Using a unique and granular dataset with more than 12 million observations on fund-by-fund and security-by-security sales and purchases during the first months of 2020 by 20,000 Mutual Funds (MFs) from 40 countries, a recent work shows that, when the Covid emergency stroke, MFs divested from assets considered the most vulnerable at the moment, that is, those issued in countries and by industries most affected by the pandemic. Consistent with the debate on funds’ intrinsic fragility and run-like risks, the paper shows that MFs exacerbated the sales when experienced more outflows from their unitholders. However, the paper also reveals several dimensions of heterogeneity in MF industry according to the asset type holdings, investment policies and performance abilities. Moreover, the paper documents that monetary policy measures affected the behaviour of MFs and therefore supports the hypothesis of the existence of an unconventional monetary policy transmission channel operating through non-bank financial institutions, which may be used to stabilize MFs themselves.

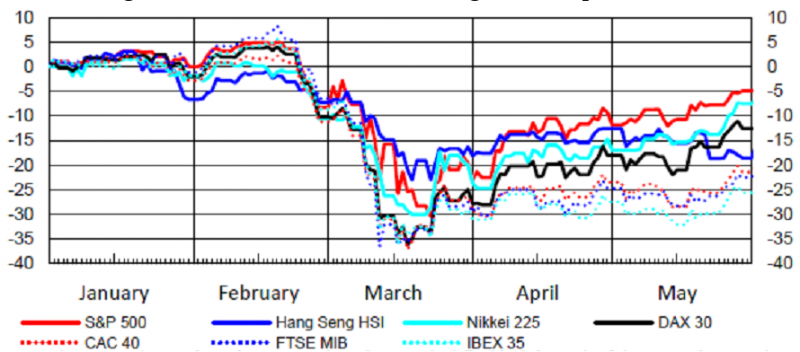

In early 2020, the outbreak of Covid-19 and the subsequent containment measures imposed in many countries caused a sudden and sharp deterioration in the economic outlook and heightened the risk aversion among investors, giving rise to a major re-pricing in global financial markets. Stock prices declined on average by close to 30 percent during the crash, but performance varied significantly across countries and industries (Figure 1).

Figure 1. Stock market returns during Covid-19 pandemic

Notes: Morningstar Direct. The figure plots the cumulative stock market returns since the spread of Covid-19 for each of the selected economies.

In Affinito and Santioni (2021), we exploit the exogenous shock of the Covid-19 outbreak to perform a comprehensive empirical analysis of Mutual Fund (MF) portfolio decisions. Understanding MF conduct has relevant implications. MFs hold a large fraction of world savings, purchase and sell securities all over the globe, and play a crucial role in the financing of governments and firms. MFs have grown substantially since the global financial crisis, partly as a result of the increased regulation of banks. Since MFs often invest in illiquid assets although guarantee their investors high levels of liquidity, the debate about MFs has increasingly focused on their intrinsic fragility and the possible implications of their conduct for financial stability (e.g., Chen et al., 2010; Goldstein et al., 2017).

The Covid-19 crisis provides a valuable opportunity to gain insights into drivers of MF behaviour and strategies as their portfolio choices may be tested by exploiting the impact of a major – and truly exogenous – worldwide shock. Specifically, we exploit the circumstance that the emergency outbreak and subsequent policy measures varied substantially across countries and industries, both in the intensity and timing. In carrying out the analysis we have the advantage of using a unique and granular dataset, which contains more than 12 million observations on fund-by-fund and security-by-security sales and purchases during the first four months of 2020 by over 20,000 MFs (about 40% of the worldwide industry in terms of total net assets) located in over 40 national jurisdictions and investing in more than 100 economies and 20 sectors. We believe ours is the first paper to assess MFs’ portfolio reactions to Covid-19 worldwide as a function of the spreading news on the pandemic and to comprehensively depict their decisions when the shock arrived and the panic broke out.

In our econometric analysis the impact of Covid-19 at country level is measured by two alternative indexes: the ratios of total number of confirmed cases or total number of deaths to total population. As is well known, these two ratios are imperfect measures of the real spread of the contagion and the extent of the health emergency. However, they are perfectly suitable to our purposes because they reflect the perception of international investors and the knowledge that they had on the impact of Covid-19 across countries and over time. The impact of Covid-19 across industries is computed through the indexes recently introduced in labour economics (e.g., Koren and Petö, 2020), which measure in each sector the extent to which firms’ operations are compatible with social distancing and lockdowns. In order to verify whether other intrinsic characteristics of financial assets (other than those linked to the Covid-19 impact) affect our results, we match our security-by-security data with information on the characteristics of each financial asset (rating scores, pressure, liquidity) and of each firm (size, profitability, leverage) issuing the worldwide assets held by MFs.

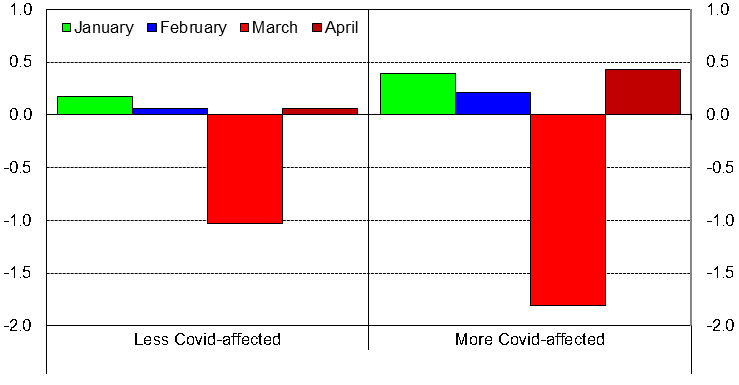

Our estimates first show that the pandemic triggered portfolio recomposition by MFs all over the world. We document that, when the panic broke out, MFs did not sell horizontally but divested from financial assets considered at the moment most troubled, those issued in countries and by industries more affected by Covid-19 (Figure 2). Furthermore, we document that MFs with more outflows from unitholders exacerbated the sales of more Covid-affected assets, which suggests that fund managers’ portfolio adjustments work in the same direction as investor outflows rather than mitigating the outflow effect (e.g., Cella et al., 2013). Therefore, our results corroborate the concern that the open-end nature of these investment vehicles creates a run-like risk, which make fire sales and price swings more likely (e.g., Stein, 2009; Manconi et al., 2012; Financial Stability Board, 2017).

However, we then examine in detail the portfolio rebalancing and reveal several dimensions of heterogeneity in MF industry. We find heterogeneous results according to MF investment policies, performance abilities, and asset type holdings. MFs turn out to include heterogeneous institutions, which use a variety of portfolio strategies that at least partially offset each other. Notably, we find that MFs with higher pre-pandemic returns did not follow the herd at the emergency outbreak, which suggests that some well managed IFs stood apart even in the panic phases. These results suggest that financial stability policies should be adapted across MF categories reflecting the varying risk appetites embedded in their different investment policies and performance strategies, and the different vulnerability of the assets they hold.

Figure 2. MF net-purchases of financial assets issued in less and more Covid-affected countries in each month during the Covid-19 outbreak

(as a percentage of Total Net Asset)

Notes: Morningstar Direct. Less Covid-affected countries (more Covid-affected) are those below (above) the 75th percentile of our measure of Covid-19 exposure across countries.

Moreover, we show that, when the shock arrived and the panic broke out, the bulk of the adjustment in MFs’ portfolios occurred abruptly and severely during the “fever” of the Covid-19 crisis (that is, in March 2020). Instead, we find signs of resurgence already in April, following the exceptional policy measures taken worldwide by public authorities in those weeks (Figure 2). We find that the rebound in April mainly concerned MF purchases of corporate bonds, which were, largely, the financial asset targeted by central banks’ programmes in the period. The result corroborates therefore the existence of a channel of unconventional monetary policy acting through non-bank financial institutions, which may enrich the policy toolbox of monetary authorities and the instruments to stabilize financial markets and MFs themselves (e.g., Falato et al., 2020; Gilchrist et al., 2020).

Our paper relates to some of the major strands of the literature on MFs. First, our results on the massive sales of Covid-affected assets, those perceived as more in distress in the period, contribute to the literature on MFs’ intrinsic fragility, which stresses that, in time of crisis, MFs sell the most troubled assets and contribute to fire sales. Second, our results on higher sales of more Covid-affected securities from MFs with more outflows contribute to the literature on the relationship between the sales of institutional investors and those of their unitholders and they corroborate the view that MFs may increase market volatility during times of turmoil because they face the risk of having to respond to massive (often retail) redemptions. Third, however, our results on the several dimensions of MF heterogeneity contribute to the literature on MF behaviour, strategies and performance abilities revealing that MF choices differ in several aspects and with different implications for financial stability policies. Fourth, our results on a non-bank financial institution channel of unconventional monetary policies contribute to a recent and relevant stream of analysis. Finally, our paper complements the fast grown literature on stock markets’ reactions to the outset of the Covid-19: this literature typically finds that pandemic-resilient assets suffered less during the outbreak, we show that MFs prioritized exactly the pandemic resilience of financial assets.

Affinito, Massimiliano and Santioni Raffaele (2021). “When the panic broke out: COVID-19 and investment funds’ portfolio rebalancing around the world,” Temi di discussione (Economic working papers), Bank of Italy, Economic Research and International Relations Area.

Cella, C., A. Ellul, and M. Giannetti (2013): “Investors’ Horizons and the Amplification of Market Shocks,” The Review of Financial Studies, 26, 1607–1648.

Chen, Q., I. Goldstein, and W. Jiang (2010): “Payoff complementarities and financial fragility: Evidence from mutual fund outflows,” Journal of Financial Economics, 97, 239–262.

Koren, M. and R. Petö (2020): “Business disruptions from social distancing,” Covid Economics.

Falato, A., I. Goldstein, and A. Hortaçsu (2020): “Financial Fragility in the Covid-19 Crisis: The Case of Investment Funds in Corporate Bond Markets,” NBER Working Papers 27559, National Bureau of Economic Research.

Financial Stability Board (2017): “Policy Recommendations to Address Structural Vulnerabilities from Asset Management Activities, Tech. rep., Financial Stability Board.

Gilchrist, S., B. Wei, V. Yue, and E. Zakrajsek (2020): “The Fed Takes on Corporate Credit Risk: An Analysis of the Efficacy of the SMCCF,” CEPR Discussion Papers 15258.

Goldstein, I., H. Jiang, and D.T. Ng (2017): “Investor flows and fragility in corporate bond funds,” Journal of Financial Economics, 126, 592–613.

Manconi, A., M.Massa, and A. Yasuda (2012): “The role of institutional investors in propagating the crisis of 2007–2008,” Journal of Financial Economics, 104, 491–518.

Stein, J. C. (2009): “Sophisticated Investors and Market E_ciency,” Journal of Finance, LXIV, 1517–1548, this paper was the 2009 AFA Presidential Address.

This policy brief is based on Affinito and Santioni (2021). The views expressed in this article are those of the authors and do not necessarily represent those of Banca d’Italia.