References

Blei, D., A. Ng, and M. Jordan. “Latent Dirichlet allocation”. The Journal of Machine Learning Research, 3:993–1022, 2003.

Blinder, A. (2018), “Central bank communications. Through a crystal ball darkly: the future of monetary policy communication”, AEA Papers and Proceedings, 108, 567-571.

Carney, M. (2009), “Discussion”, in Financial Stability and Monetary Policy, Economic Symposium of the Federal Reserve Bank of Kansas City (Kansas City: Federal Reserve Bank of Kansas City), pp. 297-311.

De Haan, J., and J.-E. Sturm (2019), “Central Bank Communication: How To Manage Expectations?”, in D. Mayes, P. Siklos, and J.-E. Sturm (Eds.), The Oxford Handbook of the Economics of Central Banking (Oxford: Oxford University Press), pp. 231-262.

Dincer, N., B. Eichengreen, and P. Geraats (2019), “Transparency of Monetary Policy in the Postcrisis World”, in D. Mayes, P. Siklos, and J.-E. Sturm (Eds.), The Oxford Handbook of the Economics of Central Banking (Oxford: Oxford University Press), pp. 287-335.

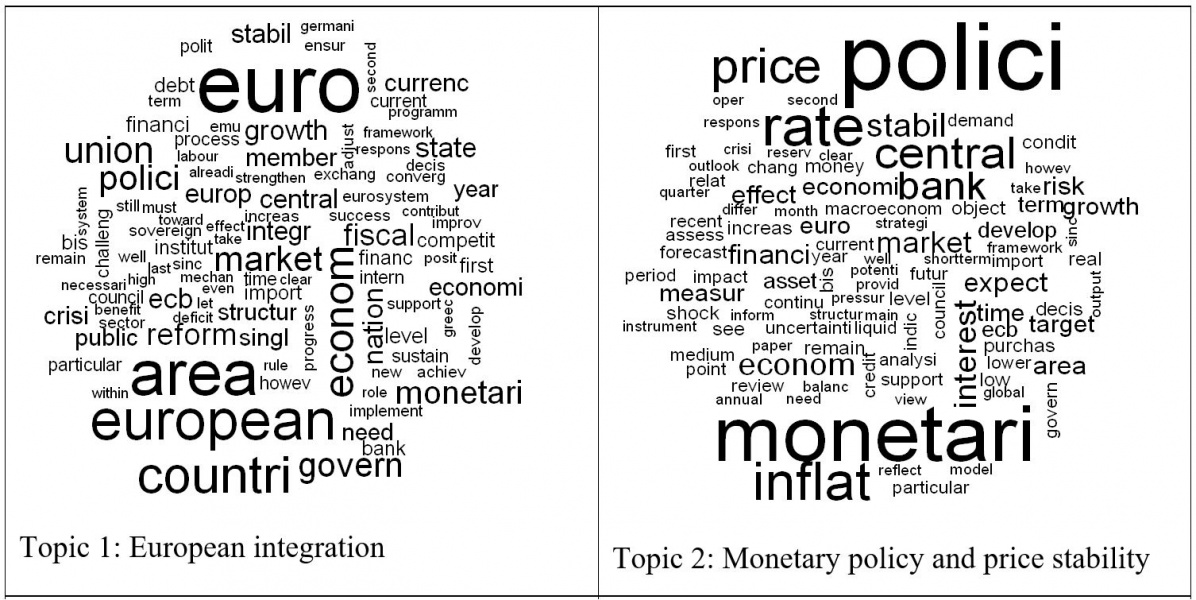

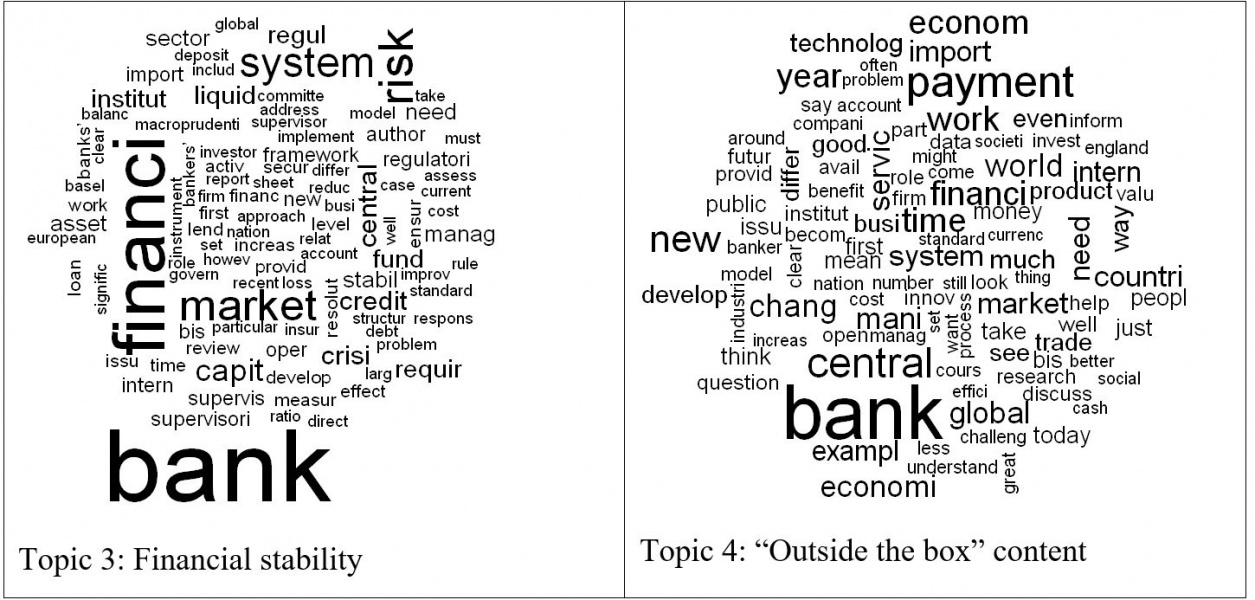

Feldkircher, M., P. Hofmarcher, and P. Siklos (2021), “What Do Central Bankers Talk About? A European Perspective on Central Bank Communication”, Focus on European Economic Integration Q2/21, pp. 61-81.

Gentzkow M., B. Kelly and M. Taddy (2019), “Text as Data”, Journal of Economic Literature 57(3). 535–574.

Shiller, R. (2019), Narrative Economics (Princeton, N.J.: Princeton University Press).

Woodford, M. (2003), Interest & Prices (Princeton: Princeton University Press).