gases, which has been rising exponentially since the industrial revolution. According to standard economics, pollution is the classic example of a negative externality, which should be addressed through pigouvian taxation. Some academics, columnists, and advocacy groups are now pushing also central bankers to implement monetary policies that may have direct impact on climate change. For example, according to De Grauwe (2019), the ECB should replace the corporate bonds that come to maturity in its portfolio with new green bonds: as this policy would not change the money supply, it would be inflation-neutral, and therefore it would not interfere with the achievement of the ECB’s primary objective. Similarly, Schoenmaker (2019) proposes to green monetary policy by tilting central banks’ balance sheets toward low-carbon sectors. Brunnermeier and Landau (2020) list several policy options for monetary authorities to address the climate challenge: one option is reorienting central banks’ asset purchases toward green securities.

In Ferrari and Nispi Landi (2021), we provide a theoretical framework to think about these proposals. In particular, we assess the effectiveness and the transmission mechanism of a “Green QE”, defined as a temporary purchase of green bonds by the central bank.2

In standard macroeconomic models, quantitative easing (QE) is not effective: Ben Bernanke, the then president of the Fed, famously claimed that QE works in practice but not in theory. This irrelevance result in theoretical models dates back to Wallace (1981), who shows that output and prices are independent from central bank’s balance sheet policies as a result of a Modigliani-Miller argument: when bonds and bank reserves are perfectly substitutable, the decision of the central bank to buy bonds by issuing reserves has no effects on relative returns. Since the global financial crisis, several economists have been challenging this result. For instance, Gertler and Karadi (2011) set up a model where a leverage constraint makes banks’ lending rate spread an increasing function of their leverage. In this framework, an increase in the stock of corporate bonds held by the central bank (financed with higher reserves) induces banks to deleverage, in order to satisfy the demand of the central bank: the lending spread decreases and the economic activity expands.

We extend the model in Gertler and Karadi (2011) by differentiating between a green sector, which does not pollute, and a brown sector, whose production generates CO2 emissions and adds to the stock of atmospheric carbon. We calibrate the model to the US economy, starting from a steady state with the current value of atmospheric carbon. Green and brown firms issue green and brown bonds respectively, in order to finance capital expenditure. Also in this modified framework a market-neutral QE is able to boost economic activity by relaxing the banking leverage constraint. Is Green QE effective in orienting production towards climate-friendly firms? The answer is no. As long as green and brown bonds are perfectly substitutable, Green QE cannot affect the (zero) spread between interest rates on the two types of bonds. The central bank can finance green bond purchases either by (i) an equal sale of brown bonds or by (ii) issuing more liabilities. In case (i), as the overall amount of bonds in banks’ portfolios has not changed, and the two bonds being perfect substitutes, interest rates on green and brown bonds do not move and economic activity is not affected (Figure 1, blue solid line). In case (ii), both green and brown interest rates decrease by the same amount, as a result of the injection of central bank liquidity (Figure 2, blue solid line): this is the same effects of a market-neutral QE.

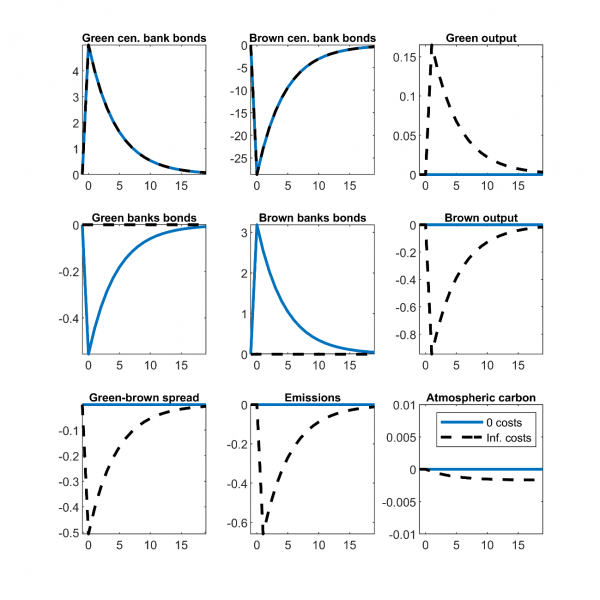

Figure 1: Green QE is financed with a sale of brown bonds

Impulse response function to a 5% increase in green bonds held by the central bank, fully financed with a sale in brown bonds. Responses are in % deviations from the steady state, except for the green-brown spread, whose response is in quarterly percent deviations from the steady state reported at annual rates. Blue solid: zero adjustment costs. Black dashed line: infinite adjustment costs.

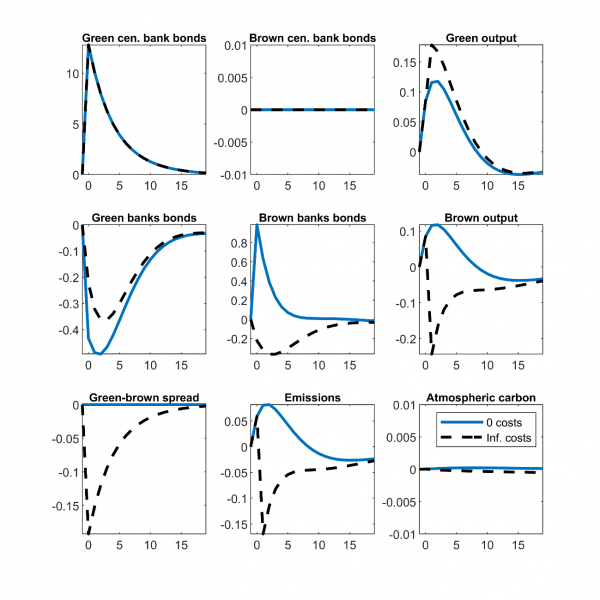

Figure 2: Green QE is financed by increasing central bank’s liabilities

Impulse response function to a 10% increase in central bank assets, entirely targeted to green bonds. Responses are in % deviations from the steady state, except for the green-brown spread, whose response is in quarterly percent deviations from the steady state reported at annual rates. Blue solid: zero adjustment costs. Black dashed line: infinite adjustment costs.

In order to give Green QE a chance to work, we need to introduce frictions to limit the substitutability between green and brown bonds. Specifically, we assume that banks pay adjustment costs whenever they change their asset composition with respect to the initial level. For illustrative purposes, we assume that adjustment costs are extremely high, so that banks never change the asset composition. When the central bank temporarily buys green bonds by selling an equal amount of brown bonds, the green-brown interest rate spread decreases: green firms issue more bonds to increase capital and production, brown firms do the opposite. The decrease in brown output reduces CO2 emissions and the stock of pollution (Figure 1, black dashed line). On the contrary, a decision by the central bank to invest in green bonds by issuing reserves generates a rise in emissions on impact, resulting from the expansionary policy (Figure 2, black dashed line); in the following periods, emissions start decreasing. This evidence signals the importance of taking into account general-equilibrium effects, even when assessing – from a hypothetical viewpoint – a central bank balance sheet expansion entirely targeted to the green sector.3

From a quantitative point of view, despite the fall in emissions (the flow), the effect on atmospheric carbon (the stock) ‒ the main variable responsible for the increase in global temperature ‒ is negligible. Given that carbon remains in the atmosphere for several decades, its stock is much larger than the flow. Therefore, a temporary reduction in the flow of emissions leads to a relatively small, although persistent, decrease in atmospheric carbon.

This evidence points toward a limited effect of a Green QE on climate change, which would weaken the case for relying excessively on this type of measure. However, a Green QE, together with the central bank’s moral suasion and other initiatives, may still be useful along the transition (driven by tax policy) toward a carbon-free economy. Moreover, we believe that our framework could be extended to study additional channels through which a Green QE may affect atmospheric carbon more strongly and more persistently: we leave these issues for future research.

Brunnermeier, M. and Landau J.P., (2020). Central banks and climate change, Vox EU column, available at https://voxeu.org/article/central-banks-and-climate-change

Gertler, M. and Karadi, P., (2011). A Model of Unconventional Monetary Policy, Journal of Monetary Economics, Vol. 58, No 1, pp. 17-34.

de Grauwe, P. (2019). Green Money Without Inflation, blog post on Social Europe, available at https://www.socialeurope.eu/green-money-without-inflation

Ferrari, A. and Nispi Landi, V., (2021). Whatever it Takes to Save the Planet? Central Banks and Unconventional Green Policy, Temi di discussione (Bank of Italy economic working papers), 1320.

Heutel, G., (2012). How should Environmental Policy Respond to Business Cycles? Optimal Policy under Persistent Productivity Shocks, Review of Economic Dynamics, Vol. 15, No 2, pp. 244-264.

Nordhaus, W., (2008). A Question of Balance: Economic Modeling of Global Warming, Yale University Press.

Schoenmaker, D., (2019). Greening Monetary Policy, Bruegel Working Paper, No. 2019/02.

Wallace, N., (1981). A Modigliani-Miller Theorem for Open-Market Operations”, American Economic Review, Vol. 71, No 3, pp. 267-274.

The opinions expressed in this paper are those of the authors and do not necessarily reflect the views of the Bank of Italy.

In our model monetary policy is neutral in the long-term: this is why we study a temporary as opposed to a permanent purchase of green bonds by the central bank.

If we reduce the parameter governing the adjustment costs, the rise in emissions is stronger and more persistent.