Any opinions and conclusions expressed herein are those of the authors and do not necessarily represent the views of the Federal Reserve Bank of Atlanta. This Policy Brief is based on the working paper “Unit Cost Expectations and Uncertainty: Firms’ Perspectives on Inflation,” presented at the SUERF-OeNB conference.

Inattention has long proved a difficult challenge for economists and policy makers when attempting to understand economic agents’ inflation expectations. Unlike other surveys of firms or households that elicit “aggregate” expectations, we focus on idiosyncratic costs that firms are well-aware of, plan for, and matter for price setting. We document three key findings. First, once aggregated, firms’ unit cost realizations closely comove with U.S. inflation statistics. Second, in aggregate, firms’ unit cost expectations are at least as accurate as the expectations of professional forecasters. Third, we find that up until early 2020, the evolution of firms’ views was similar to other survey and market-based measures of inflation uncertainty.

“Price stability is that state in which expected changes in the general price level do not effectively alter business or household decisions.” Federal Reserve Chairman Alan Greenspan, July 1996, FOMC.1

As Alan Greenspan’s quote implies, after and during times of low, stable inflation, inattention is a key feature of price stability. When prices are stable there is no reason for people to concern themselves with nationwide aggregate inflation. As a result, business executives are inattentive to inflation and tend not to factor it into their price-setting process. Unfortunately, that implies asking respondents directly for their aggregate inflation expectations is not a meaningful exercise in a stable inflationary environment.

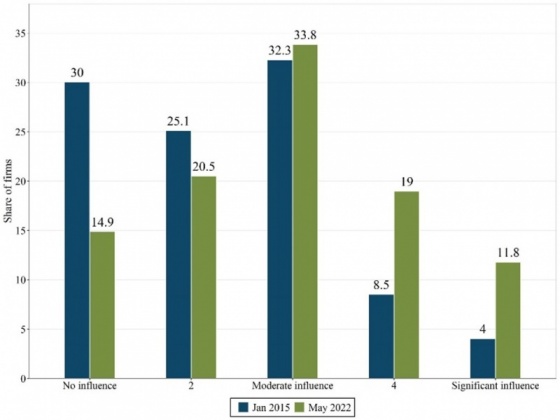

That concern is confirmed by Figure 1, which shows the influence of price indexes, like CPI, on firms’ business decisions. In January 2015, when headline CPI inflation was running at 1.7 percent over the past 6 years, more than 50% of firms said that changes in CPI had no or very little influence on their business decisions. As expected, this percentage declined from 2015 to 2022, amid a surge in inflationary pressures. Still, even in the high inflation environment in May 2022, with headline inflation at 40-year highs, one third of business executives still think aggregate inflation, as measured by the CPI, does not really matter for their business decisions.

Figure 1: Influence of Aggregate Inflation on Business Decisions

Source: FRBA Business Inflation Expectations (BIE) Survey, January 2015 and May 2022.

Notes: The above bar graph plots Likert scale responses to a special question that elicits what level of influence do price indexes (like the Consumer Price Index, or CPI) have on firms’ business decisions. Response options ranged from 1 (none) to 5 (significant).

While firms do not pay attention to national inflation rates in stable inflationary environments, they care about future nominal marginal costs and prices. Thus, to better understand inflation expectations, we take a novel approach, building a proxy for the inflation expectations of businesses by eliciting individual firm’s unit cost expectations and then aggregating these responses. We utilize the Federal Reserve Bank of Atlanta’s Business Inflation Expectations (BIE) Survey, which has been continuously collecting subjective probability distributions over own-firm future unit costs from a panel of business executives (CFOs, CEOs, and business owners) monthly since October 2011. The BIE is unique by choosing to focus on firms’ own anticipated unit costs rather than aggregate inflation expectations to gauge the expectations that matter for their price-setting behavior. In addition to its unique focus, the BIE elicits firm-level expectations in a probabilistic format, allowing us to address the uncertainty of firms’ expectations.

We document three key findings.

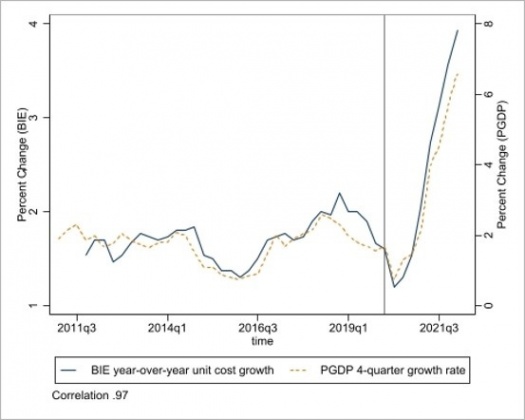

First, once aggregated, firms’ unit cost expectations closely move with U.S. inflation statistics, as seen in Figure 2. By simply aggregating firms’ unit cost expectations according to the industry share of overall GDP, we get an aggregate measure that tracks U.S. inflation very well, providing clear evidence that unit costs are an appropriate metric for understanding firms’ behavior around inflation. Moreover, own-firm unit costs trends are idiosyncratic and vary meaningfully across industry. These facts suggest to us that firms are inattentive to aggregates, but are attentive to their own costs.

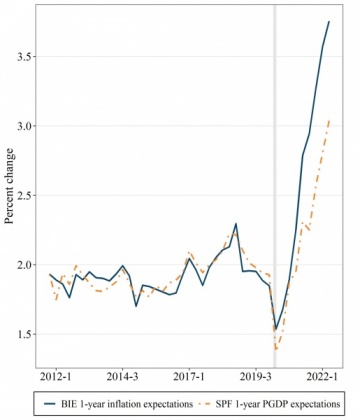

Second, in aggregate, firms’ one year-ahead unit cost expectations move in step with the inflation expectations of professional forecasters (Figure 3). At the beginning of the pandemic, firms’ unit cost expectations dropped precipitously, posting their sharpest decline in series history (back to 2011). The decline in expectations was very similar to that of the Philadelphia Fed’s Survey of Professional Forecasters (SPF). So, both firms and professionals were convinced that early on the pandemic the COVID-19 was, on net, a negative demand shock and would cause deflationary pressure on the economy. The eventual inflationary supply shock did not occur right away, but when it did, both business and professionals’ expectations adjusted almost instantaneously (and, importantly, simultaneously). Importantly, as we point out in the paper, firms’ and professionals’ expectations outperform that of households in simple out-of-sample forecasting exercises.

Figure 2: Firms’ Realized Unit Cost Growth vs. Actual Inflation

Sources: Bureau of Economic Analysis; FRBA Business Inflation Expectations (BIE) Survey.

Notes: The sample period begins in 2011q3 and ends in 2022q1. The BIE series are weighted by industry-share of GDP and quarterly averages are plotted. Given the nature of the panel, the most apt comparison is to the broadest notion of overall inflation (i.e. GDP price index). The BIE series is plotted on the left axis and the GDP Price Index is plotted on the right axis.

Figure 3: One Year-Ahead Inflation Expectations of Firms and Professionals

Source: FRBA Business Inflation Expectations (BIE) Survey; FRBP Survey of Professional Forecasters.

Notes: The BIE series are weighted by industry-share of GDP and quarterly averages are plotted, beginning in 2011q1 (for the Survey of Professional Forecasters) and 2011q3 for the BIE and running through 2022q1.

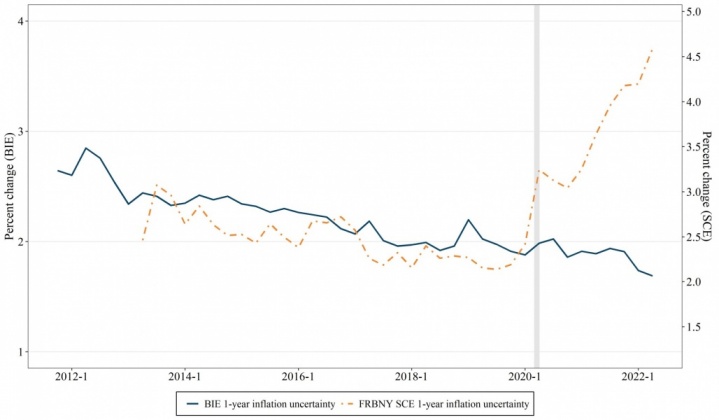

Third, utilizing a novel, flexible technique to parametrically estimate firms’ unit cost uncertainty, we find that up until the start of the pandemic inflation uncertainty was declining. We see the same pattern across firms in our panel and households from the New York Fed’s survey in Figure 4. Since the beginning of the pandemic, household inflation expectations have grown sharply, and their uncertainty has increased drastically. Our interpretation is that households were responding to the very sharp grocery price increases at the beginning of the pandemic, which made households nervous and uncertain about inflation. In contrast, firms, like market participants (as measured by the Minneapolis Fed’s Market-based Probabilities tool), shifted the weight in their probability distributions toward the lower end, a move that signaled much less concern about higher cost and inflation outcomes. Yet, here too, as supply chain disruption and labor constraints grew increasingly widespread and severe, there was a distinct upshift in firms’ and market-participants’ uncertainty weighting. From mid-2021 to date, firms have become increasingly confident that the high inflation environment will persist over the year-ahead.

Figure 4: Measures of Inflation Uncertainty: Firms vs. Households

Sources: FRBA Business Inflation Expectations (BIE) Survey; FRBNY Survey of Consumer Expectations (SCE).

Note: For the graph above, the BIE series is plotted on the left-hand axis and the SCE series on the right.

The evidence above shows that unit cost expectations provide a clear metric for understanding firms’ salient inflation expectations. Using regression analysis, we further show that unit costs are an important determinant of firms’ own price-setting behavior. Finally, we find, with randomized controlled trials, that information treatments about aggregate inflation and policymakers’ forecasts do little to alter firms’ unit cost expectations. Thus, firms pay most attention to their own unit costs and understand those unit costs to be distinct from the general economy.

Rather than send central bankers on the daunting and somewhat uncertain task of communicating information about aggregate inflation to businesses in order to, then, measure aggregated expectations appropriately, our results suggest a potentially more fruitful alternative. Survey firms on economic quantities that they care about and are connected to the aggregate phenomena that central bankers endeavor to monitor. Our work can be seen as the first firm-level survey to attempt to proxy for firms’ inflation expectations despite the challenges of inattention to aggregate inflation or official price statistics.