This Policy Brief is based on Grønlund, Jørgensen, and Schupp (2024), European Central Bank Working Paper Series No 2908. The views expressed are those of the authors and do not necessarily reflect those of the ECB.

To be confident that inflation is durably headed towards the central bank target, policymakers often look at the dynamics of not only headline inflation but also underlying inflation measures, such as core inflation, which strips out the most volatile and typically transitory components from the consumption basket. This policy brief shows how to infer market-based expectations for core inflation in the euro area, even though no financial asset directly tied to core inflation exists. The inferred core inflation expectations are available at daily frequency, more frequently than other indicators based on surveys or macroeconomic projections, offering real-time insights for policy makers. Our results show that market participants – broadly in line with the latest ECB staff projections – expect that core inflation will return to levels close to 2% by the end of this year. Moreover, we show that monetary policy shocks have a significant and persistent impact on near-term core inflation expectations.

As there exists no financial product directly tied to core inflation, we propose a joint model for headline and core inflation-linked swap rates, which allows us to estimate market-based core inflation expectations. The key assumption that allows us to price inflation-linked swaps tied to core inflation, which are not traded, is that the rates on inflation-linked swaps tied to headline inflation span the factors that drive core inflation. This assumption should be reasonably uncontroversial, as headline inflation-linked swaps should reflect the factors driving headline inflation of which core inflation is a subcomponent. Based on this key assumption, we build a joint affine term structure model for headline and core inflation-linked swap rates. Affine term structure models are often used to model the term structure of interest rates, but can also be applied to inflation-linked swap rates that are tied to headline inflation (see, for example, Camba-Mendez and Werner, 2017; Burban, De Backer, Schupp and Vladu, 2022; Ajello, Benzoni and Chyruk, 2019; Beechey, 2008). In such models of the term structure of inflation-linked swap rates, headline inflation is assumed to be a linear combination of a small set of pricing factors, with these factors following vector-autoregressive processes under both the risk-neutral and objective probability measures. In our model, the standard term structure model framework is extended by assuming that core inflation is a linear combination of the same set of pricing factors as headline inflation. That is, the set of pricing factors explaining developments in headline inflation nests the factors that drive its underlying components, such as core, food and energy inflation. Combined with the assumption that there are no arbitrage opportunities in the market, the model allows us to compute swap rates linked to both headline and core inflation of any maturity based on particular linear combinations of the same pricing factors. This means, even if we do not observe core inflation-linked swap rates, we can use the headline inflation-linked swap rates to infer the underlying pricing factors that drive both core and headline inflation-linked swap rates.

Our model estimates are based on information from historical financial, survey and inflation data. The model is informed by monthly data on inflation-linked swap rates linked to headline inflation starting in June 2005, quarterly data on headline and core inflation expectations from the ECB’s Survey of Professional Forecasters (SPF), as well as monthly realised headline and core inflation. The data on realised core inflation and survey expectations for core inflation are essential for identifying the loadings of our synthetic core inflation-linked swap rates on the pricing factors. Note that once the model parameters have been estimated, the model is flexible enough to allow the computation of a term structure of core inflation-linked swap rates at daily frequency based on observed daily headline inflation-linked swap rates.

Our model closely fits observed swap rates linked to headline inflation as well as survey information. The model produces a root mean squared error (RMSE) of around 2 bps on average across maturities for swap rates linked to headline inflation and fits survey expectations about headline and core inflation with an average RMSE of 15 bps and 11 bps across survey horizons. Although the fitting errors for survey expectations are slightly larger than for swap rates, this partly reflects a modelling choice. To avoid that the model overemphasizes survey information, the model is implemented assuming moderate measurement errors on the expectations reported in the SPF. This ensures that the primary source of information for synthetic swap rates linked to core inflation is indeed market-based, that is, coming from the observable swap rates linked to headline inflation rather than being forced to be a mirror-image of core inflation survey expectations. In line with intuition, the synthetic swap rates linked to core inflation are less volatile than ILS rates linked to HICP inflation. This reflects the lower realized volatility in core inflation compared to headline inflation, with the latter mainly driven by the highly volatile energy inflation. Nevertheless, the correlation between HICP ILS and core ILS are positive and relatively high, increasing with the maturity of the contract.

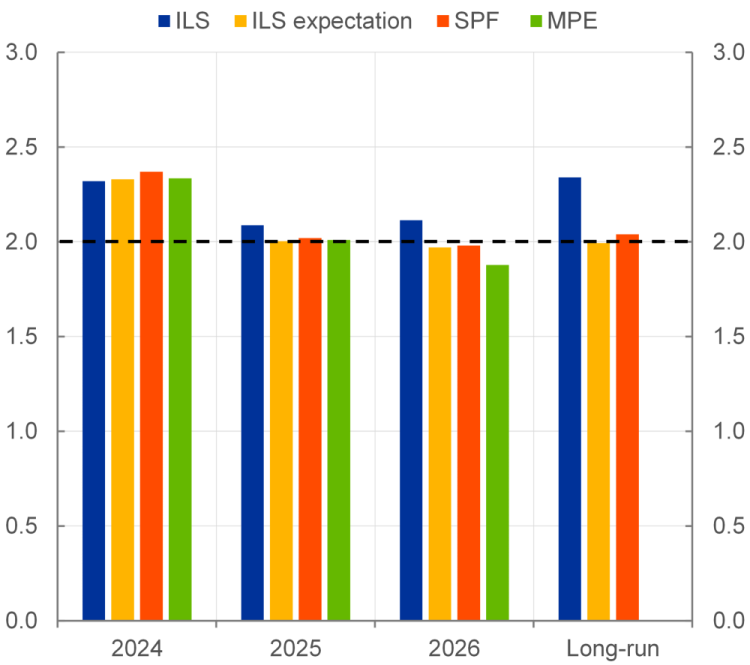

Chart 1: ILS rates and implied expectations to euro area headline inflation

(percentage per annum)

Sources: SPF, Refinitiv, ECB calculations.

Notes: Average expected year-on-year inflation rates for the given year. Long-run refers to the 5y5y forward rate for ILS rates, while year-on-year inflation in 5 years for SPF. The dashed line indicates the ECB’s inflation target of 2%.

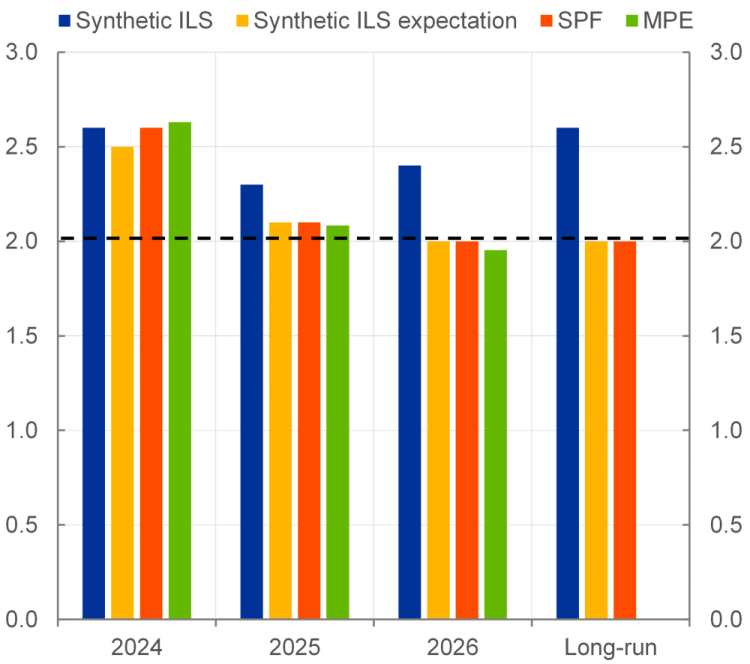

Chart 2: Synthetic core ILS rates and implied expectations to euro area core

(percentage per annum)

Sources: SPF, Refinitiv, ECB calculations.

Notes: Average expected year-on-year core inflation rates for the given year. Long-run refers to the 5y5y forward rate for ILS rates, while year-on-year inflation in 5 years for SPF. The dashed line indicates the ECB’s inflation target of 2%.

Inflation-linked swap rates do not only reflect market participants’ pure inflation expectations but also contain inflation risk premia. When pricing inflation-linked swap rates, risk averse market participants include such premia to compensate for inflation risks; that is, the risk that inflation turns out differently than expected. We therefore use our term structure model to also estimate the risk premium component embedded in the term structure of swap rates linked to headline and core inflation in order to infer market participants pure inflation expectations for both headline and core.

In early April 2024, our model results suggested that market participants expected that both headline and core inflation will return to levels close to 2% by the end of 2024 (Chart 1 and Chart 2). Specifically, the model suggested that market participants expected headline inflation to average 2.3%, 2.0% and 2.0% and core inflation to average 2.5%, 2.0% and 2.0% % in 2024, 2025 and 2026, respectively. These estimates are broadly in line with ECB staff projections from March 2024 and results from the SPF from Q1 2024. Over the longer run, market participants expect both headline and core inflation to converge towards the 2 percent target. These market-implied long-term expectations are also similar to the inflation outlook suggested by the Q1 2024 SPF and imply that market participants’ inflation expectations, for both headline and core, remain anchored at the ECB’s inflation target.

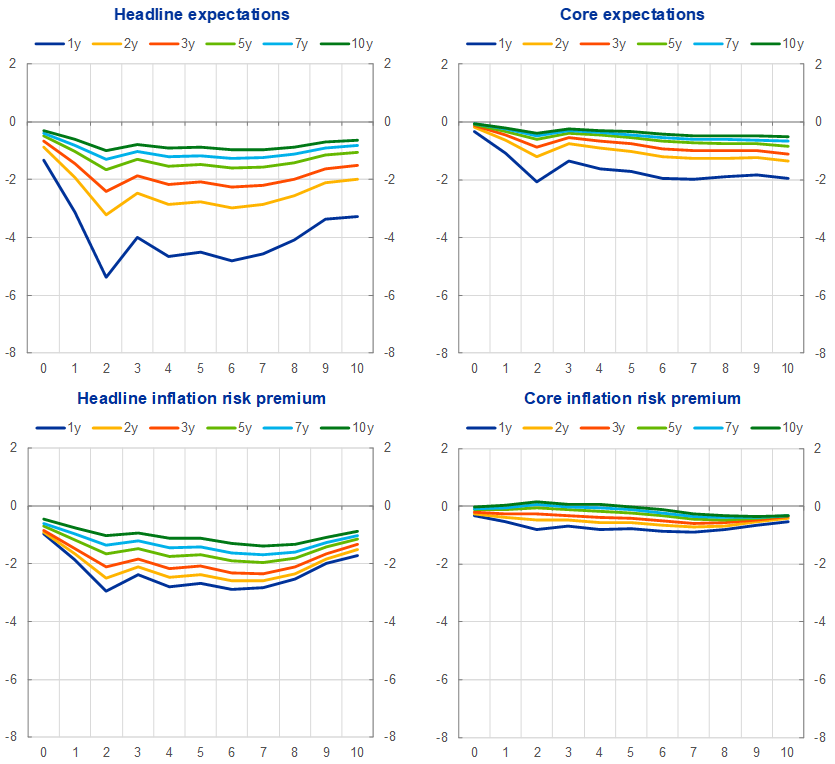

Further results show that monetary policy can significantly and persistently affect market expectations for both headline and core inflation (Chart 3). To show this, we make use of our model’s ability to produce daily estimates of both headline and core inflation expectations. This allows us to conduct event studies, measuring the causal effect of monetary policy shocks on core inflation expectations. The monetary policy shocks are computed from an updated version of the data from Altavilla et al. (2019), based on moves in Overnight Index Swaps tied to the €STR. The analysis uses a standard local projection approach to measure the effect of identified monetary policy shocks on swap rates tied to headline and core inflation, as well as their expectations and risk premium components up to 10 days into the future. The results of this exercise suggest that contractionary monetary policy shocks have significant and persistent negative effects on swap rates tied to headline, as well as swap rates tied to core inflation, through both the expectations and risk premium components. At the same time, effects on headline inflation expectations and associated risk premia are somewhat stronger than those on core inflation expectations and premia.

Chart 3: Estimated effects of a monetary policy shock on inflation expectations and associated risk premia

(y-axis: basis points; x-axis: trading days)

Note: Monetary policy shocks are the first principal component spanning changes in 1-, 3-, and 6-months as well as 1-10 year OIS rates during policy events. The series of shocks are normalised to have a standard deviation of one. The sample spans monetary policy events from September 2016 to June 2023, excluding information shocks (yields and stock prices moving in the same direction). The final number of events is 32.

In this Policy Brief we suggest a way to estimate market-based core inflation expectations for the euro area, despite that no financial market product directly tied to core inflation exists. According to our model results, market participants in mid-April 2024 expected a timely return of both headline and core inflation to the ECB’s 2% target and the market-based expectations appear firmly anchored at the target in the long run. Our core inflation expectations measure is available at daily frequency, facilitating event studies. In one such event study, we estimate how monetary policy shocks affect core inflation expectations and find that a contractionary monetary policy shock tends to lower near-term core inflation expectations, but not as much as it lowers headline inflation expectations.

Altavilla, C., L. Brugnolini and R. S. Gürkaynak, R. Motto and G. Ragusa (2019), “Measuring euro area monetary policy”, Journal of Monetary Economics, Vol. 108, pp. 162-179.

Ajello, A., Benzoni, L. and Chyruk, O. (2019), “Core and ‘Crust’: Consumer Prices and the Term Structure of Interest Rates”, The Review of Financial Studies, Vol. 33 (8)

Beechey, M. (2008), “Lowering the Anchor: How the Bank of England’s Inflation-Targeting Policy have Shaped Inflation Expectations and Perception of Inflation Risk”, FRB Working Paper, Vol. 17(4).

Camba-Mendez, G. and Werner, T. (2017), “The inflation risk premium in the post-Lehman period”, ECB Working Paper Series, No 2033

Burban, V., De Backer, B., Schupp, F. and Vladu, A.L. (2021), “Decomposing market-based measures of inflation compensation into inflation expectations and risk premia.”, ECB Economic Bulletin Issue 8/2021.

Grønlund, A., K. Jørgensen and F. Schupp (2024), “Measuring market-based core inflation expectations”, European Central Bank Working Paper No. 2908.