The opinions expressed are those of the author and do not necessarily coincide with those of Banco de Portugal or the Eurosystem.

Multinational groups may use services transactions between firms of the same group to shift profits from high-tax to low-tax countries, a strategy usually denominated as profit shifting. In this Policy Brief, we summarise the results of Garcia (2022) that explores whether those potential practices translate into an unusually large propensity of multinationals to import intra-group services from tax havens and/or into an excessive value of those imports. The analysis shows that in a high-tax country where policies significantly discourage transactions with tax havens (Portugal), multinational groups do not display a systematic excessive propensity to import intra-group services from those jurisdictions. They even systematically avoid importing from the havens that are directly targeted by Portuguese anti-tax planning policies. This notwithstanding, the value of imports by some groups from a subset of tax havens is abnormally large.

Multinational groups have been in the spotlight in the tax research and policy-making arenas because of their cross-border activities that shift profits to tax havens. The economic and accounting literatures have provided ample evidence that a large amount of profits escape corporate taxes in high-tax countries every year. For example, Tørsløv et al. (2022) estimate that close to 35% of multinational profits were shifted to tax havens in 2015. This drain of profits has important implications for the revenues available to governments to finance the goods and services provided to citizens.

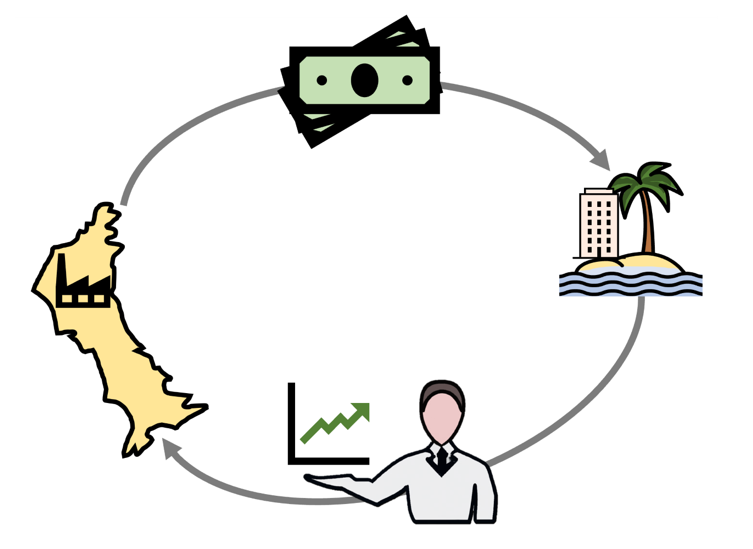

One strategy that multinational groups may use to shift their profits to tax havens for which empirical evidence is relatively scarce is through intra-group services transactions. Specifically, the firms of the group located in high-tax countries may artificially inflate their costs by paying expensive fees for services (e.g. consulting services) provided by a firm of the same group located in a tax haven (Figure 1). These transactions suitably reduce the profits booked in high-tax countries and increase those booked in the tax haven, where tax rates tend to be zero or very low.

Figure 1: Profit shifting through intra-group imports of services – stylised diagram

If multinational groups consistently use this profit shifting strategy, services trade data should reveal an abnormally large propensity of those groups to import intra-group services from tax havens, and the value of those imports should be unusually large. In a recent paper (Garcia, 2022), we investigate if these empirical regularities hold, drawing on a rich dataset about multinational groups present in Portugal and their services imports from tax havens.

Portugal is an interesting country to study profit shifting. On the one hand, the economic incentives to shift profits are particularly high as the Portuguese top statutory rate of the corporate income tax is one of the highest among OECD countries (31.5%). On the other hand, the Portuguese government has in place particularly discouraging anti-tax planning policies, which include for example a penalty tax that may be as high as 55% on transactions with tax havens. It is therefore interesting to evaluate profit shifting practices when incentives for those practices are high and simultaneously highly discouraging policies get in the way.

We start by documenting that only a small share of multinational groups in Portugal imports intra-group services from tax havens. We show that while close to 30% of the groups are present in tax havens, only 4% of them import intra-group services from those countries. Those groups tend to be the larger ones, both in terms of the size of their operations in Portugal, and in terms of the extensiveness of their geographical footprint.

The first question we then address is whether such a small share is to be expected, or if it is nonetheless excessive and therefore possibly indicative of profit shifting motives. To that end, we compare the propensity of each group to engage on intra-group imports from tax havens to the one resulting from a model incorporating several determinants of trade. We then turn our attention to the value of intra-group imports from tax havens. Using a similar model, we investigate if the amount of imports conducted by the small share of groups engaged in those transactions is larger than expected.

The results show that multinational groups do not display a systematic excessive propensity to import intra-group services from tax havens. They even systematically avoid importing from the havens that are directly targeted by Portuguese anti-tax planning policies.

This notwithstanding, the value of imports from a set of tax havens with which Portugal has signed a tax treaty is abnormally large. Given the possibility of negotiating advance agreements with the tax authority concerning transactions with those countries, the few large groups that still import excessive intra-group services from there may be the ones that incurred the cost of pre-negotiating those agreements.

Our results are consistent with anti-tax planning policies reducing the incentives of multinationals to engage on transactions with tax havens. These policies may explain the contrast between our findings and those of Hebous and Johannesen (2021), which document that German multinationals show a systematic excessive propensity to import intra-group services from tax havens. Exemptions to the anti-tax planning policies set forth by the law may give large groups a competitive edge and possibly distort competition. While the normative implications of such distortions go beyond the scope of the paper, the evidence we present informs that discussion.

Garcia, J. (2022). “Multinationals and services imports from havens: when policies stand in the way of tax planning”, Banco de Portugal Working Paper No. 14/2022.

Tørsløv T., Wier, L. and Zucman, G. (2022). “The Missing Profits of Nations”, The Review of Economic Studies, rdac049.

Hebous, S., and Johannesen, N. (2021). “At your service! The role of tax havens in international trade with services”, European Economic Review, 135, 103737.