References

Alpanda, Sami and Serdar Kabaca, “International Spillovers of Large-Scale Asset Purchases,” Journal of the European Economic Association, 2020, 18 (1), 342–391.

Bhattarai, Saroj and Christopher J. Neely, “An Analysis of the Literature on International Unconventional Monetary Policy,” Journal of Economic Literature, Forthcoming.

Bluwstein, Kristina and Fabio Canova, “Beggar-Thy-Neighbor? The International Effects of ECB Unconventional Monetary Policy Measures,” International Journal of Central Banking, September 2016, 12 (3), 69–120.

Borio, Claudio and Anna Zabai, “Unconventional monetary policies: a reappraisal,” BIS Working Papers 570, Bank for International Settlements, July 2016.

Ca’ Zorzi, Michele, Luca Dedola, Georgios Georgiadis, Marek Jarocinski, Livio Stracca, and Georg Strasser, “Monetary policy and its transmission in a globalised world,” Working Paper Series 2407, European Central Bank, May 2020.

Chen, Qianying, Marco Lombardi, Alex Ross, and Feng Zhu, “Global impact of US and euro area unconventional monetary policies: a comparison,” BIS Working Papers 610, Bank for International Settlements, January 2017.

Corbo, Vesna and Paola Di Casola, “Drivers of consumer prices and exchange rates in small open economies,” Journal of International Money and Finance, April 2022.

Dell’Ariccia, Giovanni, Pau Rabanal, and Damiano Sandri, “Unconventional Monetary Policies in the Euro Area, Japan, and the United Kingdom,” Journal of Economic Perspectives, 2018, 32 (4), 147–172.

De Rezende, Rafael B. and Annukka Ristiniemi, “A shadow rate without a lower bound constraint,” Bank of England working papers 864, Bank of England, May 2020.

Di Casola, Paola & Stockhammar, Pär, 2021. “When domestic and foreign QE overlap: evidence from Sweden,” Working Paper Series 404, Sveriges Riksbank. Latest version here.

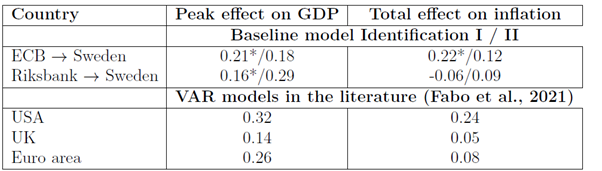

Fabo, Brian, Martina Jancokova, Elisabeth Kempf, and Lubos Pastor, “Fifty shades of QE: Comparing findings of central bankers and academics,” Journal of Monetary Economics, 2021, 120, 1–20.

Gustafsson, Peter and Tommy von Brömsen, “Coronavirus pandemic: The Riksbank’s measures and financial developments during spring and summer 2020,” Economic Review 2021:1, Sveriges Riksbank 2021.

Kolasa, Marcin and Grzegorz Wesolowski, “International spillovers of quantitative easing,” Journal of International Economics, 2020, 126.

Kuttner, Kenneth N., “Outside the Box: Unconventional Monetary Policy in the Great Recession and Beyond,” Journal of Economic Perspectives, November 2018, 32 (4), 121–46.

Moder, Isabella, “Spillovers from the ECB’s Non-standard Monetary Policy Measures on Southeastern Europe,” International Journal of Central Banking, October 2019, 15 (4), 127–163.

Weale, Martin and Tomasz Wieladek, “What are the macroeconomic effects of asset purchases?,” Journal of Monetary Economics, 2016, 79 (C), 81–93.